00, and Other Good Form

Understanding the satisfaction mortgage form

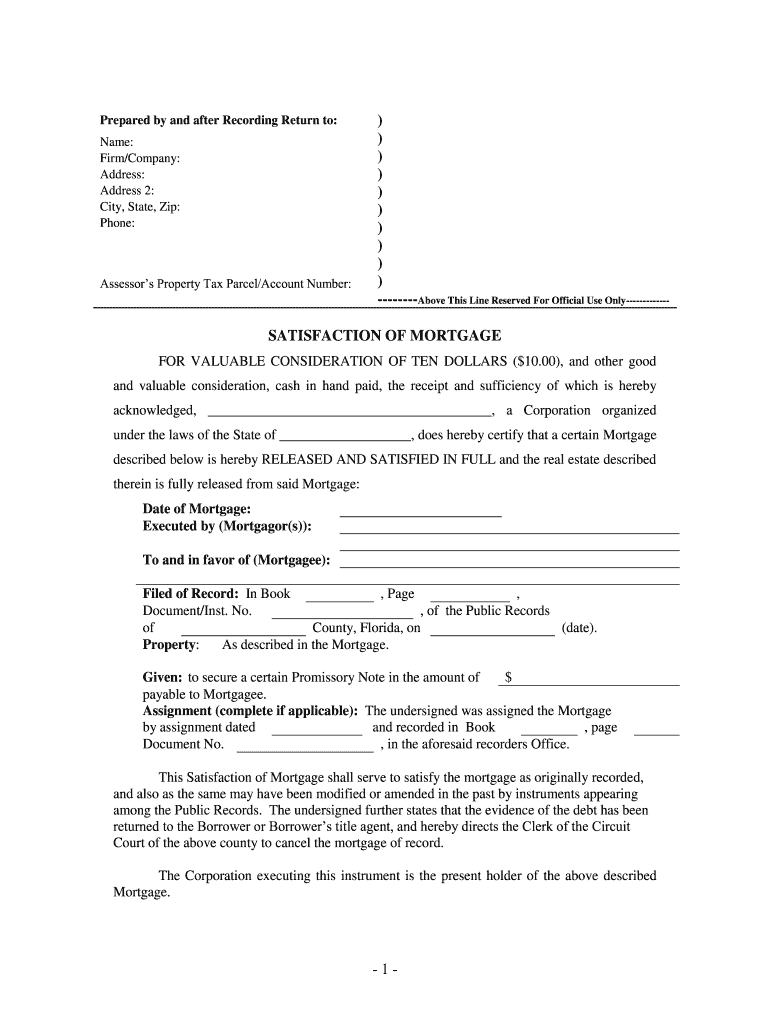

The satisfaction mortgage form is a crucial document used to indicate that a mortgage has been paid off in full. This form serves as a formal acknowledgment from the lender that the borrower has fulfilled their obligations under the mortgage agreement. Once completed, it releases the lien on the property, allowing the owner to have a clear title. This is particularly important in the United States, where the satisfaction of a mortgage must be recorded with the appropriate county office to ensure that the property records reflect the current status of the mortgage.

Steps to complete the satisfaction mortgage form

Completing the satisfaction mortgage form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the original mortgage details, borrower and lender information, and property description. Next, fill out the form carefully, ensuring that all fields are completed correctly. It is essential to have the lender sign the form to validate the satisfaction of the mortgage. After obtaining the necessary signatures, submit the form to the appropriate local government office for recording. This step is crucial for legal purposes, as it officially updates the property records.

Legal use of the satisfaction mortgage form

The satisfaction mortgage form is legally binding once it is signed by the lender and properly recorded. In the United States, this form must meet specific legal requirements to be enforceable. It is important to ensure that the form complies with state laws, as different states may have varying regulations regarding the satisfaction of mortgages. Recording the form with the county clerk or recorder's office is necessary to protect the homeowner's rights and provide evidence that the mortgage has been satisfied. Failure to properly file the form could result in complications regarding property ownership.

State-specific rules for the satisfaction mortgage form

Each state in the U.S. may have unique rules and regulations governing the satisfaction mortgage form. For instance, some states may require additional documentation or specific wording on the form. In Florida, for example, the satisfaction mortgage must be executed in a particular format and may require notarization. It is essential for borrowers and lenders to familiarize themselves with their state's requirements to ensure compliance and avoid potential legal issues. Consulting with a local real estate attorney can provide valuable guidance on state-specific rules.

Required documents for the satisfaction mortgage form

To complete the satisfaction mortgage form, several documents may be required. These typically include the original mortgage agreement, proof of payment, and any correspondence between the borrower and lender regarding the mortgage. Additionally, identification documents may be necessary to verify the identities of the parties involved. Having these documents ready can streamline the process and help avoid delays in recording the satisfaction of the mortgage.

Examples of using the satisfaction mortgage form

There are various scenarios in which the satisfaction mortgage form is utilized. For instance, when a homeowner pays off their mortgage after years of regular payments, they will need to file this form to clear the lien on their property. Another example is when a homeowner refinances their mortgage; the satisfaction mortgage form is often required to release the original lender's claim on the property. These examples highlight the importance of this form in maintaining clear and accurate property records.

Quick guide on how to complete 00 and other good

Prepare 00, And Other Good seamlessly on any gadget

Online document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the features you require to create, edit, and eSign your documents swiftly without delays. Manage 00, And Other Good on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to edit and eSign 00, And Other Good with ease

- Obtain 00, And Other Good and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically supplies for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you prefer to send your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign 00, And Other Good and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 00 and other good

How to generate an eSignature for your 00 And Other Good in the online mode

How to make an eSignature for the 00 And Other Good in Google Chrome

How to create an electronic signature for signing the 00 And Other Good in Gmail

How to make an electronic signature for the 00 And Other Good straight from your smart phone

How to create an electronic signature for the 00 And Other Good on iOS devices

How to create an electronic signature for the 00 And Other Good on Android

People also ask

-

What is a satisfaction mortgage form?

A satisfaction mortgage form is a legal document that confirms the repayment of a mortgage loan. This form is essential for releasing the lien on a property, ensuring that all parties recognize the mortgage has been paid off. With airSlate SignNow, you can easily create and manage your satisfaction mortgage forms electronically.

-

How can airSlate SignNow help with my satisfaction mortgage form?

airSlate SignNow simplifies the process of creating and sending a satisfaction mortgage form. Our platform allows you to eSign documents quickly, securely, and efficiently, saving you time and ensuring accuracy. You can easily customize the form to meet your specific needs.

-

Are there any costs associated with using airSlate SignNow to manage my satisfaction mortgage form?

Yes, airSlate SignNow offers competitively priced plans tailored for businesses. These plans include access to features that enhance the management of documents, such as the satisfaction mortgage form. You can choose a subscription that best fits your budget and usage requirements.

-

What features does airSlate SignNow provide for processing satisfaction mortgage forms?

airSlate SignNow provides features like templates, cloud storage, and automated workflows to streamline the processing of satisfaction mortgage forms. Its intuitive interface allows users to customize forms easily and track the signing process in real-time. All features are designed to enhance efficiency and compliance.

-

Can I integrate airSlate SignNow with other software for satisfaction mortgage forms?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, including CRM systems and document management tools. This allows you to enhance your workflow management while handling satisfaction mortgage forms, making it easier to maintain all your records in one central location.

-

What are the benefits of using airSlate SignNow for satisfaction mortgage forms?

Using airSlate SignNow for your satisfaction mortgage forms ensures a faster, more secure process for document management. The platform enhances collaboration, reduces the risk of human error, and increases overall efficiency. You can also access your documents anytime, anywhere, which provides added convenience.

-

Is it secure to use airSlate SignNow for my satisfaction mortgage form?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your satisfaction mortgage forms and other documents. Additionally, we comply with industry regulations to ensure that your data is safe and confidential.

Get more for 00, And Other Good

Find out other 00, And Other Good

- Sign Alabama Banking Quitclaim Deed Computer

- Sign Alabama Banking Quitclaim Deed Now

- How Can I Sign Arkansas Banking Moving Checklist

- Sign California Banking Claim Online

- Sign Arkansas Banking Affidavit Of Heirship Safe

- How To Sign Arkansas Banking Forbearance Agreement

- Sign Arizona Banking Permission Slip Easy

- Can I Sign California Banking Lease Agreement Template

- How Do I Sign Colorado Banking Credit Memo

- Help Me With Sign Colorado Banking Credit Memo

- How Can I Sign Colorado Banking Credit Memo

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself