Axa Guaranteed Growth Annuity 2004-2026

What is the Axa Guaranteed Growth Annuity

The Axa Guaranteed Growth Annuity is a financial product designed to provide a steady income stream while ensuring the principal investment grows over time. This type of annuity typically offers a guaranteed interest rate, allowing individuals to plan for retirement or other long-term financial goals with confidence. The growth is often tax-deferred, meaning that taxes on earnings are postponed until withdrawal, which can be beneficial for long-term savers.

How to use the Axa Guaranteed Growth Annuity

Using the Axa Guaranteed Growth Annuity involves selecting the appropriate investment strategy based on personal financial goals. Investors can choose how much to contribute and when to withdraw funds. The annuity can be structured to provide regular payments during retirement or as a lump sum at a specified date. Understanding the terms and conditions is essential to maximize benefits and ensure compliance with withdrawal rules.

Steps to complete the Axa Guaranteed Growth Annuity

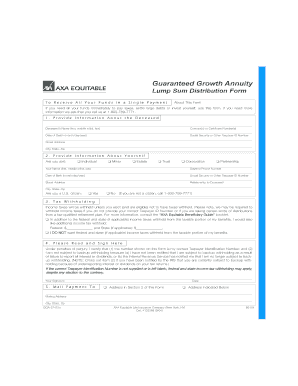

Completing the Axa Guaranteed Growth Annuity form involves several key steps:

- Gather necessary personal and financial information, including identification and income details.

- Review the terms of the annuity, including interest rates and withdrawal options.

- Fill out the application form accurately, ensuring all sections are completed.

- Submit the form through the designated method, whether online, by mail, or in person.

- Keep a copy of the submitted form for your records.

Legal use of the Axa Guaranteed Growth Annuity

The legal use of the Axa Guaranteed Growth Annuity is governed by federal and state regulations. It is crucial to ensure that all information provided in the application is truthful and complies with legal standards. Misrepresentation can lead to penalties or denial of benefits. Additionally, understanding the tax implications and withdrawal restrictions is vital for maintaining compliance with IRS guidelines.

Eligibility Criteria

Eligibility for the Axa Guaranteed Growth Annuity typically requires individuals to meet certain criteria, such as age and residency requirements. Applicants usually need to be at least eighteen years old and a resident of the state where the annuity is being offered. Financial stability may also be assessed to ensure that the annuity aligns with the individual's investment strategy and retirement planning.

Required Documents

To complete the Axa Guaranteed Growth Annuity application, several documents may be required, including:

- Proof of identity, such as a driver's license or passport.

- Social Security number for tax purposes.

- Financial statements that demonstrate income and assets.

- Any previous annuity contracts or investment documents, if applicable.

Form Submission Methods

The Axa Guaranteed Growth Annuity form can be submitted through various methods, ensuring convenience for applicants. Options typically include:

- Online submission via a secure portal, which allows for quick processing.

- Mailing the completed form to the designated address, ensuring it is sent with adequate postage.

- In-person submission at a local Axa office, allowing for immediate assistance and clarification of any questions.

Quick guide on how to complete axa guaranteed growth annuity

Complete Axa Guaranteed Growth Annuity easily on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents rapidly without delays. Manage Axa Guaranteed Growth Annuity on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Axa Guaranteed Growth Annuity with ease

- Locate Axa Guaranteed Growth Annuity and click Get Form to initiate.

- Utilize the tools provided to fill out your document.

- Mark important sections of the documents or redact sensitive information using tools that airSlate SignNow specially provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to store your modifications.

- Choose how you prefer to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Axa Guaranteed Growth Annuity and maintain excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the axa guaranteed growth annuity

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the AXA Guaranteed Growth Annuity?

The AXA Guaranteed Growth Annuity is a financial product designed to provide clients with guaranteed growth of their investments while offering protection against market volatility. This annuity guarantees a minimum return, ensuring that your initial investment grows safely over time. It’s an ideal option for those looking to secure a stable income for retirement.

-

What are the main features of the AXA Guaranteed Growth Annuity?

Key features of the AXA Guaranteed Growth Annuity include a guaranteed interest rate, tax-deferred growth, and flexible payout options. This annuity allows you to plan your retirement savings while enjoying the peace of mind that comes with guaranteed returns. Additionally, it may offer options for enhanced benefits such as death or disability riders.

-

How does the AXA Guaranteed Growth Annuity compare to other investment options?

Compared to other investment options, the AXA Guaranteed Growth Annuity stands out due to its guaranteed returns and tax advantages. While stocks and mutual funds can offer potentially higher returns, they come with signNow risks, unlike AXA's guaranteed growth approach. This makes AXA a safer choice for conservative investors.

-

Are there any fees associated with the AXA Guaranteed Growth Annuity?

Yes, the AXA Guaranteed Growth Annuity may have associated fees, which can include administrative fees or surrender charges if funds are withdrawn early. It's essential to review the specific terms and conditions with a licensed agent to understand any applicable costs. Knowing these fees upfront will help you make informed decisions about your investment.

-

What are the benefits of choosing the AXA Guaranteed Growth Annuity?

Choosing the AXA Guaranteed Growth Annuity offers numerous benefits, including a predictable income stream and the comfort of guaranteed growth regardless of market conditions. This annuity helps to protect your retirement savings while providing potential tax deferrals on accrued earnings. It’s designed for long-term financial security.

-

Can I customize my AXA Guaranteed Growth Annuity?

Yes, the AXA Guaranteed Growth Annuity can be customized to fit your financial goals and needs. You can choose different riders for additional benefits, adjust the payout schedule, and select investment options that align with your risk tolerance. This flexibility allows you to tailor the annuity to better serve your retirement strategy.

-

How can I integrate my AXA Guaranteed Growth Annuity with other financial products?

Integrating your AXA Guaranteed Growth Annuity with other financial products is straightforward, as many financial advisors and products recognize the importance of a diversified portfolio. By combining the annuity with other investments such as mutual funds or retirement accounts, you can create a well-rounded strategy for long-term growth and income. Consulting a financial advisor can provide insights on effective integration.

Get more for Axa Guaranteed Growth Annuity

Find out other Axa Guaranteed Growth Annuity

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy