State of Utah, Hereinafter Referred to as the Trustor, Whether One or More, and Form

Understanding the State of Utah, Hereinafter Referred to as the Trustor

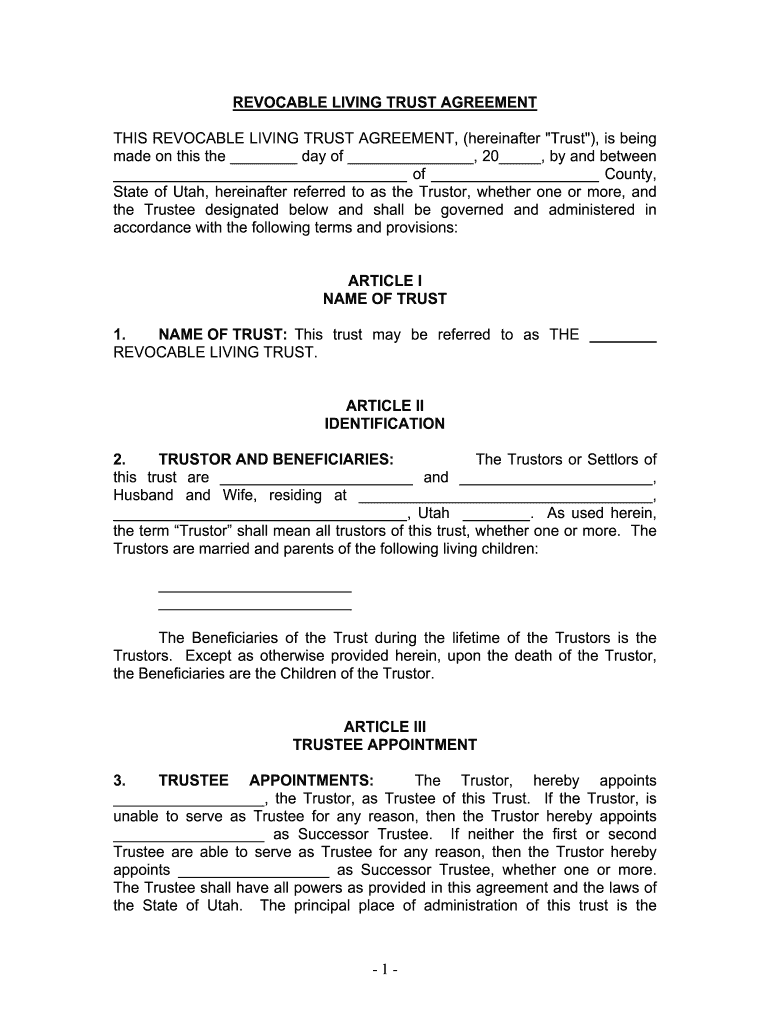

The State of Utah, hereinafter referred to as the trustor, serves as a legal entity in various agreements and contracts. This designation is crucial in establishing the roles and responsibilities of parties involved in a legal transaction. The trustor is typically the individual or entity that creates a trust, transferring assets into it for the benefit of another party, known as the beneficiary. In Utah, the trustor must comply with state-specific regulations to ensure that the trust is valid and enforceable.

Steps to Complete the State of Utah, Hereinafter Referred to as the Trustor

Completing the form for the State of Utah, hereinafter referred to as the trustor, involves several important steps. First, gather all necessary information, such as the names and addresses of the trustor and beneficiaries. Next, clearly outline the terms of the trust, including the assets involved and any specific instructions regarding their management. After drafting the trust document, ensure that it is signed by the trustor and notarized, as required by Utah law. Finally, file the trust document with the appropriate state authorities if necessary, depending on the nature of the trust.

Legal Use of the State of Utah, Hereinafter Referred to as the Trustor

The legal use of the State of Utah, hereinafter referred to as the trustor, is essential for establishing binding agreements. Trust documents must adhere to the laws governing trusts in Utah, which include provisions for the management and distribution of assets. Properly executed trusts can help in estate planning, asset protection, and ensuring that beneficiaries receive their intended inheritance. It is vital to consult legal professionals to navigate the complexities of trust law and ensure compliance with all relevant regulations.

Key Elements of the State of Utah, Hereinafter Referred to as the Trustor

Key elements that define the State of Utah, hereinafter referred to as the trustor, include the identification of the trustor, the beneficiaries, and the assets involved. Additionally, the trust document should specify the powers and duties of the trustee, who will manage the trust. It is also important to include any specific conditions or instructions that the trustor wishes to impose on the management or distribution of the trust assets. These elements are crucial for the trust's validity and effectiveness in achieving the trustor's objectives.

State-Specific Rules for the State of Utah, Hereinafter Referred to as the Trustor

State-specific rules for the State of Utah, hereinafter referred to as the trustor, govern the creation and administration of trusts. Utah law requires that trusts be executed in writing and signed by the trustor. Additionally, certain types of trusts may have specific requirements regarding their formation and management. It is essential for trustors to familiarize themselves with these rules to ensure that their trusts comply with state regulations, thus preventing potential legal disputes or challenges.

Examples of Using the State of Utah, Hereinafter Referred to as the Trustor

Examples of using the State of Utah, hereinafter referred to as the trustor, can be found in various contexts, such as estate planning and charitable giving. For instance, a trustor may establish a revocable living trust to manage their assets during their lifetime and facilitate the transfer of those assets to beneficiaries after their death. Another example is a charitable remainder trust, where the trustor donates assets to a charity while retaining the right to income from those assets during their lifetime. These examples illustrate the versatility and utility of trusts in achieving diverse financial and personal goals.

Quick guide on how to complete state of utah hereinafter referred to as the trustor whether one or more and

Effortlessly Prepare State Of Utah, Hereinafter Referred To As The Trustor, Whether One Or More, And on Any Device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, adjust, and eSign your documents swiftly without any holdups. Manage State Of Utah, Hereinafter Referred To As The Trustor, Whether One Or More, And on any device using airSlate SignNow's Android or iOS applications, and enhance your document-related processes today.

The Optimal Method to Adjust and eSign State Of Utah, Hereinafter Referred To As The Trustor, Whether One Or More, And with Ease

- Obtain State Of Utah, Hereinafter Referred To As The Trustor, Whether One Or More, And and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tiring form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Adjust and eSign State Of Utah, Hereinafter Referred To As The Trustor, Whether One Or More, And to guarantee outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of utah hereinafter referred to as the trustor whether one or more and

How to create an electronic signature for the State Of Utah Hereinafter Referred To As The Trustor Whether One Or More And online

How to make an electronic signature for the State Of Utah Hereinafter Referred To As The Trustor Whether One Or More And in Google Chrome

How to create an electronic signature for putting it on the State Of Utah Hereinafter Referred To As The Trustor Whether One Or More And in Gmail

How to create an eSignature for the State Of Utah Hereinafter Referred To As The Trustor Whether One Or More And from your smart phone

How to generate an electronic signature for the State Of Utah Hereinafter Referred To As The Trustor Whether One Or More And on iOS devices

How to generate an electronic signature for the State Of Utah Hereinafter Referred To As The Trustor Whether One Or More And on Android devices

People also ask

-

What is airSlate SignNow and how can it benefit my business hereinafter?

AirSlate SignNow is an electronic signature solution that empowers businesses to streamline their document signing processes. By using this platform, you can save time, reduce paperwork, and ensure compliance. Hereinafter, your team can focus more on core activities and less on administrative tasks.

-

What pricing plans does airSlate SignNow offer hereinafter?

AirSlate SignNow offers various pricing plans tailored to meet diverse business needs. These plans are designed to be cost-effective hereinafter, ensuring you find a suitable option for your budget and requirements. You can choose from monthly or annual subscriptions, with discounts available for longer-term commitments.

-

Is airSlate SignNow user-friendly for beginners hereinafter?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it incredibly user-friendly hereinafter. Even those with minimal technical skills can navigate the platform easily, enabling quick adoption by your team without extensive training.

-

What features does airSlate SignNow include hereinafter?

AirSlate SignNow includes a robust set of features such as customizable templates, mobile access, and real-time tracking. These features work seamlessly together hereinafter to enhance productivity and ensure that your document workflows remain efficient and organized.

-

How does airSlate SignNow ensure document security hereinafter?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption technology and complies with legal regulations to protect your documents hereinafter. This commitment to security ensures that your sensitive information remains confidential and safe from unauthorized access.

-

Can airSlate SignNow integrate with other software hereinafter?

Yes, airSlate SignNow offers several integrations with commonly used software applications like CRMs and cloud storage services. These integrations make it easy to incorporate eSigning into your existing workflows hereinafter, enhancing productivity and collaboration across platforms.

-

What types of documents can I sign using airSlate SignNow hereinafter?

You can sign a variety of documents using airSlate SignNow, including contracts, agreements, and consent forms. The platform supports many popular file formats hereinafter, making it versatile enough to meet the diverse needs of your business.

Get more for State Of Utah, Hereinafter Referred To As The Trustor, Whether One Or More, And

- 5006 declaration re notice upon ex parte application for orders solano courts ca form

- Petition dss 158 form

- Synnex corporation multijurisdiction resale certificate 07 01 13pdf form

- Application to rent the rental girl form

- Hcd 476 6g 2015 form

- Mv 47 form

- Scope of work construction management cdot form

- Power control wheel form

Find out other State Of Utah, Hereinafter Referred To As The Trustor, Whether One Or More, And

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe