More, and the Trustee Designated below and Shall Be Governed and Administered Form

Understanding the Role of the Trustee in a Living Trust

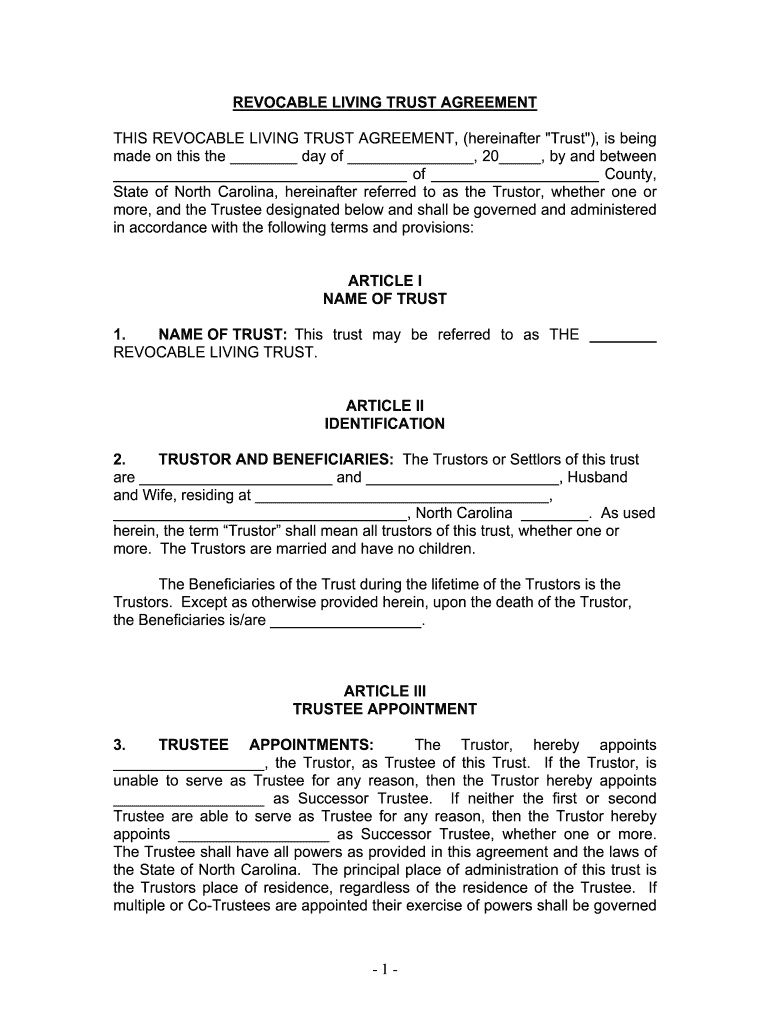

A trustee plays a crucial role in managing a living trust. This individual or entity is responsible for administering the trust according to its terms and ensuring that the assets are distributed as intended. The trustee must act in the best interests of the beneficiaries, which can include family members or other designated individuals. In North Carolina, the trustee must adhere to state laws governing trusts, ensuring compliance with both legal and fiduciary responsibilities.

When selecting a trustee, consider factors such as trustworthiness, financial acumen, and willingness to serve. You can designate a family member, friend, or professional trustee, such as a bank or trust company. The choice of trustee can significantly impact the management and distribution of the trust assets.

Steps to Create a North Carolina Living Trust

Creating a living trust in North Carolina involves several key steps to ensure it is legally valid and meets your needs. Here’s a simplified process:

- Determine Your Goals: Identify what you want to achieve with the trust, such as avoiding probate or managing assets during your lifetime.

- Choose Your Assets: Decide which assets to place in the trust, including real estate, bank accounts, and investments.

- Select a Trustee: Choose a reliable trustee who will manage the trust according to your wishes.

- Draft the Trust Document: Create a legal document that outlines the terms of the trust, including how assets will be managed and distributed.

- Fund the Trust: Transfer ownership of the selected assets into the trust to ensure they are managed according to your instructions.

- Review and Update: Regularly review the trust to ensure it reflects your current wishes and circumstances.

Legal Considerations for a Living Trust in North Carolina

When establishing a living trust in North Carolina, it is essential to understand the legal framework that governs trusts. North Carolina law requires that a living trust must be in writing and signed by the grantor. Additionally, the trust must be funded with assets to be effective.

It is important to note that while a living trust can help avoid probate, it does not provide protection from creditors or taxes. Consulting with a legal professional familiar with North Carolina trust laws can help you navigate these complexities and ensure compliance with all legal requirements.

Benefits of Using a Living Trust

A living trust offers several advantages for individuals looking to manage their assets effectively. Some key benefits include:

- Avoiding Probate: Assets in a living trust do not go through probate, allowing for quicker distribution to beneficiaries.

- Privacy: Unlike a will, a living trust is not a public document, keeping your financial affairs private.

- Flexibility: As the grantor, you can modify or revoke the trust at any time during your lifetime.

- Management During Incapacity: A living trust allows for the management of your assets if you become incapacitated, ensuring your wishes are followed.

Printable Living Trust Forms in North Carolina

For those looking to create a living trust, printable living trust forms are readily available. These forms can simplify the process of establishing a trust, providing a structured format for your information and intentions. However, it is advisable to ensure that any form used complies with North Carolina laws and adequately reflects your specific needs.

While using printable forms can be convenient, consider consulting with a legal professional to review the completed documents. This ensures that all legal requirements are met and that your trust functions as intended.

Quick guide on how to complete more and the trustee designated below and shall be governed and administered

Complete More, And The Trustee Designated Below And Shall Be Governed And Administered effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle More, And The Trustee Designated Below And Shall Be Governed And Administered on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign More, And The Trustee Designated Below And Shall Be Governed And Administered with ease

- Find More, And The Trustee Designated Below And Shall Be Governed And Administered and click Get Form to initiate.

- Use the tools available to fill out your document.

- Mark pertinent sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Decide how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign More, And The Trustee Designated Below And Shall Be Governed And Administered while ensuring seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the more and the trustee designated below and shall be governed and administered

How to make an electronic signature for your More And The Trustee Designated Below And Shall Be Governed And Administered in the online mode

How to make an eSignature for the More And The Trustee Designated Below And Shall Be Governed And Administered in Google Chrome

How to make an eSignature for signing the More And The Trustee Designated Below And Shall Be Governed And Administered in Gmail

How to create an electronic signature for the More And The Trustee Designated Below And Shall Be Governed And Administered right from your smart phone

How to generate an eSignature for the More And The Trustee Designated Below And Shall Be Governed And Administered on iOS

How to make an eSignature for the More And The Trustee Designated Below And Shall Be Governed And Administered on Android OS

People also ask

-

What is an NC living trust?

An NC living trust is a legal document that allows individuals to place their assets into a trust during their lifetime, which can then be managed by a trustee for the benefit of the trust's beneficiaries. By using an NC living trust, you can avoid probate, ensure privacy, and provide clear instructions for asset distribution.

-

How does airSlate SignNow facilitate the creation of an NC living trust?

With airSlate SignNow, you can easily create, edit, and eSign NC living trust documents online. The platform offers user-friendly templates and collaboration tools, making it simple for you to customize your living trust according to North Carolina laws.

-

What are the benefits of using an NC living trust?

An NC living trust provides numerous benefits, including avoiding lengthy probate processes, maintaining privacy regarding your estate, and allowing for seamless management of your assets during incapacity. Additionally, it can streamline the transfer of assets after your passing.

-

What features does airSlate SignNow offer for NC living trust documents?

airSlate SignNow offers several features for NC living trust documents, including customizable templates, secure eSigning, document sharing, and a robust audit trail for tracking changes. These features ensure that your living trust is created accurately and securely.

-

How much does it cost to use airSlate SignNow for creating an NC living trust?

airSlate SignNow offers competitive pricing that varies based on your subscription plan. You can start with a free trial to explore features for drafting your NC living trust, after which affordable monthly plans provide excellent value for frequent users.

-

Can I integrate airSlate SignNow with other applications for managing my NC living trust?

Yes, airSlate SignNow seamlessly integrates with various applications and services to enhance your workflow. You can connect it with cloud storage, CRM systems, and other tools, facilitating efficient management of your NC living trust and other important documents.

-

Is it easy to modify an NC living trust using airSlate SignNow?

Absolutely! Modifying your NC living trust with airSlate SignNow is a straightforward process. The platform allows you to make edits easily to your existing documents, ensuring that any updates or changes to your trust can be done quickly and efficiently.

Get more for More, And The Trustee Designated Below And Shall Be Governed And Administered

- Oversized overweight permit application form 850 040 02 revised june 2016

- Ic disc commission agreement form

- Motor vehicle representative exam study guide form

- Ohp renewal part 1 oregon form

- Please read uscnjphaorg form

- Annual return uscnjphaorg form

- Form b11 amp39generalamp39 declaration by passport applicant australian

- Blank fillable car title form

Find out other More, And The Trustee Designated Below And Shall Be Governed And Administered

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors