Schedule L WV State Tax Department 2017

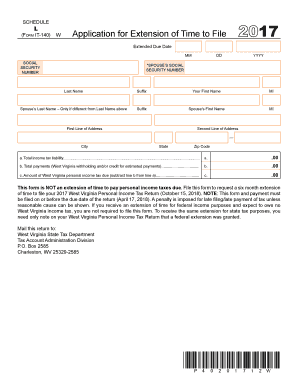

What is the Schedule L WV State Tax Department

The Schedule L is a tax form used by the West Virginia State Tax Department to report certain types of income and adjustments. This form is specifically designed for individuals and businesses that need to disclose additional information related to their tax obligations in West Virginia. It helps taxpayers calculate their taxable income accurately by allowing them to include or exclude specific items as required by state tax regulations.

How to use the Schedule L WV State Tax Department

Using the Schedule L involves several steps to ensure accurate reporting of income and adjustments. Taxpayers should first gather all relevant financial documents, including income statements and receipts for deductions. Next, they should fill out the form by entering their income details and any applicable adjustments. It is essential to follow the instructions provided on the form carefully to avoid errors that could lead to penalties or delays in processing.

Steps to complete the Schedule L WV State Tax Department

Completing the Schedule L requires a methodical approach:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Download or obtain a physical copy of the Schedule L from the West Virginia State Tax Department.

- Fill in your personal information at the top of the form.

- Report your total income in the designated sections.

- Include any adjustments or deductions that apply to your situation.

- Review the completed form for accuracy before submission.

Key elements of the Schedule L WV State Tax Department

The Schedule L contains several key elements that are crucial for accurate tax reporting. These include:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Income Reporting: Sections to report various types of income, including wages, dividends, and business income.

- Adjustments: Areas to list allowable deductions and adjustments to income.

- Signature: A section for the taxpayer to sign and date the form, confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of the filing deadlines associated with the Schedule L. Typically, the form must be submitted by April fifteenth of the tax year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also keep track of any changes in state tax laws that may affect these deadlines.

Form Submission Methods

The Schedule L can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can file electronically through the West Virginia State Tax Department's online portal.

- Mail: The completed form can be mailed to the designated address provided in the form instructions.

- In-Person: Taxpayers may also choose to submit the form in person at their local tax office.

Quick guide on how to complete schedule l wv state tax department

Craft Schedule L WV State Tax Department effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to access the correct form and securely retain it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Schedule L WV State Tax Department on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Schedule L WV State Tax Department with ease

- Find Schedule L WV State Tax Department and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or cover sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Schedule L WV State Tax Department and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule l wv state tax department

Create this form in 5 minutes!

How to create an eSignature for the schedule l wv state tax department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule L for the WV State Tax Department?

Schedule L is a form used by businesses in West Virginia to report their income and expenses to the WV State Tax Department. It helps ensure compliance with state tax regulations and provides a clear overview of a business's financial activities. Understanding how to fill out Schedule L is crucial for accurate tax reporting.

-

How can airSlate SignNow help with Schedule L submissions?

airSlate SignNow streamlines the process of completing and submitting Schedule L to the WV State Tax Department. Our platform allows users to easily fill out, sign, and send documents electronically, reducing the time and effort required for tax submissions. This ensures that your Schedule L is submitted accurately and on time.

-

Is there a cost associated with using airSlate SignNow for Schedule L?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions provide access to features that simplify the completion and submission of Schedule L to the WV State Tax Department. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for Schedule L?

airSlate SignNow includes features such as document templates, electronic signatures, and secure cloud storage, all of which are beneficial for managing Schedule L submissions. These tools enhance efficiency and ensure that your documents are organized and easily accessible. Additionally, our platform is user-friendly, making it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other software for Schedule L?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when preparing Schedule L for the WV State Tax Department. This means you can connect with accounting software, CRM systems, and more to enhance your document management process.

-

What are the benefits of using airSlate SignNow for tax documents like Schedule L?

Using airSlate SignNow for tax documents such as Schedule L provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and submitted quickly, helping you avoid delays with the WV State Tax Department. Additionally, electronic signatures are legally binding, providing peace of mind.

-

How secure is airSlate SignNow when handling Schedule L?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your sensitive information when handling Schedule L submissions to the WV State Tax Department. You can trust that your data is safe and secure while using our platform.

Get more for Schedule L WV State Tax Department

Find out other Schedule L WV State Tax Department

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement