Financial Hardship Letter PDF Form

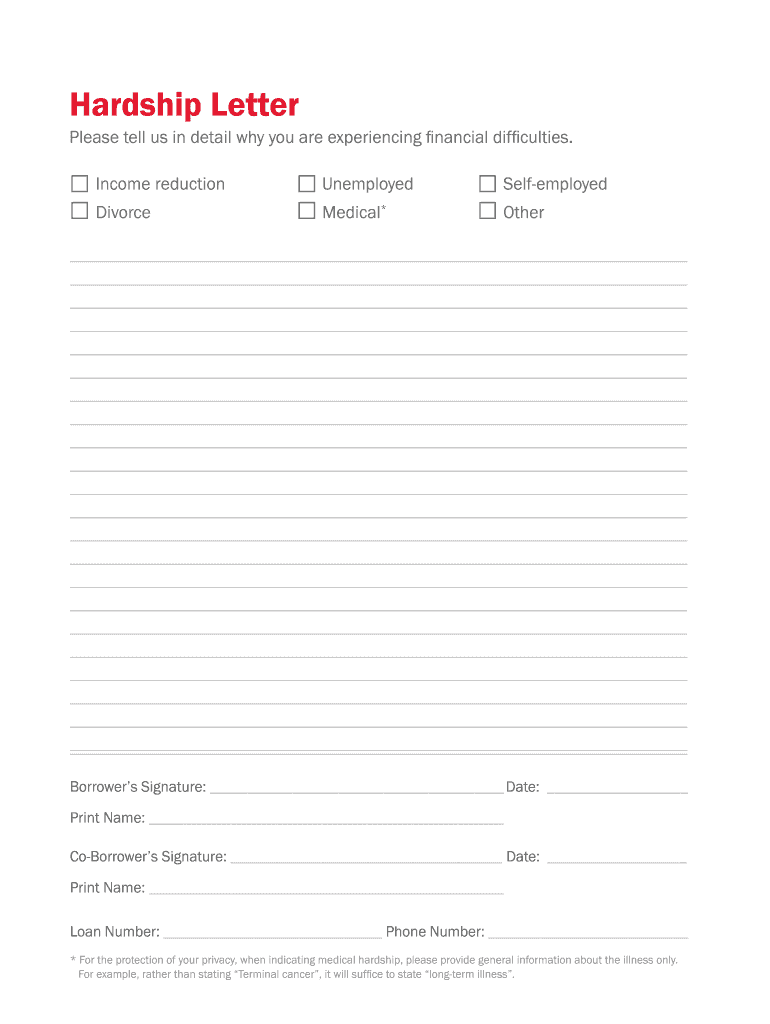

Key elements of the financial hardship letter

A financial hardship letter is a crucial document that outlines your current financial situation and the reasons for your inability to meet your financial obligations. Key elements to include in your letter are:

- Your personal information: Include your full name, address, and contact details at the top of the letter.

- Recipient's information: Address the letter to the appropriate party, such as your lender or mortgage company.

- Explanation of hardship: Clearly describe the circumstances leading to your financial difficulties, such as job loss, medical expenses, or other unforeseen events.

- Financial details: Provide a summary of your income, expenses, and any assets you may have. This helps the recipient understand your financial situation better.

- Request for assistance: Specify the type of assistance you are seeking, whether it is a loan modification, forbearance, or another form of relief.

- Supporting documentation: Mention any documents you are including to support your claims, such as pay stubs, bank statements, or medical bills.

- Closing statement: End the letter with a polite closing, expressing your hope for understanding and assistance.

Steps to complete the financial hardship letter

Completing a financial hardship letter involves several important steps to ensure clarity and effectiveness. Follow these steps to create a comprehensive letter:

- Gather your information: Collect all necessary personal and financial information, including details about your income, expenses, and the reasons for your hardship.

- Choose a format: Decide whether you will write a formal letter or use a template. A template can help you structure your letter effectively.

- Draft the letter: Write the letter, ensuring to include all key elements. Be honest and straightforward in your explanation.

- Review and edit: Carefully review your letter for clarity, grammar, and spelling. Make sure it accurately reflects your situation.

- Include supporting documents: Attach any relevant documents that can substantiate your claims and provide a clearer picture of your financial situation.

- Send the letter: Submit your letter to the appropriate party, either by mail or electronically, depending on their requirements.

Legal use of the financial hardship letter

Understanding the legal implications of a financial hardship letter is essential for its effective use. This letter serves as a formal request for assistance and can impact your financial agreements. Key legal aspects include:

- Legally binding nature: When properly executed, a financial hardship letter can be considered a formal request and may obligate the lender to respond.

- Compliance with regulations: Ensure that your letter complies with relevant laws and regulations, such as the Fair Debt Collection Practices Act, which protects consumers from unfair treatment.

