Corporate Income Tax Credits Alaska Department of Revenue Tax 2013

What is the Corporate Income Tax Credits Alaska Department Of Revenue Tax?

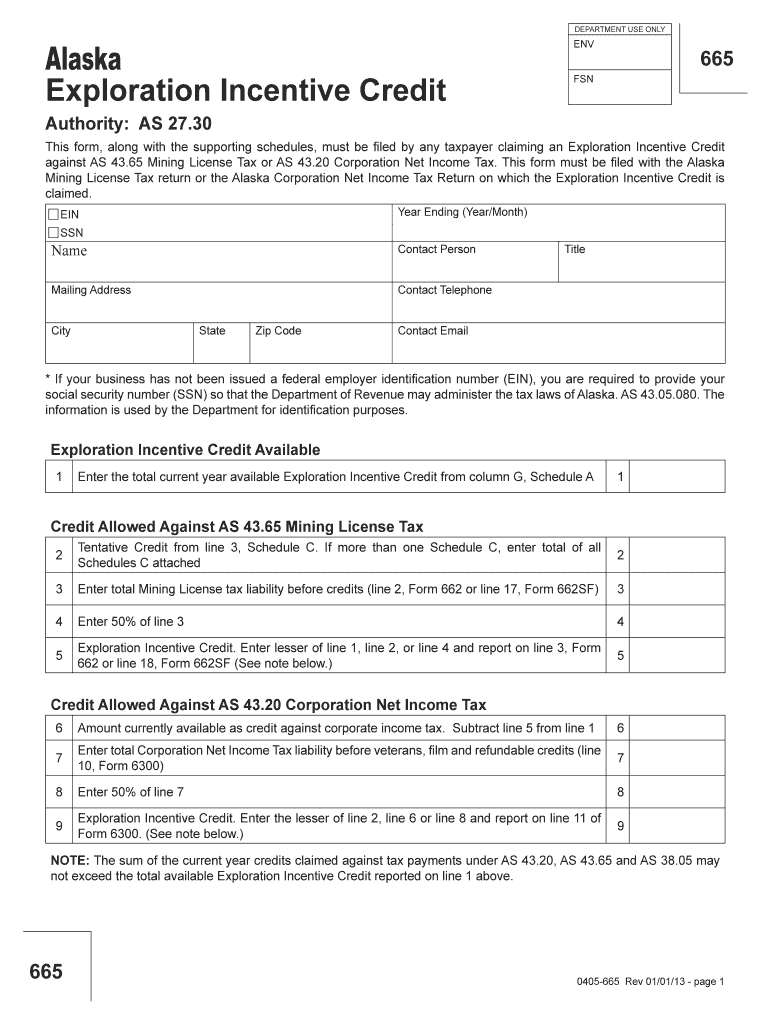

The Corporate Income Tax Credits offered by the Alaska Department of Revenue are designed to incentivize businesses operating within the state. These credits can significantly reduce a company's tax liability, making it an attractive option for corporations looking to invest in Alaska. The credits are typically available for specific activities, such as research and development, job creation, and investments in certain industries. Understanding the eligibility criteria and the types of credits available is essential for businesses aiming to maximize their tax benefits.

Steps to complete the Corporate Income Tax Credits Alaska Department Of Revenue Tax

Completing the Corporate Income Tax Credits form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents and information related to your business operations in Alaska. Next, fill out the form by providing detailed information about your corporation, including income, expenses, and the specific credits you are claiming. Once completed, review the form for accuracy before submission. It is important to keep copies of all documentation for your records.

Eligibility Criteria

To qualify for the Corporate Income Tax Credits from the Alaska Department of Revenue, businesses must meet specific eligibility criteria. Generally, these criteria include being a registered corporation in Alaska, having a minimum level of taxable income, and engaging in qualified activities that align with state goals, such as economic development or environmental sustainability. It is advisable to consult the official guidelines or a tax professional to confirm eligibility before applying.

Application Process & Approval Time

The application process for Corporate Income Tax Credits typically involves submitting the completed form along with any required supporting documentation to the Alaska Department of Revenue. After submission, the review process can take several weeks, depending on the volume of applications and the complexity of the claims. Businesses should ensure that all information is accurate and complete to avoid delays in processing and approval.

Required Documents

When applying for Corporate Income Tax Credits, businesses must provide several key documents to support their claims. These may include financial statements, tax returns, proof of business registration in Alaska, and documentation related to the specific activities for which credits are being claimed. Ensuring that all required documents are included with the application can help facilitate a smoother approval process.

State-specific rules for the Corporate Income Tax Credits Alaska Department Of Revenue Tax

The Alaska Department of Revenue has established specific rules governing the Corporate Income Tax Credits that businesses must adhere to. These rules outline the types of activities that qualify for credits, the calculation methods for determining the amount of credit, and any limitations or caps on the credits available. Staying informed about these state-specific regulations is crucial for businesses to ensure compliance and maximize their tax benefits.

Legal use of the Corporate Income Tax Credits Alaska Department Of Revenue Tax

The legal use of Corporate Income Tax Credits involves adhering to the guidelines set forth by the Alaska Department of Revenue. This includes accurately reporting income, claiming only eligible credits, and maintaining proper documentation to support claims. Non-compliance with these regulations can result in penalties, including the denial of credits or additional tax liabilities. It is essential for businesses to understand their legal obligations when utilizing these tax credits.

Quick guide on how to complete corporate income tax credits alaska department of revenue tax

Prepare Corporate Income Tax Credits Alaska Department Of Revenue Tax effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals. It presents an ideal environmentally friendly replacement for traditional printed and signed paperwork, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without complications. Manage Corporate Income Tax Credits Alaska Department Of Revenue Tax on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The most efficient way to modify and eSign Corporate Income Tax Credits Alaska Department Of Revenue Tax effortlessly

- Obtain Corporate Income Tax Credits Alaska Department Of Revenue Tax and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Mark pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign Corporate Income Tax Credits Alaska Department Of Revenue Tax and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporate income tax credits alaska department of revenue tax

Create this form in 5 minutes!

How to create an eSignature for the corporate income tax credits alaska department of revenue tax

How to create an electronic signature for your Corporate Income Tax Credits Alaska Department Of Revenue Tax in the online mode

How to make an electronic signature for the Corporate Income Tax Credits Alaska Department Of Revenue Tax in Chrome

How to make an electronic signature for signing the Corporate Income Tax Credits Alaska Department Of Revenue Tax in Gmail

How to make an electronic signature for the Corporate Income Tax Credits Alaska Department Of Revenue Tax right from your smart phone

How to generate an eSignature for the Corporate Income Tax Credits Alaska Department Of Revenue Tax on iOS

How to create an electronic signature for the Corporate Income Tax Credits Alaska Department Of Revenue Tax on Android

People also ask

-

What are Corporate Income Tax Credits offered by the Alaska Department of Revenue?

Corporate Income Tax Credits by the Alaska Department of Revenue are incentives designed to reduce the state's corporate tax burden. These credits are typically available for businesses that contribute to economic development in Alaska, including investment in local jobs and infrastructure. Understanding these credits can help your business save signNowly on tax expenses.

-

How can I apply for Corporate Income Tax Credits through the Alaska Department of Revenue?

To apply for Corporate Income Tax Credits from the Alaska Department of Revenue, businesses must complete the necessary application forms and provide required documentation. This process often involves demonstrating eligibility based on business activities and contributions to the state. It's crucial to ensure that all information is accurate to facilitate a smooth application process.

-

Are there any fees associated with obtaining Corporate Income Tax Credits from the Alaska Department of Revenue?

Generally, there are no direct fees specifically associated with obtaining Corporate Income Tax Credits from the Alaska Department of Revenue, as the program aims to benefit businesses financially. However, businesses may incur minor administrative costs in preparing and submitting the required documents. It's advisable to consult a tax professional to understand any indirect costs.

-

What features does airSlate SignNow offer for managing tax credit documentation?

airSlate SignNow provides a user-friendly platform for managing the documentation associated with Corporate Income Tax Credits through secure eSigning and document management features. Businesses can easily send, track, and store tax-related documents, streamlining the compliance process with the Alaska Department of Revenue. This efficiency helps ensure that you don't miss critical deadlines or requirements.

-

What benefits do Corporate Income Tax Credits provide for businesses in Alaska?

Corporate Income Tax Credits from the Alaska Department of Revenue can signNowly reduce your effective tax rate, allowing more capital to be reinvested into your business. These credits also create opportunities for funding growth projects and hiring employees, directly impacting your company's bottom line. By leveraging these credits, businesses can remain competitive while supporting state initiatives.

-

Can I integrate airSlate SignNow with other tools for tax management?

Yes, airSlate SignNow supports integration with various accounting and tax management tools, allowing businesses to streamline their Corporate Income Tax Credits processes. This capability ensures that your entire workflow, from eSigning documents to filing applications, remains efficient and connected. Enhanced integrations lead to better data management and reduced manual entry errors.

-

How can I ensure compliance when using Corporate Income Tax Credits from the Alaska Department of Revenue?

To ensure compliance with Corporate Income Tax Credits from the Alaska Department of Revenue, businesses should keep thorough records of all qualifying activities and documentation. Regular consultation with a tax advisor is recommended to understand any changes in local laws or regulations that might impact eligibility. Using platforms like airSlate SignNow can also help manage compliance documentation effortlessly.

Get more for Corporate Income Tax Credits Alaska Department Of Revenue Tax

- Da form 5960 sep 1990 printable

- Swimming pool check list form

- Da 7432 form

- Da 7574 form

- Sniper qualification firing table vi stationary and moving known distance targets m110 day dos with the tmr and anpvs 26 da form

- M240 qualification card form

- Family member status chra fe korea army form

- Fort leavenworth tax office form

Find out other Corporate Income Tax Credits Alaska Department Of Revenue Tax

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure