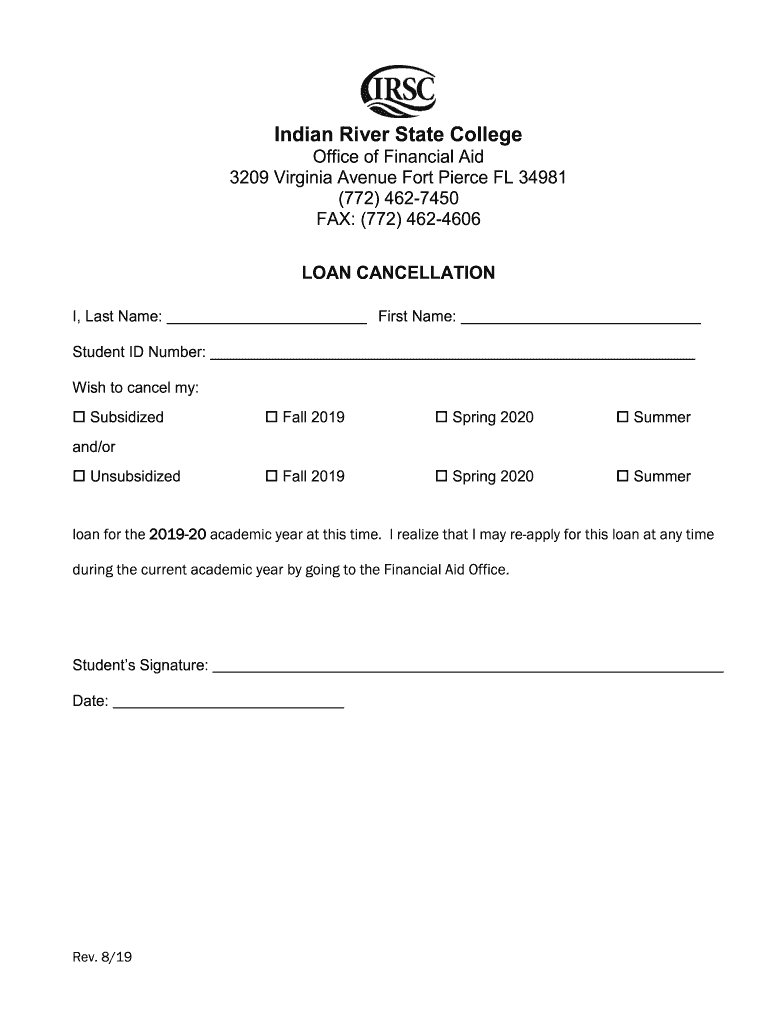

Loan Cancelation Form Loan Cancelation Form 2019-2026

Understanding the Loan Cancellation Letter

A loan cancellation letter is a formal document that requests the termination of a loan agreement. This letter serves as a notification to the lender that the borrower wishes to cancel the loan and outlines the reasons for this decision. It is essential for borrowers to understand the implications of sending such a letter, as it may affect their credit score and future borrowing capabilities.

Key Elements of the Loan Cancellation Letter

When drafting a loan cancellation letter, certain elements must be included to ensure clarity and effectiveness. These elements typically consist of:

- Borrower Information: The full name, address, and contact details of the borrower.

- Lender Information: The name and address of the lending institution.

- Loan Details: Specific information about the loan, including the loan number, amount, and date of origination.

- Reason for Cancellation: A clear explanation of why the borrower is canceling the loan.

- Signature: The borrower’s signature to validate the request.

Steps to Complete the Loan Cancellation Letter

Completing a loan cancellation letter involves several straightforward steps. First, gather all necessary information, including loan details and personal information. Next, write the letter in a professional tone, clearly stating your intention to cancel the loan. Ensure that you include all key elements mentioned previously. After drafting the letter, review it for accuracy and completeness before signing it. Finally, send the letter to the lender using a method that confirms receipt, such as certified mail.

Legal Use of the Loan Cancellation Letter

The legal validity of a loan cancellation letter is crucial for both the borrower and the lender. In the United States, a properly executed loan cancellation letter can serve as a legal document that may protect the borrower from future obligations related to the loan. It is advisable to retain a copy of the letter and any correspondence with the lender for record-keeping purposes. Additionally, understanding the laws governing loan agreements in your state can provide further assurance of the letter's legal standing.

How to Obtain the Loan Cancellation Letter

Borrowers can obtain a loan cancellation letter template from various sources, including online legal resources or financial institutions. Many lenders may provide a specific form or template that outlines the necessary information required for cancellation. Alternatively, borrowers can create their own letter by following the key elements and guidelines discussed earlier. It is essential to ensure that the letter meets all legal requirements and is tailored to the specific loan agreement.

Examples of Using the Loan Cancellation Letter

There are various scenarios in which a loan cancellation letter may be applicable. For instance, a borrower may decide to cancel a personal loan due to unforeseen financial difficulties or to avoid high-interest rates on a car loan. Additionally, if a borrower finds a better loan offer, they may choose to cancel their current loan to take advantage of more favorable terms. Each situation requires a clear and concise loan cancellation letter to communicate the borrower’s intentions effectively.

Quick guide on how to complete loan cancelation form loan cancelation form

Effortlessly Prepare Loan Cancelation Form Loan Cancelation Form on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required for you to create, modify, and electronically sign your documents quickly without delays. Manage Loan Cancelation Form Loan Cancelation Form on any device with the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

How to Modify and Electronically Sign Loan Cancelation Form Loan Cancelation Form with Ease

- Obtain Loan Cancelation Form Loan Cancelation Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of your documents or obscure sensitive information with tools provided specifically by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, and errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Loan Cancelation Form Loan Cancelation Form and ensure smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct loan cancelation form loan cancelation form

Create this form in 5 minutes!

How to create an eSignature for the loan cancelation form loan cancelation form

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is a loan cancellation letter and when should I use it?

A loan cancellation letter is a formal document that communicates the intention to cancel a loan agreement. It can be used when a borrower decides to back out of a loan or when a lender agrees to cancel a loan under certain conditions. It's essential to provide this letter in writing to ensure clarity and avoid any potential misunderstandings.

-

How does airSlate SignNow assist with creating a loan cancellation letter?

airSlate SignNow simplifies the process of creating a loan cancellation letter by providing customizable templates tailored to your needs. With our user-friendly interface, you can generate, edit, and eSign your letter efficiently, ensuring all necessary details are included. This streamlines the paperwork so you can focus on your financial matters.

-

What features does airSlate SignNow offer for loan cancellation letters?

AirSlate SignNow offers numerous features to enhance your experience with loan cancellation letters. You can easily create, edit, and send documents for eSignature, track document status in real-time, and store your letters securely in the cloud. These features ensure that your loan cancellation processes are efficient and well-organized.

-

Is airSlate SignNow cost-effective for generating a loan cancellation letter?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses and individuals looking to create a loan cancellation letter. Our pricing plans are tailored to fit various budgets, providing you with essential features without overspending. The savings realized by streamlining documentation processes can be signNow.

-

Can I integrate airSlate SignNow with other applications for loan cancellation letters?

AirSlate SignNow offers seamless integration with many popular applications, allowing you to enhance your workflow for loan cancellation letters. You can connect with CRMs, cloud storage services, and other productivity tools, ensuring that your document management processes remain efficient. This alleviates the need for repetitive data entry and simplifies your operations.

-

Are there any legal considerations when drafting a loan cancellation letter?

Yes, it is important to consider legal aspects when drafting a loan cancellation letter. Make sure to comply with local regulations and accurately outline your intentions and agreements. Using airSlate SignNow's templates can help ensure that your letter contains all necessary legal language to protect your interests.

-

What are the benefits of using airSlate SignNow for loan cancellation letters?

Using airSlate SignNow for your loan cancellation letters offers multiple benefits, including time savings, security, and ease of use. You can quickly create and send your letters electronically, reducing the need for paper documents. Moreover, our secure platform ensures that your sensitive information remains protected.

Get more for Loan Cancelation Form Loan Cancelation Form

Find out other Loan Cancelation Form Loan Cancelation Form

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter