Irs Form 1024 1998

What is the IRS Form 1024

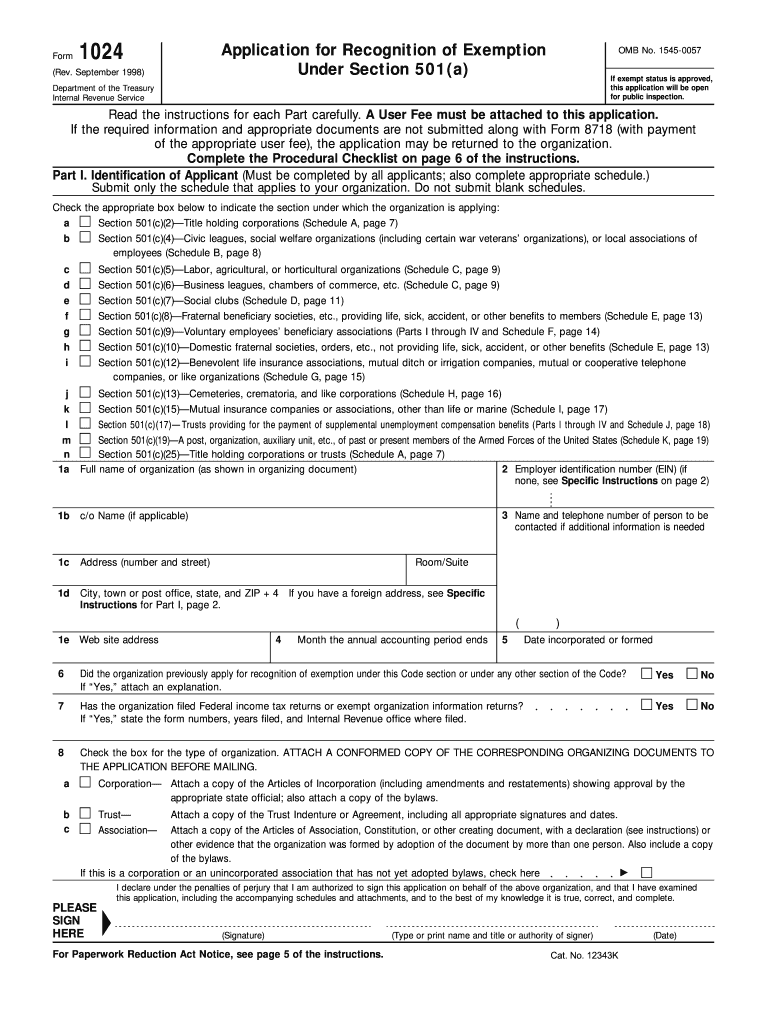

The IRS Form 1024 is an application used by organizations seeking recognition of exemption from federal income tax under Section 501(a) of the Internal Revenue Code. This form is primarily utilized by non-profit entities, including charitable organizations, social welfare organizations, and other groups that qualify for tax-exempt status. Completing this form accurately is essential for organizations to receive the benefits associated with tax exemption, such as exemption from federal income tax and eligibility to receive tax-deductible contributions.

How to Obtain the IRS Form 1024

Organizations can obtain the IRS Form 1024 from the official IRS website or through various tax assistance resources. The form is available for download in PDF format, allowing users to print and fill it out manually. Additionally, many tax professionals and legal advisors can provide guidance on accessing and completing the form. It is crucial to ensure that you are using the most current version of the form to comply with IRS regulations.

Steps to Complete the IRS Form 1024

Completing the IRS Form 1024 involves several key steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary documentation, including your organization's mission statement, financial data, and details about your activities.

- Fill Out the Form: Carefully complete each section of the form, providing detailed information as required. Ensure that all responses are accurate and consistent.

- Review the Form: Before submission, review the completed form for any errors or omissions. It may be beneficial to have a knowledgeable individual or tax professional review it as well.

- Submit the Form: File the completed Form 1024 with the IRS, either online or via mail, depending on your preference and the IRS guidelines.

Legal Use of the IRS Form 1024

The IRS Form 1024 must be used in accordance with federal laws governing tax-exempt organizations. It is essential for applicants to understand the legal implications of their application and ensure that their activities align with the requirements set forth by the IRS. Misuse of the form or failure to comply with IRS regulations can result in penalties, including denial of tax-exempt status.

Key Elements of the IRS Form 1024

Key elements of the IRS Form 1024 include:

- Organization Information: Basic details about the organization, including its name, address, and purpose.

- Type of Organization: Identification of the specific type of organization applying for tax-exempt status.

- Financial Information: Disclosure of financial data, including revenue sources and projected budgets.

- Activities Description: A comprehensive description of the activities the organization plans to undertake.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1024 can vary based on the organization's fiscal year and other factors. Generally, organizations should file the form within 27 months from the end of the month in which they were formed to ensure retroactive tax-exempt status. It is advisable to keep track of these deadlines to avoid potential complications with tax exemption.

Quick guide on how to complete irs form 1024 1998

Accomplish Irs Form 1024 effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Form 1024 on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign Irs Form 1024 effortlessly

- Find Irs Form 1024 and click on Get Form to start.

- Make use of the available tools to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that reason.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 1024 and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1024 1998

Create this form in 5 minutes!

How to create an eSignature for the irs form 1024 1998

How to generate an eSignature for the Irs Form 1024 1998 in the online mode

How to create an eSignature for the Irs Form 1024 1998 in Google Chrome

How to generate an electronic signature for putting it on the Irs Form 1024 1998 in Gmail

How to create an electronic signature for the Irs Form 1024 1998 from your smart phone

How to make an eSignature for the Irs Form 1024 1998 on iOS

How to generate an eSignature for the Irs Form 1024 1998 on Android devices

People also ask

-

What is the purpose of IRS Form 1024?

IRS Form 1024 is used to apply for recognition of exemption under section 501(a) of the Internal Revenue Code. This form is essential for organizations seeking tax-exempt status, as it provides the IRS with the necessary information to evaluate the organization's eligibility. Submitting IRS Form 1024 accurately can help streamline the approval process for your nonprofit or charitable organization.

-

How can airSlate SignNow help me with IRS Form 1024?

airSlate SignNow offers an intuitive platform that allows you to easily prepare, send, and eSign IRS Form 1024. With our electronic signature capabilities, you can ensure that your form is signed securely and efficiently, reducing the time it takes to gather necessary approvals. This means you can focus more on your organization's goals while we handle your document needs.

-

Are there any costs associated with using airSlate SignNow for IRS Form 1024?

Yes, airSlate SignNow operates on a subscription model, providing various pricing tiers to suit different organizational needs. Each plan includes features like unlimited document signing, storage, and integrations, ensuring you have everything you need to manage IRS Form 1024 at an affordable price. Check our pricing page for detailed information on which plan works best for you.

-

What features does airSlate SignNow offer for managing IRS Form 1024?

airSlate SignNow provides robust features for managing IRS Form 1024, including customizable templates, electronic signatures, and document tracking. These features enable you to streamline the application process, ensuring your form is completed and submitted accurately. Additionally, our platform allows for easy collaboration among team members, making it simple to gather input and finalize your IRS Form 1024.

-

Can I integrate airSlate SignNow with other software for IRS Form 1024?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, including CRMs, document management systems, and cloud storage services. This means you can easily import and export IRS Form 1024 data to and from your preferred tools, enhancing your workflow and ensuring all your documents are in one place.

-

Is airSlate SignNow secure for submitting IRS Form 1024?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all transactions, including submissions of IRS Form 1024, are protected with advanced encryption and secure data storage. Our platform complies with industry standards, providing peace of mind that your sensitive information remains confidential and secure throughout the signing process.

-

How long does it take to get approval after submitting IRS Form 1024?

The time it takes to receive approval after submitting IRS Form 1024 can vary, but typically it can take anywhere from 3 to 6 months. Factors such as the completeness of your application and the IRS's current workload can impact the review time. Preparing your application accurately with airSlate SignNow can help expedite the process, as our tools ensure thorough submissions.

Get more for Irs Form 1024

- California bill of sale for automobile or vehicle including odometer statement and promissory note form

- Ga notice of commencement form

- New york contract for sale and purchase of real estate with no broker for residential home sale agreement form

- Mississippi quitclaim deed from individual to two individuals in joint tenancy form

- How to fill discharge certificate form

- New jersey living will form

- Contract for deed texas form

- Virginia residential rental lease agreement form

Find out other Irs Form 1024

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed