Irrevocable Trust Which is a Qualifying Subchapter S Trust Form

What is the irrevocable trust which is a qualifying subchapter S trust

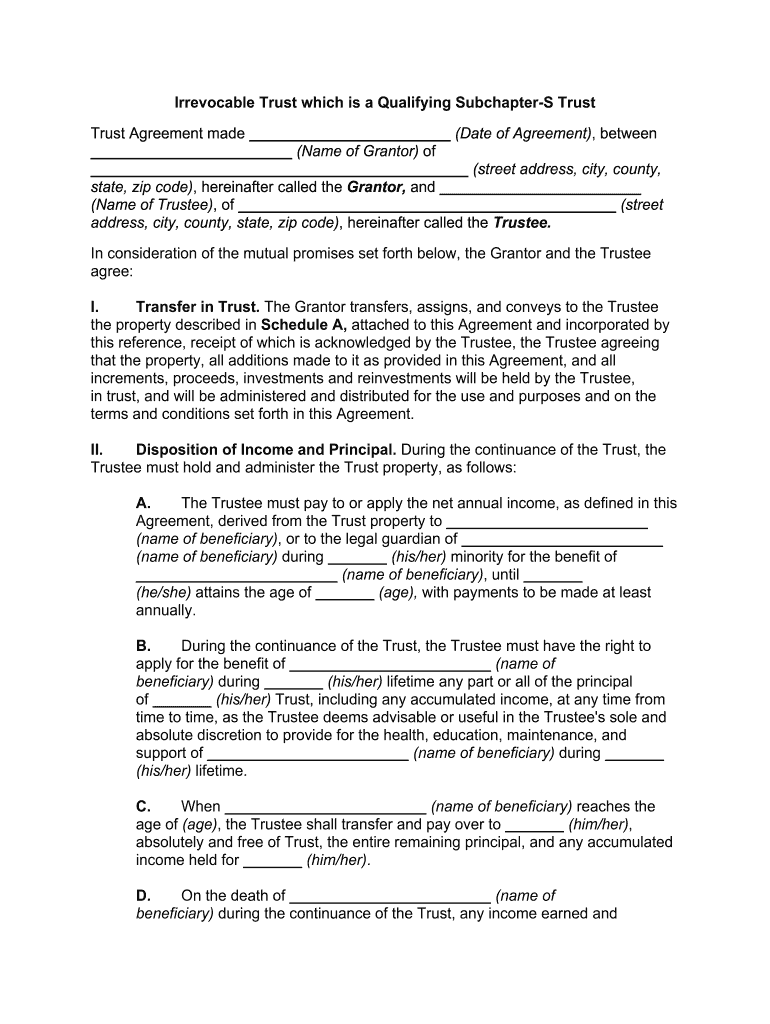

The irrevocable trust which qualifies as a subchapter S trust is a specific type of trust designed to meet the requirements set forth by the Internal Revenue Service (IRS). This trust allows income generated by the trust assets to be passed through to the beneficiaries without being subject to federal income tax at the trust level. The primary characteristic of this trust is that once established, the grantor cannot modify or revoke it, ensuring that the assets are managed according to the trust's terms. This structure is particularly beneficial for estate planning, as it can help reduce estate taxes and provide a clear framework for the distribution of assets.

Key elements of the irrevocable trust which is a qualifying subchapter S trust

Several key elements define the irrevocable trust which qualifies as a subchapter S trust. Firstly, it must have one or more beneficiaries who are individuals, estates, or certain types of charities. Secondly, the trust must be irrevocable, meaning that the grantor cannot alter or dissolve it once it is established. Additionally, the trust must meet specific IRS requirements, such as having a valid taxpayer identification number and adhering to the distribution rules set forth for subchapter S corporations. Lastly, the trust must be structured to ensure that it does not exceed the allowable number of shareholders as defined by the IRS.

Steps to complete the irrevocable trust which is a qualifying subchapter S trust

Completing the irrevocable trust which qualifies as a subchapter S trust involves several important steps. First, the grantor should consult with a legal or financial advisor to ensure compliance with IRS regulations. Next, the trust document must be drafted, clearly outlining the terms, beneficiaries, and trustee responsibilities. After the document is prepared, it must be signed and notarized to ensure its legal validity. The grantor should then fund the trust by transferring assets into it, which may include cash, real estate, or other investments. Finally, it is essential to apply for a taxpayer identification number for the trust and file any necessary IRS forms to establish its subchapter S status.

IRS guidelines for the irrevocable trust which is a qualifying subchapter S trust

The IRS provides specific guidelines that govern the formation and operation of an irrevocable trust which qualifies as a subchapter S trust. These guidelines include requirements for the trust's structure, such as having only eligible shareholders and ensuring that the trust does not engage in prohibited transactions. Additionally, the trust must adhere to distribution rules, which dictate how income and gains are allocated to beneficiaries. It is crucial for trustees to maintain accurate records and file annual tax returns, reporting the trust's income and distributions in compliance with IRS regulations. Failure to adhere to these guidelines may result in penalties or loss of subchapter S status.

Required documents for the irrevocable trust which is a qualifying subchapter S trust

Establishing an irrevocable trust which qualifies as a subchapter S trust requires several key documents. The primary document is the trust agreement, which outlines the terms and conditions of the trust. Additionally, the grantor must obtain a taxpayer identification number from the IRS, which is necessary for tax reporting purposes. If the trust holds real estate or other significant assets, documentation proving the transfer of these assets into the trust is also required. Furthermore, any relevant IRS forms must be completed and submitted to ensure compliance with federal regulations.

Eligibility criteria for the irrevocable trust which is a qualifying subchapter S trust

To establish an irrevocable trust which qualifies as a subchapter S trust, certain eligibility criteria must be met. The trust must have only eligible beneficiaries, which typically include individuals or certain types of estates and charities. Additionally, the trust cannot have more than one hundred shareholders, and all shareholders must be U.S. citizens or residents. The trust must also be irrevocable, meaning that the grantor cannot change its terms after establishment. Lastly, the trust must comply with all IRS regulations regarding income distribution and tax reporting to maintain its subchapter S status.

Quick guide on how to complete irrevocable trust which is a qualifying subchapter s trust

Effortlessly Prepare Irrevocable Trust Which Is A Qualifying Subchapter S Trust on Any Device

Managing documents online has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely save it on the internet. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Handle Irrevocable Trust Which Is A Qualifying Subchapter S Trust on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

The Easiest Way to Edit and Electronically Sign Irrevocable Trust Which Is A Qualifying Subchapter S Trust Effortlessly

- Locate Irrevocable Trust Which Is A Qualifying Subchapter S Trust and select Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet-ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Irrevocable Trust Which Is A Qualifying Subchapter S Trust to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irrevocable trust which is a qualifying subchapter s trust

How to create an electronic signature for the Irrevocable Trust Which Is A Qualifying Subchapter S Trust in the online mode

How to create an eSignature for your Irrevocable Trust Which Is A Qualifying Subchapter S Trust in Chrome

How to create an electronic signature for putting it on the Irrevocable Trust Which Is A Qualifying Subchapter S Trust in Gmail

How to make an electronic signature for the Irrevocable Trust Which Is A Qualifying Subchapter S Trust straight from your smart phone

How to create an eSignature for the Irrevocable Trust Which Is A Qualifying Subchapter S Trust on iOS

How to make an eSignature for the Irrevocable Trust Which Is A Qualifying Subchapter S Trust on Android devices

People also ask

-

What is a Subchapter S Form?

A Subchapter S Form is a document that enables a corporation to be taxed under Subchapter S of the Internal Revenue Code. This form allows business owners to avoid double taxation on their income. By filing the Subchapter S Form, businesses can distribute income or losses directly to shareholders.

-

How can airSlate SignNow help with the Subchapter S Form process?

airSlate SignNow simplifies the process of completing and signing the Subchapter S Form electronically. With our platform, you can upload, fill out, and eSign your Subchapter S Form within minutes, streamlining workflows. Our user-friendly interface makes it easy to manage your documents securely.

-

What are the pricing options for using airSlate SignNow for the Subchapter S Form?

airSlate SignNow offers flexible pricing plans to accommodate different business needs for handling Subchapter S Forms. Our pricing is competitive and designed to provide great value for businesses of all sizes. You can start with a free trial to explore features specific to Subchapter S Form handling.

-

Are there any special features for managing the Subchapter S Form?

Yes, airSlate SignNow includes features tailored for managing the Subchapter S Form, such as customizable templates and automated workflows. These tools enhance accuracy and efficiency when preparing and signed the form. Additionally, document tracking ensures you know the status of your Subchapter S Form at all times.

-

Can airSlate SignNow integrate with other tools for filing the Subchapter S Form?

Absolutely! airSlate SignNow can integrate with various software applications to help you efficiently file your Subchapter S Form. Whether you use accounting software or document management systems, our platform can enhance your overall process. These integrations save time and reduce the risk of errors.

-

What are the benefits of using airSlate SignNow for Subchapter S Forms?

Using airSlate SignNow for your Subchapter S Forms provides several benefits, including reduced processing time and improved accuracy. The electronic signing feature eliminates the need for physical paperwork, making collaboration easier. Additionally, enhanced security measures protect sensitive business information during the submitting process.

-

Is it easy to share the Subchapter S Form with partners or accountants?

Yes, airSlate SignNow makes it incredibly easy to share your Subchapter S Form with partners or accountants. You can invite specific individuals to view or sign documents securely, streamlining communication. This collaborative approach helps ensure everyone involved is on the same page throughout the process.

Get more for Irrevocable Trust Which Is A Qualifying Subchapter S Trust

- Choice transfer brequestb seattle public schools seattleschools form

- Form canpass remote area border crossing rabc permit

- Ny state security license renewal form dos 1246

- Pick up player form alabama usssa

- Form approved by the toledo regional association of realtors and the toledo bar association

- Multimodal dangerous goods form modello mercipericolose

- Png incoming passenger declaration cruise ships form

- Monopoly board pdf form

Find out other Irrevocable Trust Which Is A Qualifying Subchapter S Trust

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online