Collin County Homestead Exemption Form

What is the Collin County Homestead Exemption Form

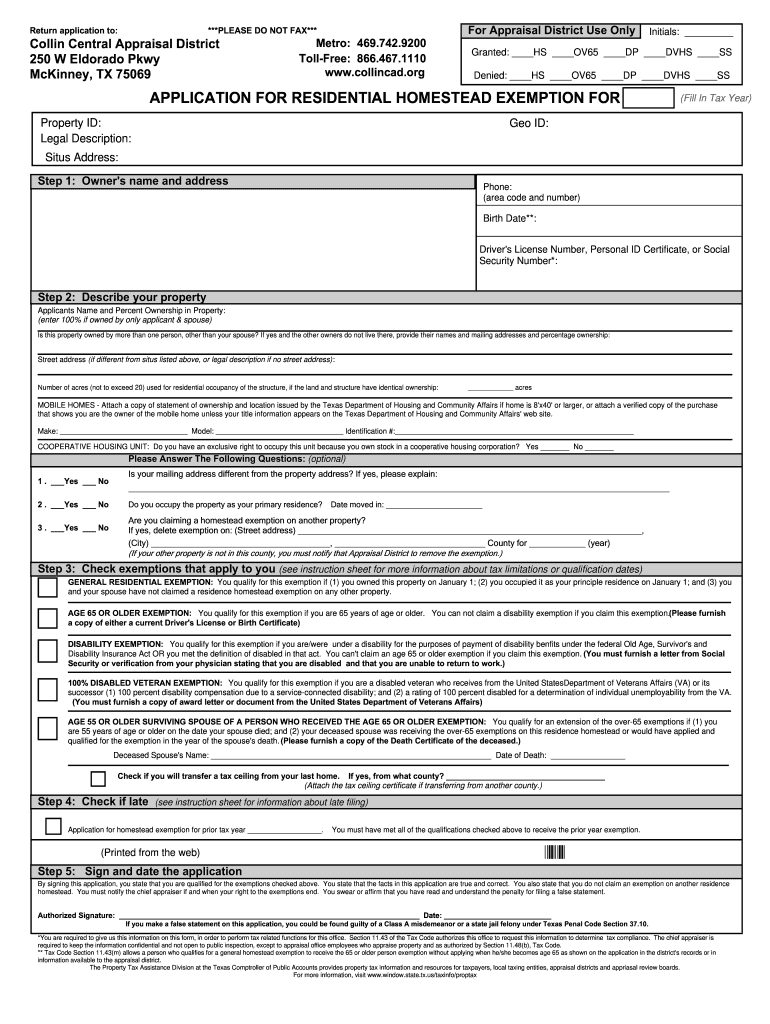

The Collin County Homestead Exemption Form is a legal document that allows homeowners in Collin County, Texas, to apply for a property tax exemption on their primary residence. This exemption can significantly reduce the amount of property taxes owed, making homeownership more affordable. The form requires specific information about the property and the homeowner, ensuring that only eligible applicants receive the benefits. Understanding this form's purpose is crucial for homeowners looking to maximize their tax savings.

Eligibility Criteria

To qualify for the Collin County Homestead Exemption, applicants must meet certain criteria. Homeowners must occupy the property as their primary residence as of January first of the tax year. Additionally, applicants should not claim a homestead exemption on any other property. Other factors, such as age, disability status, and income levels, may also influence eligibility. Familiarizing oneself with these requirements is essential for a successful application.

Steps to complete the Collin County Homestead Exemption Form

Completing the Collin County Homestead Exemption Form involves several key steps. First, gather necessary documentation, including proof of identity and property ownership. Next, accurately fill out the form, ensuring all required fields are completed. After completing the form, review it for accuracy before submission. This careful approach helps prevent delays in processing and ensures compliance with local regulations.

Form Submission Methods (Online / Mail / In-Person)

Homeowners can submit the Collin County Homestead Exemption Form through various methods. The form is available for online submission, which offers a convenient option for many applicants. Alternatively, homeowners can mail the completed form to the appropriate county office or deliver it in person. Understanding these submission methods can help streamline the application process and ensure timely filing.

Filing Deadlines / Important Dates

Awareness of filing deadlines is critical for applicants of the Collin County Homestead Exemption. Typically, the deadline to submit the form is April 30 of the tax year for which the exemption is sought. Missing this deadline can result in the loss of potential tax savings. Keeping track of important dates ensures that homeowners can take full advantage of the exemption benefits.

Required Documents

When applying for the Collin County Homestead Exemption, certain documents are required to support the application. Homeowners must provide proof of identity, such as a driver's license or state ID, along with documentation that verifies property ownership. Additional documents may include utility bills or tax statements that confirm residency. Having these documents ready can facilitate a smoother application process.

Legal use of the Collin County Homestead Exemption Form

The Collin County Homestead Exemption Form must be used in accordance with state laws and regulations. Homeowners are responsible for ensuring that the information provided is accurate and truthful. Misrepresentation or fraudulent claims can lead to penalties, including the denial of the exemption and potential legal consequences. Understanding the legal implications of this form is essential for all applicants.

Quick guide on how to complete collin county homestead exemption deadline form

Complete Your T's and I's on Collin County Homestead Exemption Form

Engaging in contracts, managing listings, arranging calls, and showings - realtors and property professionals navigate a range of responsibilities daily. Many of these tasks necessitate numerous documents, such as Collin County Homestead Exemption Form, that must be completed swiftly and as accurately as possible.

airSlate SignNow is a comprehensive solution that enables real estate professionals to alleviate the document load and allows them to concentrate more on their clients’ goals during the entire negotiation process, helping them secure the optimal terms on the transaction.

How to fill out Collin County Homestead Exemption Form with airSlate SignNow:

- Go to the Collin County Homestead Exemption Form page or utilize our library’s search features to find the one you require.

- Click on Get form - you’ll be promptly taken to the editor.

- Begin completing the form by selecting fillable fields and entering your text.

- Add new text and modify its settings if necessary.

- Choose the Sign option in the top toolbar to generate your eSignature.

- Explore additional features used to annotate and enhance your form, such as drawing, highlighting, adding shapes, and more.

- Select the notes tab and create comments regarding your document.

- Conclude the process by downloading, sharing, or sending your form to your chosen users or organizations.

Eliminate paper for good and enhance the homebuying process with our intuitive and powerful solution. Experience greater simplicity when completing Collin County Homestead Exemption Form and other real estate documents online. Give our service a try!

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the collin county homestead exemption deadline form

How to generate an eSignature for the Collin County Homestead Exemption Deadline Form online

How to create an eSignature for your Collin County Homestead Exemption Deadline Form in Google Chrome

How to make an electronic signature for signing the Collin County Homestead Exemption Deadline Form in Gmail

How to create an eSignature for the Collin County Homestead Exemption Deadline Form right from your mobile device

How to create an electronic signature for the Collin County Homestead Exemption Deadline Form on iOS devices

How to create an eSignature for the Collin County Homestead Exemption Deadline Form on Android devices

People also ask

-

What is the Collin County homestead exemption application process?

The Collin County homestead exemption application process involves submitting the required documentation to the local appraisal district. You must complete the application form and provide proof of residency. This exemption can lower your property taxes, making it beneficial for homeowners in Collin County.

-

How much does it cost to file a Collin County homestead exemption application?

Filing a Collin County homestead exemption application is free of charge. There are no application fees or hidden costs associated with the process. This makes it an attractive option for homeowners looking to save on property taxes in Collin County.

-

What are the benefits of applying for a Collin County homestead exemption?

Applying for a Collin County homestead exemption can signNowly reduce your property tax bill. Additionally, it may offer protection from creditors and help qualify you for other tax relief programs. Homeowners can enjoy peace of mind knowing they are maximizing their tax savings with this exemption.

-

Are there any eligibility requirements for the Collin County homestead exemption application?

To be eligible for the Collin County homestead exemption application, you must occupy the property as your primary residence and own the home as of January 1 of the tax year. There are also income limits for certain types of exemptions. Always check the current criteria to ensure your application is valid.

-

How can I submit my Collin County homestead exemption application?

You can submit your Collin County homestead exemption application in person at the local appraisal office or online through the Collin County official website. Make sure to gather all necessary documents before submission. Additionally, using eSignature solutions like airSlate SignNow can streamline this process.

-

What documents are needed for the Collin County homestead exemption application?

Necessary documents for the Collin County homestead exemption application may include proof of ownership, a valid Texas driver's license, and any relevant financial documents. Ensure that you have these ready to expedite the application process. Accurate documentation will enhance your chance of approval.

-

When is the deadline to apply for the Collin County homestead exemption?

The deadline to apply for a Collin County homestead exemption is typically April 30 of the tax year for which you seek the exemption. It's crucial to submit your application on time to benefit from the reduction in property taxes. Late submissions may result in missing out on tax savings.

Get more for Collin County Homestead Exemption Form

- City of mountain view false alarm abatement program form

- Fixed indemnity insurancecoverage for the in health insurance form

- John doe smith affidavit template form

- British columbia search and rescue ics forms instructions jibc

- Dl 90b 2015 2019 form

- Colposcopy report form

- Consent to disclose utility customer data xcel energy form

- Form ad 1048 2015 2019

Find out other Collin County Homestead Exemption Form

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form