Form I 918 Supplement A, Petition for Qualifying Family Member of U 1 Recipient 2017

What is the Form I-918 Supplement A?

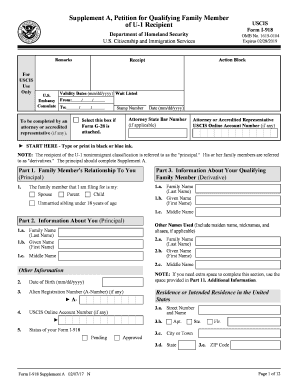

The Form I-918 Supplement A, officially known as the Petition for Qualifying Family Member of U-1 Recipient, is a crucial document for individuals seeking to assist family members of U-1 visa holders. This form allows qualifying family members to apply for derivative U nonimmigrant status, which provides protection and the opportunity to remain in the United States. The U-1 visa is designated for victims of certain crimes who have suffered substantial mental or physical abuse and are helpful to law enforcement in the investigation or prosecution of those crimes.

How to Use the Form I-918 Supplement A

To effectively use the Form I-918 Supplement A, it is essential to understand its purpose and the eligibility criteria. This form must be submitted alongside the primary Form I-918, which is for the U-1 applicant. The Supplement A is specifically for family members, including spouses, children, parents, and siblings of the U-1 recipient. It is important to ensure that all required information is accurately filled out, including personal details, relationship to the U-1 recipient, and any necessary supporting documentation.

Steps to Complete the Form I-918 Supplement A

Completing the Form I-918 Supplement A involves several important steps:

- Gather necessary documents, including proof of relationship to the U-1 recipient.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Attach required supporting documents, such as identification and evidence of the qualifying relationship.

- Submit the completed form along with the primary Form I-918 to the appropriate USCIS office.

Key Elements of the Form I-918 Supplement A

Understanding the key elements of the Form I-918 Supplement A is vital for successful completion. Key components include:

- Personal Information: Details about the applicant, including name, date of birth, and address.

- Relationship to U-1 Recipient: Clear documentation of the familial relationship, such as marriage certificates or birth certificates.

- Eligibility Criteria: Information confirming the applicant’s eligibility as a qualifying family member.

Form Submission Methods

The Form I-918 Supplement A can be submitted through various methods. Applicants may choose to file the form online, by mail, or in person, depending on their specific circumstances and preferences. It is essential to verify the current submission guidelines from USCIS to ensure compliance with any recent changes in filing procedures.

Required Documents

When submitting the Form I-918 Supplement A, certain documents are required to support the application. These may include:

- Proof of the qualifying relationship to the U-1 recipient.

- Identification documents, such as passports or birth certificates.

- Any additional evidence that supports the claim for derivative status.

Quick guide on how to complete form i 918 supplement a petition for qualifying family member of u 1 recipient

Discover the simplest method to complete and sign your Form I 918 Supplement A, Petition For Qualifying Family Member Of U 1 Recipient

Are you still investing time in preparing your physical documentation instead of managing it online? airSlate SignNow offers a superior approach to fill out and sign your Form I 918 Supplement A, Petition For Qualifying Family Member Of U 1 Recipient and related forms for public services. Our advanced electronic signature solution equips you with everything necessary to handle documents swiftly and in compliance with regulatory requirements - robust PDF editing, organizing, safeguarding, signing, and sharing functionalities all available within an easy-to-use interface.

Only a few steps are needed to complete and sign your Form I 918 Supplement A, Petition For Qualifying Family Member Of U 1 Recipient:

- Insert the editable template into the editor by clicking the Get Form button.

- Verify the information you must provide in your Form I 918 Supplement A, Petition For Qualifying Family Member Of U 1 Recipient.

- Navigate through the fields using the Next option to avoid missing any details.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Revise the content using Text boxes or Images from the top toolbar.

- Emphasize what is essential or Redact sections that are no longer relevant.

- Press Sign to create a legally valid electronic signature using any method you prefer.

- Include the Date next to your signature and conclude your task with the Done button.

Store your completed Form I 918 Supplement A, Petition For Qualifying Family Member Of U 1 Recipient in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our service also provides versatile form sharing options. There’s no need to print your templates when you need to send them to the appropriate public office - use email, fax, or request a USPS “snail mail” delivery from your account. Try it today!

Create this form in 5 minutes or less

Find and fill out the correct form i 918 supplement a petition for qualifying family member of u 1 recipient

FAQs

-

How should a petitioner fill in Part 5 Household Size of the form I-864 Affidavit of support if he would like to sponsor 2 principal immigrants at the same time? Each family has 4 members.

Each principal beneficiary (and their family) is petitioned with a separate I-130 petition, and each I-130 petition has a separate I-864 Affidavit of Support. Each family’s I-864 does not count the other family in the “family members” in Part 3 (note that it says “Do not include any relative listed on a separate visa petition.”).If the two I-864s are filed at the same time for the two families, then each family’s I-864’s household size (Part 5) would just count the number of people immigrating in that family, which is 4 (item 1), the petitioner (item 2), and the petitioner’s spouse (item 3), dependent children (item 4), and other tax dependents (item 5), if there are any. It would not count anyone from the other family.On the other hand, if one I-864 is filed for one family, and that family has already immigrated before the second I-864 is filed for the other family, then the first family’s members will need to be counted in Part 5 item 6 (people sponsored on Form I-864 who are now lawful permanent residents) for the second family’s I-864.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

-

My brother is a US citizen and he submitted I-130 petition form for me (eligible family member). How long does it take to get the approval from the government? Some says it take over 10 years or more. Is that right?

As a brother of a US Citizen, you are eligible to obtain permanent residency under the F4 Visa category.You can refer to the State Department's visa bulletin (June 2018 - Visa Bulletin For June 2018 ) to roughly estimate when your petition will be granted permanent residency.On the Visa Bulletin For June 2018 page, scroll down and look for a table in the section titled “FINAL ACTION DATES FOR FAMILY-SPONSORED PREFERENCE CASES”. Under the F4 row, look for the column that identifies with your country of birth. Only applications filed on or before the date listed is will be adjudicated in June 2018 for a beneficiary who is elgible under the F4 category. Compare this date with the date USCIS acknowledged receipt of (receiving) the I-130 application from the petitioner (your brother). The difference in dates is the probable estimate of how long it would take for you to get your permanent residency.Good luck.

-

When filling out form I-864 for a Fiance(e) Visa, what is the difference between doing (1) co-sponsorship and (2) including a house member in co-payment of the minimum financial requirement (i.e., attaching the form I-864a to I-864)?

You don't do I-864 for a fiance visa. You do an I-134.

Create this form in 5 minutes!

How to create an eSignature for the form i 918 supplement a petition for qualifying family member of u 1 recipient

How to create an electronic signature for your Form I 918 Supplement A Petition For Qualifying Family Member Of U 1 Recipient online

How to make an electronic signature for your Form I 918 Supplement A Petition For Qualifying Family Member Of U 1 Recipient in Google Chrome

How to make an eSignature for putting it on the Form I 918 Supplement A Petition For Qualifying Family Member Of U 1 Recipient in Gmail

How to make an electronic signature for the Form I 918 Supplement A Petition For Qualifying Family Member Of U 1 Recipient right from your smart phone

How to create an eSignature for the Form I 918 Supplement A Petition For Qualifying Family Member Of U 1 Recipient on iOS

How to create an eSignature for the Form I 918 Supplement A Petition For Qualifying Family Member Of U 1 Recipient on Android OS

People also ask

-

What is USCIS Form I-918?

USCIS Form I-918 is a visa application form used by individuals seeking U nonimmigrant status in the United States. This form is specifically for victims of certain crimes who have suffered mental or physical abuse and are willing to assist law enforcement in the investigation or prosecution of criminal activity.

-

How can airSlate SignNow assist with USCIS Form I-918?

airSlate SignNow provides a user-friendly platform to eSign and manage documents like the USCIS Form I-918 easily. With our solution, users can ensure that all required signatures are obtained securely and efficiently, streamlining the application process.

-

What are the pricing plans for using airSlate SignNow?

Our pricing plans for airSlate SignNow are affordable and designed to cater to businesses of all sizes. Customers can choose from different tiers, depending on their needs, with features that include the ability to handle documents like USCIS Form I-918 effectively.

-

What features does airSlate SignNow offer for USCIS Form I-918?

airSlate SignNow offers various features for handling USCIS Form I-918, including document templates, advanced signing options, and real-time tracking. These features ensure that your applications are not only completed but also managed efficiently without delays.

-

Can airSlate SignNow integrate with other tools for managing USCIS Form I-918?

Yes, airSlate SignNow seamlessly integrates with a variety of tools and platforms to help you manage documents like USCIS Form I-918 more effectively. These integrations enhance workflow efficiency, allowing you to automate processes and keep all your documents organized.

-

What benefits does airSlate SignNow provide for filing USCIS Form I-918?

Using airSlate SignNow for filing USCIS Form I-918 provides numerous benefits, including enhanced security, ease of access, and quick turnaround times for document processing. Our solution helps users save time and focus on critical aspects of their cases while ensuring legal compliance.

-

Is airSlate SignNow secure for managing sensitive documents like USCIS Form I-918?

Absolutely! airSlate SignNow prioritizes security and utilizes industry-standard encryption to safeguard sensitive documents, including USCIS Form I-918. You can trust that your information is protected throughout the signing and submission process.

Get more for Form I 918 Supplement A, Petition For Qualifying Family Member Of U 1 Recipient

Find out other Form I 918 Supplement A, Petition For Qualifying Family Member Of U 1 Recipient

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template