- Documentation: Keep copies of your letter and any correspondence with the lender, as these may be necessary for future reference or legal purposes.

- Potential consequences: Be aware that submitting a hardship letter may affect your credit score or loan terms, depending on the lender's response.

Examples of using the financial hardship letter

Utilizing a financial hardship letter can vary based on individual circumstances. Here are some common scenarios where such a letter may be beneficial:

- Mortgage assistance: Homeowners facing difficulties may use a hardship letter to request a loan modification or forbearance from their mortgage lender.

- Credit card relief: Individuals struggling with credit card payments can submit a hardship letter to negotiate lower payments or interest rates.

- Student loan deferment: Borrowers may use a hardship letter to request deferment or forbearance on their student loans due to financial challenges.

- Medical debt negotiation: Patients facing overwhelming medical bills can write a hardship letter to negotiate payment plans or reductions with healthcare providers.

How to use the financial hardship letter PDF

Using a financial hardship letter in PDF format can streamline the process of submission and ensure professionalism. Here’s how to effectively use this format:

- Download a template: Start by downloading a financial hardship letter template in PDF format. This ensures that your letter maintains a professional appearance.

- Fill in your details: Complete the template with your personal information, the recipient's details, and the content of your letter.

- Save and review: After filling out the PDF, save it and review the content for accuracy and completeness.

- Submit electronically: If the lender accepts electronic submissions, you can send the PDF via email or through their online portal.

- Print and mail: If required, print the PDF and send it via traditional mail, ensuring to keep a copy for your records.

Required documents for the financial hardship letter

When submitting a financial hardship letter, including supporting documents can strengthen your case. Commonly required documents include:

- Proof of income: Recent pay stubs, tax returns, or bank statements that demonstrate your current financial status.

- Expense documentation: Bills, statements, or receipts that outline your monthly expenses and financial obligations.

- Medical records: If applicable, include documentation of medical expenses that contribute to your financial hardship.

- Employment termination notice: If you have lost your job, provide a copy of your termination notice or layoff letter.

Quick guide on how to complete financial hardship letter pdf

Effortlessly Prepare Financial Hardship Letter Pdf on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Financial Hardship Letter Pdf on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The Easiest Way to Edit and eSign Financial Hardship Letter Pdf Effortlessly

- Obtain Financial Hardship Letter Pdf and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes necessitating printouts of new document copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from any device of your choice. Edit and eSign Financial Hardship Letter Pdf while ensuring effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the financial hardship letter pdf

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is a hardship letter?

A hardship letter is a formal document that explains your financial difficulties and requests leniency from creditors or lenders. It details your situation, including your income, expenses, and reasons for your hardships. Writing a clear hardship letter is essential for obtaining relief options and understanding how to navigate your financial challenges.

-

How can airSlate SignNow help me create a hardship letter?

airSlate SignNow provides templates that simplify the process of drafting a hardship letter. With our user-friendly interface, you can easily customize your document to reflect your personal financial situation. Plus, you can securely eSign and send your hardship letter to the required parties within minutes.

-

Is there a cost associated with using airSlate SignNow for my hardship letter?

airSlate SignNow offers a cost-effective solution for document management, including the creation of hardship letters. Our pricing plans are designed to suit various business needs, ensuring that you can access essential features without breaking the bank. Additionally, you may benefit from a free trial to explore the platform's capabilities.

-

What features does airSlate SignNow provide for hardship letters?

airSlate SignNow offers features like customizable templates, electronic signatures, and secure document storage to enhance your hardship letter creation. You can collaborate with others in real time and track the status of your sent documents easily. These features ensure that your hardship letter is both professional and effectively communicated.

-

Can I integrate airSlate SignNow with other applications for my hardship letter needs?

Yes, airSlate SignNow supports integration with various applications, making it easier to manage your hardship letters alongside other business processes. You can connect with platforms like Google Drive, Dropbox, and more to streamline your document workflow. This integration capability enhances efficiency and organization in handling your financial documentation.

-

What are the benefits of using airSlate SignNow for drafting a hardship letter?

Using airSlate SignNow to draft a hardship letter brings numerous benefits, such as saving time and ensuring legal compliance. The platform's intuitive design helps eliminate errors and simplifies the signing process. Additionally, it provides a secure method for sharing your hardship letter, thus enhancing privacy and peace of mind.

-

How long does it take to create a hardship letter with airSlate SignNow?

Creating a hardship letter with airSlate SignNow is quick and straightforward; most users can complete the process in under 30 minutes. The availability of templates and easy-to-follow instructions signNowly reduces drafting time. Once completed, you can eSign and send your hardship letter immediately.

Get more for Financial Hardship Letter Pdf

Find out other Financial Hardship Letter Pdf

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form