Baker 1098 T 2016-2026

What is the Baker 1098 T

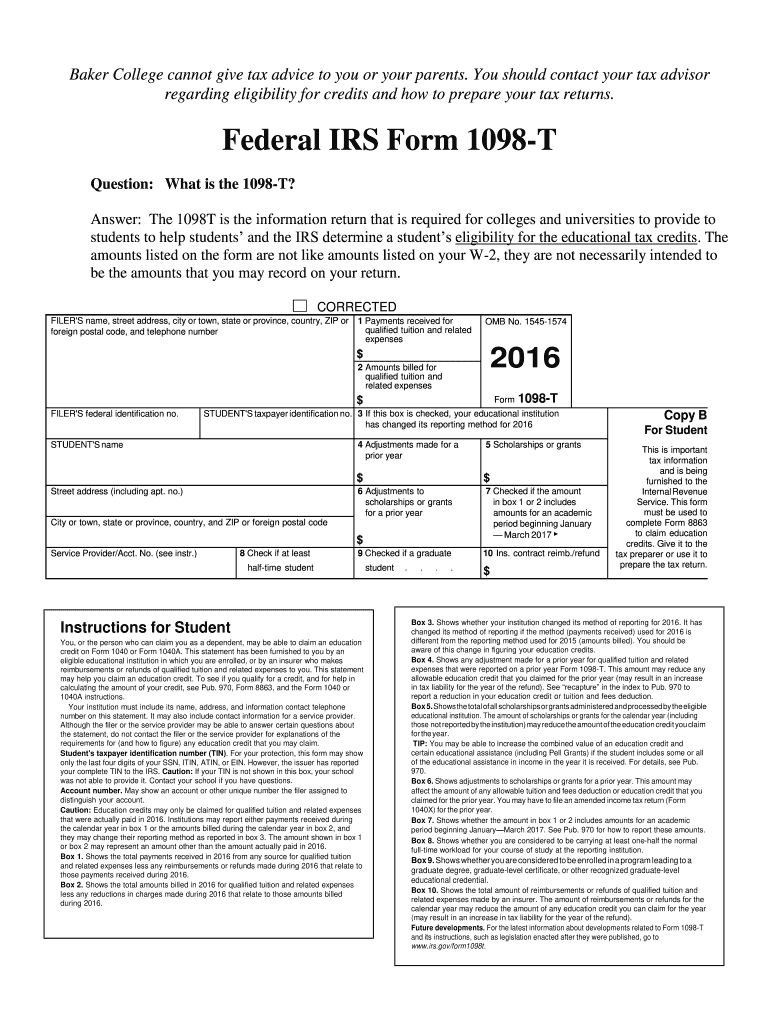

The Baker 1098 T is a tax form issued by Baker College, primarily used to report qualified tuition and related expenses for students. This form is essential for students and their families as it helps in determining eligibility for education tax credits and deductions. The Baker College 1098 T provides information on the amount billed for qualified tuition, scholarships, and grants received during the tax year. It is crucial for students to retain this form for accurate tax reporting and to take advantage of potential tax benefits.

How to obtain the Baker 1098 T

Students can obtain the Baker 1098 T form through their student account portal. Typically, Baker College provides access to this form electronically, allowing students to download and print it directly. In some cases, students may also receive a physical copy via mail. It is advisable for students to check their email and student portal notifications for updates regarding the availability of the form, usually issued by the end of January each year.

Steps to complete the Baker 1098 T

Completing the Baker 1098 T involves several straightforward steps. First, gather all necessary documentation, including tuition payment receipts and any financial aid information. Next, review the form for accuracy, ensuring that all personal details, such as the federal identification number, are correct. Enter the amounts for qualified tuition and related expenses in the appropriate fields. Finally, retain a copy of the completed form for your records and for filing your taxes.

Legal use of the Baker 1098 T

The Baker 1098 T form is legally binding and must be filled out accurately to comply with IRS regulations. It serves as a record of educational expenses and is used to support claims for tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. To ensure legal compliance, it is important to provide truthful information and maintain copies of all supporting documents in case of an audit.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Baker 1098 T form. According to IRS regulations, educational institutions are required to issue this form to students who have paid qualified tuition and related expenses. The form must be filed with the IRS, and students must use the information reported on the form when preparing their tax returns. Adhering to IRS guidelines ensures that students can accurately claim available tax benefits and avoid penalties.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Baker 1098 T. Typically, educational institutions must provide the form to students by January 31 of the following tax year. Students should ensure they have received their form by this date to prepare their tax returns accurately. Additionally, the deadline for filing federal tax returns is usually April 15, unless extended. Keeping track of these dates helps students avoid late filing penalties.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Baker 1098 T can result in penalties. If a student does not report the information accurately or fails to file the form, they may face fines from the IRS. It is crucial to ensure that all information is correct and submitted on time to avoid any potential legal issues or financial penalties. Understanding these consequences emphasizes the importance of careful completion and submission of the form.

Quick guide on how to complete baker 1098 t

Fill out Baker 1098 T effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Baker 1098 T on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Baker 1098 T with ease

- Find Baker 1098 T and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or missing files, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Baker 1098 T and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the baker 1098 t

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is Baker 1098 T and how can it benefit my business?

The Baker 1098 T is a crucial tax form used to report qualified tuition and related expenses. By utilizing airSlate SignNow, you can easily eSign and send this document, streamlining your tax preparation process. This form's integration with our platform simplifies the management of education-related expenses, making it easier for businesses to stay compliant and organized.

-

How does airSlate SignNow handle the Baker 1098 T form?

AirSlate SignNow provides a user-friendly interface that allows you to create, edit, and eSign the Baker 1098 T form efficiently. With our advanced features, you can customize the document to suit your needs while ensuring all necessary information is included. Our platform also allows for seamless sharing and storage of the completed forms.

-

Is there a cost to use airSlate SignNow for the Baker 1098 T?

AirSlate SignNow offers competitive pricing plans that cater to various business needs, including the management of the Baker 1098 T form. Our cost-effective solution ensures you can send and eSign documents without breaking the bank. Explore our pricing page for detailed information on plans and features.

-

Can I integrate airSlate SignNow with other tools for Baker 1098 T processing?

Yes, airSlate SignNow can be integrated with various applications to enhance your workflow when processing the Baker 1098 T form. Whether you use accounting software or CRM tools, our platform supports integrations that facilitate efficient document management and signing processes.

-

What security measures does airSlate SignNow implement for Baker 1098 T documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the Baker 1098 T. Our platform utilizes advanced encryption and secure servers to protect your information. Additionally, we comply with industry standards to ensure that your documents remain confidential and secure throughout the signing process.

-

Can multiple users collaborate on the Baker 1098 T form using airSlate SignNow?

Absolutely! AirSlate SignNow allows multiple users to collaborate on the Baker 1098 T form in real-time. This feature enables seamless communication and document editing, ensuring everyone involved has access to the most up-to-date information and can contribute to the completion of the form.

-

What types of businesses can benefit from using airSlate SignNow for Baker 1098 T forms?

Any business that deals with education expenses can benefit from using airSlate SignNow for the Baker 1098 T form. Whether you are a school, university, or educational service provider, our platform streamlines the eSigning process, making it easier to manage necessary documentation efficiently.

Get more for Baker 1098 T

- Faqssouth state bank form

- Commutingform18 19doc

- Employment of relatives approval form uf human resources

- Genetics 4 dominant and recessive alleles flashcardsquizlet form

- Travel forms forms travel office texas state university

- Preliminary technology assessment report volume ii c form

- Mail code l453 form

- 2020 hunter form

Find out other Baker 1098 T

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe