Dr 15 2020-2026

What is the DR-15?

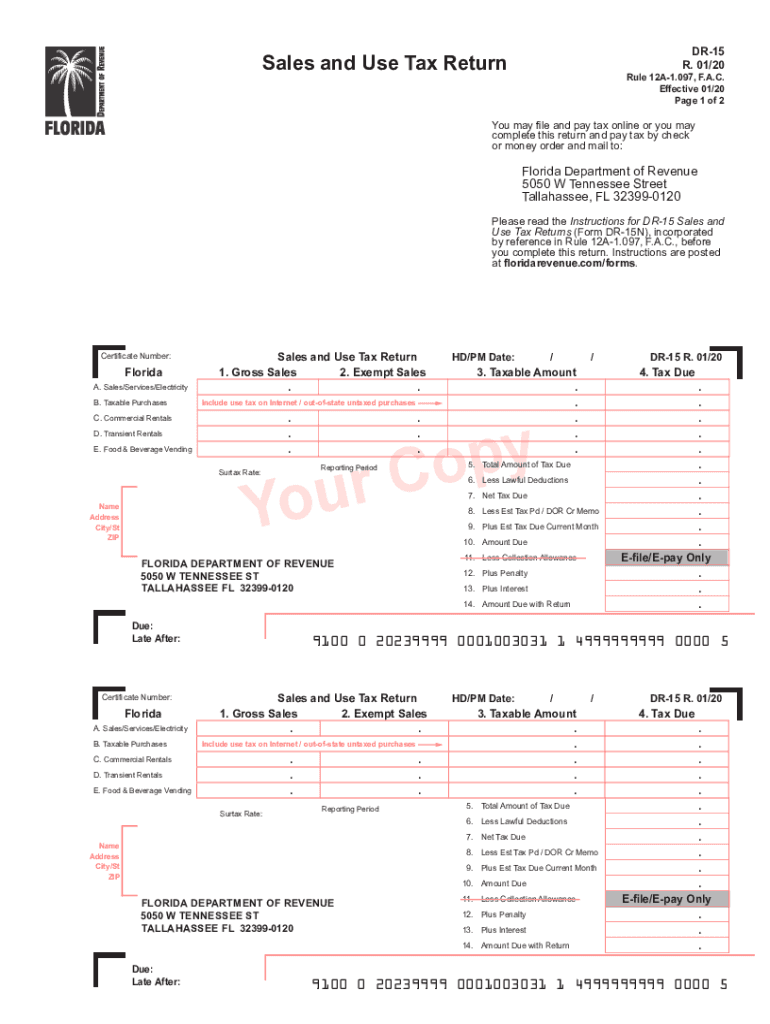

The DR-15 is the official Florida sales and use tax return form. It is utilized by businesses and individuals to report and remit sales tax collected on taxable sales. This form is essential for ensuring compliance with Florida tax laws and is a critical component of the state's revenue system. The DR-15 captures various details, including total sales, taxable sales, and the amount of tax due. Understanding this form is vital for anyone involved in selling goods or services in Florida.

How to Use the DR-15

Using the DR-15 involves several key steps to ensure accurate reporting. First, gather all necessary sales records for the reporting period. Next, calculate the total sales and determine which sales are taxable. Enter these figures on the form, ensuring that all calculations are accurate. After completing the form, it must be submitted to the Florida Department of Revenue, along with any payment due. Utilizing a digital platform can streamline this process, making it easier to fill out and submit the form online.

Steps to Complete the DR-15

Completing the DR-15 form requires careful attention to detail. Follow these steps for a successful submission:

- Gather sales records for the reporting period.

- Identify taxable and non-taxable sales.

- Calculate the total sales tax collected.

- Fill out the DR-15 form with accurate figures.

- Review the form for any errors or omissions.

- Submit the completed form online or by mail, along with the payment.

By following these steps, you can ensure that your sales and use tax filing is both accurate and compliant with state regulations.

Legal Use of the DR-15

The DR-15 form is legally binding when completed and submitted according to Florida law. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. The electronic submission of the DR-15 is recognized under the ESIGN Act, making it a valid method for filing. This legal recognition provides assurance that electronic signatures and submissions are treated with the same validity as traditional paper filings.

Filing Deadlines / Important Dates

Filing deadlines for the DR-15 are crucial for compliance. Generally, the form is due on the first day of the month following the end of the reporting period. For example, if you are reporting for the month of January, the form must be submitted by February first. It is important to stay informed about any changes to these deadlines, as failure to file on time can result in penalties and interest on unpaid taxes.

Form Submission Methods

The DR-15 can be submitted through various methods, providing flexibility for taxpayers. The primary methods include:

- Online submission through the Florida Department of Revenue's website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated Department of Revenue offices.

Choosing the online submission method can expedite processing and reduce the risk of errors.

Key Elements of the DR-15

Understanding the key elements of the DR-15 is essential for accurate completion. Important sections of the form include:

- Total sales: The gross amount of all sales made during the reporting period.

- Taxable sales: The total amount of sales subject to sales tax.

- Sales tax collected: The total sales tax collected from customers.

- Exemptions: Any applicable exemptions that reduce the taxable amount.

Each of these components plays a vital role in ensuring that the sales and use tax return is accurate and compliant with Florida regulations.

Quick guide on how to complete f 1120n instructions for corporate incomefranchise tax

Effortlessly prepare Dr 15 on any device

The management of online documents has surged in popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Dr 15 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

Effortlessly edit and eSign Dr 15

- Locate Dr 15 and click on Get Form to initiate the process.

- Utilize the tools provided to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Dr 15 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f 1120n instructions for corporate incomefranchise tax

Create this form in 5 minutes!

How to create an eSignature for the f 1120n instructions for corporate incomefranchise tax

How to create an eSignature for the F 1120n Instructions For Corporate Incomefranchise Tax online

How to make an electronic signature for the F 1120n Instructions For Corporate Incomefranchise Tax in Chrome

How to make an electronic signature for signing the F 1120n Instructions For Corporate Incomefranchise Tax in Gmail

How to create an eSignature for the F 1120n Instructions For Corporate Incomefranchise Tax from your mobile device

How to make an electronic signature for the F 1120n Instructions For Corporate Incomefranchise Tax on iOS devices

How to generate an eSignature for the F 1120n Instructions For Corporate Incomefranchise Tax on Android devices

People also ask

-

What is Florida sales and use tax online?

Florida sales and use tax online refers to the ability to file and manage your sales tax obligations through an online platform. It simplifies the process of calculating, collecting, and remitting sales taxes, ensuring compliance with Florida's tax laws. Utilizing an online solution makes it easier for businesses to track their tax liabilities.

-

How can airSlate SignNow help with Florida sales and use tax online?

airSlate SignNow provides a user-friendly platform that allows businesses to easily prepare and submit documents related to Florida sales and use tax online. The solution accelerates the signing process and minimizes compliance risks by keeping all records in one secure place. Our features support streamlined tax filing, saving you time and reducing hassle.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Each plan includes access to tools for managing Florida sales and use tax online, ensuring cost-effective solutions for document handling and e-signatures. Contact our sales department for specific pricing that aligns with your requirements.

-

Is airSlate SignNow compliant with Florida tax laws?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that businesses can remain aligned with Florida's sales and use tax regulations. Our platform is updated regularly to reflect any changes in the law, helping users file their Florida sales and use tax online with confidence. This reduces the risk of errors and potential penalties.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow offers seamless integrations with major accounting software, allowing you to connect your systems for a streamlined workflow. This integration can enhance your ability to manage Florida sales and use tax online by syncing relevant financial data automatically, ensuring accuracy in tax calculations.

-

What features does airSlate SignNow offer for managing taxes?

airSlate SignNow comes equipped with various features designed to simplify tax management. These include customizable templates for tax documents, automatic reminders for filing deadlines, and secure e-signature capabilities. These features make handling Florida sales and use tax online straightforward and efficient, giving you peace of mind.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority for airSlate SignNow; we utilize industry-leading encryption and authentication methods to protect your documents. This ensures that all data related to Florida sales and use tax online is stored securely, preventing unauthorized access. You can confidently manage sensitive tax information without compromising security.

Get more for Dr 15

- Pelvic floor impact questionnaire short form 7 pfiq 7 palmer

- Form 2 request for reinstatement gordon darby inc

- High school code request form the college board

- Statement of organization packet msweb03 co wake nc form

- Application for employment colorado mesa university coloradomesa form

- Floridarealtors floridabar asis 3 redline form

- Johnson county annual occupational tax return 001 fy form

- Temporary use permit application form

Find out other Dr 15

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors