WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon Gov Oregon 2007

What is the winery annual privilege tax statement Oregon gov Oregon?

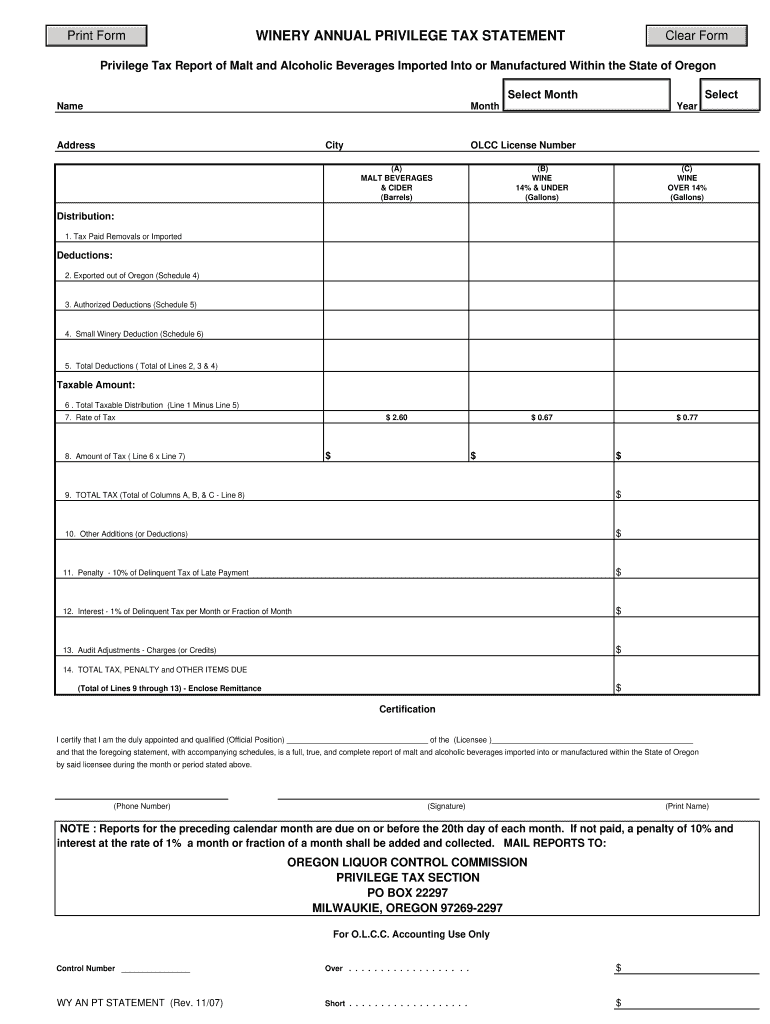

The winery annual privilege tax statement is a specific tax form required by the state of Oregon for wineries operating within its jurisdiction. This statement is essential for reporting the annual privilege tax owed by wineries, which is a tax imposed on the privilege of conducting business as a winery in Oregon. The form captures various details, including the winery's production levels, sales, and any applicable deductions. It is crucial for compliance with state tax regulations and helps ensure that wineries contribute their fair share to state revenue.

How to use the winery annual privilege tax statement Oregon gov Oregon

Using the winery annual privilege tax statement involves a few key steps. First, wineries must gather all necessary financial data, including sales figures and production amounts for the year. Once the data is collected, the winery can fill out the form accurately, ensuring all required fields are completed. After completing the statement, it should be submitted according to the guidelines provided by the Oregon government, either electronically or via mail. Proper use of the form helps maintain compliance with state tax laws and avoids potential penalties.

Steps to complete the winery annual privilege tax statement Oregon gov Oregon

Completing the winery annual privilege tax statement involves several important steps:

- Gather financial records: Collect sales and production data for the reporting year.

- Access the form: Obtain the latest version of the winery annual privilege tax statement from the Oregon government website.

- Fill out the form: Enter all required information accurately, including any deductions or credits applicable to your winery.

- Review for accuracy: Double-check all entries to ensure the information is correct and complete.

- Submit the form: File the completed statement electronically or by mail, following the submission guidelines provided by the state.

Key elements of the winery annual privilege tax statement Oregon gov Oregon

The winery annual privilege tax statement includes several key elements that are essential for proper reporting. These elements typically consist of:

- Business Information: Name, address, and contact details of the winery.

- Production Data: Total wine production for the year, including types and volumes.

- Sales Information: Total sales figures, broken down by category if necessary.

- Tax Calculation: A section for calculating the total privilege tax owed based on the reported data.

- Signature: A declaration that the information provided is accurate, requiring a signature from an authorized representative.

State-specific rules for the winery annual privilege tax statement Oregon gov Oregon

Oregon has specific rules governing the winery annual privilege tax statement that wineries must adhere to. These rules include deadlines for submission, the tax rate applicable to different production levels, and any exemptions or deductions that may apply. Wineries should also be aware of the penalties for late filing or inaccuracies in reporting. Understanding these state-specific regulations is crucial for compliance and to avoid potential legal issues.

Form submission methods for the winery annual privilege tax statement Oregon gov Oregon

Wineries in Oregon have multiple options for submitting the winery annual privilege tax statement. The primary methods include:

- Online Submission: Many wineries prefer to submit their forms electronically through the Oregon government’s online portal, which provides a streamlined process.

- Mail Submission: Wineries can also choose to print the completed form and send it via postal mail to the designated tax office.

- In-Person Submission: For those who prefer face-to-face interactions, submitting the form in person at a local tax office is an option.

Quick guide on how to complete winery annual privilege tax statement oregongov oregon

Prepare WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon effortlessly

- Find WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select how you want to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct winery annual privilege tax statement oregongov oregon

Create this form in 5 minutes!

How to create an eSignature for the winery annual privilege tax statement oregongov oregon

How to create an eSignature for your Winery Annual Privilege Tax Statement Oregongov Oregon online

How to make an eSignature for the Winery Annual Privilege Tax Statement Oregongov Oregon in Chrome

How to generate an electronic signature for signing the Winery Annual Privilege Tax Statement Oregongov Oregon in Gmail

How to create an eSignature for the Winery Annual Privilege Tax Statement Oregongov Oregon right from your smartphone

How to create an eSignature for the Winery Annual Privilege Tax Statement Oregongov Oregon on iOS devices

How to create an eSignature for the Winery Annual Privilege Tax Statement Oregongov Oregon on Android

People also ask

-

What is the WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon?

The WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon is a tax document required for wineries operating in Oregon. It reports the amount of annual privilege tax owed by the winery, based on its revenue. Understanding this statement is crucial for compliance with state tax laws.

-

How can airSlate SignNow assist with the WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon?

airSlate SignNow simplifies the process of eSigning and sending the WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon. Our platform allows wineries to quickly prepare and distribute documents while ensuring security and compliance with state guidelines. This solutions saves time and reduces the hassle associated with document management.

-

Are there any costs associated with using airSlate SignNow for the WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon?

Yes, there are subscription plans available for airSlate SignNow, which vary based on features and usage levels. The cost is designed to be budget-friendly, particularly for small and medium wineries needing to manage their WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon efficiently. You can choose a plan that best fits your winery's needs.

-

Does airSlate SignNow offer features specifically for tax document management?

Absolutely! airSlate SignNow offers features tailored for tax document management, including customizable templates for the WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon. Users can create, edit, and store important documents with a user-friendly interface, making tax season less stressful.

-

Is airSlate SignNow compliant with Oregon regulations regarding the WINERY ANNUAL PRIVILEGE TAX STATEMENT?

Yes, airSlate SignNow is fully compliant with Oregon's regulations for the WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon. Our platform ensures that all documents meet legal standards, providing wineries with peace of mind when submitting their tax statements and other necessary paperwork.

-

What integrations does airSlate SignNow offer for winery operations?

airSlate SignNow integrates with various platforms such as Google Drive, Dropbox, and CRM systems, enhancing the workflow for wineries handling the WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon. This seamless integration helps streamline document management, making it easier to track and file important tax documents.

-

Can I track the status of my WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your documents, including the WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon, in real-time. You will receive notifications when documents are viewed, signed, or completed, which aids in better management and organization of your winery's compliance paperwork.

Get more for WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon

Find out other WINERY ANNUAL PRIVILEGE TAX STATEMENT Oregon gov Oregon

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal