St 3 2017

What is the St 3?

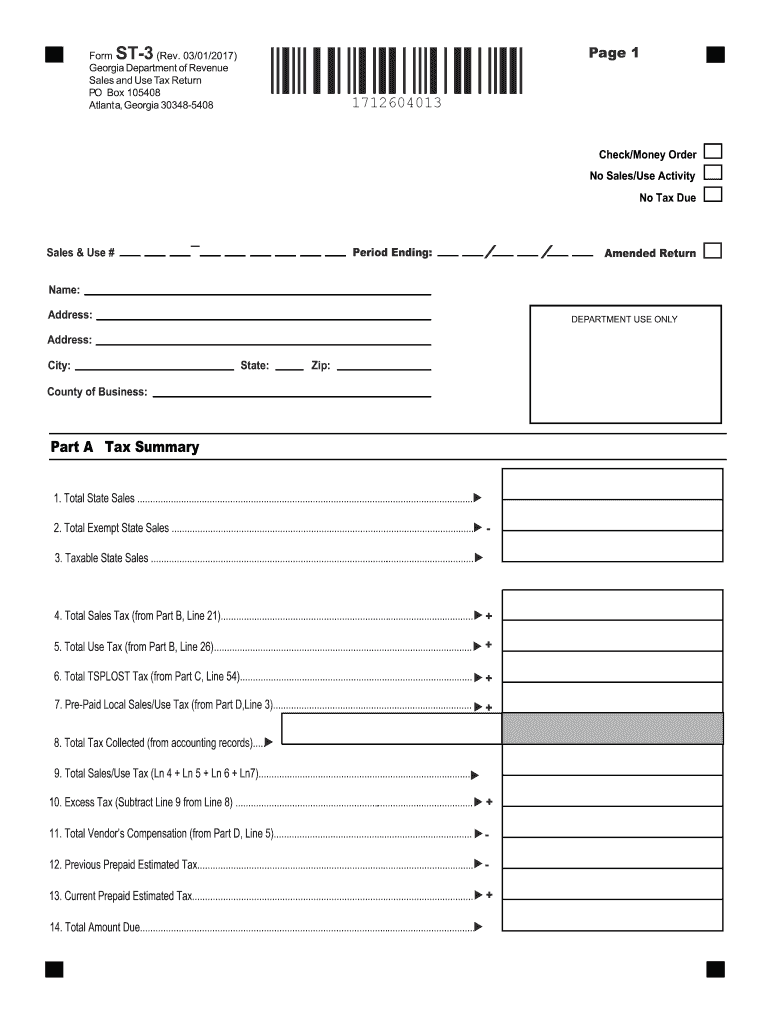

The Georgia sales and use tax form ST 3 is a crucial document used by businesses and individuals to claim exemption from sales tax on certain purchases. This form is primarily utilized by organizations that qualify for tax-exempt status, such as non-profits, government entities, and certain educational institutions. By submitting the ST 3, taxpayers can ensure they are not charged sales tax on eligible transactions, which can lead to significant savings over time.

How to use the St 3

To effectively use the Georgia sales tax form ST 3, it is essential to understand its purpose and the requirements for submission. The form should be completed accurately, detailing the nature of the purchase and the reason for the tax exemption. Once filled out, the ST 3 can be presented to the seller at the time of purchase. It is important to retain a copy of the form for your records, as it serves as proof of your tax-exempt status should it be needed for future reference.

Steps to complete the St 3

Completing the Georgia sales tax form ST 3 involves several key steps:

- Obtain the form from the Georgia Department of Revenue or through authorized channels.

- Fill in the required fields, including your name, address, and the reason for exemption.

- Provide details about the items being purchased, including descriptions and quantities.

- Sign and date the form to validate it.

- Submit the completed form to the seller at the time of purchase.

Ensuring that all information is accurate and complete will facilitate a smoother transaction and help avoid potential issues with tax compliance.

Legal use of the St 3

The legal use of the Georgia sales tax form ST 3 is governed by state law, which outlines the specific criteria for tax exemption. Only qualified entities can utilize this form, and misuse of the ST 3 can lead to penalties, including fines and back taxes owed. It is essential to understand the legal implications of using the ST 3 and to ensure that all claims for exemption are legitimate and well-documented.

Filing Deadlines / Important Dates

While the Georgia sales tax form ST 3 is typically presented at the point of sale, it is important to be aware of any relevant deadlines or important dates related to sales tax filings. Tax-exempt organizations should keep track of any changes in tax law or filing requirements that may affect their use of the ST 3. Regularly checking for updates from the Georgia Department of Revenue can ensure compliance and prevent any issues during tax season.

Form Submission Methods (Online / Mail / In-Person)

The Georgia sales tax form ST 3 can be submitted in various ways, depending on the seller's preferences and the nature of the transaction. Typically, it is presented in person at the time of purchase. However, some sellers may accept the form via email or fax. It is advisable to confirm with the seller regarding their preferred submission method to ensure that the exemption is processed correctly.

Quick guide on how to complete ga sales use tax 2017 2019 form

Your assistance manual on preparing your St 3

If you’re wondering how to generate and submit your St 3, here are some brief instructions on how to simplify tax filing.

To begin, all you need to do is register your airSlate SignNow account to transform your document management online. airSlate SignNow is an exceptionally intuitive and powerful document solution that enables you to modify, generate, and complete your income tax forms with ease. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and return to amend information as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your St 3 in no time:

- Set up your account and start editing PDFs in just a few minutes.

- Access our catalog to find any IRS tax form; browse through versions and schedules.

- Click Get form to open your St 3 in the editor.

- Fill in the necessary fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if needed).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to increased return errors and delays in refunds. Naturally, before e-filing your taxes, consult the IRS website for filing guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct ga sales use tax 2017 2019 form

FAQs

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the ga sales use tax 2017 2019 form

How to generate an electronic signature for the Ga Sales Use Tax 2017 2019 Form in the online mode

How to generate an electronic signature for your Ga Sales Use Tax 2017 2019 Form in Google Chrome

How to make an eSignature for putting it on the Ga Sales Use Tax 2017 2019 Form in Gmail

How to create an eSignature for the Ga Sales Use Tax 2017 2019 Form straight from your smartphone

How to make an electronic signature for the Ga Sales Use Tax 2017 2019 Form on iOS

How to generate an electronic signature for the Ga Sales Use Tax 2017 2019 Form on Android devices

People also ask

-

What is the Georgia sales tax form ST 3 used for?

The Georgia sales tax form ST 3 is a resale certificate that allows businesses to purchase items without paying sales tax, provided they intend to resell those items. This form ensures compliance with Georgia tax regulations and helps businesses manage their expenses effectively.

-

How can airSlate SignNow help me with my Georgia sales tax form ST 3?

airSlate SignNow offers a streamlined solution for businesses needing to send and eSign the Georgia sales tax form ST 3. With our user-friendly platform, you can create, share, and manage this form efficiently, ensuring that it is filled out correctly and submitted on time.

-

What features does airSlate SignNow provide for managing the Georgia sales tax form ST 3?

airSlate SignNow includes features such as document templates, secure eSignatures, and automated workflows that simplify the management of the Georgia sales tax form ST 3. These features help save time and reduce errors, making compliance straightforward for your business.

-

Is there a cost associated with using airSlate SignNow for the Georgia sales tax form ST 3?

Yes, while airSlate SignNow offers various pricing plans, the cost-effective solutions are designed to cater to different business needs. By utilizing our platform for the Georgia sales tax form ST 3, you can save on potential penalties and improve operational efficiency.

-

Can I integrate airSlate SignNow with other tools for my sales tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and business management tools, enhancing your ability to manage sales tax documents efficiently. This allows for seamless use of the Georgia sales tax form ST 3 alongside other essential business operations.

-

How secure is the submission of the Georgia sales tax form ST 3 through airSlate SignNow?

Security is a top priority for airSlate SignNow. When you submit the Georgia sales tax form ST 3 through our platform, your documents are protected with top-notch encryption and security measures, ensuring the confidentiality and integrity of your sensitive information.

-

What benefits can I expect from using airSlate SignNow for my sales tax forms?

Using airSlate SignNow for your sales tax forms, including the Georgia sales tax form ST 3, offers numerous benefits like increased efficiency, easy document tracking, and reduced turnaround time. These advantages can signNowly simplify your tax management processes.

Get more for St 3

Find out other St 3

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy