Dr15ez 2020-2026

What is the DR-15EZ?

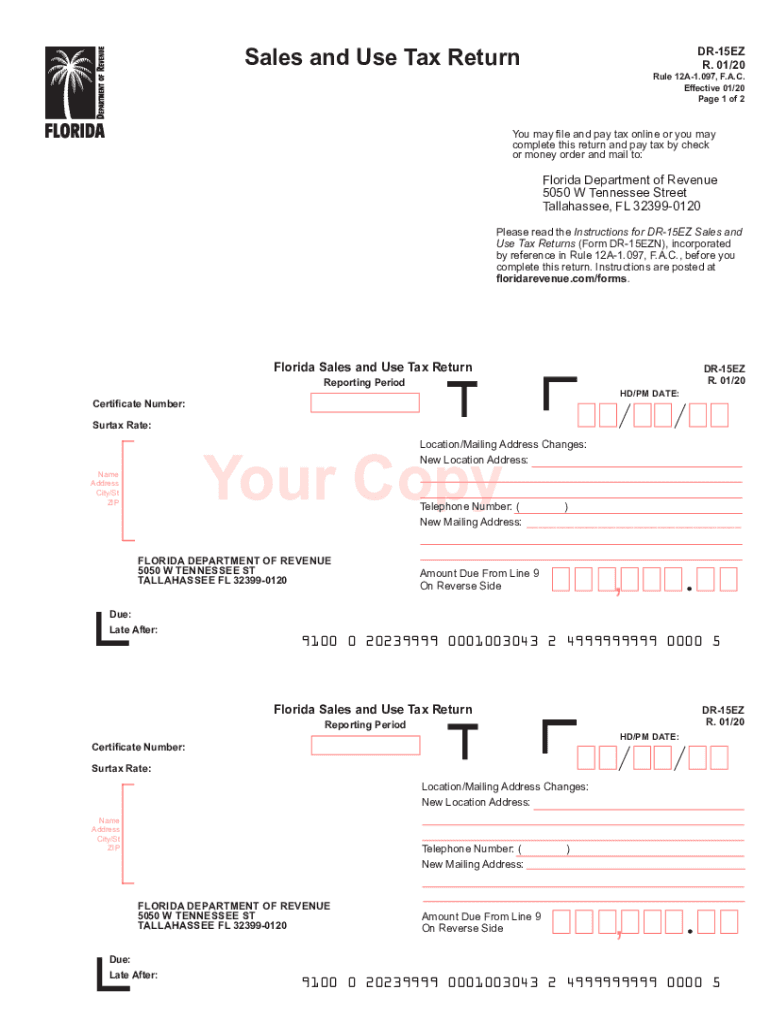

The DR-15EZ is a simplified Florida sales tax form designed for businesses to report and remit sales and use tax. This form is particularly beneficial for small businesses and those with straightforward tax situations, allowing for an easier filing process. The DR-15EZ captures essential information regarding taxable sales, exemptions, and the total tax due, making it a vital tool for compliance with Florida tax regulations.

How to Use the DR-15EZ

Using the DR-15EZ involves several straightforward steps. First, gather all necessary sales records, including receipts and invoices. Next, accurately fill out the form by entering your total sales, any applicable exemptions, and calculating the total tax owed. It is important to ensure that all figures are correct to avoid penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference and compliance requirements.

Steps to Complete the DR-15EZ

Completing the DR-15EZ involves a series of clear steps:

- Collect all sales data for the reporting period.

- Enter your total gross sales on the form.

- List any exempt sales and calculate the taxable amount.

- Compute the total sales tax due based on the applicable rate.

- Review all entries for accuracy before submission.

Legal Use of the DR-15EZ

The DR-15EZ is legally recognized for reporting sales and use tax in Florida. To ensure its legal validity, it must be completed accurately and submitted by the designated deadlines. Compliance with state tax laws is essential to avoid penalties and ensure that your business remains in good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the DR-15EZ are crucial for compliance. Typically, the form must be submitted monthly or quarterly, depending on your business's sales volume. It is important to mark your calendar for these deadlines to avoid late fees. The Florida Department of Revenue provides specific dates each year, so staying informed is essential for timely submissions.

Form Submission Methods

The DR-15EZ can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the Florida Department of Revenue's website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices.

Choosing the right submission method can streamline your filing process and ensure timely compliance.

Quick guide on how to complete tallahassee fl 32399 0120

Effortlessly Prepare Dr15ez on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed materials, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any hold-ups. Manage Dr15ez across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Simplest Method to Edit and eSign Dr15ez Easily

- Find Dr15ez and then click Get Form to initiate the process.

- Make use of the tools provided to complete your form.

- Emphasize important parts of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for those tasks.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information thoroughly and then click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether it be by email, text message (SMS), invite link, or download to your computer.

No more worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Dr15ez and ensure excellent communication at any phase of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tallahassee fl 32399 0120

Create this form in 5 minutes!

How to create an eSignature for the tallahassee fl 32399 0120

How to make an electronic signature for your Tallahassee Fl 32399 0120 online

How to make an eSignature for the Tallahassee Fl 32399 0120 in Google Chrome

How to make an eSignature for signing the Tallahassee Fl 32399 0120 in Gmail

How to create an electronic signature for the Tallahassee Fl 32399 0120 from your smart phone

How to create an electronic signature for the Tallahassee Fl 32399 0120 on iOS devices

How to generate an eSignature for the Tallahassee Fl 32399 0120 on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 'dr.'?

airSlate SignNow is a powerful eSignature tool that allows businesses to manage their document workflows efficiently. The 'dr.' relates to the document review process, where airSlate SignNow streamlines approvals and ensures that documents are signed promptly and securely.

-

How much does airSlate SignNow cost for users in the 'dr.' field?

airSlate SignNow offers competitive pricing plans suitable for various users, including those in the 'dr.' field. You can choose from monthly or annual subscriptions, with discounts available for yearly commitments, providing an affordable eSigning solution for healthcare professionals.

-

What features does airSlate SignNow offer that benefit 'dr.' professionals?

airSlate SignNow provides numerous features that are beneficial for 'dr.' professionals, such as easy document uploads, customizable templates, and advanced security settings. These features help ensure that sensitive patient information is handled securely while allowing for quick document turnaround.

-

Can I integrate airSlate SignNow with other tools I use as a 'dr.'?

Absolutely! airSlate SignNow seamlessly integrates with various popular applications, making it easier for 'dr.' professionals to connect their existing workflows. Whether you're using CRM systems, cloud storage, or practice management tools, you can enhance your efficiency by integrating airSlate SignNow.

-

How does airSlate SignNow ensure document security for 'dr.' users?

Security is a top priority for airSlate SignNow, particularly for 'dr.' users handling sensitive information. The platform employs encryption, two-factor authentication, and compliance with industry standards to guarantee that your documents and patient data remain secure throughout the signing process.

-

Can airSlate SignNow help with patient consent forms in the 'dr.' industry?

Yes, airSlate SignNow is an excellent solution for managing patient consent forms in the 'dr.' industry. You can easily create, send, and sign consent documents electronically, ensuring compliance and convenience for both patients and healthcare providers.

-

What benefits do 'dr.' users gain from using airSlate SignNow?

By using airSlate SignNow, 'dr.' users gain access to an easy-to-use electronic signature tool that saves time and resources. This means quicker patient onboarding, enhanced document accuracy, and the ability to focus more on patient care rather than paperwork.

Get more for Dr15ez

Find out other Dr15ez

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy