Gift in Kind or Non Cash Contribution Donation Form Library

What is the Gift In Kind Or Non Cash Contribution Donation Form library

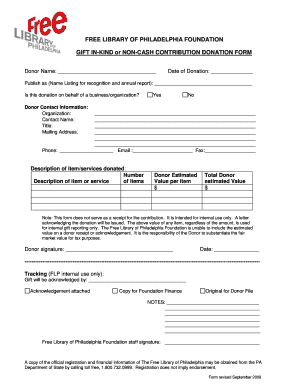

The Gift In Kind Or Non Cash Contribution Donation Form library is a collection of documents designed to facilitate the process of donating non-cash contributions. This form is essential for individuals and organizations looking to provide gifts that are not monetary in nature, such as goods, services, or property. It serves as a formal record of the donation, ensuring that both the donor and the recipient have a clear understanding of the items being donated, their estimated value, and the terms of the donation.

Key elements of the Gift In Kind Or Non Cash Contribution Donation Form library

Several key elements are vital to the Gift In Kind Or Non Cash Contribution Donation Form library. These include:

- Donor Information: Details about the individual or organization making the donation, including name, address, and contact information.

- Recipient Information: Information about the organization or individual receiving the donation.

- Description of Items: A detailed list of the items being donated, including their condition and estimated value.

- Date of Donation: The specific date when the donation is made.

- Signatures: Signatures from both the donor and recipient, confirming the details of the donation.

Steps to complete the Gift In Kind Or Non Cash Contribution Donation Form library

Completing the Gift In Kind Or Non Cash Contribution Donation Form involves several straightforward steps:

- Gather all necessary information about the donation, including the items being donated and their estimated values.

- Fill out the donor and recipient information sections accurately.

- Provide a detailed description of each item, including its condition and value.

- Specify the date of the donation.

- Review the completed form for accuracy.

- Obtain signatures from both the donor and recipient.

- Keep a copy of the signed form for your records.

Legal use of the Gift In Kind Or Non Cash Contribution Donation Form library

The legal use of the Gift In Kind Or Non Cash Contribution Donation Form library is crucial for both donors and recipients. This form provides documentation that can be used for tax purposes, ensuring compliance with IRS regulations regarding non-cash charitable contributions. It is important for donors to retain this documentation as it may be required to substantiate the value of the donation when filing taxes. Additionally, the form helps protect both parties by clearly outlining the terms of the donation.

IRS Guidelines

The IRS has specific guidelines regarding non-cash contributions that are essential to understand when using the Gift In Kind Or Non Cash Contribution Donation Form library. Donors must ensure that the value of the donated items is accurately assessed according to IRS standards. For donations exceeding a certain value, additional documentation may be required, such as a qualified appraisal. It is advisable for donors to consult IRS Publication 526 for detailed information on the rules governing charitable contributions.

Form Submission Methods

The Gift In Kind Or Non Cash Contribution Donation Form can be submitted through various methods, depending on the preferences of the donor and recipient. Common submission methods include:

- Online Submission: Many organizations allow for digital submissions through their websites, enabling a quick and efficient process.

- Mail: The completed form can be printed and mailed to the recipient organization.

- In-Person: Donors may choose to deliver the form in person during the donation process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gift in kind or non cash contribution donation form library

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Gift In Kind Or Non Cash Contribution Donation Form library?

The Gift In Kind Or Non Cash Contribution Donation Form library is a collection of customizable templates designed to help organizations document non-cash donations efficiently. This library simplifies the process of recording and managing gifts in kind, ensuring compliance and proper acknowledgment for donors.

-

How can the Gift In Kind Or Non Cash Contribution Donation Form library benefit my organization?

Utilizing the Gift In Kind Or Non Cash Contribution Donation Form library streamlines the donation process, saving time and reducing errors. It enhances donor relations by providing clear documentation and acknowledgment, which can encourage future contributions.

-

Is there a cost associated with using the Gift In Kind Or Non Cash Contribution Donation Form library?

The Gift In Kind Or Non Cash Contribution Donation Form library is part of the airSlate SignNow platform, which offers various pricing plans. Depending on your organization's needs, you can choose a plan that fits your budget while gaining access to this valuable resource.

-

Can I customize the forms in the Gift In Kind Or Non Cash Contribution Donation Form library?

Yes, the forms in the Gift In Kind Or Non Cash Contribution Donation Form library are fully customizable. You can modify fields, add your organization's branding, and tailor the content to meet your specific requirements, ensuring that the forms align with your operational needs.

-

What features are included in the Gift In Kind Or Non Cash Contribution Donation Form library?

The Gift In Kind Or Non Cash Contribution Donation Form library includes features such as eSignature capabilities, automated workflows, and secure document storage. These features enhance the efficiency of managing non-cash contributions and ensure that all documentation is easily accessible.

-

How does the Gift In Kind Or Non Cash Contribution Donation Form library integrate with other tools?

The Gift In Kind Or Non Cash Contribution Donation Form library seamlessly integrates with various CRM and accounting software. This integration allows for smooth data transfer and management, ensuring that all donation records are up-to-date and accurately reflected across your systems.

-

Is the Gift In Kind Or Non Cash Contribution Donation Form library user-friendly?

Absolutely! The Gift In Kind Or Non Cash Contribution Donation Form library is designed with user experience in mind. Its intuitive interface makes it easy for users of all skill levels to create, send, and manage donation forms without any technical expertise.

Get more for Gift In Kind Or Non Cash Contribution Donation Form library

- 13 printable financial affidavit form florida templates

- Florida final judgment form

- 12 980 a 2010 form

- Example of completing an affidavit of corroborating witness 2000 form

- Petition relocation 2010 form

- Florida family law forms financial affidavit 2011

- Supreme c flcourts form

- Form florida petition 2011

Find out other Gift In Kind Or Non Cash Contribution Donation Form library

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form