Tc810 Form 2014

What is the Tc810 Form

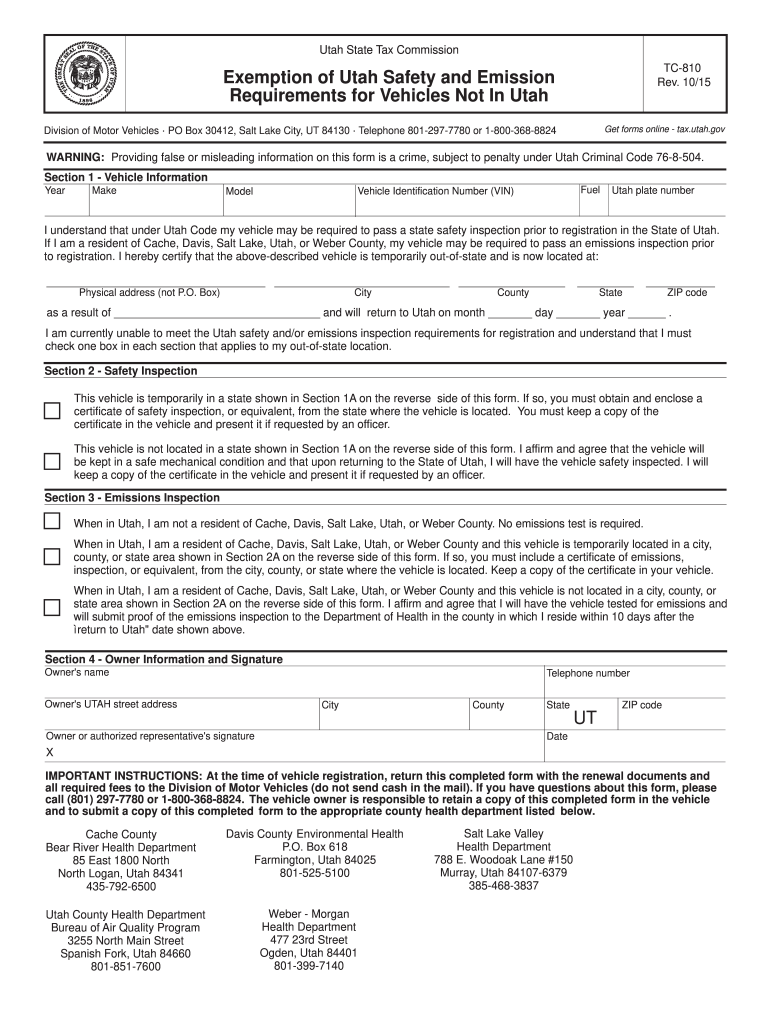

The Tc810 Form is an important document used primarily for tax purposes in the United States. It serves as a means for individuals or businesses to report specific financial information to the relevant tax authorities. Understanding the purpose and structure of the Tc810 Form is crucial for ensuring compliance with tax regulations. This form typically includes sections for identifying the taxpayer, detailing income, and reporting deductions or credits that may apply.

How to use the Tc810 Form

Using the Tc810 Form involves several straightforward steps. First, gather all necessary financial documents, such as income statements and prior tax returns, to ensure accurate reporting. Next, fill out the form completely, paying close attention to each section to avoid errors. After completing the form, review it for accuracy and completeness before submitting it to the appropriate tax authority. Depending on your preference, the Tc810 Form can often be submitted electronically or via traditional mail.

Steps to complete the Tc810 Form

Completing the Tc810 Form requires careful attention to detail. The following steps outline the process:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Provide details about your income sources, ensuring to include all relevant amounts.

- Document any deductions or credits you are eligible for, as these can significantly affect your tax liability.

- Review all entries for accuracy, checking for any missing information or errors.

- Sign and date the form, confirming that the information provided is true and correct.

Legal use of the Tc810 Form

The Tc810 Form is legally recognized as a valid document for tax reporting when completed correctly. To ensure its legal standing, it is essential to adhere to all relevant tax laws and regulations. This includes filing the form by the designated deadlines and maintaining accurate records of all submitted information. Failure to comply with these regulations can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Tc810 Form can vary based on individual circumstances, such as whether you are filing as an individual or a business entity. Generally, it is advisable to submit the form by April 15 for individual taxpayers. Businesses may have different deadlines depending on their fiscal year. Keeping track of these important dates is crucial to avoid late fees and ensure compliance with tax regulations.

Required Documents

When preparing to complete the Tc810 Form, certain documents are necessary to provide accurate information. Commonly required documents include:

- W-2 forms from employers, detailing wages and tax withholdings.

- 1099 forms for any freelance or contract work.

- Receipts or documentation for deductions, such as medical expenses or charitable contributions.

- Previous year’s tax return for reference.

Who Issues the Form

The Tc810 Form is issued by the relevant tax authority, which in the United States is typically the Internal Revenue Service (IRS). This form is part of the broader framework of tax documentation that individuals and businesses must navigate to ensure compliance with federal tax laws. Understanding the issuing authority helps clarify the guidelines and regulations associated with the form.

Quick guide on how to complete tc810 2014 form

Effortlessly Prepare Tc810 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed paperwork, as you can access the necessary forms and securely save them online. airSlate SignNow equips you with all the features you require to create, modify, and electronically sign your documents quickly without delays. Handle Tc810 Form on any platform with airSlate SignNow's Android or iOS applications and simplify your document operations today.

How to Edit and Electronically Sign Tc810 Form with Ease

- Obtain Tc810 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Tc810 Form to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc810 2014 form

Create this form in 5 minutes!

How to create an eSignature for the tc810 2014 form

How to create an electronic signature for your Tc810 2014 Form in the online mode

How to make an electronic signature for your Tc810 2014 Form in Google Chrome

How to generate an electronic signature for signing the Tc810 2014 Form in Gmail

How to create an eSignature for the Tc810 2014 Form straight from your smartphone

How to make an eSignature for the Tc810 2014 Form on iOS

How to make an electronic signature for the Tc810 2014 Form on Android

People also ask

-

What is the Tc810 Form and how can it be used?

The Tc810 Form is a crucial document used for tax-related purposes, and it can easily be managed using airSlate SignNow. With our platform, you can fill out, sign, and send the Tc810 Form securely and efficiently. This streamlines your workflow, saving you time and reducing the chances of errors.

-

How does airSlate SignNow simplify the completion of the Tc810 Form?

airSlate SignNow simplifies the completion of the Tc810 Form by providing a user-friendly interface that allows for easy document editing and signing. You can access the form from any device, ensuring you can complete it on-the-go. Our platform also enables you to automate repetitive tasks, making the process even more efficient.

-

Are there any costs associated with using airSlate SignNow for the Tc810 Form?

Using airSlate SignNow for the Tc810 Form comes with flexible pricing plans designed to fit various business needs. We offer a free trial, allowing you to explore our features before committing to a subscription. This ensures you can assess the value our service brings to handling your tax documents.

-

What features does airSlate SignNow offer for managing the Tc810 Form?

airSlate SignNow offers a range of features for managing the Tc810 Form, including electronic signatures, templates, and document tracking. These tools help enhance collaboration and ensure that your document is processed promptly. Additionally, you can integrate with other applications to further streamline your workflow.

-

Can I integrate airSlate SignNow with other software to manage the Tc810 Form?

Yes, airSlate SignNow supports integrations with various software applications to enhance your experience when managing the Tc810 Form. Whether you use CRM systems, cloud storage, or project management tools, our platform can seamlessly connect, allowing for better document management and efficiency.

-

What are the benefits of using airSlate SignNow for the Tc810 Form compared to traditional methods?

Using airSlate SignNow for the Tc810 Form offers numerous benefits over traditional methods, including faster processing times and reduced paper waste. Our electronic signing feature ensures that documents can be signed in seconds, not days. Plus, you can store and retrieve documents effortlessly, making compliance and record-keeping much easier.

-

Is the Tc810 Form secure when using airSlate SignNow?

Absolutely! The Tc810 Form is secured with top-notch encryption and compliance measures when processed through airSlate SignNow. We prioritize data security and privacy, ensuring that your sensitive information remains confidential and protected from unauthorized access.

Get more for Tc810 Form

Find out other Tc810 Form

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word