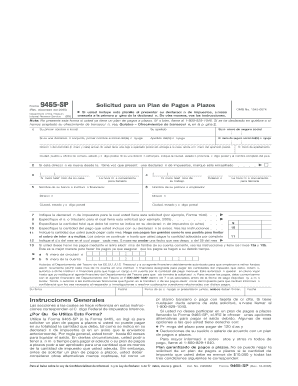

Form 9465 SP Rev December Fill in Capable

What is the Form 9465?

The Form 9465, also known as the Installment Agreement Request, is a document used by taxpayers in the United States to request a payment plan for their federal tax liabilities. This form allows individuals to pay their taxes over time rather than in a lump sum. It is particularly useful for those who may be experiencing financial difficulties but still wish to meet their tax obligations. By submitting this form, taxpayers can propose a monthly payment amount that fits their budget, making it easier to manage their tax debt.

How to Use the Form 9465

Using the Form 9465 involves several straightforward steps. First, taxpayers need to gather their financial information, including income, expenses, and any outstanding tax balances. Next, they should fill out the form accurately, providing details such as their name, Social Security number, and the amount owed. After completing the form, it can be submitted electronically through the IRS website or mailed directly to the appropriate IRS address. It is important to ensure that the proposed monthly payment amount is realistic and aligns with the taxpayer's financial situation.

Steps to Complete the Form 9465

Completing the Form 9465 requires careful attention to detail. Here are the key steps:

- Download the Form 9465 from the IRS website or obtain a physical copy.

- Fill out personal information, including your name, address, and Social Security number.

- Indicate the total amount you owe to the IRS and the proposed monthly payment you can afford.

- Provide your bank account information if you wish to set up direct debit for payments.

- Sign and date the form to certify that the information provided is accurate.

- Submit the form electronically or by mail, ensuring it reaches the IRS by the specified deadline.

Legal Use of the Form 9465

The Form 9465 is legally binding once submitted and accepted by the IRS. This means that taxpayers are obligated to adhere to the payment plan established through the form. Failure to comply with the terms of the installment agreement can result in penalties, including the potential for the IRS to take further collection actions. It is essential for taxpayers to understand their rights and responsibilities when using this form to avoid any legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form 9465 are crucial for taxpayers seeking to establish a payment plan. Generally, the form should be submitted as soon as a taxpayer realizes they will not be able to pay their tax bill in full. For those filing their tax returns, it is advisable to submit the Form 9465 by the tax return due date to avoid additional penalties. Understanding these deadlines can help taxpayers manage their tax obligations more effectively.

Eligibility Criteria

To qualify for an installment agreement using Form 9465, taxpayers must meet specific eligibility criteria. Generally, individuals must owe less than a certain amount, which can change annually. Additionally, they should be current with their tax filings and not have defaulted on any previous installment agreements. Meeting these criteria is essential for the IRS to approve the request for a payment plan.

Quick guide on how to complete form 9465

Complete form 9465 effortlessly on any device

Online document handling has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage form 9465 on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign form 9465 without hassle

- Find form 9465 and click Get Form to start.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign form 9465 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 9465

Create this form in 5 minutes!

How to create an eSignature for the form 9465

How to make an eSignature for your Form 9465 Sp Rev December 2005 Fill In Capable in the online mode

How to generate an electronic signature for the Form 9465 Sp Rev December 2005 Fill In Capable in Chrome

How to make an electronic signature for putting it on the Form 9465 Sp Rev December 2005 Fill In Capable in Gmail

How to create an eSignature for the Form 9465 Sp Rev December 2005 Fill In Capable right from your mobile device

How to generate an eSignature for the Form 9465 Sp Rev December 2005 Fill In Capable on iOS devices

How to make an electronic signature for the Form 9465 Sp Rev December 2005 Fill In Capable on Android OS

People also ask form 9465

-

What is the form 9465 and how can airSlate SignNow help with it?

The form 9465 is a request for installment agreement with the IRS, allowing taxpayers to pay their tax liabilities over time. airSlate SignNow simplifies the process of electronically signing and submitting the form 9465, ensuring you stay compliant while saving time.

-

Is there a cost associated with using airSlate SignNow for the form 9465?

Yes, while airSlate SignNow offers various pricing plans, the cost of using the platform for the form 9465 is competitive and tailored to fit the needs of different users. You can choose a plan that suits your needs and benefit from a cost-effective solution for eSigning documents.

-

What features does airSlate SignNow offer for the form 9465?

airSlate SignNow provides features such as easy document uploads, customizable templates, and reminders for your form 9465. This ensures a seamless experience while managing your tax documents and simplifies the eSigning process.

-

Can I track the status of my form 9465 with airSlate SignNow?

Absolutely! airSlate SignNow offers tracking features that allow you to monitor the status of your form 9465 in real-time. You'll receive notifications when the document is viewed and signed, ensuring you have peace of mind.

-

How can airSlate SignNow integrate with my existing systems for the form 9465?

airSlate SignNow easily integrates with popular tools and platforms, facilitating the streamlined submission of the form 9465. Whether you use accounting software or document management systems, airSlate SignNow ensures smooth compatibility.

-

What are the benefits of using airSlate SignNow for the form 9465 over traditional methods?

Using airSlate SignNow for the form 9465 saves time and resources compared to traditional paper methods. With electronic signatures and automated workflows, the entire process becomes faster, reducing the likelihood of errors or delays.

-

Is airSlate SignNow secure for signing sensitive documents like the form 9465?

Yes, airSlate SignNow employs advanced security measures to protect your sensitive information when signing the form 9465. With encryption and secure access protocols, you can trust that your documents are handled with care and confidentiality.

Get more for form 9465

- The effect of a consent order without a finding form

- 009 any estate dod on or after 11 with a will form

- Parent education coordinators invoice form

- Right to an attorney in an abuse or neglect case request for court appointed attorney or waiver of form

- Form small claim packet

- Application for waiver of fee form

- Form fa 4110e divorce joint petition with minor children

- Iep review checklist spedsbcsck12inus form

Find out other form 9465

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online