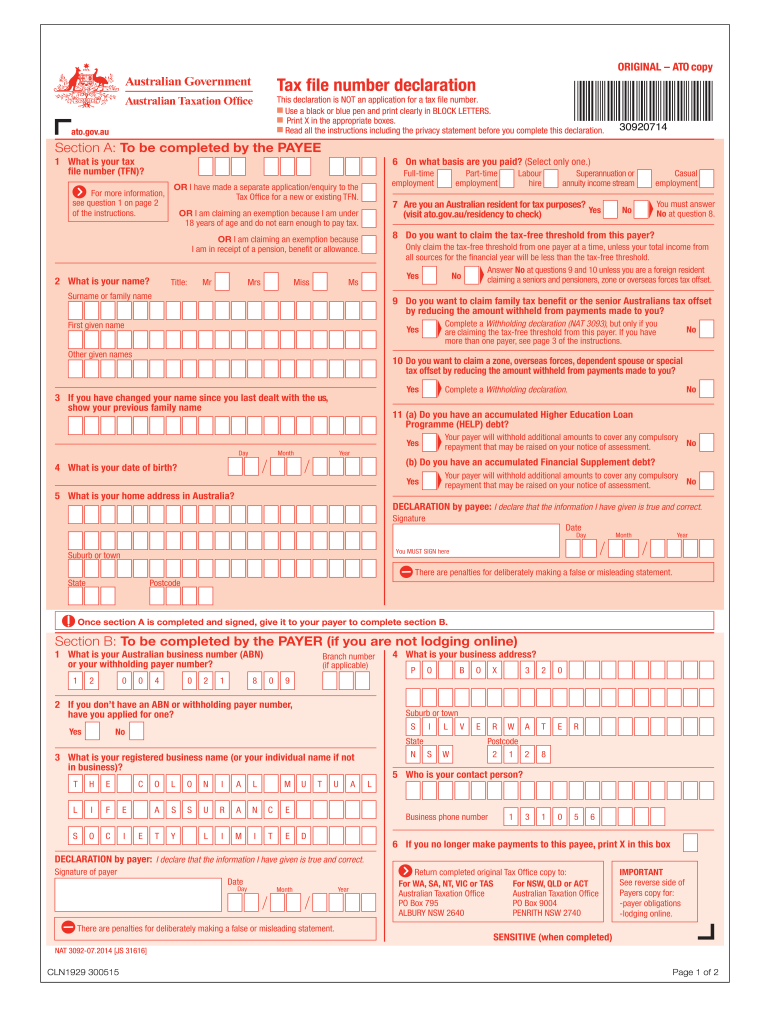

Tax File Declaration Form 2015

What is the Tax File Declaration Form

The Tax File Declaration Form is an essential document used by employees in the United States to declare their tax status to their employer. This form collects information about an employee's tax situation, including their filing status, exemptions, and any additional withholding preferences. It ensures that the correct amount of federal income tax is withheld from an employee's paycheck, helping to prevent underpayment or overpayment of taxes throughout the year.

How to use the Tax File Declaration Form

To use the Tax File Declaration Form, an employee must first obtain the form from their employer or the appropriate tax authority. After filling out the required information, the employee submits the form to their employer's payroll department. It is important to ensure that all information is accurate and up-to-date, as this will affect the tax withholding from their paycheck. Employees should review their tax situation periodically, especially after significant life changes, to determine if a new form needs to be submitted.

Steps to complete the Tax File Declaration Form

Completing the Tax File Declaration Form involves several straightforward steps:

- Obtain the form from your employer or download it from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- List any exemptions you qualify for, which can reduce your taxable income.

- Specify any additional amount you wish to withhold from your paycheck.

- Review the completed form for accuracy and sign it.

- Submit the form to your employer's payroll department.

Legal use of the Tax File Declaration Form

The Tax File Declaration Form is legally binding when completed accurately and submitted to the employer. It complies with federal tax laws that require employers to withhold the correct amount of tax from employee wages. Employees must ensure that the information provided is truthful and reflects their current tax situation to avoid penalties or issues with the IRS. Employers are also required to keep these forms on file for record-keeping and compliance purposes.

Key elements of the Tax File Declaration Form

Several key elements are essential for the Tax File Declaration Form:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Indicates whether the employee is single, married, or head of household.

- Exemptions: Details any exemptions that can reduce taxable income.

- Additional Withholding: Allows employees to specify extra amounts to be withheld from their paychecks.

- Signature: The employee's signature certifies that the information is accurate and complete.

Form Submission Methods

The Tax File Declaration Form can be submitted through various methods, depending on the employer's policies:

- Online Submission: Many employers offer electronic submission through payroll systems.

- Mail: Employees may also send a physical copy of the form to their employer's payroll department.

- In-Person: Submitting the form directly to the payroll office is another option for employees.

Quick guide on how to complete tax file declaration form 2015

Manage Tax File Declaration Form effortlessly on any gadget

Digital document handling has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Tax File Declaration Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

Steps to modify and eSign Tax File Declaration Form with ease

- Locate Tax File Declaration Form and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Tax File Declaration Form and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax file declaration form 2015

Create this form in 5 minutes!

How to create an eSignature for the tax file declaration form 2015

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is a Tax File Declaration Form?

A Tax File Declaration Form is a document used by employees in Australia to provide their tax information to their employer. This form is essential for ensuring that taxes are withheld correctly from employee wages. Using airSlate SignNow, you can easily create and eSign your Tax File Declaration Form to streamline the process.

-

How can airSlate SignNow help with my Tax File Declaration Form?

airSlate SignNow simplifies the process of creating and signing your Tax File Declaration Form. With our user-friendly interface, you can fill out the form electronically, ensuring all necessary details are accurately captured. Additionally, our platform allows for quick eSigning to expedite the submission process.

-

Is there a cost associated with using airSlate SignNow for the Tax File Declaration Form?

Yes, airSlate SignNow offers a range of pricing plans to accommodate businesses of all sizes. Our plans are cost-effective and designed to provide maximum value for managing your documents, including the Tax File Declaration Form. You can select a plan based on your organization's needs and budget.

-

What features does airSlate SignNow offer for managing documents like the Tax File Declaration Form?

airSlate SignNow provides numerous features for managing documents, including customizable templates, secure eSignature capabilities, and cloud storage. For the Tax File Declaration Form, these features ensure that you can efficiently complete and manage your document while maintaining security and compliance.

-

Can I integrate airSlate SignNow with other software for handling the Tax File Declaration Form?

Yes, airSlate SignNow supports integrations with various software applications, making it easy to manage your Tax File Declaration Form alongside your existing tools. Whether it's payroll software, human resource management systems, or cloud storage solutions, our integrations streamline your workflow.

-

How secure is my information when using airSlate SignNow for the Tax File Declaration Form?

Security is a top priority at airSlate SignNow. When you use our platform for your Tax File Declaration Form, your information is protected with industry-standard encryption and security protocols. This ensures that your sensitive data remains confidential and safeguarded during the eSigning process.

-

Can I track the status of my Tax File Declaration Form with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking capabilities that allow you to monitor the status of your Tax File Declaration Form in real time. You will receive notifications when the document is viewed, signed, and completed, enhancing your document management experience.

Get more for Tax File Declaration Form

Find out other Tax File Declaration Form

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word