8960 Form

What is the 8960

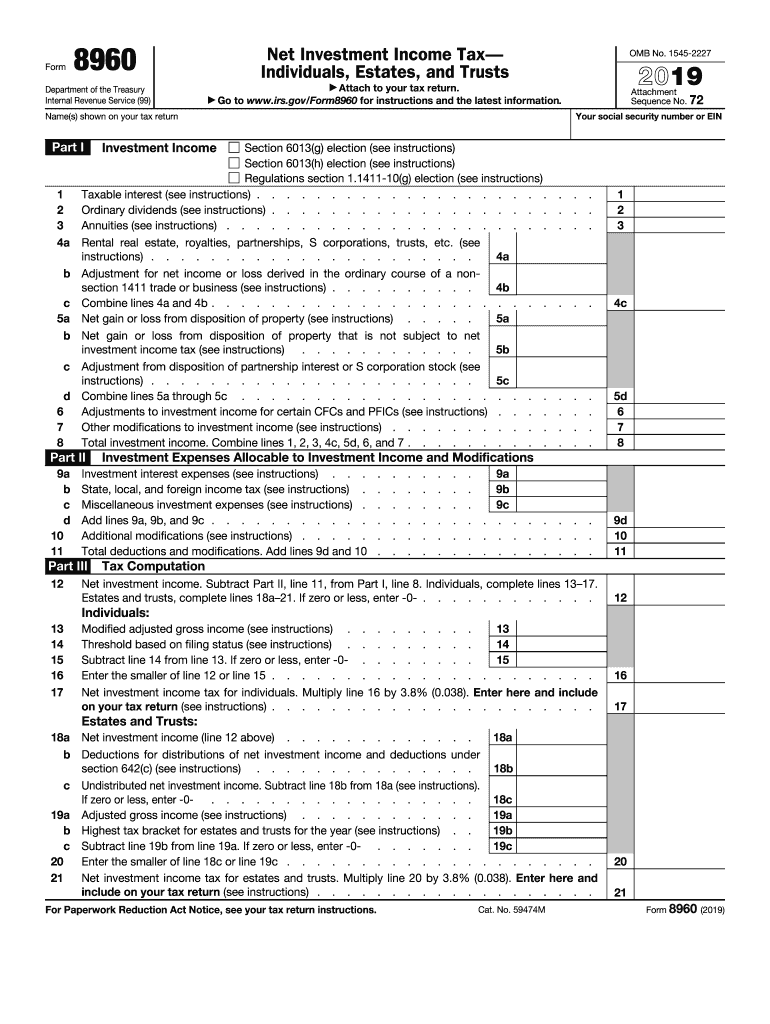

The 2019 Form 8960 is a tax form used by individuals and estates to calculate and report the Net Investment Income Tax (NIIT). This tax applies to certain high-income taxpayers who have net investment income above specific thresholds. The form helps determine the amount of tax owed based on the taxpayer's net investment income, which includes interest, dividends, capital gains, rental income, and other forms of passive income.

How to use the 8960

To use the 2019 Form 8960, taxpayers must first gather relevant financial information regarding their investment income. This includes details about interest, dividends, capital gains, and any other applicable income sources. After completing the form, taxpayers should attach it to their Form 1040 or Form 1040-NR when filing their annual tax return. It is essential to ensure that all calculations are accurate to avoid potential penalties.

Steps to complete the 8960

Completing the 2019 Form 8960 involves several steps:

- Gather all necessary financial documents related to investment income.

- Determine your modified adjusted gross income (MAGI) to see if it exceeds the threshold for NIIT.

- Calculate your net investment income by summing all applicable income sources.

- Complete the form by filling in the required fields, including your MAGI and net investment income.

- Review the form for accuracy and completeness before submission.

Legal use of the 8960

The 2019 Form 8960 is legally binding when completed and submitted according to IRS guidelines. It must be signed and dated by the taxpayer to validate the information provided. The form's legal standing is supported by compliance with tax laws and regulations, ensuring that all reported figures are accurate and truthful. Failure to comply with these requirements may result in penalties or audits by the IRS.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline to file Form 8960 is typically the same as the deadline for filing your federal income tax return, which is usually April 15 of the following year. If you require additional time, you may file for an extension, but it is crucial to ensure that any taxes owed are paid by the original deadline to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

The 2019 Form 8960 can be submitted in several ways. Taxpayers can file electronically using tax preparation software, which often includes e-filing options for convenience. Alternatively, the form can be printed and mailed to the appropriate IRS address listed in the form instructions. In-person submission is not a common method for tax forms, as the IRS primarily handles submissions through electronic or mail channels.

Quick guide on how to complete 2019 form 8960 net investment income taxindividuals estates and trusts

Effortlessly prepare 8960 on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents quickly and without delays. Manage 8960 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign 8960 with ease

- Find 8960 and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or obscure sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your revisions.

- Select how you prefer to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from the device of your choosing. Edit and eSign 8960 and ensure clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8960 net investment income taxindividuals estates and trusts

How to generate an electronic signature for your 2019 Form 8960 Net Investment Income Taxindividuals Estates And Trusts in the online mode

How to create an eSignature for your 2019 Form 8960 Net Investment Income Taxindividuals Estates And Trusts in Google Chrome

How to make an eSignature for putting it on the 2019 Form 8960 Net Investment Income Taxindividuals Estates And Trusts in Gmail

How to generate an eSignature for the 2019 Form 8960 Net Investment Income Taxindividuals Estates And Trusts straight from your smart phone

How to create an eSignature for the 2019 Form 8960 Net Investment Income Taxindividuals Estates And Trusts on iOS devices

How to generate an electronic signature for the 2019 Form 8960 Net Investment Income Taxindividuals Estates And Trusts on Android devices

People also ask

-

What is the 2019 form 8960 and why is it important?

The 2019 form 8960 is a tax form used to calculate the net investment income tax (NIIT) for high-income earners. It is important as it helps individuals report their investment income and ensure compliance with tax regulations. Properly filling out the 2019 form 8960 can prevent tax penalties and ensure accurate tax filings.

-

How can airSlate SignNow assist in completing the 2019 form 8960?

airSlate SignNow allows users to easily send, receive, and eSign documents, including tax forms like the 2019 form 8960. Its user-friendly interface simplifies the process of managing tax documents, helping users to gather necessary signatures quickly and securely. This ensures that your tax documents are processed efficiently.

-

What are the pricing options for airSlate SignNow when managing forms like the 2019 form 8960?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes, making it easy to manage forms like the 2019 form 8960 without breaking the bank. Each plan includes essential features such as eSignatures and document management tools. This flexibility allows you to choose the best plan based on your needs.

-

Can I integrate airSlate SignNow with other software to manage the 2019 form 8960?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications, enhancing the management of documents like the 2019 form 8960. Whether you use CRM systems or cloud storage services, integration options allow for streamlined workflows and easier access to your tax documents. This integration ensures your business processes remain efficient.

-

What features does airSlate SignNow offer for eSigning the 2019 form 8960?

AirSlate SignNow provides robust eSigning features that make it simple to sign and send the 2019 form 8960 securely. Users can invite multiple signers, customize signing workflows, and track document statuses in real-time. These features enhance security and ensure compliance with electronic signature laws.

-

Is there any support available for completing the 2019 form 8960 using airSlate SignNow?

Absolutely! airSlate SignNow offers customer support to assist users with any questions related to completing the 2019 form 8960. The support team can provide guidance on document preparation, eSigning processes, and general inquiries, ensuring you have the resources needed to manage your tax forms effectively.

-

How does airSlate SignNow ensure the security of the 2019 form 8960 documents?

AirSlate SignNow prioritizes security through encryption and secure storage solutions for documents like the 2019 form 8960. This ensures that personal and financial data remain protected and confidential during the signing process. Users can trust that their sensitive information is handled with the highest security standards.

Get more for 8960

Find out other 8960

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors