H M TREASURY HELP to BUY ISA SCHEME RULES TISA 2020

What is the H M TREASURY HELP TO BUY ISA SCHEME RULES TISA

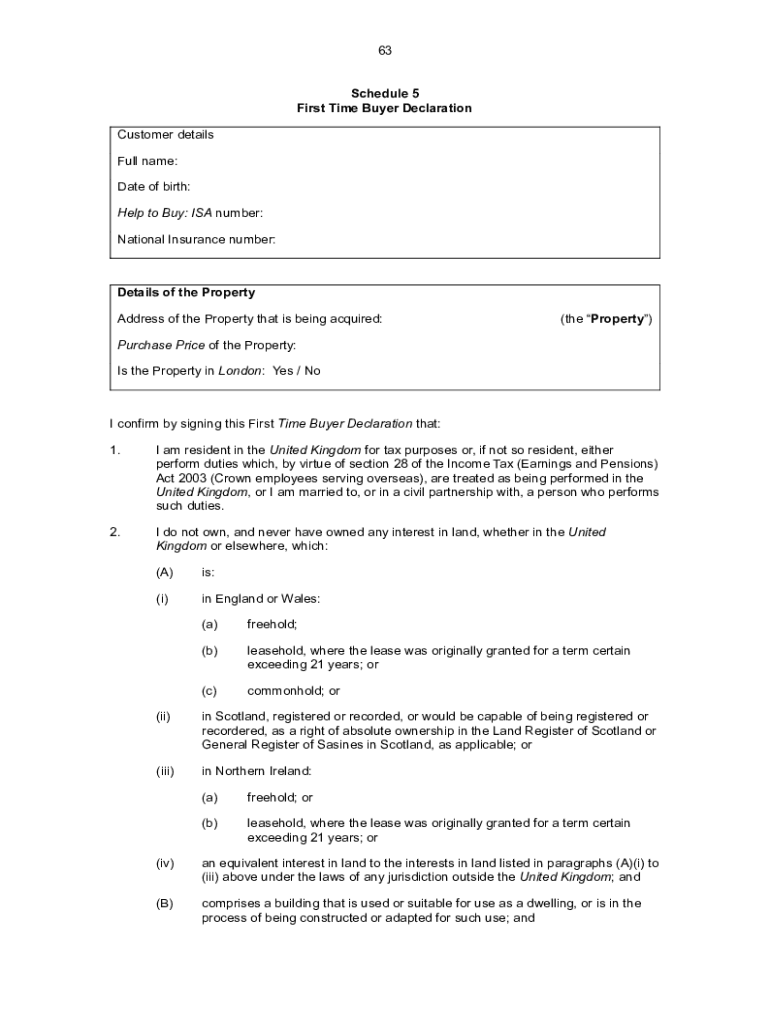

The H M Treasury Help to Buy ISA Scheme is a savings initiative designed to assist first-time homebuyers in the United Kingdom. This scheme allows individuals to save money towards their first home while receiving a government bonus. The scheme is governed by specific rules that outline eligibility, contribution limits, and the process for claiming the bonus. Participants can save up to a certain amount each month, with the government providing a percentage of the savings as a bonus when they purchase their first home.

Key elements of the H M TREASURY HELP TO BUY ISA SCHEME RULES TISA

Key elements of the Help to Buy ISA Scheme include:

- Eligibility: The scheme is available only to first-time homebuyers aged 16 or older.

- Contribution limits: Individuals can save up to £200 per month, with an initial deposit of up to £1,200.

- Government bonus: For every £200 saved, the government adds a £50 bonus, up to a maximum bonus of £3,000.

- Property price cap: The property purchased must not exceed a certain price limit, which varies by location.

How to use the H M TREASURY HELP TO BUY ISA SCHEME RULES TISA

Using the Help to Buy ISA Scheme involves several steps:

- Open an account: Choose a bank or building society that offers the Help to Buy ISA and complete the application process.

- Make contributions: Deposit money into the account regularly, adhering to the monthly limits.

- Claim the bonus: When ready to purchase a home, inform your ISA provider to claim the government bonus, which will be paid directly to your solicitor or conveyancer.

Steps to complete the H M TREASURY HELP TO BUY ISA SCHEME RULES TISA

Completing the Help to Buy ISA process involves these steps:

- Research and select a suitable ISA provider.

- Fill out the application form with personal information.

- Provide identification and proof of address as required by the provider.

- Start saving and keep track of contributions.

- When ready to buy a home, contact the provider to initiate the bonus claim.

Eligibility Criteria

To qualify for the Help to Buy ISA Scheme, individuals must meet specific criteria:

- Must be a first-time buyer.

- Must be at least 16 years old.

- Must be a UK resident.

- Must not have previously owned property in the UK or abroad.

Application Process & Approval Time

The application process for the Help to Buy ISA is straightforward. Once you select a provider, you will need to:

- Complete the application form, providing necessary personal details.

- Submit identification documents as required.

- Wait for approval, which typically takes a few days, depending on the provider.

After approval, you can start making contributions to your ISA account.

Create this form in 5 minutes or less

Find and fill out the correct h m treasury help to buy isa scheme rules tisa

Create this form in 5 minutes!

How to create an eSignature for the h m treasury help to buy isa scheme rules tisa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the H M TREASURY HELP TO BUY ISA SCHEME RULES TISA?

The H M TREASURY HELP TO BUY ISA SCHEME RULES TISA outline the eligibility criteria and benefits for individuals saving for their first home. This scheme allows first-time buyers to save up to £12,000, with the government providing a bonus of 25% on savings. Understanding these rules is crucial for maximizing your savings potential.

-

How does the H M TREASURY HELP TO BUY ISA SCHEME TISA work?

The H M TREASURY HELP TO BUY ISA SCHEME TISA works by allowing individuals to open a special savings account designed for first-time home buyers. You can deposit money into this account, and once you are ready to purchase a home, you can claim a government bonus. This bonus can signNowly boost your savings, making home ownership more attainable.

-

What are the benefits of the H M TREASURY HELP TO BUY ISA SCHEME TISA?

The primary benefit of the H M TREASURY HELP TO BUY ISA SCHEME TISA is the government bonus that adds 25% to your savings, up to a maximum of £3,000. Additionally, this scheme encourages disciplined saving, helping you signNow your home-buying goal faster. It also provides a tax-free way to save for your future.

-

Are there any fees associated with the H M TREASURY HELP TO BUY ISA SCHEME TISA?

Generally, there are no fees associated with opening or maintaining a H M TREASURY HELP TO BUY ISA SCHEME TISA account. However, it's important to check with your chosen bank or financial institution for any specific terms or conditions. This makes it a cost-effective option for first-time buyers.

-

Can I use the H M TREASURY HELP TO BUY ISA SCHEME TISA with other savings accounts?

Yes, you can use the H M TREASURY HELP TO BUY ISA SCHEME TISA alongside other savings accounts. However, it's essential to keep in mind the maximum contribution limits to ensure you benefit fully from the government bonus. Combining different savings strategies can enhance your overall savings plan.

-

What types of properties can I purchase using the H M TREASURY HELP TO BUY ISA SCHEME TISA?

The H M TREASURY HELP TO BUY ISA SCHEME TISA can be used to purchase a variety of properties, including new builds and existing homes. However, the property must be valued at £450,000 or less in London and £250,000 or less outside London. This ensures that the scheme remains accessible to first-time buyers.

-

How do I claim the government bonus from the H M TREASURY HELP TO BUY ISA SCHEME TISA?

To claim the government bonus from the H M TREASURY HELP TO BUY ISA SCHEME TISA, you need to provide your solicitor with a closing statement from your ISA provider. This statement will confirm the amount saved and the bonus you are entitled to. It's a straightforward process that can signNowly aid your home purchase.

Get more for H M TREASURY HELP TO BUY ISA SCHEME RULES TISA

Find out other H M TREASURY HELP TO BUY ISA SCHEME RULES TISA

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online