1040a Form 2009

What is the 1040A Form

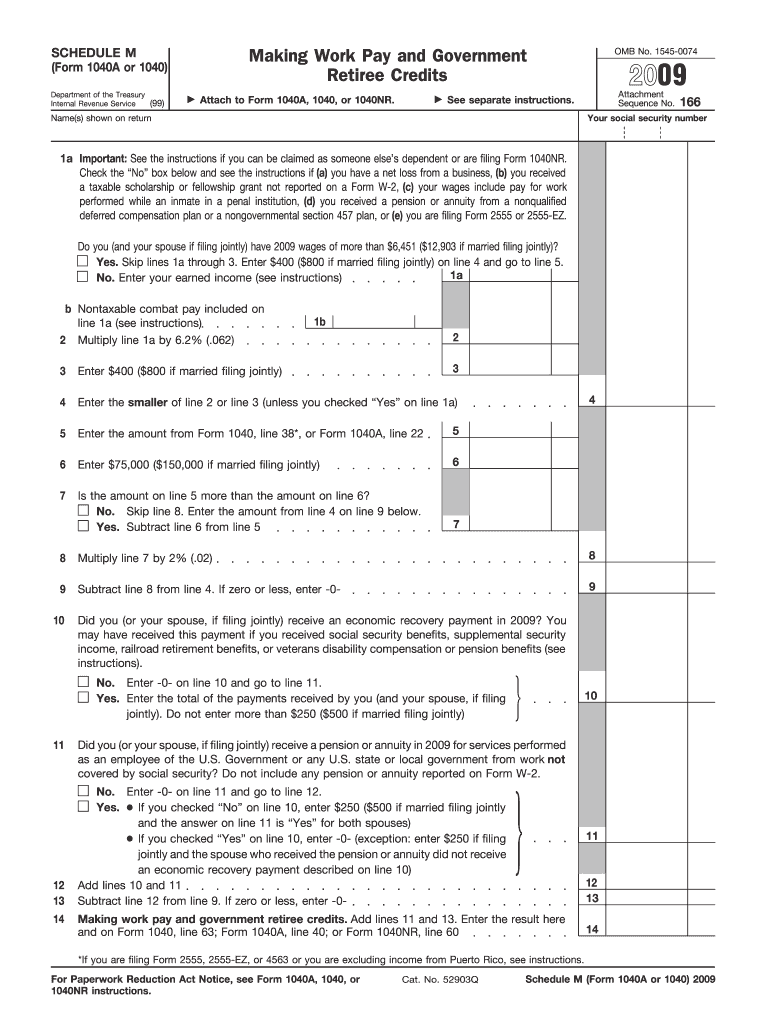

The 1040A Form is a simplified version of the standard IRS Form 1040, designed for taxpayers with straightforward tax situations. It allows individuals to report income, claim certain tax credits, and calculate their tax liability. This form is typically used by those who do not itemize deductions and have a limited number of income sources, such as wages, salaries, and certain pensions. The 1040A is particularly beneficial for taxpayers who meet specific eligibility criteria, making the filing process easier and more efficient.

How to Use the 1040A Form

Using the 1040A Form involves several steps to ensure accurate reporting of your financial information. First, gather all necessary documents, including W-2 forms, interest statements, and any other income records. Next, carefully follow the instructions provided on the form to input your income, deductions, and credits. It's essential to double-check your entries for accuracy before submitting the form to avoid potential issues with the IRS. Once completed, you can file the form electronically or by mail, depending on your preference.

Steps to Complete the 1040A Form

Completing the 1040A Form requires a systematic approach to ensure all information is accurately reported. Here are the key steps:

- Gather your financial documents, including income statements and deduction records.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income on the appropriate lines, including wages, interest, and dividends.

- Claim any eligible tax credits and deductions, such as the standard deduction.

- Calculate your total tax liability and any refund or amount owed.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mailing it to the appropriate IRS address.

Legal Use of the 1040A Form

The 1040A Form is legally recognized by the IRS as a valid method for reporting income and calculating taxes owed. To ensure compliance, taxpayers must adhere to IRS guidelines regarding eligibility and filing requirements. The form must be filled out accurately, and any discrepancies may lead to penalties or audits. It is essential to keep copies of the submitted form and any supporting documents for your records, as they may be required for future reference or in case of an audit.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 1040A Form to avoid penalties. Typically, the deadline for filing individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can request an extension to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete the 1040A Form accurately, several documents are necessary. These include:

- W-2 forms from employers detailing wages and tax withholdings.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Documentation for any tax credits or deductions being claimed, such as student loan interest statements.

- Records of any other income sources, including pensions or unemployment benefits.

Who Issues the Form

The 1040A Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the form and accompanying instructions on its official website, ensuring that taxpayers have access to the most current version and guidelines for filing. It is crucial for taxpayers to use the correct form version for the applicable tax year to ensure compliance with federal tax laws.

Quick guide on how to complete 2009 1040a form

Set up 1040a Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly and efficiently. Handle 1040a Form on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign 1040a Form without hassle

- Obtain 1040a Form and click Obtain Form to begin.

- Utilize the tools provided to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes a matter of seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Completed button to save your changes.

- Select how you wish to deliver your form: via email, SMS, an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require you to print new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign 1040a Form to ensure optimal communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 1040a form

Create this form in 5 minutes!

How to create an eSignature for the 2009 1040a form

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the 1040a Form and how is it used?

The 1040a Form is a simplified version of the standard 1040 tax form, designed for individuals with straightforward tax situations. It allows filers to report income, claim deductions, and calculate tax liability efficiently. Using the 1040a Form can streamline the tax-filing process for those who qualify.

-

How can airSlate SignNow help with digitally signing the 1040a Form?

airSlate SignNow provides an easy-to-use platform for digitally signing the 1040a Form, making the process quick and secure. With our solution, users can eSign documents from any device, ensuring that their tax forms are properly executed and submitted on time. This enhances efficiency and reduces the hassle of manual signatures.

-

Are there any costs associated with using airSlate SignNow to fill out the 1040a Form?

Yes, airSlate SignNow offers a variety of pricing plans tailored to fit different needs, including individuals and businesses. Depending on the plan you choose, you can enjoy a number of features that facilitate the preparation and signing of the 1040a Form. Our pricing is competitive, offering a cost-effective solution for your document management.

-

What features does airSlate SignNow offer for managing the 1040a Form?

AirSlate SignNow includes features such as customizable templates, secure storage, and integration with various applications that make managing the 1040a Form seamless. Users can also track document statuses and receive notifications when their forms are signed. These tools ensure that you remain organized and compliant during tax season.

-

Can I store my completed 1040a Form securely with airSlate SignNow?

Absolutely! AirSlate SignNow provides secure cloud storage for all your documents, including completed 1040a Forms. Our platform complies with industry-standard security protocols, ensuring that your sensitive tax information remains protected. You can confidently store and access your forms whenever required.

-

Is it easy to integrate airSlate SignNow with other tax preparation software for the 1040a Form?

Yes, airSlate SignNow offers strong integrations with various tax preparation software, making it easy to utilize alongside your existing tools for the 1040a Form. This compatibility allows for efficient data transfer and document management. You can streamline your workflow, reducing the chances of errors during tax preparation.

-

How does airSlate SignNow enhance the efficiency of filing the 1040a Form?

AirSlate SignNow enhances efficiency by allowing users to prepare, sign, and send the 1040a Form digitally in just a few clicks. With features such as document routing and automated reminders, users can ensure timely submission of their forms. This helps eliminate delays and keeps your tax filing process on track.

Get more for 1040a Form

- Mississippi non disclosure agreement nda template form

- North carolina secretary of state notary notary form

- In district court county of state of north dakota case no form

- Affidavit of petitioner north dakota download fillable form

- Nj licensed plumber form

- Nm form 4 505

- Pdffiller dps 423 form

- Short deed trust form

Find out other 1040a Form

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast