Form 4563 Rev October Exclusion of Income for Bona Fide Residents of American Samoa

Understanding IRS Form 4563

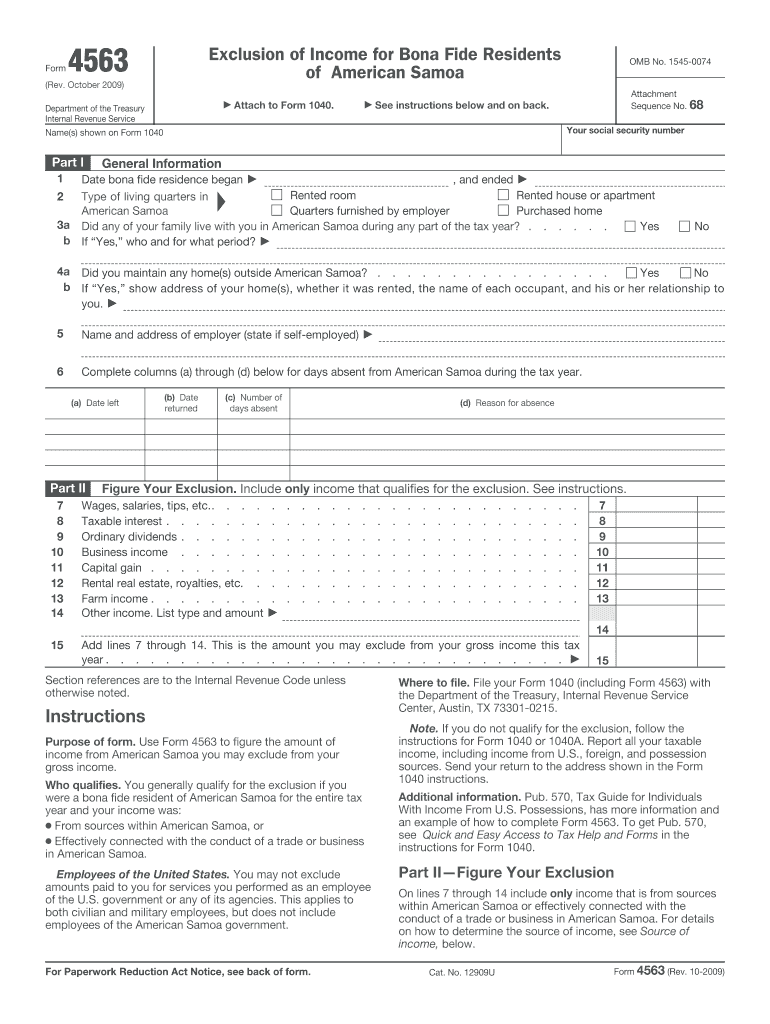

IRS Form 4563 is officially known as the Exclusion of Income for Bona Fide Residents of American Samoa. This tax form is designed for individuals who qualify as bona fide residents of American Samoa and wish to exclude certain types of income from their federal tax returns. The purpose of this form is to facilitate the reporting of income that is exempt from U.S. federal taxation under specific conditions outlined by the IRS.

Steps to Complete IRS Form 4563

Completing IRS Form 4563 involves several key steps to ensure accurate reporting. First, gather all necessary documentation that supports your claim for income exclusion. This includes proof of residency in American Samoa and details about your income sources. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Be sure to accurately report your income and indicate the amount you are excluding. Finally, review the form for any errors before submission to avoid delays or complications.

Eligibility Criteria for IRS Form 4563

To qualify for the exclusions available on IRS Form 4563, you must meet specific eligibility criteria. You must be a bona fide resident of American Samoa for the entire tax year and must not have a tax home outside of American Samoa during that period. Additionally, the income you wish to exclude must be derived from sources within American Samoa. Understanding these criteria is essential to ensure compliance and to maximize your tax benefits.

Obtaining IRS Form 4563

IRS Form 4563 can be easily obtained through the IRS website or by contacting the IRS directly. The form is available in PDF format, which allows for easy printing and completion. If you prefer a digital approach, many tax preparation software solutions also offer the capability to fill out and e-file this form, streamlining the process for taxpayers.

Legal Use of IRS Form 4563

The legal use of IRS Form 4563 is governed by IRS guidelines, which stipulate that the form must be filed accurately and on time to qualify for the income exclusion. Failure to comply with these regulations may result in penalties or disqualification from claiming the exclusion. It is crucial to understand the legal implications of using this form, including the need for proper documentation and adherence to filing deadlines.

Filing Deadlines for IRS Form 4563

Filing deadlines for IRS Form 4563 align with the standard federal tax filing deadlines. Typically, the form must be submitted by April 15 of the following tax year, unless an extension has been granted. It is important to keep track of these deadlines to avoid late filing penalties and to ensure that you receive any applicable tax benefits in a timely manner.

Quick guide on how to complete form 4563 rev october 2009 exclusion of income for bona fide residents of american samoa

Accomplish Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It presents an excellent environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without delays. Manage Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused task today.

How to modify and electronically sign Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa with ease

- Locate Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information thoroughly and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4563 rev october 2009 exclusion of income for bona fide residents of american samoa

How to create an eSignature for the Form 4563 Rev October 2009 Exclusion Of Income For Bona Fide Residents Of American Samoa in the online mode

How to create an electronic signature for the Form 4563 Rev October 2009 Exclusion Of Income For Bona Fide Residents Of American Samoa in Chrome

How to make an eSignature for signing the Form 4563 Rev October 2009 Exclusion Of Income For Bona Fide Residents Of American Samoa in Gmail

How to make an electronic signature for the Form 4563 Rev October 2009 Exclusion Of Income For Bona Fide Residents Of American Samoa from your smart phone

How to make an eSignature for the Form 4563 Rev October 2009 Exclusion Of Income For Bona Fide Residents Of American Samoa on iOS

How to make an electronic signature for the Form 4563 Rev October 2009 Exclusion Of Income For Bona Fide Residents Of American Samoa on Android

People also ask

-

What is Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa?

Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa is a tax form used by residents of American Samoa to exclude specific types of income from their federal tax obligations. This form is essential for ensuring that bona fide residents can accurately report their income and take advantage of relevant exclusions under U.S. tax law.

-

How can airSlate SignNow help with Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa?

airSlate SignNow simplifies the process of completing and eSigning Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa. Our platform allows users to fill out the form electronically, ensuring accuracy and compliance while saving time in the submission process.

-

What are the pricing options for using airSlate SignNow for Form 4563 Rev October?

airSlate SignNow offers flexible pricing plans suitable for individuals and businesses needing to manage Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa. Our plans are designed to be cost-effective, providing access to essential features for efficient document management and eSigning.

-

Are there any specific features in airSlate SignNow that assist with tax forms like Form 4563 Rev October?

Yes, airSlate SignNow includes features such as templates for Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa, customizable fields, and secure cloud storage. These features enhance the user experience, making it easier to complete and manage tax-related documents quickly.

-

Can I integrate airSlate SignNow with other software for managing Form 4563 Rev October?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax software, allowing for streamlined management of Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa. This integration ensures that all your important documents are easily accessible and organized.

-

What benefits does airSlate SignNow provide for users working with Form 4563 Rev October?

Using airSlate SignNow for Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa offers numerous benefits, including increased efficiency, enhanced security, and ease of use. Users can quickly complete and sign documents from anywhere, reducing the risk of errors and delays.

-

Is airSlate SignNow suitable for individuals filing Form 4563 Rev October?

Yes, airSlate SignNow is an excellent choice for individuals filing Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa. Our user-friendly interface makes it simple for anyone to manage their tax forms without needing extensive technical knowledge.

Get more for Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa

- Irs 3125 publication form

- Blumberg p193 lease filled out form

- Fed publication 4345 form

- Publication 3864 rev june 2002 tax facts for seniors with a change in marital status form

- Publication 3204 form

- Local damage assessment form for flood victims tazewellcounty

- Raffles rules ampamp conditions current updated psq form

- 002 legal civil petition form

Find out other Form 4563 Rev October Exclusion Of Income For Bona Fide Residents Of American Samoa

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online