What is a Debt Schedule in Business Form

What is a debt schedule in business

A debt schedule is a financial document that outlines a company's outstanding debts, including loans, bonds, and other liabilities. This schedule provides a detailed view of the company's obligations, including the amount owed, interest rates, payment terms, and due dates. It serves as a crucial tool for financial management, helping businesses track their liabilities and plan for future cash flow needs. Understanding the debt schedule is essential for assessing a company's financial health and making informed decisions about financing and investments.

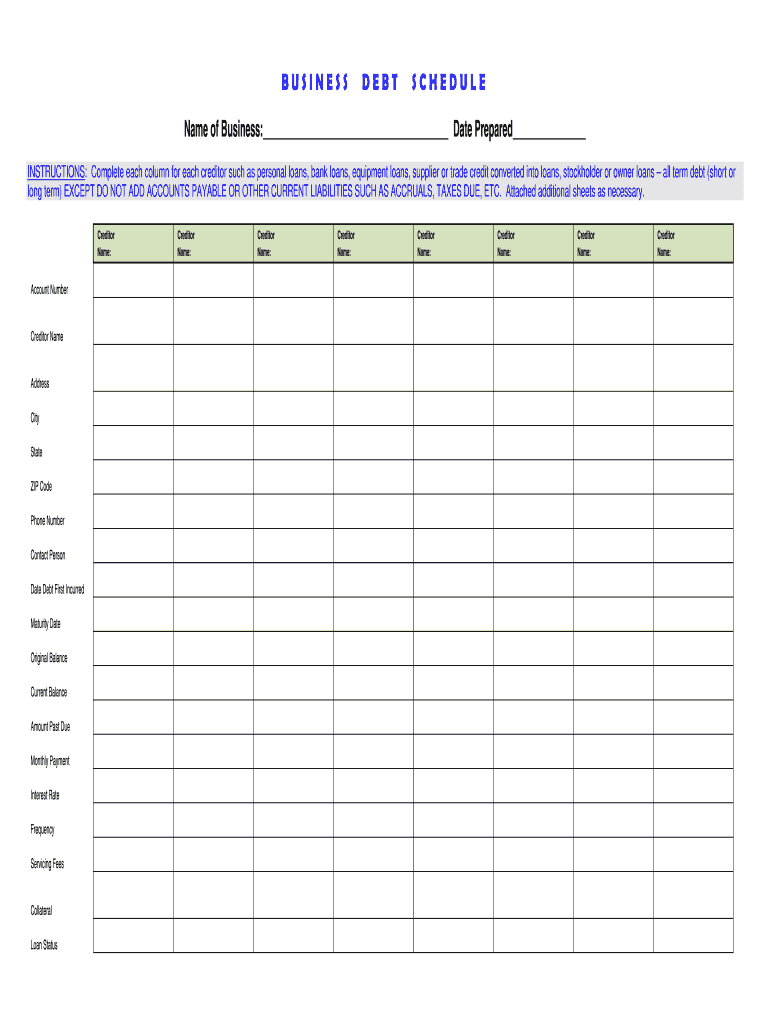

Key elements of a debt schedule

A comprehensive debt schedule typically includes the following key elements:

- Creditor Information: Names of lenders or financial institutions.

- Principal Amount: The original amount borrowed or the face value of the debt.

- Interest Rate: The cost of borrowing expressed as a percentage.

- Payment Terms: Details on how and when payments are made, including frequency (monthly, quarterly, etc.).

- Maturity Date: The date by which the debt must be fully repaid.

- Current Balance: The remaining amount owed on each debt.

- Collateral: Any assets pledged as security for the debt.

These elements help businesses manage their debt effectively and ensure timely payments, which is vital for maintaining a good credit rating.

Steps to complete a debt schedule template

Creating a debt schedule template involves several important steps:

- Gather Financial Information: Collect all relevant data about existing debts, including loan agreements and statements.

- List Each Debt: Create a table or spreadsheet that includes all debts, detailing the key elements mentioned earlier.

- Calculate Total Debt: Sum the principal amounts to determine the total outstanding debt.

- Review Payment Terms: Ensure that all payment terms are accurately reflected, including interest rates and due dates.

- Update Regularly: Keep the debt schedule current by updating it with any new debts or changes to existing obligations.

Following these steps will help ensure that the debt schedule is an effective tool for financial management.

Legal use of a debt schedule

The debt schedule is not only a financial tool but also has legal implications. It serves as a record of a company's obligations and can be used in various legal contexts, such as during audits, bankruptcy proceedings, or when seeking additional financing. To ensure its legal validity, it is essential to maintain accurate records and comply with relevant regulations, such as those outlined in the Uniform Commercial Code (UCC) for secured transactions. Additionally, having a reliable electronic signature solution can enhance the legal standing of agreements related to the debt schedule.

Examples of using a debt schedule

Debt schedules can be utilized in various scenarios, including:

- Financial Planning: Businesses use debt schedules to forecast cash flow and plan for future financing needs.

- Loan Applications: Lenders often require a debt schedule to assess a borrower's creditworthiness.

- Investment Analysis: Investors review debt schedules to evaluate the financial health and risk profile of a company.

- Debt Restructuring: Companies may use debt schedules during negotiations with creditors to restructure existing obligations.

These examples highlight the versatility of debt schedules in supporting sound financial decision-making.

Quick guide on how to complete what is a debt schedule in business

Complete What Is A Debt Schedule In Business effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle What Is A Debt Schedule In Business on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign What Is A Debt Schedule In Business without effort

- Locate What Is A Debt Schedule In Business and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign What Is A Debt Schedule In Business and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is a debt schedule in business

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is a debt schedule template?

A debt schedule template is a structured document that outlines a borrower's debt obligations over a specified period. It includes key details such as the loan amount, interest rates, maturity dates, and payment schedules. Using a debt schedule template can help businesses manage their debt more effectively and maintain financial clarity.

-

How can I create a debt schedule template with airSlate SignNow?

You can easily create a debt schedule template using airSlate SignNow by leveraging our intuitive document editor. Simply choose a pre-built template or start from scratch, customize it with your financial details, and save it for future use. This allows for quick adjustments and ensures your debt management strategy is always up to date.

-

Is there a cost associated with using the debt schedule template feature?

While airSlate SignNow offers various pricing plans, the debt schedule template feature is included in all subscription tiers. This means you can access and utilize the debt schedule template at no additional cost, giving you a cost-effective solution for managing your debt documents easily.

-

What are the benefits of using a debt schedule template?

Using a debt schedule template helps streamline your financial planning by organizing your debt information in one place. It enhances transparency, making it easier to track payments and deadlines. Additionally, a well-organized debt schedule template can aid in cash flow management and help avoid late payments.

-

Can I customize the debt schedule template to fit my business needs?

Absolutely! The debt schedule template in airSlate SignNow is fully customizable. You can adjust fields, add or remove sections, and tailor the design to align with your business's unique requirements, ensuring the template meets your specific debt management goals.

-

Does the debt schedule template integrate with other tools?

Yes, airSlate SignNow offers integrations with various tools such as Google Drive, Microsoft Office, and cloud storage solutions. This allows you to import and export your debt schedule template seamlessly, enabling you to manage your documents in conjunction with other financial tools and applications.

-

How does using a debt schedule template improve financial accuracy?

A debt schedule template improves financial accuracy by providing a clear and organized way to document all debt-related information. By systematically inputting data and using calculations within the template, errors can be minimized, leading to more reliable financial forecasts and better decision-making.

Get more for What Is A Debt Schedule In Business

- Bill of sale form nebraska last will and testament form for married

- Type the name of the guardian form

- Fields 40 44 form

- Application to relieve estate from form

- All of the signs your spouse may be cheatingaffaircare form

- Opm form 71 download fillable pdf request for leave or

- Sample of a board resolutionboardeffect form

- 049 pa code35335a seller property disclosure statement form

Find out other What Is A Debt Schedule In Business

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document