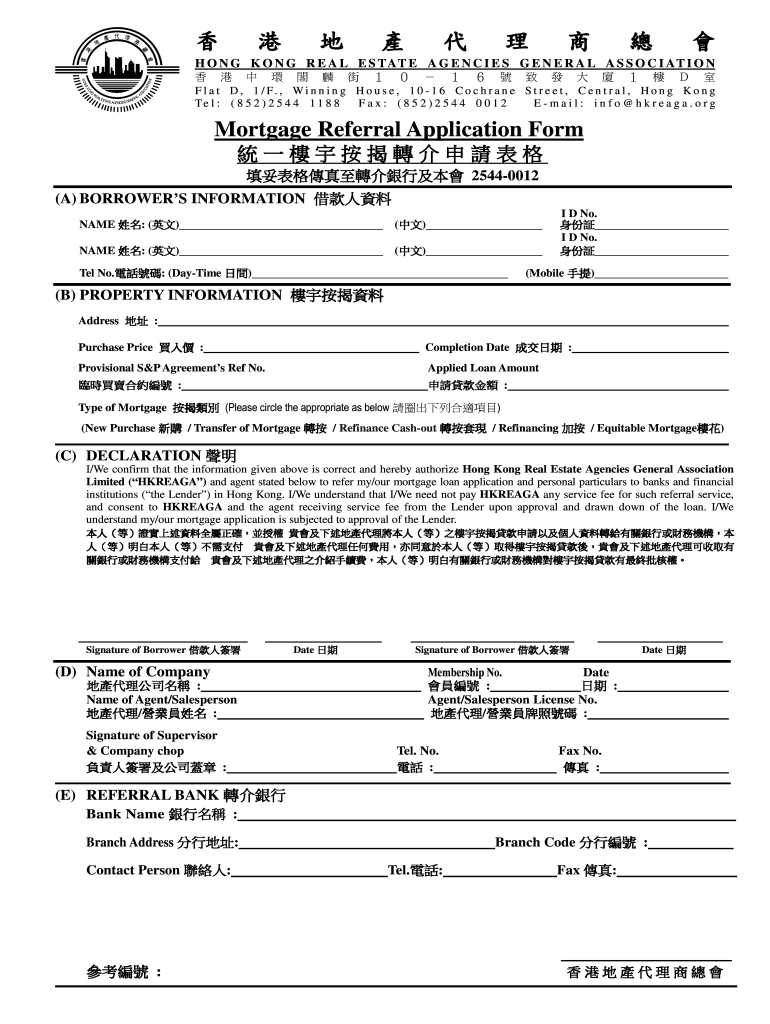

Mortgage Referral Application Form

What is the Mortgage Referral Application Form

The Mortgage Referral Application Form, also known as the hk hkreaga application, is a crucial document used in the mortgage process. This form allows individuals or entities to refer potential borrowers to lenders, facilitating the initiation of mortgage applications. It serves as an official request for lenders to evaluate the financial qualifications of the referred parties. Understanding this form is essential for both referrers and borrowers, as it outlines the necessary information required for processing mortgage applications.

How to use the Mortgage Referral Application Form

Using the Mortgage Referral Application Form involves several straightforward steps. First, ensure you have the correct version of the hk hkreaga form, which can be obtained online or through authorized channels. Next, fill out the form with accurate details about the borrower, including their financial information and contact details. Once completed, the form can be submitted electronically, ensuring that all required fields are filled to avoid processing delays. Utilizing digital tools for this process enhances efficiency and ensures secure transmission of sensitive information.

Steps to complete the Mortgage Referral Application Form

Completing the Mortgage Referral Application Form involves a series of steps that ensure accuracy and compliance. Begin by gathering all necessary information about the borrower, including their income, credit history, and property details. Next, accurately fill in each section of the form, paying close attention to details such as names, addresses, and financial figures. After completing the form, review it for any errors or omissions. Finally, submit the form through the designated method, whether online or via mail, ensuring you keep a copy for your records.

Legal use of the Mortgage Referral Application Form

The legal use of the Mortgage Referral Application Form is governed by various regulations that ensure its validity. To be legally binding, the form must be completed in accordance with relevant laws, such as the ESIGN Act and UETA, which govern electronic signatures and documents in the United States. It is important to ensure that all parties involved understand the implications of the information provided in the form, as it may affect their financial obligations and rights. Using a reputable digital signing solution can further enhance the legal standing of the completed form.

Key elements of the Mortgage Referral Application Form

Key elements of the Mortgage Referral Application Form include essential information that must be accurately captured for effective processing. These elements typically consist of the borrower's personal details, including full name, contact information, and social security number. Financial information such as income, employment status, and existing debts are also critical. Additionally, the form may require details about the property being financed, including its address and estimated value. Ensuring that all these elements are complete and correct is vital for a smooth referral process.

Eligibility Criteria

Eligibility criteria for the Mortgage Referral Application Form typically include specific financial and personal qualifications that borrowers must meet. Generally, lenders assess factors such as credit scores, income levels, and employment history to determine a borrower's suitability for a mortgage. It is important for referrers to understand these criteria to ensure that they are referring individuals who are likely to qualify for a mortgage. Being aware of these requirements can streamline the referral process and increase the chances of successful loan approval.

Quick guide on how to complete mortgage referral application form

Complete Mortgage Referral Application Form easily on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed papers, as you can access the correct form and securely save it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Manage Mortgage Referral Application Form on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to adjust and electronically sign Mortgage Referral Application Form with ease

- Obtain Mortgage Referral Application Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Mortgage Referral Application Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage referral application form

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is hk hkreaga mortgage?

The hk hkreaga mortgage is a financial product designed for individuals looking to make property investments in Hong Kong. It provides borrowers with competitive rates and flexible repayment options, ensuring they can finance their dreams efficiently. Understanding this mortgage can help you navigate the Hong Kong property market more effectively.

-

How can airSlate SignNow assist with hk hkreaga mortgage applications?

airSlate SignNow simplifies the hk hkreaga mortgage application process by allowing you to eSign and send documents securely and swiftly. With its user-friendly platform, you can manage your mortgage paperwork without the hassle of physical documents. This efficiency can speed up your approval times and streamline your financing journey.

-

What are the key features of the hk hkreaga mortgage?

The hk hkreaga mortgage typically includes features like competitive interest rates, flexible repayment terms, and support for different property types. Understanding these features can help you choose the best mortgage option for your investment goals. airSlate SignNow can help you handle all the necessary documentation efficiently.

-

What are the benefits of choosing hk hkreaga mortgage?

Choosing an hk hkreaga mortgage offers several benefits, including access to favorable loan conditions and the potential for property appreciation. This mortgage can also help you establish a reliable credit history in Hong Kong's financial system. By using airSlate SignNow, you can manage all related documents electronically and streamline your financing experience.

-

How much can I expect to pay for an hk hkreaga mortgage?

The cost of an hk hkreaga mortgage can vary based on the lender, loan amount, and interest rate options available. It's advisable to compare different offers and consider associated fees, such as appraisal and processing fees. Utilizing airSlate SignNow can help you easily compile and organize this information for better decision-making.

-

What documents do I need for an hk hkreaga mortgage?

To apply for an hk hkreaga mortgage, you generally need proof of income, identification, financial statements, and property details. Ensuring you have these documents ready can expedite the application process. airSlate SignNow allows you to upload and eSign these documents seamlessly, making the submission process much simpler.

-

Can I refinance my hk hkreaga mortgage through airSlate SignNow?

Yes, you can refinance your hk hkreaga mortgage through airSlate SignNow by preparing the necessary paperwork and eSigning the new mortgage agreement. Refinancing may help you secure better interest rates or change loan terms to suit your current financial situation. Using airSlate SignNow ensures that all documents are handled efficiently throughout the refinancing process.

Get more for Mortgage Referral Application Form

Find out other Mortgage Referral Application Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy