Irrevocable Trust Agreement for Benefit of Trustor's Children Form

What is the irrevocable trust agreement for benefit of trustor's children?

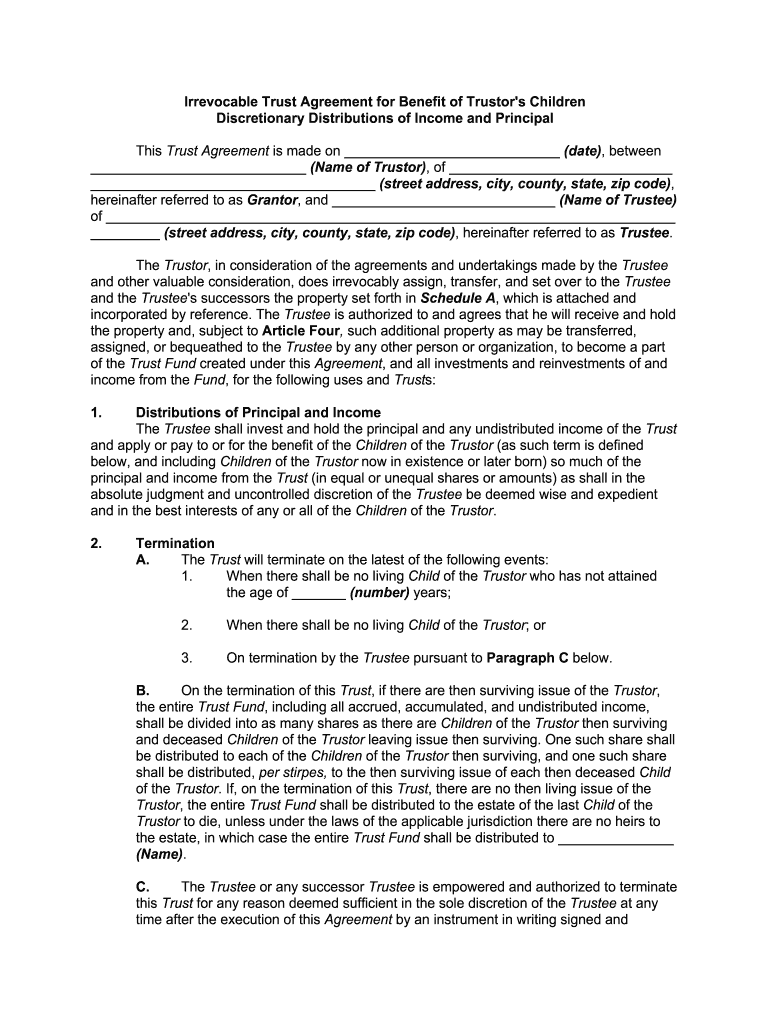

An irrevocable trust agreement for the benefit of the trustor's children is a legal document that establishes a trust where the trustor relinquishes control of their assets. This type of trust is designed to provide financial support and benefits to the trustor's children. Once the trust is created, the trustor cannot modify or revoke it, ensuring that the assets are protected and distributed according to the terms outlined in the agreement.

The primary purpose of this trust is to manage and distribute assets to the beneficiaries, which in this case are the trustor's children. The trust can include various types of assets, such as real estate, investments, or cash, and can specify how and when the children will receive these benefits. This arrangement can help in estate planning by reducing estate taxes and protecting assets from creditors.

Key elements of the irrevocable trust agreement for benefit of trustor's children

Several key elements are essential to consider when creating an irrevocable trust agreement for the benefit of the trustor's children:

- Trustor: The individual creating the trust, who relinquishes ownership of the assets.

- Trustee: The person or institution responsible for managing the trust assets and ensuring compliance with the trust's terms.

- Beneficiaries: The trustor's children who will receive the benefits from the trust.

- Assets: The property or financial resources placed into the trust, which can include cash, real estate, or investments.

- Distribution Terms: Specific guidelines on how and when the assets will be distributed to the beneficiaries.

- Duration: The time frame for which the trust will remain in effect, which can vary based on the trustor's wishes.

Steps to complete the irrevocable trust agreement for benefit of trustor's children

Completing an irrevocable trust agreement involves several steps to ensure it is legally binding and meets the trustor's intentions:

- Consult a legal professional: It is advisable to seek guidance from an attorney who specializes in estate planning to navigate the complexities of trust law.

- Determine the trust's purpose: Clearly define the goals of the trust, including the specific benefits for the trustor's children.

- Select a trustee: Choose a reliable individual or institution to manage the trust and its assets.

- Draft the trust agreement: Work with the attorney to create a detailed document outlining the terms, conditions, and distribution of assets.

- Sign the agreement: The trustor must sign the document in the presence of a notary public to ensure its validity.

- Fund the trust: Transfer the designated assets into the trust to activate it.

Legal use of the irrevocable trust agreement for benefit of trustor's children

The irrevocable trust agreement serves a crucial legal function in estate planning. Once established, it provides a framework for managing and distributing assets to the trustor's children, ensuring that the trustor's wishes are honored after their passing. This type of trust can help minimize estate taxes and protect assets from creditors, as the assets are no longer considered part of the trustor's estate.

Additionally, the trust can include specific provisions regarding the management of the assets, such as investment strategies or guidelines for distributions. This legal structure helps to provide clarity and security for both the trustor and the beneficiaries, making it a valuable tool in financial planning.

Examples of using the irrevocable trust agreement for benefit of trustor's children

There are various scenarios in which an irrevocable trust agreement can be beneficial for the trustor's children:

- Education Funding: The trust can be set up to provide funds for the children's education expenses, ensuring they have access to quality schooling.

- Healthcare Costs: The trust can allocate funds specifically for medical expenses, providing financial support for health-related needs.

- Asset Protection: By placing assets in an irrevocable trust, the trustor can protect those assets from potential creditors or legal claims.

- Long-Term Financial Support: The trust can be structured to provide ongoing financial support to the children throughout their lives, rather than a lump sum distribution at a specific age.

Quick guide on how to complete irrevocable trust agreement for benefit of trustors children

Effortlessly Prepare Irrevocable Trust Agreement For Benefit Of Trustor's Children on Any Device

Managing documents online has become increasingly favored by both enterprises and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed paperwork, as you can easily access the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Irrevocable Trust Agreement For Benefit Of Trustor's Children on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Irrevocable Trust Agreement For Benefit Of Trustor's Children with Ease

- Find Irrevocable Trust Agreement For Benefit Of Trustor's Children and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information, then click the Done button to save your changes.

- Choose how you want to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Irrevocable Trust Agreement For Benefit Of Trustor's Children and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irrevocable trust agreement for benefit of trustors children

How to make an eSignature for your Irrevocable Trust Agreement For Benefit Of Trustors Children online

How to create an electronic signature for your Irrevocable Trust Agreement For Benefit Of Trustors Children in Google Chrome

How to generate an electronic signature for signing the Irrevocable Trust Agreement For Benefit Of Trustors Children in Gmail

How to generate an electronic signature for the Irrevocable Trust Agreement For Benefit Of Trustors Children straight from your mobile device

How to generate an electronic signature for the Irrevocable Trust Agreement For Benefit Of Trustors Children on iOS devices

How to generate an electronic signature for the Irrevocable Trust Agreement For Benefit Of Trustors Children on Android OS

People also ask

-

What is an irrevocable trust principal?

The irrevocable trust principal refers to the assets that are placed into an irrevocable trust and cannot be altered or removed by the grantor. This means that once the irrevocable trust principal is established, it provides long-term security and benefits for the beneficiaries. Understanding this concept is crucial for effective estate planning.

-

How does an irrevocable trust principal benefit my estate planning?

An irrevocable trust principal can signNowly reduce estate taxes, as the assets are removed from your taxable estate. It also ensures that the assets are protected from creditors and cannot be claimed in legal actions against you. This form of trust is particularly advantageous for individuals seeking to preserve wealth for future generations.

-

Are there any fees associated with setting up an irrevocable trust principal?

Yes, establishing an irrevocable trust principal may involve legal fees for drafting the trust documents and additional costs for managing the trust. While these initial expenses can vary, the long-term benefits, like tax savings and asset protection, often outweigh these costs. It's best to consult with a legal professional to understand all associated fees.

-

Can I modify the terms of my irrevocable trust principal after it's created?

No, once an irrevocable trust principal is established, the terms cannot be modified or revoked by the grantor. This characteristic is what distinguishes it from a revocable trust, providing more assurance to the beneficiaries. It’s important to have a well-thought-out plan before creating an irrevocable trust.

-

What features should I look for in an irrevocable trust service?

When choosing an irrevocable trust service, consider features such as user-friendly document creation, secure e-signature capabilities, and compliance with legal standards. Additionally, look for services that offer robust customer support and resources for understanding how the irrevocable trust principal operates. These features can simplify the process of establishing your trust.

-

How does an irrevocable trust principal interact with other estate planning tools?

An irrevocable trust principal can complement other estate planning tools such as wills and life insurance policies. By working together, these tools can create a comprehensive strategy that addresses asset distribution, tax implications, and fiduciary responsibilities. It’s advisable to integrate all these elements for a harmonious estate plan.

-

Can an irrevocable trust principal be used for charitable giving?

Yes, an irrevocable trust principal can be structured to include charitable donations, providing tax benefits for the grantor. This can also ensure that a portion of your estate supports causes you care about while providing long-term benefits to beneficiaries. Charitable irrevocable trusts are a great way to combine philanthropy and effective estate planning.

Get more for Irrevocable Trust Agreement For Benefit Of Trustor's Children

Find out other Irrevocable Trust Agreement For Benefit Of Trustor's Children

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors