Ex A1 Form

What is the Ex A1

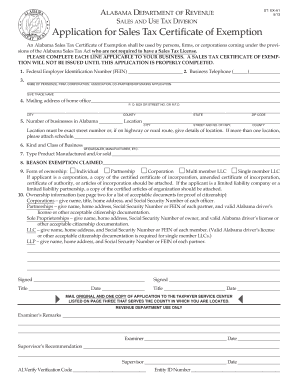

The Ex A1 form is a crucial document used in Alabama for claiming a sales tax exemption. This form allows eligible entities, such as non-profit organizations and certain government agencies, to purchase goods and services without paying sales tax. By completing the Ex A1, businesses can ensure compliance with state tax regulations while maximizing their financial resources.

How to use the Ex A1

Using the Ex A1 form involves several steps to ensure proper completion and submission. First, determine if your organization qualifies for the exemption. Next, fill out the form accurately, providing all required information, including the name of the organization, address, and the specific reason for the exemption. Once completed, present the form to vendors at the time of purchase to avoid sales tax charges.

Steps to complete the Ex A1

Completing the Ex A1 form requires careful attention to detail. Follow these steps:

- Gather necessary information about your organization, including tax identification numbers.

- Clearly state the purpose of the exemption on the form.

- Ensure all fields are filled out completely and accurately.

- Review the form for any errors or omissions before submission.

Legal use of the Ex A1

The legal use of the Ex A1 form is governed by Alabama state tax laws. To ensure the form is recognized as valid, it must be used solely by eligible entities for qualifying purchases. Misuse of the form can lead to penalties, including back taxes and fines. It is essential to maintain proper documentation and records of all transactions made under this exemption.

Eligibility Criteria

Eligibility for using the Ex A1 form is limited to specific types of organizations. Generally, non-profit organizations, government entities, and certain educational institutions qualify for exemption. To confirm eligibility, organizations should review state guidelines and ensure they meet the necessary criteria before applying for the exemption.

Form Submission Methods

The Ex A1 form can be submitted in various ways, depending on the preferences of the vendor and the organization. Typically, it is presented in person at the time of purchase. However, some vendors may accept the form via email or fax. It is important to confirm the preferred submission method with the vendor to avoid any complications.

Quick guide on how to complete ex a1

Complete Ex A1 effortlessly on any device

Web-based document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Ex A1 on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Ex A1 with ease

- Obtain Ex A1 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Ex A1 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ex a1

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is an application sales tax exemption form?

An application sales tax exemption form is a document that allows qualified individuals or organizations to apply for exemption from sales tax. This form must be completed accurately to ensure compliance with tax regulations and to avoid unnecessary tax payments on eligible purchases.

-

How can airSlate SignNow help with the application sales tax exemption form?

airSlate SignNow offers a streamlined process for completing and eSigning your application sales tax exemption form. Our platform ensures that your documents are easily accessible and securely signed, simplifying the submission process and enhancing efficiency.

-

What features does airSlate SignNow provide for signing the application sales tax exemption form?

With airSlate SignNow, you can easily create, edit, and sign your application sales tax exemption form. Our software includes templates, real-time collaboration, and secure storage, all designed to facilitate a hassle-free signing experience.

-

Is there a cost associated with using airSlate SignNow for the application sales tax exemption form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our pricing is competitive and includes features that simplify the process of managing your application sales tax exemption form, making our solution cost-effective for all users.

-

Can I integrate airSlate SignNow with other applications for managing my application sales tax exemption form?

Absolutely! airSlate SignNow provides seamless integrations with popular business applications such as Google Drive, Dropbox, and CRM systems. This allows you to efficiently manage your application sales tax exemption form alongside your other business processes.

-

What are the benefits of using airSlate SignNow for my application sales tax exemption form?

Using airSlate SignNow for your application sales tax exemption form offers numerous benefits, including increased efficiency, enhanced security, and ease of use. Our platform helps you speed up the signing process so you can focus on your core business operations.

-

How do I start using airSlate SignNow for my application sales tax exemption form?

To get started with airSlate SignNow, simply sign up for an account and choose a pricing plan that works for you. After that, you can upload, create, and manage your application sales tax exemption form right away with our user-friendly interface.

Get more for Ex A1

Find out other Ex A1

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement