Form 1099

What is the Form 1099

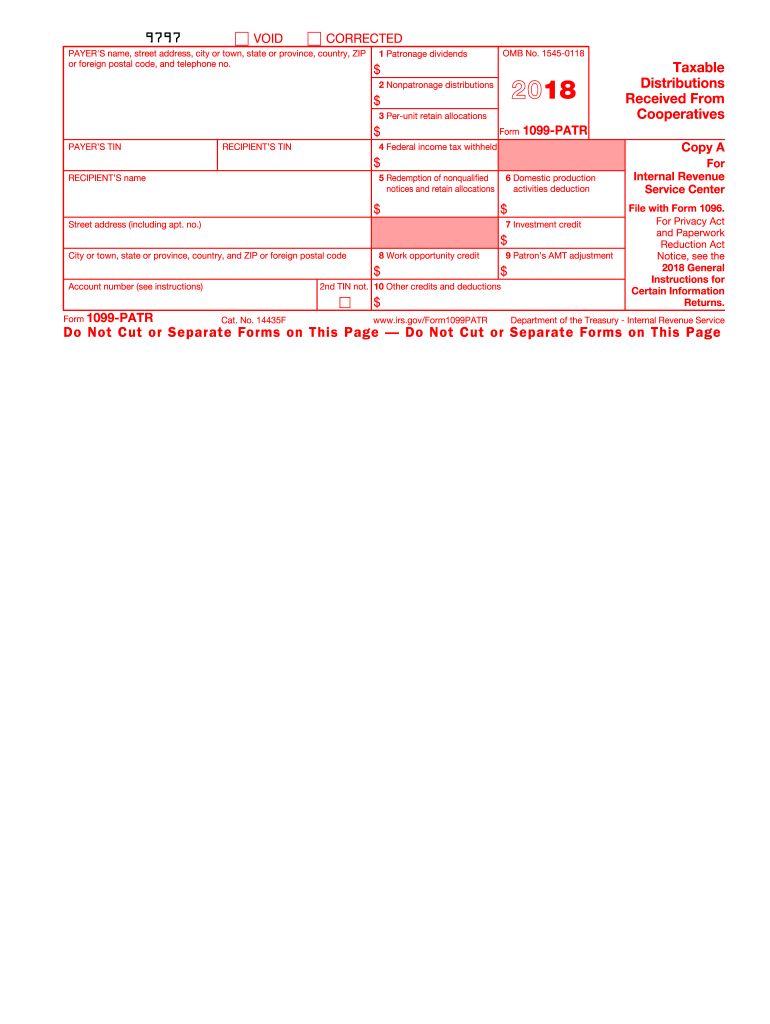

The 1099 form serves as an important tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is primarily utilized by businesses and individuals who have paid independent contractors, freelancers, or other non-employees. The 1099 form encompasses several variants, with the most common being the 1099-MISC and 1099-NEC, which report miscellaneous income and non-employee compensation, respectively. Understanding the purpose of the 1099 form is crucial for accurate tax reporting and compliance with IRS regulations.

Steps to complete the Form 1099

Completing the 1099 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the payee, including their name, address, and taxpayer identification number (TIN). Next, determine the appropriate type of 1099 form to use based on the nature of the payment. Fill out the form by entering the required details, including the total amount paid during the tax year. After completing the form, review it for accuracy before submitting it to the IRS and providing a copy to the payee. It is advisable to keep a copy for your records as well.

Legal use of the Form 1099

The legal use of the 1099 form is governed by IRS regulations, which require accurate reporting of income to ensure compliance with tax laws. Businesses are obligated to issue a 1099 form to any non-employee who has received payments totaling $600 or more during the tax year. Failure to issue the form can result in penalties from the IRS. Additionally, the information reported on the 1099 form must match the payee's tax return to avoid discrepancies that could lead to audits or fines. It is essential to understand these legal requirements to maintain compliance and avoid potential issues.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 form are critical for compliance with IRS regulations. Generally, the deadline for providing the 1099 form to recipients is January thirty-first of the year following the tax year in question. The deadline for submitting the form to the IRS is typically February twenty-eighth if filing by mail and March thirty-first if filing electronically. It is important to be aware of these dates to avoid late filing penalties and ensure timely reporting of income.

Who Issues the Form

The 1099 form is issued by businesses or individuals who make payments to non-employees, such as independent contractors, freelancers, or vendors. This includes various types of organizations, including sole proprietorships, partnerships, and corporations. Each entity that pays a non-employee $600 or more during the tax year is responsible for issuing a 1099 form. It is essential for these issuers to maintain accurate records of payments to ensure compliance with IRS requirements.

Examples of using the Form 1099

There are several scenarios in which the 1099 form is utilized. For instance, a business may issue a 1099-MISC to a freelance graphic designer who provided services worth $1,200 during the year. Similarly, a landlord might issue a 1099 for rental income received from a tenant. Other examples include payments made to attorneys, medical service providers, and consultants. Each of these instances highlights the importance of the 1099 form in accurately reporting income for tax purposes.

Quick guide on how to complete govform1099patr department of the treasury internal revenue service

Complete Form 1099 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly and without interruptions. Manage Form 1099 on any device using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

How to adjust and electronically sign Form 1099 with ease

- Obtain Form 1099 and click on Get Form to begin.

- Utilize the resources we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to submit your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your needs for document management in just a few clicks from any device you prefer. Modify and electronically sign Form 1099 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the govform1099patr department of the treasury internal revenue service

How to create an electronic signature for your Govform1099patr Department Of The Treasury Internal Revenue Service in the online mode

How to create an eSignature for the Govform1099patr Department Of The Treasury Internal Revenue Service in Chrome

How to make an eSignature for putting it on the Govform1099patr Department Of The Treasury Internal Revenue Service in Gmail

How to generate an eSignature for the Govform1099patr Department Of The Treasury Internal Revenue Service right from your smart phone

How to create an electronic signature for the Govform1099patr Department Of The Treasury Internal Revenue Service on iOS devices

How to generate an electronic signature for the Govform1099patr Department Of The Treasury Internal Revenue Service on Android

People also ask

-

What is a 1099 form 2018 printable?

A 1099 form 2018 printable is a tax document used to report various types of income other than wages, salaries, and tips. It's essential for independent contractors and freelancers as it summarizes the income they've earned. You can create, fill out, and print your 1099 form 2018 easily with airSlate SignNow.

-

How can I fill out a 1099 form 2018 printable using airSlate SignNow?

Filling out a 1099 form 2018 printable with airSlate SignNow is straightforward. You can upload your form, easily enter the required information, and use our intuitive interface to ensure accuracy. Once completed, you can download or send the form electronically.

-

What are the benefits of using airSlate SignNow for my 1099 form 2018 printable?

Using airSlate SignNow for your 1099 form 2018 printable provides a streamlined and secure way to manage your tax documents. It eliminates the hassle of printing and mailing by allowing you to eSign and send forms digitally. Additionally, our solution is cost-effective and user-friendly, perfect for businesses of all sizes.

-

Is airSlate SignNow compliant with IRS regulations for 1099 form 2018 printable?

Yes, airSlate SignNow is designed to comply with IRS regulations for all tax documents, including the 1099 form 2018 printable. We ensure that our eSignature processes meet legal standards, so your documents are valid and secure for submission to the IRS.

-

Can I integrate airSlate SignNow with other tools for managing my 1099 form 2018 printable?

Absolutely! airSlate SignNow offers integrations with various applications and platforms, making it easy to manage your 1099 form 2018 printable alongside your other business tools. Connect with accounting software or CRMs to simplify your workflow and maintain seamless operations.

-

What is the pricing structure for using airSlate SignNow for 1099 form 2018 printable?

airSlate SignNow offers flexible pricing plans tailored to different business needs. We provide affordable options for individuals and organizations alike, ensuring you can efficiently manage your 1099 form 2018 printable without breaking the bank. Sign up for a free trial to explore features before committing.

-

Can I send my completed 1099 form 2018 printable directly to recipients through airSlate SignNow?

Yes, airSlate SignNow allows you to send your completed 1099 form 2018 printable directly to your recipients. Once the form is filled out and signed, you can easily share it via email or generate a secure link for access. This feature saves time and makes the process more efficient.

Get more for Form 1099

Find out other Form 1099

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe