940 Pr Form

What is the 940 PR?

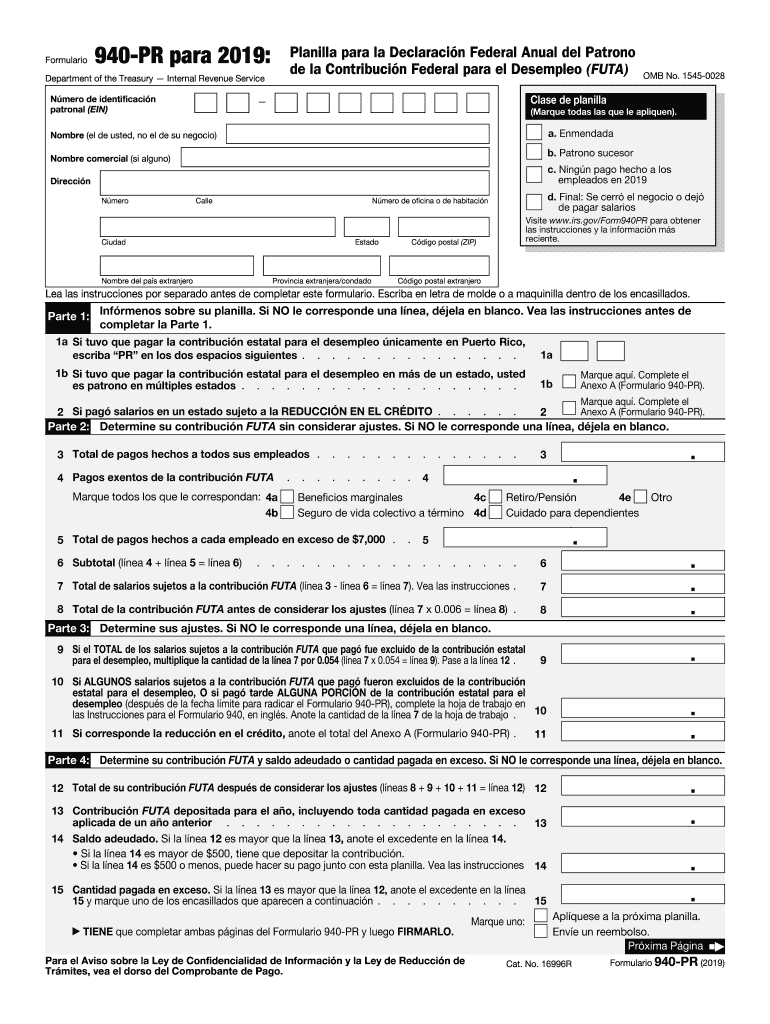

The 940 PR, also known as the 2019 Form 940, is a federal tax form used by employers in Puerto Rico to report their Federal Unemployment Tax Act (FUTA) liabilities. This form is essential for businesses that pay wages to employees in Puerto Rico, as it helps ensure compliance with federal unemployment tax regulations. The 940 PR is specifically designed for employers operating in Puerto Rico to report their annual FUTA tax obligations accurately.

Steps to Complete the 940 PR

Completing the 940 PR involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including total wages paid to employees and any applicable credits. Next, fill out the form by entering the required details in the appropriate sections. Be sure to calculate the FUTA tax owed based on the wages reported. After completing the form, review it for any errors or omissions. Finally, submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the 940 PR to avoid any penalties. Typically, the form must be filed annually by January 31 of the following year. If January 31 falls on a weekend or holiday, the deadline may be extended to the next business day. Employers should also keep track of any specific dates related to payments of FUTA taxes to ensure timely compliance.

Legal Use of the 940 PR

The legal use of the 940 PR ensures that employers fulfill their obligations under the Federal Unemployment Tax Act. This form serves as a formal declaration of the FUTA tax owed and is necessary for maintaining compliance with federal tax laws. Employers must ensure that the information provided on the form is accurate and complete to avoid legal repercussions, including fines or audits.

Key Elements of the 940 PR

Several key elements must be included when completing the 940 PR. These elements include the employer's identification information, total wages paid to employees, any adjustments for previous years, and the calculation of the FUTA tax owed. It is important to accurately report these elements to ensure compliance with tax regulations and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The 940 PR can be submitted through various methods, providing flexibility for employers. The form can be filed online using approved tax software or by mailing a paper copy to the appropriate IRS address. In-person submission is generally not available for this form. Employers should choose the method that best suits their needs while ensuring timely submission.

Penalties for Non-Compliance

Failure to comply with the requirements of the 940 PR can result in significant penalties. These penalties may include fines for late filing, inaccuracies in reporting, or failure to pay the required FUTA taxes. Employers should be diligent in completing and submitting the form on time to avoid these financial repercussions.

Quick guide on how to complete 2019 form 940 pr employers annual federal unemployment futa tax return puerto rican version

Complete 940 Pr effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow offers all the tools necessary to create, edit, and eSign your documents swiftly and without hassle. Manage 940 Pr on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 940 Pr with ease

- Obtain 940 Pr and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools provided specifically by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require new paper copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign 940 Pr and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 940 pr employers annual federal unemployment futa tax return puerto rican version

How to create an eSignature for your 2019 Form 940 Pr Employers Annual Federal Unemployment Futa Tax Return Puerto Rican Version online

How to create an eSignature for your 2019 Form 940 Pr Employers Annual Federal Unemployment Futa Tax Return Puerto Rican Version in Chrome

How to create an eSignature for putting it on the 2019 Form 940 Pr Employers Annual Federal Unemployment Futa Tax Return Puerto Rican Version in Gmail

How to make an eSignature for the 2019 Form 940 Pr Employers Annual Federal Unemployment Futa Tax Return Puerto Rican Version right from your mobile device

How to generate an eSignature for the 2019 Form 940 Pr Employers Annual Federal Unemployment Futa Tax Return Puerto Rican Version on iOS devices

How to make an electronic signature for the 2019 Form 940 Pr Employers Annual Federal Unemployment Futa Tax Return Puerto Rican Version on Android devices

People also ask

-

What is the 2019 Form 940?

The 2019 Form 940 is an annual return for employers to report their Federal Unemployment Tax Act (FUTA) tax liabilities. This form is crucial for businesses to ensure compliance with federal regulations and accurately calculate the taxes owed. Using tools like airSlate SignNow can simplify the eSigning process for your 2019 Form 940, ensuring it is submitted timely and accurately.

-

How can airSlate SignNow assist with the 2019 Form 940?

airSlate SignNow streamlines the process of filling out and eSigning the 2019 Form 940, making it easier for businesses to manage their tax obligations. With features like templates and cloud storage, you can prepare and sign your form in minutes. This efficiency reduces the risk of error and delays in submission.

-

What features does airSlate SignNow offer for managing the 2019 Form 940?

airSlate SignNow offers robust features, including customizable templates, secure cloud storage, and real-time tracking for the 2019 Form 940. These features ensure that your documents are easily accessible and securely signed. Additionally, the audit trail capability provides transparency and accountability for every form submitted.

-

Is airSlate SignNow cost-effective for handling documents like the 2019 Form 940?

Yes, airSlate SignNow is a cost-effective solution for handling documents, including the 2019 Form 940. With competitive pricing plans, businesses can choose a package that suits their needs without overspending. This affordability combined with the efficiency of digital signing makes it a valuable tool for all your document management.

-

Can I integrate airSlate SignNow with other software for the 2019 Form 940?

Absolutely! airSlate SignNow supports integrations with various software applications, enhancing your workflow for managing the 2019 Form 940. Whether you use accounting software or HR platforms, integration with SignNow helps streamline your processes and keeps your data in sync.

-

What are the benefits of using electronic signatures for the 2019 Form 940?

Using electronic signatures for the 2019 Form 940 offers numerous benefits, including faster turnaround times and enhanced security. Electronic signing through airSlate SignNow helps to eliminate paper clutter, reduces chances of loss, and provides a convenient way for multiple parties to sign documents quickly.

-

How does airSlate SignNow ensure the security of my 2019 Form 940?

airSlate SignNow prioritizes security, employing industry-standard encryption protocols to protect sensitive information such as your 2019 Form 940. Our platform also supports authentication methods to verify signers, ensuring that only authorized individuals can access and sign your documents. This focus on security gives businesses peace of mind.

Get more for 940 Pr

Find out other 940 Pr

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship