Scdeptofrevenueformfs102 2018

What is the South Carolina installment form?

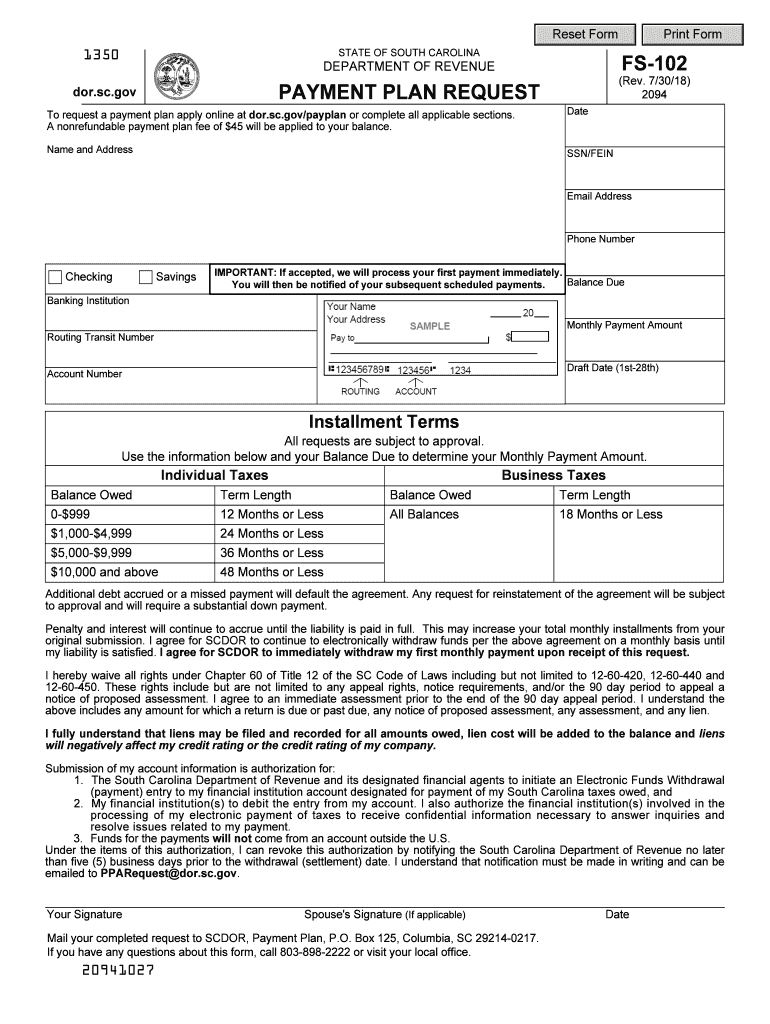

The South Carolina installment form, often referred to as the FS 102, is a document used by taxpayers in South Carolina to request an installment agreement for tax payments. This form is particularly important for individuals or businesses who may not be able to pay their taxes in full by the due date. By submitting this form, taxpayers can propose a payment plan that allows them to pay their tax liabilities over time, easing financial strain while remaining compliant with state tax regulations.

Steps to complete the South Carolina installment form

Completing the South Carolina installment form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including income, expenses, and any outstanding tax liabilities. Next, fill out the FS 102 form by providing personal identification details, including your name, address, and Social Security number. Be sure to specify the total amount owed and the proposed monthly payment amount. After completing the form, review it thoroughly to confirm that all information is correct. Finally, submit the form through the designated method, which may include online submission, mailing, or in-person delivery.

Legal use of the South Carolina installment form

The South Carolina installment form is legally binding once submitted and approved by the South Carolina Department of Revenue. It is essential to understand that entering into an installment agreement does not absolve the taxpayer of their tax obligations. Instead, it provides a structured way to manage payments over time. Taxpayers must adhere to the terms outlined in the agreement, including making timely payments, to avoid penalties or further collection actions. Understanding the legal implications of this form is crucial for maintaining compliance with state tax laws.

Required documents for the South Carolina installment form

When preparing to submit the South Carolina installment form, certain documents may be required to support your application. These typically include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of monthly expenses, including bills and other financial obligations.

- A copy of the tax return for the year in which the tax liability was incurred.

- Any previous correspondence with the South Carolina Department of Revenue regarding tax matters.

Having these documents ready can streamline the process and increase the likelihood of approval for your installment agreement.

Form submission methods for the South Carolina installment form

The South Carolina installment form can be submitted through various methods, ensuring convenience for taxpayers. Options typically include:

- Online submission via the South Carolina Department of Revenue's website.

- Mailing the completed form to the appropriate address designated by the Department of Revenue.

- In-person submission at local Department of Revenue offices, which may provide immediate assistance and guidance.

Choosing the right submission method can depend on personal preference and urgency, but online submission is often the fastest option.

State-specific rules for the South Carolina installment form

Each state has its own regulations regarding installment agreements, and South Carolina is no exception. Taxpayers should be aware of specific rules that may affect their application. For instance, the South Carolina Department of Revenue may require taxpayers to be current on all tax filings to qualify for an installment agreement. Additionally, there may be limits on the total amount owed to be eligible for this payment plan. Understanding these state-specific rules is vital for ensuring compliance and successfully managing tax liabilities.

Quick guide on how to complete fs 102 2018 2019 form

Your assistance manual on how to prepare your Scdeptofrevenueformfs102

If you’re wondering how to generate and submit your Scdeptofrevenueformfs102, here are some concise instructions on how to simplify tax filing.

To start, you only need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that allows you to modify, draft, and finalize your tax documents with ease. With its editor, you can toggle between text, checkboxes, and electronic signatures and go back to update information as necessary. Optimize your tax management with advanced PDF editing, eSignatures, and straightforward sharing.

Follow the steps below to finalize your Scdeptofrevenueformfs102 in no time:

- Set up your account and start processing PDFs within minutes.

- Use our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Scdeptofrevenueformfs102 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to append your legally-binding electronic signature (if needed).

- Examine your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper may lead to increased return errors and delay refunds. Importantly, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct fs 102 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out the Form 102 (ICAI) for an articleship? Can anyone provide a sample format?

Form 102 serves as a contract between you and your Principal at work. It becomes binding only when its Franked.Franking is nothing but converting it into a Non Judicial Paper. So u'll be filling in your name, your articleship period and other details and you and your boss(principal) will sign it on each page and at the end. It need not be sent to the institute , one copy is for you and another for your Principal .Nothin to worry..And while filling the form if you have any query , just see the form filled by old articles. The record will be with your Principal or ask your seniors.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the fs 102 2018 2019 form

How to generate an eSignature for your Fs 102 2018 2019 Form in the online mode

How to make an eSignature for the Fs 102 2018 2019 Form in Chrome

How to create an eSignature for putting it on the Fs 102 2018 2019 Form in Gmail

How to generate an electronic signature for the Fs 102 2018 2019 Form from your smartphone

How to create an eSignature for the Fs 102 2018 2019 Form on iOS

How to create an electronic signature for the Fs 102 2018 2019 Form on Android

People also ask

-

What is the SCDeptofRevenueFormFS102 and why is it important?

The SCDeptofRevenueFormFS102 is a crucial form used for tax-related purposes in South Carolina. Understanding this form is essential for businesses and individuals to ensure compliance with state tax regulations and to avoid potential penalties.

-

How can airSlate SignNow help with SCDeptofRevenueFormFS102?

airSlate SignNow streamlines the process of completing and eSigning the SCDeptofRevenueFormFS102. With our user-friendly platform, you can easily fill out the form and send it securely for signatures, saving time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for SCDeptofRevenueFormFS102?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage documents like the SCDeptofRevenueFormFS102 without breaking the bank.

-

What features does airSlate SignNow offer for the SCDeptofRevenueFormFS102?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure eSignature capabilities specifically for documents like the SCDeptofRevenueFormFS102. These features enhance the efficiency and security of your document management process.

-

Can I integrate airSlate SignNow with other software for handling SCDeptofRevenueFormFS102?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, allowing you to manage your SCDeptofRevenueFormFS102 alongside your existing workflows. Popular integrations include CRM systems, cloud storage, and productivity tools.

-

What are the benefits of using airSlate SignNow for SCDeptofRevenueFormFS102?

Using airSlate SignNow for the SCDeptofRevenueFormFS102 offers numerous benefits, including improved efficiency, enhanced security, and easy access to documents from anywhere. Our platform simplifies the signing process, ensuring that you can focus on your business rather than paperwork.

-

How secure is airSlate SignNow when handling SCDeptofRevenueFormFS102?

Security is our top priority at airSlate SignNow. We use advanced encryption protocols and comply with industry standards to ensure that your SCDeptofRevenueFormFS102 and other sensitive documents are protected from unauthorized access.

Get more for Scdeptofrevenueformfs102

- Appendix of forms form 81f formule 81f motion to change gnb

- Emirates islamic bank online form

- General forbearance request use this form to request a general forbearance on yor direct loans ffel program loans or federal

- Teladoc credentialing application amazon web services form

- Sde residential damage inspection worksheet mokan stormsmart form

- Anacostia watershed society release and waiver of liability all educational and volunteer event participants please read and form

- Returning worker form

- 5 chapter 5 test form 2b score waukee high school blogs waukeeschools

Find out other Scdeptofrevenueformfs102

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist