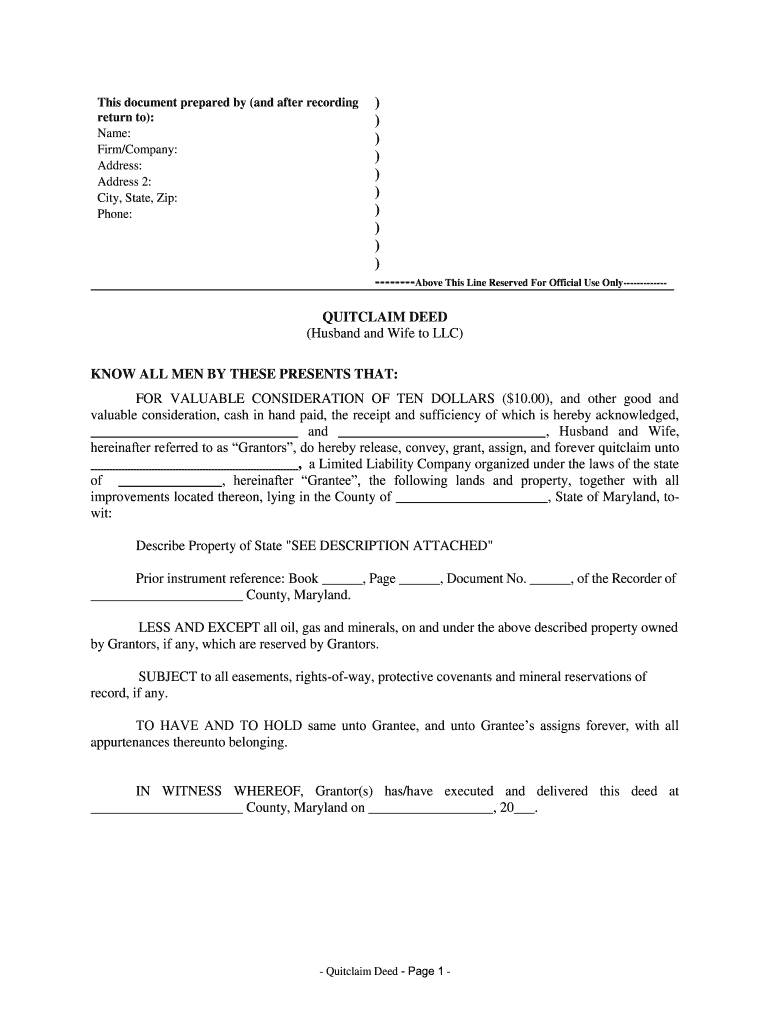

Hereinafter Referred to as Grantors, Do Hereby Release, Convey, Grant, Assign, and Forever Quitclaim Unto Form

Understanding the husband wife LLC

A husband wife LLC is a unique business structure designed for married couples who want to operate a business together. This type of limited liability company allows both partners to manage the business while enjoying liability protection. In many states, including Maryland, a husband wife LLC can simplify tax filings and provide personal asset protection, making it an attractive option for couples engaged in entrepreneurship.

Key benefits of a husband wife LLC

Establishing a husband wife LLC offers several advantages:

- Liability protection: Both partners are shielded from personal liability for business debts and obligations.

- Simplified tax treatment: Couples can choose to be taxed as a sole proprietorship or partnership, depending on their needs.

- Shared management: Both spouses can actively participate in the business operations without the need for formalities required by other business structures.

Steps to form a husband wife LLC

Creating a husband wife LLC involves several key steps:

- Choose a name: Select a unique name that complies with state regulations.

- File Articles of Organization: Submit the necessary paperwork to your state’s business filing agency.

- Create an Operating Agreement: Draft an agreement outlining the management structure and operational procedures of the LLC.

- Obtain necessary licenses: Ensure you have all required business licenses and permits to operate legally.

Legal considerations for husband wife LLCs

When forming a husband wife LLC, it is important to understand the legal implications:

- State-specific regulations: Each state has its own rules regarding LLC formation and operation, so it is crucial to research local laws.

- Compliance with tax laws: Couples must adhere to IRS guidelines for reporting income and expenses, particularly if choosing to be taxed as a partnership.

- Personal liability: While an LLC provides liability protection, individual actions may still expose personal assets if not properly managed.

Required documents for establishing a husband wife LLC

To successfully form a husband wife LLC, you will need to gather and submit several key documents:

- Articles of Organization: This document formally establishes the LLC with the state.

- Operating Agreement: While not always required, this document outlines the management structure and operational guidelines.

- Tax identification number: Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

Maintaining your husband wife LLC

Once established, it is essential to maintain your husband wife LLC to ensure compliance and protect your business:

- File annual reports: Many states require LLCs to file annual reports to maintain good standing.

- Keep accurate records: Maintain detailed financial records and documentation of business activities.

- Separate personal and business finances: Keep personal and business expenses distinct to uphold liability protection.

Quick guide on how to complete hereinafter referred to as grantors do hereby release convey grant assign and forever quitclaim unto

Prepare Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto easily on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, enabling you to access the required form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The simplest way to edit and eSign Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto effortlessly

- Obtain Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hereinafter referred to as grantors do hereby release convey grant assign and forever quitclaim unto

How to create an electronic signature for the Hereinafter Referred To As Grantors Do Hereby Release Convey Grant Assign And Forever Quitclaim Unto online

How to create an electronic signature for your Hereinafter Referred To As Grantors Do Hereby Release Convey Grant Assign And Forever Quitclaim Unto in Chrome

How to generate an electronic signature for putting it on the Hereinafter Referred To As Grantors Do Hereby Release Convey Grant Assign And Forever Quitclaim Unto in Gmail

How to create an electronic signature for the Hereinafter Referred To As Grantors Do Hereby Release Convey Grant Assign And Forever Quitclaim Unto straight from your smartphone

How to create an eSignature for the Hereinafter Referred To As Grantors Do Hereby Release Convey Grant Assign And Forever Quitclaim Unto on iOS

How to make an eSignature for the Hereinafter Referred To As Grantors Do Hereby Release Convey Grant Assign And Forever Quitclaim Unto on Android OS

People also ask

-

What is a husband wife LLC and how does it work?

A husband wife LLC is a limited liability company formed by a married couple, allowing them to operate their business as a single entity. This structure provides liability protection and tax benefits, as income can be reported on a joint tax return. By creating a husband wife LLC, couples can streamline their business operations while separating personal and business risks.

-

What are the benefits of a husband wife LLC?

The primary benefits of a husband wife LLC include liability protection, tax advantages, and ease of management. This structure helps couples protect their personal assets from business liabilities, allows for pass-through taxation, and generally simplifies administrative tasks. Overall, a husband wife LLC can enhance financial security and promote smoother business operations.

-

How do I form a husband wife LLC?

To form a husband wife LLC, you need to choose a business name, file the required paperwork with your state, and pay the associated fees. It’s essential to create an operating agreement that outlines each partner's roles and responsibilities. Consulting with a legal expert can help navigate the formation process more efficiently, ensuring compliance with local laws.

-

Can I use airSlate SignNow to manage documents for my husband wife LLC?

Absolutely! airSlate SignNow provides an efficient solution for managing documents related to your husband wife LLC. You can seamlessly send and eSign essential documents, ensuring quick turnaround times while maintaining the security of your data. This allows you to focus on your business while handling necessary paperwork with ease.

-

What are the features of airSlate SignNow that benefit a husband wife LLC?

airSlate SignNow offers features such as secure eSigning, document templates, and automated workflows that are particularly beneficial for a husband wife LLC. These tools streamline the document management process, reduce errors, and save time, allowing couples to concentrate on growing their business. Additionally, users benefit from integrations with various apps that enhance productivity.

-

How much does it cost to use airSlate SignNow for a husband wife LLC?

The pricing for using airSlate SignNow is competitive and varies based on the features and services you select for your husband wife LLC. There are different plans available, catering to both small startups and larger enterprises. Consider the features you need to choose the right plan that fits your budget and business needs.

-

Are there integrations available for airSlate SignNow that can help my husband wife LLC?

Yes, airSlate SignNow offers numerous integrations with popular platforms like Google Drive, Dropbox, and Microsoft Office, which can benefit your husband wife LLC. These integrations enhance productivity and streamline your workflow by allowing easy access and management of documents. You can customize your tech stack to fit the specific needs of your business.

Get more for Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto

- Ohio new hire reporting fairfield county intranet co fairfield oh form

- Notice of non payment claim against miller act payment bond form

- Employment application for company drivers waggoners trucking form

- Without you the tragic story of badfinger dan matovina form

- Application for an amendment fort erie ontario form

- Certificate immunization form quincypublicschoolscom

- Bpg emergency procedures nov 05 fin everysite form

- Mass responses and prayers form

Find out other Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form