Form 9661

What is the Form 9661

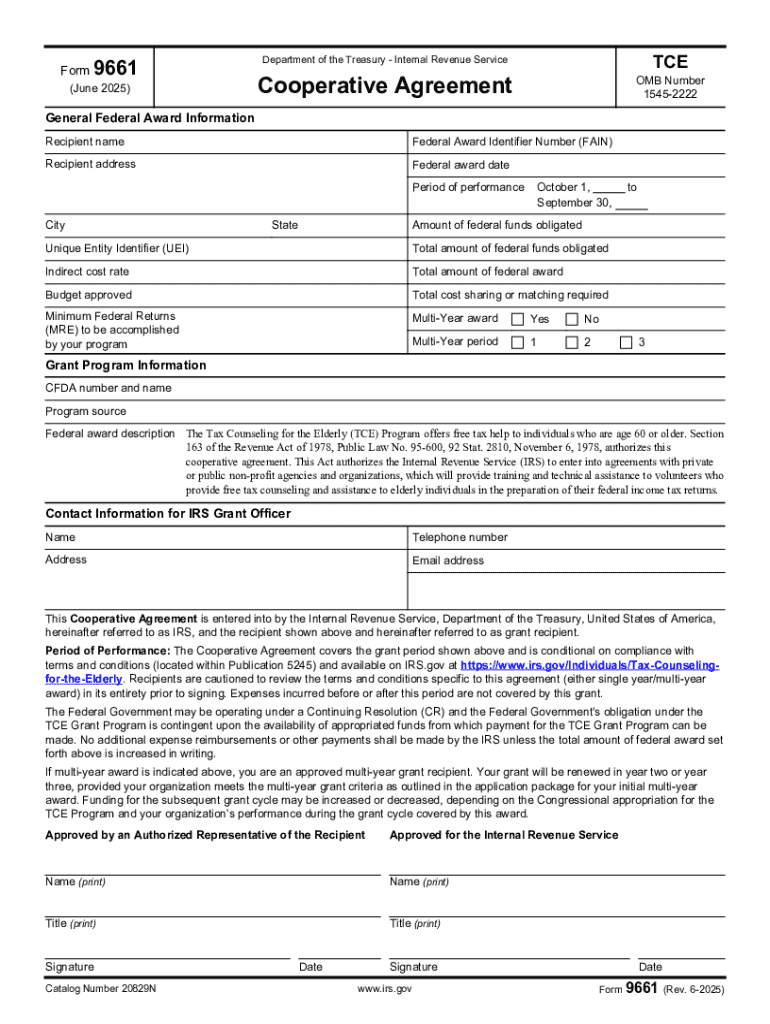

The Form 9661 is a document used by businesses in the United States to report certain tax-related information to the Internal Revenue Service (IRS). This form is specifically designed for entities that need to provide details about their tax obligations and compliance. Understanding the purpose of Form 9661 is essential for businesses to ensure they meet their tax responsibilities accurately and on time.

How to use the Form 9661

To effectively use Form 9661, businesses must first determine their eligibility and the specific information required for completion. The form serves as a means to communicate essential tax data to the IRS. Users should carefully follow the instructions provided with the form to ensure all necessary sections are filled out correctly. This includes providing accurate financial information and any relevant identifiers such as Employer Identification Numbers (EIN).

Steps to complete the Form 9661

Completing Form 9661 involves several key steps:

- Gather necessary information, including business identification details and financial records.

- Download the form from the IRS website or obtain a physical copy.

- Fill out the form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the specified deadline.

Each step is crucial for ensuring compliance and avoiding potential penalties.

Legal use of the Form 9661

The legal use of Form 9661 is governed by IRS regulations. Businesses must ensure that they are using the most current version of the form and that it is submitted in accordance with IRS guidelines. Failure to comply with these regulations can lead to penalties and complications in tax processing. It is advisable for businesses to consult with a tax professional if they have questions regarding the legal implications of using this form.

Filing Deadlines / Important Dates

Filing deadlines for Form 9661 are critical for compliance. Businesses must be aware of the specific dates set by the IRS for submission to avoid late penalties. Typically, the form must be filed by the end of the tax year, but it is essential to check the IRS guidelines for any updates or changes to these dates. Keeping a calendar of important tax deadlines can help ensure timely filing.

Required Documents

To complete Form 9661, several documents may be required, including:

- Financial statements that reflect the business's income and expenses.

- Previous tax returns for reference.

- Any supporting documentation that substantiates the information provided on the form.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy.

Form Submission Methods

Form 9661 can be submitted to the IRS through various methods. Businesses have the option to file the form online, by mail, or in person at designated IRS offices. Each method has its own set of guidelines and processing times, so it is important to choose the one that best fits the business's needs. Online submissions may offer quicker processing times, while mail submissions require careful attention to postage and delivery times.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 9661

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 9661 and how can airSlate SignNow help?

Form 9661 is a document used for specific business processes, and airSlate SignNow simplifies its management. With our platform, you can easily create, send, and eSign Form 9661, ensuring a smooth workflow. Our user-friendly interface makes it accessible for all users, regardless of technical expertise.

-

How much does it cost to use airSlate SignNow for Form 9661?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while efficiently managing Form 9661 and other documents. We also provide a free trial, allowing you to explore our features before committing.

-

What features does airSlate SignNow offer for Form 9661?

airSlate SignNow provides a range of features for managing Form 9661, including customizable templates, secure eSigning, and real-time tracking. These features enhance your document workflow, making it easier to collaborate and finalize Form 9661 efficiently. Additionally, our platform supports multiple file formats for added convenience.

-

Can I integrate airSlate SignNow with other applications for Form 9661?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage Form 9661. You can connect with popular tools like Google Drive, Salesforce, and more, streamlining your document processes. This integration allows for a more cohesive workflow across your business operations.

-

What are the benefits of using airSlate SignNow for Form 9661?

Using airSlate SignNow for Form 9661 offers numerous benefits, including increased efficiency and reduced turnaround time. Our platform ensures that your documents are securely signed and stored, minimizing the risk of errors. Additionally, the ease of use allows your team to focus on core tasks rather than getting bogged down by paperwork.

-

Is airSlate SignNow secure for handling Form 9661?

Absolutely! airSlate SignNow prioritizes security, ensuring that your Form 9661 and other documents are protected. We utilize advanced encryption and comply with industry standards to safeguard your data. You can trust that your sensitive information remains confidential and secure.

-

How can I get started with airSlate SignNow for Form 9661?

Getting started with airSlate SignNow for Form 9661 is simple. Sign up for a free trial on our website, and you’ll gain immediate access to our features. Once registered, you can start creating and sending Form 9661 documents right away, with helpful resources available to guide you.

Get more for Form 9661

- Professional engineersurveyor supplemental information form

- The standard your choiceeducator options disability benefits packet 2008 form

- Room license application amp permit city of north wildwood form

- Guam medical referral form

- Texas hvac license prep course form

- Kenton county form acc1

- Trans114net 2013 form

- Cr 240 surety bond 7 10 criminal forms

Find out other Form 9661

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF