V Form

What is the V Form

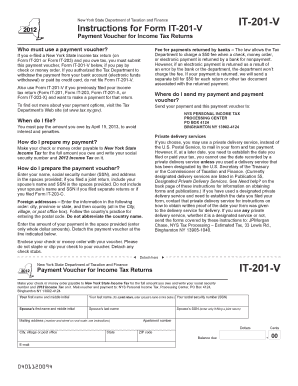

The IT-201-V form, commonly referred to as the V Form, is a payment voucher used by taxpayers in New York State. This form is specifically designed for individuals who need to make payments related to their personal income tax returns. It serves as a means to submit payments electronically or via mail, ensuring that taxpayers can fulfill their obligations efficiently and accurately. The V Form is essential for those who owe taxes and want to avoid penalties by making timely payments.

How to use the V Form

Using the IT-201-V form is straightforward. Taxpayers must complete the form with their personal information, including their name, address, and Social Security number. Additionally, they should indicate the payment amount and the tax year for which the payment is being made. Once completed, the form can be submitted along with the payment, either electronically through an authorized platform or by mailing it to the specified address. Ensuring accuracy in the details provided on the form is crucial to avoid processing delays.

Steps to complete the V Form

Completing the IT-201-V form involves several key steps:

- Gather necessary information, including your Social Security number and the amount you owe.

- Download or access the IT-201-V form from the New York State Department of Taxation and Finance website.

- Fill in your personal details accurately, ensuring that your name and address match your tax return.

- Specify the payment amount and the tax year for which you are making the payment.

- Review the form for accuracy before submitting it.

- Choose your submission method: electronically or by mail.

Legal use of the V Form

The IT-201-V form is legally recognized for making tax payments in New York State. When completed correctly and submitted on time, it ensures compliance with state tax laws. Using the V Form helps taxpayers avoid penalties associated with late payments. It is important to retain a copy of the completed form and any payment confirmation for personal records, as this documentation may be needed for future reference or in case of disputes.

Filing Deadlines / Important Dates

Timely submission of the IT-201-V form is critical. The filing deadline for personal income tax payments typically coincides with the tax return due date, which is usually April fifteenth for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Taxpayers should also be aware of any extensions that may apply. Staying informed about these dates helps ensure that payments are made promptly and without incurring penalties.

Required Documents

To complete the IT-201-V form, taxpayers need to have certain documents on hand. These typically include:

- Your most recent tax return, which provides necessary personal information.

- Any notices or correspondence from the New York State Department of Taxation and Finance regarding your tax obligations.

- Payment information, such as bank details if paying electronically.

Having these documents ready can streamline the process of filling out the V Form and ensure accuracy in the information provided.

Quick guide on how to complete v form

Effortlessly Prepare V Form on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Manage V Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign V Form with Ease

- Find V Form and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for sharing your form: via email, text message (SMS), invitation link, or download it to your computer.

Disregard lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign V Form and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the v form

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is it 201 v. and how does it relate to airSlate SignNow?

It 201 v. refers to the specific version of airSlate SignNow that includes enhanced features and functionalities for eSigning and document management. This version is designed to streamline business processes, making it easier to send and sign documents electronically.

-

How much does the it 201 v. version of airSlate SignNow cost?

The pricing for the it 201 v. version of airSlate SignNow is competitive and offers various plans tailored to different business needs. You can choose a plan that fits your budget while accessing robust eSigning capabilities and document workflows.

-

What are the key features of it 201 v. in airSlate SignNow?

It 201 v. comes packed with features such as customizable templates, multi-party signing, automated workflows, and real-time tracking. These features enhance efficiency and ensure that your document signing process is smooth and secure.

-

How does airSlate SignNow's it 201 v. improve business productivity?

Using it 201 v. of airSlate SignNow can signNowly improve business productivity by reducing the time spent on manual document handling. The platform automates signing processes, allowing teams to focus on more strategic tasks while ensuring compliance and security.

-

Can it 201 v. integrate with other applications?

Yes, it 201 v. of airSlate SignNow offers integration capabilities with popular software and applications, enhancing its functionality. This means you can seamlessly connect it with your existing tools, making your document workflow even more efficient.

-

What benefits does it 201 v. offer for remote teams?

It 201 v. provides signNow benefits for remote teams, such as the ability to review, sign, and send documents from anywhere. This increases collaboration among team members and ensures that projects stay on track, regardless of location.

-

Is it 201 v. suitable for small businesses?

Absolutely! It 201 v. is designed to be user-friendly and cost-effective, making it perfect for small businesses looking to enhance their document management processes. Its scalability allows for growth without the need for extensive training.

Get more for V Form

Find out other V Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document