Irs 14039 B 2014

What is the IRS 14039 B?

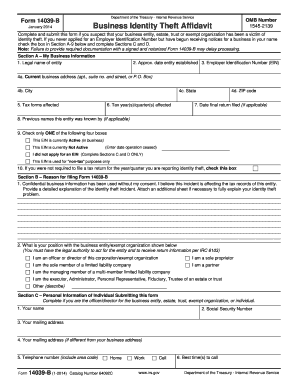

The IRS 14039 B form, also known as the Identity Theft Affidavit, is a crucial document designed to assist individuals who suspect that their personal information has been compromised and used fraudulently to file tax returns. This form allows taxpayers to report instances of identity theft to the IRS, facilitating the resolution of issues arising from fraudulent activities. By submitting the IRS 14039 B, individuals can help protect their tax records and ensure that their rightful tax refunds are not unlawfully claimed by others.

How to Use the IRS 14039 B

Using the IRS 14039 B form involves several straightforward steps. First, ensure that you have identified a clear case of identity theft, such as receiving a notice from the IRS about a return filed in your name that you did not submit. Next, download the form from the IRS website or obtain a physical copy. Fill out the required sections, providing accurate information about your identity and the fraudulent activity. Once completed, submit the form to the IRS as instructed, either electronically or via mail, depending on your situation. It is vital to keep a copy for your records.

Steps to Complete the IRS 14039 B

Completing the IRS 14039 B form requires careful attention to detail. Follow these steps:

- Download the form from the IRS website or request a paper version.

- Provide your personal information, including your name, address, and Social Security number.

- Describe the nature of the identity theft, including any relevant details about the fraudulent tax return.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the IRS, following the submission guidelines provided on the form.

Legal Use of the IRS 14039 B

The IRS 14039 B form serves a legal purpose in the context of identity theft. By filing this affidavit, individuals are formally notifying the IRS of fraudulent activity involving their personal information. This legal documentation can help protect taxpayers from further issues related to identity theft, ensuring that the IRS takes appropriate action to investigate and resolve the matter. It is important to understand that submitting the form does not automatically guarantee resolution but initiates the process of addressing the identity theft claims.

Required Documents

When submitting the IRS 14039 B form, it is essential to include specific supporting documents to strengthen your case. Typically, you may need to provide:

- A copy of your government-issued identification, such as a driver's license or passport.

- Any correspondence from the IRS regarding the fraudulent activity.

- Proof of your identity, which may include documents like utility bills or bank statements showing your name and address.

These documents help verify your identity and the legitimacy of your claim, aiding the IRS in processing your affidavit efficiently.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the IRS 14039 B form, it is advisable to file it as soon as you suspect identity theft. Prompt action can help mitigate the consequences of fraud on your tax records. Additionally, keep in mind that the IRS may have specific timelines for responding to identity theft claims, so timely submission is beneficial for resolution. Monitoring any communications from the IRS after filing is also crucial to stay informed about the status of your case.

Quick guide on how to complete irs 14039 b

Effortlessly prepare Irs 14039 B on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and safely keep it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any hold-ups. Manage Irs 14039 B on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Irs 14039 B effortlessly

- Obtain Irs 14039 B and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Irs 14039 B while ensuring excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 14039 b

Create this form in 5 minutes!

How to create an eSignature for the irs 14039 b

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is IRS 14039 B and how does airSlate SignNow help?

IRS 14039 B is a form used to report identity theft related to tax issues. With airSlate SignNow, you can easily eSign and securely send this form along with any supporting documents, ensuring a smooth submission process for identity theft claims.

-

How much does it cost to use airSlate SignNow for IRS 14039 B forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs, starting from a monthly fee that provides access to features necessary for managing IRS 14039 B forms. Our cost-effective solution allows you to sign documents electronically without breaking the bank.

-

What features does airSlate SignNow offer for handling IRS 14039 B documents?

airSlate SignNow provides features like customizable templates, secure eSigning, and document tracking, which are essential for efficiently managing IRS 14039 B forms. These capabilities streamline your workflow and enhance compliance by ensuring all documents are properly handled.

-

Can I integrate airSlate SignNow with other software for IRS 14039 B submissions?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing users to manage IRS 14039 B submissions alongside other tools they use daily. This integration capability simplifies the process of gathering necessary documents and submitting them to the IRS.

-

Is airSlate SignNow secure for sending IRS 14039 B forms?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive information related to IRS 14039 B forms. Your data is safe, ensuring compliance with IRS regulations and peace of mind.

-

How can I track the status of my IRS 14039 B submissions in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your IRS 14039 B submissions through our user-friendly dashboard. This feature allows you to see when documents are viewed, signed, and completed, helping you stay organized throughout the process.

-

What benefits does airSlate SignNow provide for businesses dealing with IRS 14039 B?

Using airSlate SignNow for IRS 14039 B forms streamlines the eSigning process, reduces paper usage, and minimizes delays in document processing. These benefits not only enhance overall efficiency but also improve the experience for both businesses and their clients.

Get more for Irs 14039 B

- Special power of attorney for closing real estate transaction form

- Whose address is form

- Accepting an offer home sellers handbookthe office of attorney form

- Provider update form dentaquest

- State of mississippi including any uniform premarital agreement act or other applicable laws

- Fiduciary deed form fill out and sign printable pdf

- Order birth death or marriage records on line or by phone form

- Mississippi commercial lease form

Find out other Irs 14039 B

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself