Form P 1 1999-2026

What is the Form P 1

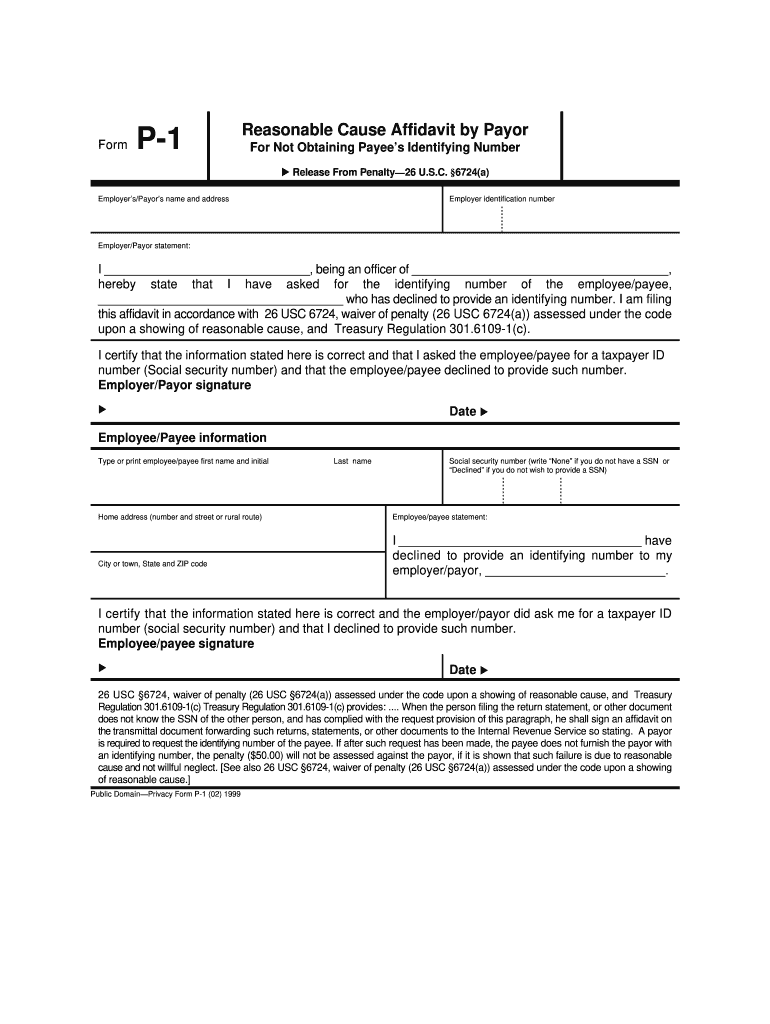

The Form P 1 is a document primarily used in the United States for various legal and financial purposes. It often serves as an affidavit or declaration, providing essential information about a payee and their relationship to a specific transaction. This form is crucial for ensuring that all parties involved have a clear understanding of their roles and responsibilities. It is commonly utilized in contexts such as tax reporting, benefit claims, and other official documentation.

How to use the Form P 1

Using the Form P 1 involves a straightforward process. First, gather all necessary information regarding the payee and the specific transaction. This includes the payee's identifying details and any relevant financial information. Next, fill out the form accurately, ensuring that all fields are completed as required. Once the form is filled out, it should be reviewed for accuracy before submission. Depending on the context, the completed form may need to be signed and dated to validate its contents.

Steps to complete the Form P 1

Completing the Form P 1 requires careful attention to detail. Follow these steps:

- Gather necessary information about the payee.

- Access the form, either in a digital format or as a printed document.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Sign and date the form if required.

- Submit the form according to the specified guidelines.

Legal use of the Form P 1

The Form P 1 must be used in compliance with relevant laws and regulations. It is essential to understand that this form serves a legal purpose, and any inaccuracies or omissions can lead to complications. The form should be filled out truthfully, as it may be subject to verification by authorities. Ensuring that the form is completed correctly can help avoid potential legal issues and support the integrity of the documentation process.

Examples of using the Form P 1

There are several scenarios in which the Form P 1 may be utilized:

- When a payee needs to declare their identification for tax purposes.

- In situations where a payee is applying for benefits or financial assistance.

- To confirm the relationship between a payor and payee in legal agreements.

Who Issues the Form

The Form P 1 is typically issued by government agencies or organizations that require formal documentation of payee information. This may include tax authorities, social security offices, or financial institutions. It is important to obtain the form from an official source to ensure that it meets all necessary legal requirements.

Quick guide on how to complete form p 1

The optimal method to locate and sign Form P 1

Across the entirety of your organization, ineffective methods surrounding paper approvals can consume a signNow amount of work hours. Executing documentation like Form P 1 is an inherent aspect of operations in every sector, which is why the effectiveness of each agreement’s lifecycle is crucial to the overall productivity of the business. With airSlate SignNow, signing your Form P 1 can be as straightforward and rapid as possible. On this platform, you will discover the most recent version of nearly any document. Even better, you can sign it immediately without the need to install external software on your device or print out physical copies.

Steps to obtain and sign your Form P 1

- Explore our repository by category or use the search bar to locate the document you require.

- View the document preview by clicking on Learn more to confirm it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your document and insert any essential details using the toolbar.

- Once completed, click the Sign tool to endorse your Form P 1.

- Choose the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as necessary.

With airSlate SignNow, you possess everything required to manage your documents proficiently. You can find, complete, edit, and even dispatch your Form P 1 within a single tab effortlessly. Enhance your workflows by utilizing a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What are some real-life bad habits that programming gives people?

1. JumpinessOften I appear to be doing nothing, when I'm actually mulling over some program flow in my head, or wondering what went wrong with that last SQL query, or how to break down that new proposed functionality into bite-sized pieces. You know the drill.And then someone comes up behind me and quite innocently calls my name or taps me on the shoulder. HOLY SHIT. (It's worse when I'm drinking coffee)Lately some of my younger colleagues have started thinking it's funny to startle me when I'm in thinking mode. Not cool, you little brats.2. Taking things too literallyYou guys have probably heard the joke about the programmer's wife, eggs and milk. Trust me, it's so real it's not even funny. For example, during interviews - Interviewer: Do you know how Paypal's IPN works?Me: Yes.(awkward silence)Interviewer: (patiently) I mean, I'd like you to explain the how Paypal's IPN works.Me: Oh! Right. Here goes...Luckily, interviewer was a fellow techie. And understood that I wasn't trying to be funny, or evasive.3. Expecting things to be literalI tend to get frustrated when I ask what I thought was a reasonably straightforward question with a Y/N answer, and someone gives me a long answer without actually answering my question.Maybe it's the result of writing so many functions and methods. You can define what output the method gives you, if at all. If you want a true or false, you define the return value as a Boolean. If you want a line of text, you make the method return a String.Ah, but human beings aren't wired that way.

-

How good are the teachers at IIT Patna?

Well,the first thought that would come to your mind when this “term” Indian Institute of Technology,Patna,is talked about will be regarding the faculty!!!Let me first put forward few disclaimers:This answer pertains to only the faculty deployed to look after the undergraduate studies.IITPatna is no more a new IIT now .It was established way back in 2008 and it stands today in 2017 well settled in it’s permanent campus a few kilometres from Patna!The prerequisite to read this answer is that you should wipe off all the dirt that this tag of a “New IIT” spreads in your mind, to blur the true image of IIT Patna today.The faculty here is well qualified -they earned their PhD degrees from renowned institutes and are now asset to the institute.The faculty at IITP is at par with most of the so called “older” IITs .The amazing fact about IITP is concerning the student to faculty ratio which is way better than most other IITs.The faculty is always ready to help you almost instaneously and virtually !!!Just drop a mail and they will sort out your problems within 12 hours-sometimes even within few minutes.Also at the end of each semester it is mandatory for all students to fill in a feedback form wherein a student’s holistic opinion regarding the particular faculty responsible for that particular course is taken care of.Thus the faculty is constantly improving via the feedback form :pThe professors not only help you academically but also are involved with the students in helping them outperform others in internationally and nationally acclaimed competitions of literally all branches.So if you choose IITP over other IITs ,you wont leave dissappointed :)

-

What are some smart things that lazy people do?

Here, found a few pictures on the internet where lazy people show their talent.Note - Credits to the respective photograph owners.Blender cleaning made easyCleaning your blender can be such a hassle. A simple, lazy life hack is to pop some water and a dash of dish soap into the blender and turn it on for a short while. We can see this going wrong if you use too much soap though.Colouring boxDoes your child enjoy drawing and colouring? Are they dangerous with crayons and can't be trusted near walls? Here's your solution, pop them in a cardboard box and let them get on with it.Cookies and milkUnless you're lactose or dairy intolerant, if you have some cookies dunking them in milk (or tea for us Brits) is pretty much mandatory. Doing so though makes unnecessary washing up. Unless, of course, you use the cookie container to hold your drink too. Delicious genius.Lazy smokerSmoking is bad for you and you shouldn't do it. But if you too enjoy a good cigarette, then this lazy chap can help you solve the hassle of dealing with falling ash and mess. A weirdly wonderful cigarette holder/ashtray combination gadget is the answer to all your smoking needs.Walking your humanDogs are great, we love them, but they do need a lot of looking after. This lazy genius has changed things up a bit by making the dog walking him instead. His four-legged friend sure seems to be enjoying it too, win, win!Lazy birdIt's not just people who are lazy apparently, even nature has some lazy clever creatures looking for new and ingenious ways to save energy. As the saying goes, work smarter, not harder. Why fly when you can have someone else do it for you?Masterfully lazy parentingLooking after your kids is such a chore. They're so demanding "Dad, can we play?", "Dad, can I have a snack?, "Dad, Dad, Dad, Dad..." it's endless. But this genius might have the lazy, yet an awesome solution. Tie a string to the kid's swing, grab a beer and keep them entertained from afar with your feet up. Nice and relaxed.Walking the dog is hard workOwning a dog is hard work. They might be man's best friend, but what a hassle it is to have to walk them on a daily basis. This lady has put a golf cart to superb use to ease the misery of the daily chores and give her legs a rest while she gives her pooch some walkies.Let me Google that for youSome people worry about robots and computers taking their jobs. Others embrace tech to make their lives that little bit easier. Let's face it, you'll probably get better results from Google anyway.Technology is heavy and inconvenientTablets are great for watching hilarious prank videos on YouTube, but they're also heavy and inconvenient for long-term watching. A selfie stick, a long pole or some clever workmanship can put an end to that misery.Washing more than just dishesIt turns out the dishwasher isn't just for dishes. Well, it might not have specifically been designed to wash potatoes, but there's no reason you can put it to that use. Just avoid dish soap.A private cinema screeningBinge watching Netflix on your phone is taxing on the arms, but creating your own hands-free cinema screen is easy if you have an empty box, a pair of scissors and a love for arts and crafts.Watching TV in bedBeing lazy and watching TV in bed is great, but having to account for a picture that's incorrectly aligned when you're horizontal can be such a pain. This young chap had the simple yet genius idea of simply popping his television on its side. We're not sure we'd risk that with a modern flatscreen though.Nerf darts and light switchesToo lazy to get up and turn the lights out? No problem. Pop some darts into your trusty Nerf gun and shoot the light switch. Of course, this sort of laziness requires plenty of ammo or a crack shot. Otherwise, you'll end up sleeping with the lights on.Packaging is just so inconvenientModern packaging is a hassle to open. Theft prevention is all well and good until you can't get into the box to use what you bought. This lazy genius just cut out the middleman and plugged the bulb in anyway.When laziness becomes a life hackSometimes being lazy pays off. We all love a good life hack. Anything that makes life easier is a welcome addition to our knowledgebase. Here a simple tip makes DIY a breeze. Instead of measuring and marking where n you need to drill just photocopy the holes, stick the copy on the wall and drill right through.YouTube vs choresThis lazy individual managed to get out of cleaning their room (at least temporarily) by using YouTube videos to replicate the noise of a vacuum cleaner.Laying down is greatWhen you don't have a cardboard box, there's always this option for watching videos on your phone or tablet. We're not sure how comfortable it is, but at least there's no danger of dropping a device on your face.Mondays are hardMondays are hard work. Dragging yourself into work or college after a hard weekend of relaxing can be too much effort for the modern lazy man. We always wondered why monitors rotated in these weird and wonderful ways. Now we know the answer.It still works as intendedAnother case of frustrating packaging or just a clever use of something for its intended purpose? This doorstop is still keeping the door open, so there aren't too many holes we can pick in this lazy person's logic.Getting the most out of your four-legged friendYou have to walk your dog. You have to clean up after them. You have to bring them food. It's only fair every now and then they return the favour. Here, some clever lazy person has added a bottle opener to their dog's collar, now all they need to do is to train Daisy to bring a bottle too.All the comfort of home on the roadWhen you need to go out, but can't quite bring yourself to leave the comfort of your favourite leather recliner, there are always other options. This lazy genius has created a new form of transport using a comfy seat and a scooter. We're not too sure it's road legal, but we don't doubt its comfort.Lessons in parentingParenting is exhausting, there's no doubt about it. Maybe parents like the one pictured here are onto a trick though - why expend important energy on mundane tasks like going out in public when you can use technology to get around?Saving time at HalloweenBuying pumpkins costs money. Carving pumpkins makes a mess. This smarty-pants may well have spent a little of their money on electricity, but they saved time at Halloween. Time that could be much better spent on stuffing sweets or pulling pranks than cutting up a pumpkin that would inevitably rot and be thrown away anyway.Taking notes in classLooks like we're raising a whole generation of lazy people. In the good old days, we had to suffer wrist ache when scrawling pages and pages of notes during lectures. Now the youth just have to remember to bring their phone or tablet to class and make sure they've got a good enough camera to make the "notes" readable.Hands-free telephonyThe lazy tech user doesn't let things like not having the right equipment hold them back. Making hands-free calls without getting a crick in the neck, even with a corded phone, doesn't have to be difficult.Cooking that will blow you awayMicrowave on the fritz? Did takeaway arrive cold? No problem, just set your hairdryer to hot and gently warm your food until it's ready to eat again. We can't say we'd recommend this one for hygiene reasons, plus on too high a setting you may well just blow all your food across the room, but it's ingenious anyway.Fitbit hacksPeople are always finding clever ways to beat the system. We all love a good fitness tracker to help support us on our goals towards weight loss and a healthier lifestyle, but some days you really just don't want to put in those steps. To ease the guilt, this lazy gadget fan simply taped their Fitbit to a desk fan and watched all the steps roll in.Letting the dog take you for a walkWalking the dog is another way to clock up your steps for the day, but letting them loose can give you the edge when it comes to hitting your goals. You're only cheating yourself of course, but if the competition is stiff among friends, why not give yourself the edge on the leaderboard.Daylight savings timeClocks are such a bore. Every year when daylight savings time comes around (or ends) we have to adjust all the clocks to the right time. Such a hassle. Why bother when a simple sign will do.A watched pot might eventually boilThe clever lazy people among us put technology to good use for even the simplest of tasks. Why keep getting up to check on a boiling pot of food when you can use an IP connected camera, baby monitor or even a phone to watch it from afar?The writing's on the wallThis one equally belongs in the "you had one job" category of internet memes. Someone really couldn't be bothered to move this clock once something else had been erected in front of it. A quick and simple solution solved the problem with very little effort though.A smart viewing experienceAlthough we can imagine some initial effort went into setting this up, it was far less hassle than having to cut up a cardboard box and now this kid has a perfect way to view his films with ease.A new use for FaceTimeWe bet when Apple first created FaceTime the developers never thought people would use it to keep an eye on food cooking in their oven. They say the first bite is with the eye. Now you can take that first bite over the internet.A nice relaxing bathBefore there was streaming technology for playing games remotely, there was this guy.Taking a bath and video calling his TV so he could play PlayStation games remotely. You have to admire the sheer brilliance behind this one. Though it makes us a bit nervous to see how close that tablet is balanced to the edge of the bath.Thanks,VibhorYou might also like to read my answers on:What are the most random and ridiculously expensive things celebs have ever bought?Where can I get the latest series of home appliances at discounted rates? I am also looking for deals that can help me in saving more?

-

What are the first steps to invest in the Indian stock market? How do you open a Demat account and start buying shares?

I am going to ignore your question and share 5 proven steps to get started investing.Starting your first investment is a lot like climbing a mountain.You’re starting from ground zero with a lot of enthusiasm, but when you realize you have to climb for days to get anywhere, that enthusiasm often turns into the feeling of being overwhelmed.But when it comes to your investing career, the weather conditions, metaphorically speaking, are terrible as well.Hold on! You have made a smart move to invest in Equity, popularly called as shares. Indian GDP is growing at 6%-7% per annum and as thumb-rule equities deliver return which is equal to GDP growth + Inflation. Equities are best investment vehicle used as a hedge against inflation.Hey! getting started with your first investments is not terribly difficult - Here's what I would do to start my first investment and build up to $1000, $2000, $10,000………permonth in "passive" income.SEBI regulated a tight charge over documents submission. So this makes it a most crucial step. Your names, dates, and signature should be identical on all of your submitted docs.Below are the exact 4 basic documents that one need to get registered as a stock trader with SEBI.PAN cardIdentity proof (Aadhar card, driving license etc)Bank statement (last 6 month)Cancelled chequeThese are the basic documents. However, in some rare case, additional documents are needed. Consult the broker for the same.In addition, you would also have to fill up the registration form to which the above documents would be attached (highlighted in next step).But where do you submit the damn documents?This is what I’m going to show you in step 2.Not only brokers help you to get your documents verified with SEBI, they also facilitate live trading in stock market. You can buy and sell stocks with just one call or one click (on trading app, platforms)What you’ve to do is contact a broker and deliver them registration form with above-attached documents.But still one should choose a broker with great attention. Some brokers charge so high that most of your profit is swallowed by their charges. An uncle of mine generated a brokerage of 1.5 lakh in 2 months on F&O trading. I was baffled after seeing his charge-sheet.When was the last time you read an investing book or an economic magazine article? Do your daily reading habits center around hot tips tweets, Facebook updates, or the directions on moneycontrol website? If you’re one of the countless people who doesn't make a habit of reading books and articles regularly, you might be missing out: reading has a signNow number of benefits on your investments and your market behavior.Step away from your computer stock screen for a little while, crack open a book, and replenish your soul for a little while.Below are 3 books which are highly recommended to beginners.Stocks to Riches: Insights on Investor Behavior (by Parag Parikh)My personal opinion: At my earlier days, I started reading highly suggested books but didn’t benefit more than this book. In my opinion, this book is a key to understanding other books. Just an extremely insightful book of great practical value that every investor, both beginners and the experienced, should read. No more words.Rich Dad Poor Dad (by Robert T. Kiyosaki)My personal opinion: This is my all time favorite. This book has also qualified for the Amazon Best Reads List – June’16. This book what made me understand the crux of value investing and spread a great message of how money makes money.The Little Book That Still Beats the Market (by Joel Greenblatt)Side Note: Still I’m finding this book to read. Also tried to buy this book on Amazon but not in stock. Contact me personally if you can endorse this book to me. I read summary and reviews of others on this book and find it interesting. He made the value investing simple by just following ROCE and ROE matrix.Edit: I finally got the book.However, when you’re done with above books. Try your luck on some more detailed books here - 11 books that will change the way you look at stock marketNow you’re all done. You got registered with a broker and learned about the stock market. The next step will show you how to stand out from everyone out there...What I like to do next is become a pro trader by tracking my performance, nearly daily.Well quoted by Anurag Bhatia in another answer of the same question.“Maintain a trading journal. Practice paper trading. Yes, you have to practice trading every day to be above average at it. Just like the world's best athletes practice every day”However, you don’t have to make a trading journal, if you’re registered with Zerodha. As they have an inbuilt Q platform to track daily, weekly, monthly……. performance. Get more of it here.This is the most important stage to make yourself a successful investor. Everyday tracks your profit and loss. You don’t have to give hours, 15 minutes will be enough.What you have to do is whenever you have a profit activate your flashback and figure out what made you invest in this share and mark that criterion as a good evaluator of share. And same applies to the loss position in opposite way.When you have traded for a couple of months, nearly daily and got great insights of the market, open up Q platform, track your past transaction and create an algorithm.…….and do whatever you need to cultivate maximum profit from stock market fluctuation.Create your strategy………Create your parameters……….Create your own disciples……….In-short, rely on yourself and trade like a boss. Don’t get influenced by other traders, instead, influence them by your moves.This is where the real money will be made. There are no shortcuts in this process...this is how it's done.Just remember one thing:Following others will not make you rich. Making others follow you will make you rich.Hit me up on my website if you need any help.Stay invested in Sensex or Nifty 50. Normally shares of this category don't tumble more than 5% per day. Exceptions are always there but it's better than mid or small cap stocks. Once you get some experience in the field, choose your stock by your own analysis and own strategy.Go for short term trading (although, I’m a great enemy of short term trading) but as a beginner, you’ll not invest much so you should try with a short run. If you invested for the long run, you’ll lose your interest in some time.Keep the volume of traded money equal to the money which will not make you unhappy, if you lost them.Don’t get trapped in the vicious circle of brokers, advisers…. If their advice are so much effective than they would have been trading shares, not selling their advice.Here’s the reality: You’re in a tough spot.Starting investment profitably for a layman is not easy, but if you’re willing to put in consistent effort, it can be done.I’ve shown you four of the most effective steps I know to get started investing for a newbie. I encourage you to just focus on above steps until you create a sound money making a portfolio.If you’re looking for a bigger guide (with an illustration of a stock), this might help you - How to start investing: A complete guide from "आहा..." to "oh! shit"If you’ve additional advice for newbies or have any sound investment strategy to share with others, I’d love to hear about them in the comments below.

-

Why are most of the IT engineers frustrated in their life?

I generally like surfing Quora when I feel sufficiently sluggish to do any of my pending work. As I am a software engineer, my mouse stop scrolling over when I saw question ” Why are most of the people in the software industry unhappy with their lives?”. Below that there was answer from Jitender S Bhatia:-He wants to write code. But is assigned to bug fixing.His cousins think he is a Scientist. In reality his work is often clerical.He floats to office. After 2 hour trek through traffic.He hides his office badge. When hailing a auto – to avoid software engineer tax.His relatives think he sits in a fancy cabin. A small cubicle is the reality.He has an Engineering degree. Now stuck in a WHILE loop.[ALSO READ :- As a software engineer, what’s the best skill set to have for the next 5-10 years?]His best friend works on Big Data. He is struggling with Core Java.His childhood friend lives at Riverfront, Florida, USA. He lives near Silkboard Junction, Next to XYZ Bakery.He appears for interviews. To find his stagnant market value.He pays 30% surcharge on house rent. Because landlord suspects he earns a lot.His mother asks him over phone if he had dinner. He says Yes. And then boils Maggi.When his neighbour’s kid calls him Uncle. He goes deaf.[]He finds difficulty in completing his mandatory working hours.He has a friend circle which he calls “lunch buddies”.His life is all about swipes, sometimes he even look for a radical machine in washroom for swiping his access card.Idea of startup was always in his back head, which he dreams to execute, but never gather that much courage to take initiative.Writing blogs for inner satisfaction and waiting for people to click ads on his blog to earn some “paise” and not even rupee.As the last pointer says about blog, you can also read my blog for related geek questions.ALSO READ :- As a software engineer, what’s the best skill set to have for the next 5-10 years?ALSO READ :- As a software engineer, what’s the best skill set to have for the next 5-10 years?I write about what was the first google doodle?Microsoft has murdered Ms-Paintfog computing ? Is it exist?

-

What is the best way to learn the Indian stock market for free?

Now a day, buying a stock is as simple as recharging your mobile or transferring money. All you need is computer with internet connection, a bank account and some money in that account, obviously.If you have seen movie Guru (in which Abhishek Bachchan was in leading role based on life of Dhirubhai Ambani), the scenario of stock market might scare you. But it was something like 50-60 years back. Now, no physical appearance, no much paper works are required. You can buy a stock sitting in your room in front of your laptop and that too within 2 minutes. How? That’s what I am going to teach you now. How to buy a stock in stock market? Just be with me for the next 5-10 minutes.Buying shares online is the easy task, but I believe first you need to find that right stock that you should buy. There are few basic work which you should go through to find the best stock for you:Read and Research:There are tons of websites on the internet where you can get tutorials for stock market basics and about how to buy a stock in Stock Market? For beginners, I will recommend to follow websites of moneycontrol, economic times and Investopedia - Sharper Insight. Smarter Investing, Learn how to follow Stock Market and trends- Trade BrainsThere are few books which are must read for the beginners in stock market. They are:The Intelligent InvestorOne Up on the wall streetBeating the streetCommon Stocks and uncommon profitsIn addition, please check out this link to know about other must read books for stock investors:http://www.tradebrains.in/10-mus...You can read further about Indian stock market from the following useful links:Investment Basics,Sensex, Nifty & Index,How to create your Stock Portfolio?,Learn how to follow Stock Market and trends- Trade Brains,Six Different Types of Stock in Indian Market according to Peter LynchNow after learning the basics, the main tasks begins. You need to learn how to follow the stock market, their trends, their fluctuations etc.Get good financial knowledge:A good financial knowledge is the key for the success in the stock market. You need to understand the fundamentals before entering the stock world. The basics of Earnings per share(EPS), P/E Ratio, Book Value, P/BV, Dividend, Return on Equity(ROE), Return on capital employed(ROCE), debt/equity ratio etx should be known to you before you analyze a stock. You can read further about from these links: Investment Basics, Six Different Types of Stock in Indian Market according to Peter LynchMake your dummy portfolio:A portfolio is nothing but your collection of stocks from different or same sectors. A portfolio shows how many shares you are owning from which sector. Generally, a good portfolio maximizes the profit and minimizes the rist. You can learn how to create your portfolio from this link: How to create your Stock Portfolio?Follow the stock you’re interest in for few days:The last step before buying a stock from stock market is to learn how to follow stocks in the stock market. You should know how to track stocks so that you can buy/sell them at the best time. I advice the beginners to at least follow the stocks for 1 month before buying them. You can learn how to follow a stock from this link: Learn how to follow Stock Market and trends- Trade Brains.Now that you know all the basics for the stock market, you can move further for How to buy a stock in Stock Market?How to buy a stock in Stock Market?The basics requirements for buying a stock in stock market are:Stock broker: General people can’t go to a stock exchange and buy/sell stocks. Only members of the stock exchange can buy and sell and they are called the brokers. Every broker should be registered on the Securities and exchange board of India(SEBI). There are a number of brokers/ sub-brokers which you can choose for trading. Some online brokers are Sharekhan, Kotak Securities, ICICI Direct, 5paise and India Bulls.Saving Account: Obviously you need a saving account for trading in the stock market.Demat A/C: It’s very simple to open a demat account. Now a day, the banks even offer you to open 3-in-1 account, i.e. all three Saving+ Demat+ Trading account, by filling few forms just once. 3-in-1 account will save your timing a lot and I recommend you to open a 3-in-1 account if you want to start trading in the stocks. You can open it in banks like ICICI, SBI, Kotak etc.Note: If you open a 3-in-1 account you won’t need to find a stock broker as trading account is already included in it.Laptop and Internet connection: Obviously, the soul of modern era which is a must for all the online facilities.NOTE:The documents required to open a 3-in-1 account are PAN card, Aadhar Card (for address proof) and an ID proof (generally Aadhar/Pan card can also be used as ID card). Once you opened your demat account, you will receive your username and password, and then you can start trading using your account.I hope this answer is useful for the readers. Further, if you want to read the complete post, you can find it here:How to buy a stock in Stock Market? Step-by-step Explanation.

-

How profitable is options trading? How much of a hassle is it? Can one make good profits with just 1 hour of trading per day?

I started off investing in stocks. Then, before I could realize, I was trading stocks. I traded stocks for many years. I avoided options. They always sounded very expensive to me. Option premiums are generally so rich I couldn't justify putting money on long option positions. Initially, I played options by buying a few times but overall I lost money in options long positions. "Unlimited profit at limited risk of loss" is a true statement but you need to consider the odds for both scenarios. Most option prices decay too fast and they are more likely to expire worthless than to give you "unlimited" profit! For last 2-3 years, since I saw weekly options, I combined my stock trading with shorting/selling options and I think it has worked out very well. Few important points: 1) Remember the key difference: most common people get lured by the "unlimited profit potential against limited loss/risk" with BUYING options; I play on the other side. I short/sell options to open my positions. I take unlimited risk or loss potential against limited profit potential! 2) I just do not trade options for the sake of trading options. First I take a view on a stock or the market. If I think a stock is about to form a bottom, I sell put options. If I think a stock is about to form a top, I sell call options. I collect the premium. Many times, the options expire and I keep the money :) Sometimes the buyers exercise them and I end up with a long or short position in the stock which is fine with me as I already had a bullish or bearish view on that security. I rarely close my short positions! They expire worth less or end up in a long or short position for me.3) I trade only weekly options! It is a Monday to Friday game and for me the premiums are too attractive. How profitable is options trading? I am too busy to run numbers or do analysis on my positions ;) However, around 2 years back, I decided to see if I can buy a Tesla car trading TSLA stocks! My then 7 year old son was very much interested in a Tesla! He was a big fan. Anyway, I started trading TSLA stock, most of the positions were options trading, and to be honest with my son about our deal, I created a blog and logged my trades! I think god also wanted a Tesla for my son or we were just too lucky, the trading went well. I think better then my general options trading. Who knows. I don't. However, you can look at my blog and go through the posts. Or, you will find a Google doc (spreadsheet) with all TSLA positions I had. Remember, this was all trading (and not investing) and most positions were options trading! Also, please remember, I am just trying to answer this question with some relevant real life data and by no means, I am telling you to start trading options! Trading options or stocks is very very risky business and is not for every one. There is no magic wand that can work profitably for every trader. Some have to lose to let some others to profit ;)#TSLA4Tesla project: Trade TSLA Stock For A Tesla car- stock trading with a purpose

-

Does the UN employ MSW graduates? And how to apply?

This is a wide question. I take it that MSW is a “Master of Social Work”, e.g. like this http://www.uni.edu/csbs/socialwo....All UN jobs are advertised on their website - UN Careers. For professional posts, i.e. those called P-1 through P-5; the educational requirement is generally a Masters degree from a reputable university (included on the list of recognized institutions by UNESCO - UNESCO Portal to Recognized Higher Education Institutions) within a field that is applicable for the post.Typically the job description will list law, economics, social sciences etc as required field of study. So, if it says Social Sciences, my guess would be that a MSW could be accepted.You can apply by identifying the jobs at the UN page above and click apply. You need to fill out an application form that can be re-used for later applications.A word of advise, only apply for jobs that you qualify for, e.g. if it says 7 years experience and you have 5, your application will be discarded.

Create this form in 5 minutes!

How to create an eSignature for the form p 1

How to make an electronic signature for the Form P 1 online

How to make an eSignature for your Form P 1 in Chrome

How to generate an electronic signature for signing the Form P 1 in Gmail

How to create an eSignature for the Form P 1 from your smartphone

How to make an eSignature for the Form P 1 on iOS

How to generate an electronic signature for the Form P 1 on Android

People also ask

-

What is Form P 1 and how does it relate to airSlate SignNow?

Form P 1 is a specific document type that businesses may need to complete for various regulatory purposes. With airSlate SignNow, you can easily create, send, and eSign Form P 1, ensuring compliance and efficiency in your document workflows.

-

How much does it cost to use airSlate SignNow for Form P 1?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can choose a plan that allows you to manage Form P 1 and other documents effectively without breaking the bank.

-

What features does airSlate SignNow offer for managing Form P 1?

airSlate SignNow provides a user-friendly interface that allows you to easily upload, edit, and eSign Form P 1. Additionally, it includes features such as templates, reminders, and secure storage to streamline your document management process.

-

Can I integrate airSlate SignNow with other applications for Form P 1?

Yes, airSlate SignNow offers seamless integrations with various applications, such as CRM systems and project management tools. This allows you to automate the workflow for Form P 1, improving efficiency and reducing manual errors.

-

What are the benefits of using airSlate SignNow for Form P 1?

Using airSlate SignNow for Form P 1 streamlines your document processes, saving time and reducing paperwork. The platform enhances collaboration, ensuring that all stakeholders can eSign and manage Form P 1 from anywhere, at any time.

-

Is airSlate SignNow secure for handling Form P 1?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including Form P 1. Your data is encrypted and stored securely, giving you peace of mind when handling sensitive information.

-

How does airSlate SignNow simplify the eSigning process for Form P 1?

airSlate SignNow simplifies the eSigning process for Form P 1 by allowing users to sign documents electronically in just a few clicks. The intuitive interface and mobile accessibility mean that you can eSign Form P 1 on-the-go, enhancing productivity.

Get more for Form P 1

- Form i 601a application for provisional unlawful presence uscis

- Form waiver rights 2015

- Form waiver rights 2017 2019

- Application advance 2016 2019 form

- Form i 918 supplement a petition for qualifying family member of u 1 recipient

- Form i 730 2017 2019

- I 600a supplement 2016 2019 form

- I 600a supplement 2015 form

Find out other Form P 1

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now