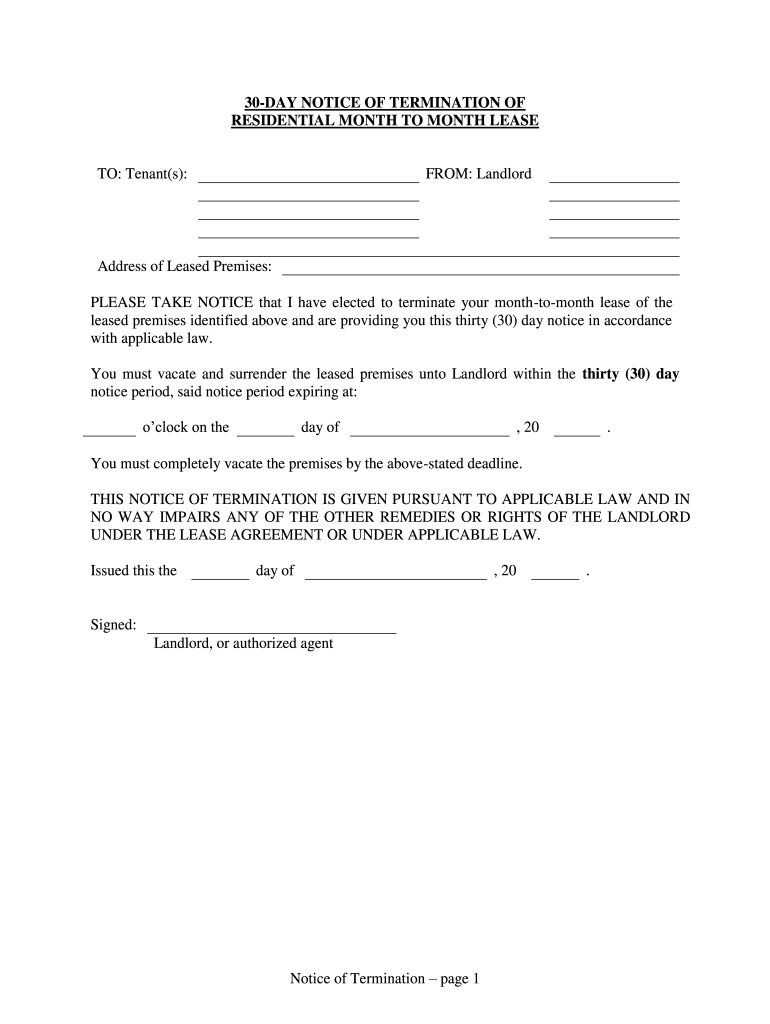

To Tenants Form

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C form, which is essential for self-employed individuals reporting income or loss from a business. Understanding these guidelines helps ensure compliance and accuracy in tax reporting. The IRS outlines the necessary information required, including gross receipts, expenses, and net profit or loss. Familiarizing yourself with these guidelines can aid in preparing a thorough and correct filing.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline for filing your Schedule C is typically April 15 of the following year. However, if you are unable to meet this deadline, you may file for an extension, which grants an additional six months. It is crucial to note that while an extension allows more time to file, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

When preparing to fill out the Schedule C, gather all necessary documents to ensure a smooth process. Required documents include records of all income received, receipts for business expenses, and any relevant financial statements. Keeping organized records helps substantiate your claims and simplifies the completion of the form.

Steps to Complete the Schedule C

Completing the Schedule C involves several key steps. Start by entering your business information, including the name and address. Next, report your income by listing all gross receipts. After that, detail your expenses, categorizing them appropriately. Finally, calculate your net profit or loss by subtracting total expenses from total income. Review your entries for accuracy before submission.

Digital vs. Paper Version

Choosing between a digital or paper version of the Schedule C can impact your filing experience. The digital version allows for easier calculations and automatic error checking, while the paper version requires manual entry and calculations. Many taxpayers find that using digital tools streamlines the process, particularly when combined with eSignature solutions for submitting forms securely.

Taxpayer Scenarios

Different taxpayer scenarios can affect how Schedule C is completed. For instance, self-employed individuals may have various deductions available that differ from those of a traditional employee. Understanding your specific situation, such as whether you operate as a sole proprietor, LLC, or partnership, can influence the information you report and the deductions you claim.

Penalties for Non-Compliance

Failing to comply with IRS requirements when filing Schedule C can result in penalties. Common penalties include late filing fees, underpayment penalties, and interest on unpaid taxes. It is essential to ensure that all information is accurate and submitted on time to avoid these financial repercussions. Familiarity with compliance requirements can help mitigate risks associated with tax filing.

Quick guide on how to complete to tenants

Prepare TO Tenants effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without delays. Manage TO Tenants across any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to edit and eSign TO Tenants with ease

- Locate TO Tenants and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of the documents or redact sensitive details using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign TO Tenants and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the to tenants

How to make an electronic signature for your To Tenants online

How to create an eSignature for the To Tenants in Chrome

How to generate an electronic signature for putting it on the To Tenants in Gmail

How to generate an electronic signature for the To Tenants from your smartphone

How to make an eSignature for the To Tenants on iOS devices

How to create an electronic signature for the To Tenants on Android

People also ask

-

What is the irs gov schedule c 2019 and how can airSlate SignNow help?

The irs gov schedule c 2019 is a tax form that self-employed individuals use to report income and expenses. airSlate SignNow simplifies this process by allowing users to easily send and eSign documents related to their Schedule C filings, ensuring compliance and accuracy in their submissions.

-

How does airSlate SignNow ensure compliance with the irs gov schedule c 2019?

airSlate SignNow follows strict security measures and legal guidelines to ensure that all eSigned documents are compliant with the requirements of the irs gov schedule c 2019. Our platform provides legally binding signatures, which can help you avoid potential tax issues.

-

What features does airSlate SignNow offer for managing documents related to the irs gov schedule c 2019?

airSlate SignNow offers a range of features including document templates, automated workflows, and secure storage, which enables users to manage their filings for the irs gov schedule c 2019 efficiently. With these tools, you can streamline your document preparation and keep track of important deadlines.

-

Is airSlate SignNow affordable for small business owners preparing the irs gov schedule c 2019?

Yes, airSlate SignNow provides a cost-effective solution that is perfect for small business owners. Our pricing plans are designed to accommodate startups and individual entrepreneurs, ensuring they have the right tools to manage their tax forms, including the irs gov schedule c 2019.

-

Can I integrate airSlate SignNow with other applications for my irs gov schedule c 2019?

Absolutely! airSlate SignNow supports numerous integrations with popular accounting and tax software, streamlining the process for filling out your irs gov schedule c 2019. This means you can easily transfer data and ensure accuracy in your financial documents.

-

What are the benefits of using airSlate SignNow for the irs gov schedule c 2019?

By using airSlate SignNow, you gain access to a user-friendly interface that makes eSigning and document management easy and efficient. This not only saves you time but also minimizes errors when preparing your irs gov schedule c 2019, allowing you to focus more on your business.

-

Is it easy to eSign documents related to the irs gov schedule c 2019 with airSlate SignNow?

Yes, eSigning documents with airSlate SignNow is quick and straightforward. Users can simply upload their files, add necessary fields for signatures, and send them out for eSignature—all while staying compliant with irs gov schedule c 2019 requirements.

Get more for TO Tenants

- Cf 6r env 01 form

- Prescription records online form

- Drec property disclosure final effective 12 1 13 delaware form

- Rental lease agreement texas pdf filler form

- Byron katie worksheet form

- 275 021 08 form

- Rubric for food science lab experiments hospitality and tourism cte sfasu form

- Health care proxy appointing your health care agen form

Find out other TO Tenants

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple