Irrevocable Trust Which is a Qualifying Subchapter S Trust Form

What is the irrevocable trust which is a qualifying subchapter S trust

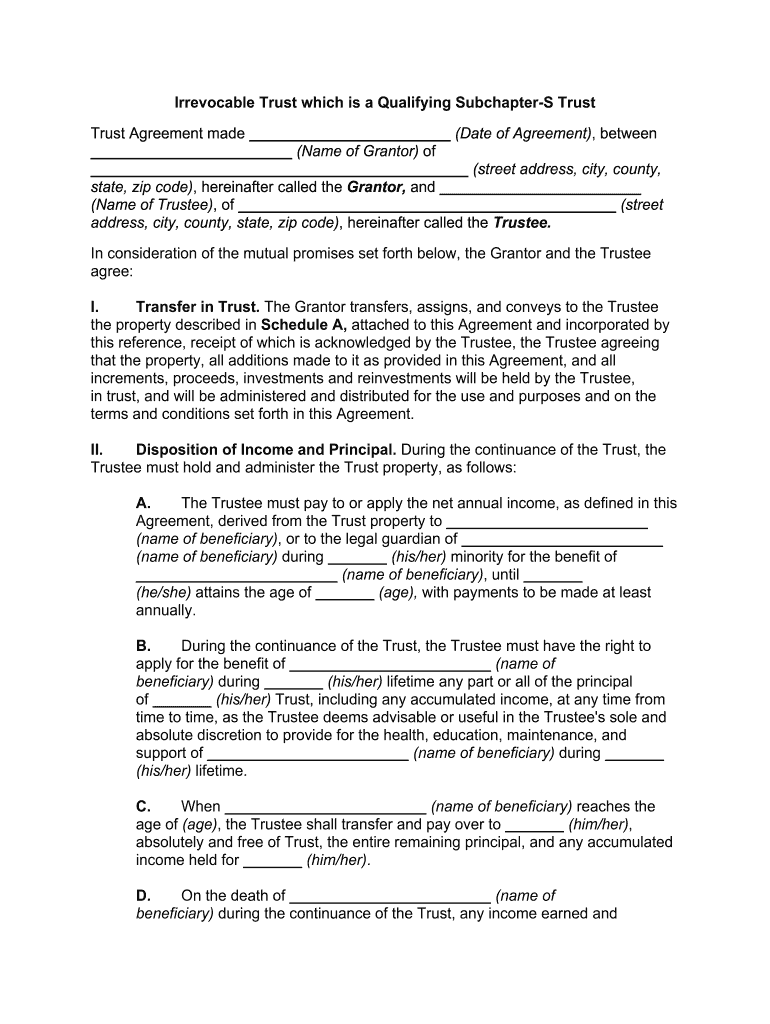

The irrevocable trust which qualifies as a subchapter S trust is a specific type of trust designed to meet the requirements set forth by the Internal Revenue Service (IRS). This trust allows income generated by the trust assets to be passed through to the beneficiaries without being subject to federal income tax at the trust level. The primary characteristic of this trust is that once established, the grantor cannot modify or revoke it, ensuring that the assets are managed according to the trust's terms. This structure is particularly beneficial for estate planning, as it can help reduce estate taxes and provide a clear framework for the distribution of assets.

Key elements of the irrevocable trust which is a qualifying subchapter S trust

Several key elements define the irrevocable trust which qualifies as a subchapter S trust. Firstly, it must have one or more beneficiaries who are individuals, estates, or certain types of charities. Secondly, the trust must be irrevocable, meaning that the grantor cannot alter or dissolve it once it is established. Additionally, the trust must meet specific IRS requirements, such as having a valid taxpayer identification number and adhering to the distribution rules set forth for subchapter S corporations. Lastly, the trust must be structured to ensure that it does not exceed the allowable number of shareholders as defined by the IRS.

Steps to complete the irrevocable trust which is a qualifying subchapter S trust

Completing the irrevocable trust which qualifies as a subchapter S trust involves several important steps. First, the grantor should consult with a legal or financial advisor to ensure compliance with IRS regulations. Next, the trust document must be drafted, clearly outlining the terms, beneficiaries, and trustee responsibilities. After the document is prepared, it must be signed and notarized to ensure its legal validity. The grantor should then fund the trust by transferring assets into it, which may include cash, real estate, or other investments. Finally, it is essential to apply for a taxpayer identification number for the trust and file any necessary IRS forms to establish its subchapter S status.

IRS guidelines for the irrevocable trust which is a qualifying subchapter S trust

The IRS provides specific guidelines that govern the formation and operation of an irrevocable trust which qualifies as a subchapter S trust. These guidelines include requirements for the trust's structure, such as having only eligible shareholders and ensuring that the trust does not engage in prohibited transactions. Additionally, the trust must adhere to distribution rules, which dictate how income and gains are allocated to beneficiaries. It is crucial for trustees to maintain accurate records and file annual tax returns, reporting the trust's income and distributions in compliance with IRS regulations. Failure to adhere to these guidelines may result in penalties or loss of subchapter S status.

Required documents for the irrevocable trust which is a qualifying subchapter S trust

Establishing an irrevocable trust which qualifies as a subchapter S trust requires several key documents. The primary document is the trust agreement, which outlines the terms and conditions of the trust. Additionally, the grantor must obtain a taxpayer identification number from the IRS, which is necessary for tax reporting purposes. If the trust holds real estate or other significant assets, documentation proving the transfer of these assets into the trust is also required. Furthermore, any relevant IRS forms must be completed and submitted to ensure compliance with federal regulations.

Eligibility criteria for the irrevocable trust which is a qualifying subchapter S trust

To establish an irrevocable trust which qualifies as a subchapter S trust, certain eligibility criteria must be met. The trust must have only eligible beneficiaries, which typically include individuals or certain types of estates and charities. Additionally, the trust cannot have more than one hundred shareholders, and all shareholders must be U.S. citizens or residents. The trust must also be irrevocable, meaning that the grantor cannot change its terms after establishment. Lastly, the trust must comply with all IRS regulations regarding income distribution and tax reporting to maintain its subchapter S status.

Quick guide on how to complete irrevocable trust which is a qualifying subchapter s trust

Effortlessly Prepare Irrevocable Trust Which Is A Qualifying Subchapter S Trust on Any Device

Managing documents online has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely save it on the internet. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Handle Irrevocable Trust Which Is A Qualifying Subchapter S Trust on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

The Easiest Way to Edit and Electronically Sign Irrevocable Trust Which Is A Qualifying Subchapter S Trust Effortlessly

- Locate Irrevocable Trust Which Is A Qualifying Subchapter S Trust and select Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet-ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Irrevocable Trust Which Is A Qualifying Subchapter S Trust to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irrevocable trust which is a qualifying subchapter s trust

How to create an electronic signature for the Irrevocable Trust Which Is A Qualifying Subchapter S Trust in the online mode

How to create an eSignature for your Irrevocable Trust Which Is A Qualifying Subchapter S Trust in Chrome

How to create an electronic signature for putting it on the Irrevocable Trust Which Is A Qualifying Subchapter S Trust in Gmail

How to make an electronic signature for the Irrevocable Trust Which Is A Qualifying Subchapter S Trust straight from your smart phone

How to create an eSignature for the Irrevocable Trust Which Is A Qualifying Subchapter S Trust on iOS

How to make an eSignature for the Irrevocable Trust Which Is A Qualifying Subchapter S Trust on Android devices

People also ask

-

What is an Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

An Irrevocable Trust Which Is A Qualifying Subchapter S Trust is a specific type of irrevocable trust that meets IRS requirements to allow its income to be taxed to the beneficiaries, rather than the trust itself. This setup can provide tax benefits while ensuring that the assets are protected from creditors. Understanding this structure is crucial for effective estate planning.

-

How can airSlate SignNow assist with managing an Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

airSlate SignNow offers a streamlined solution for managing documents related to an Irrevocable Trust Which Is A Qualifying Subchapter S Trust. With our platform, you can easily create, send, and eSign trust documents securely and efficiently, ensuring compliance and peace of mind for all parties involved.

-

What are the benefits of using airSlate SignNow for my Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

Using airSlate SignNow for your Irrevocable Trust Which Is A Qualifying Subchapter S Trust provides numerous benefits, including enhanced security, convenience, and time savings. Our platform allows you to track document status in real-time, ensuring that all signatures are obtained promptly and securely.

-

Is there a cost associated with using airSlate SignNow for my Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of individuals and businesses managing an Irrevocable Trust Which Is A Qualifying Subchapter S Trust. Our plans are designed to be cost-effective, providing excellent value for the features and support we offer.

-

Can I integrate airSlate SignNow with other tools for managing my Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

Absolutely! airSlate SignNow seamlessly integrates with various productivity tools and software, making it easy to manage your Irrevocable Trust Which Is A Qualifying Subchapter S Trust alongside your other business applications. This integration simplifies workflows and enhances efficiency.

-

What types of documents can I manage with airSlate SignNow for my Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

With airSlate SignNow, you can manage a wide range of documents related to your Irrevocable Trust Which Is A Qualifying Subchapter S Trust, including trust agreements, amendments, and beneficiary designations. Our platform supports various document formats, ensuring flexibility and ease of use.

-

How secure is airSlate SignNow for handling my Irrevocable Trust Which Is A Qualifying Subchapter S Trust documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect all documents related to your Irrevocable Trust Which Is A Qualifying Subchapter S Trust, ensuring that sensitive information remains confidential and secure.

Get more for Irrevocable Trust Which Is A Qualifying Subchapter S Trust

- Business privilege greater philadelphia film office film form

- Irs publication 179 circular pr gua contributiva federal form

- Form 1040 sp u s individual income tax return spanish version

- Irs official site forms

- Form 8379 injured spouse filed after return e filed

- Intent to return form

- Basketball line up sheet team form

- Invitation letter for china tourist visa omnivisa com form

Find out other Irrevocable Trust Which Is A Qualifying Subchapter S Trust

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple