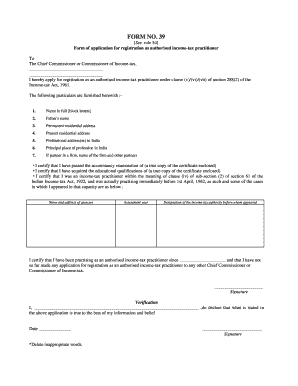

Form 39 See Rule 54 of Income Tax

What is the Form 39 under Rule 54 of Income Tax?

The Form 39 is a crucial document in the context of income tax compliance in the United States. It serves as a declaration for individuals or entities seeking to report specific financial details as mandated by the Internal Revenue Service (IRS). This form is particularly relevant for taxpayers who need to disclose particular types of income or deductions that may not be covered under standard filing procedures. Understanding its purpose is essential for ensuring compliance with tax regulations.

Steps to Complete the Form 39 under Rule 54 of Income Tax

Completing the Form 39 involves a series of steps that ensure accurate reporting of financial information. Here are the key steps:

- Gather necessary financial documents, including income statements and receipts for deductions.

- Fill out personal identification information, ensuring accuracy in names and social security numbers.

- Detail specific income sources and any applicable deductions in the designated sections of the form.

- Review the completed form for errors or omissions before submission.

- Sign and date the form to validate the information provided.

Legal Use of the Form 39 under Rule 54 of Income Tax

The legal framework surrounding the Form 39 is defined by IRS regulations, which dictate how and when this form should be used. It is essential for taxpayers to understand that the information provided must be truthful and complete to avoid penalties. The form may be subject to audits, and inaccuracies can lead to legal repercussions. Therefore, ensuring compliance with the legal requirements is paramount.

Required Documents for Form 39 under Rule 54 of Income Tax

To successfully complete the Form 39, certain documents are required. These include:

- W-2 forms or 1099 forms that report income.

- Receipts for any deductible expenses.

- Previous year’s tax return for reference.

- Any additional documentation that supports claims made on the form.

Filing Deadlines for Form 39 under Rule 54 of Income Tax

Timely submission of the Form 39 is critical to avoid penalties. The IRS typically sets specific deadlines for form submissions, which may vary based on individual circumstances. Generally, taxpayers should aim to file their forms by April 15 of the following tax year. Extensions may be available, but they require separate applications and do not exempt taxpayers from timely payment of any taxes owed.

Examples of Using the Form 39 under Rule 54 of Income Tax

Practical examples of when to use the Form 39 include:

- Reporting freelance income that does not appear on a standard W-2.

- Claiming deductions for business expenses incurred while working from home.

- Disclosing income from rental properties or investments that require detailed reporting.

Quick guide on how to complete form 39 see rule 54 of income tax

Complete Form 39 See Rule 54 Of Income Tax effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Handle Form 39 See Rule 54 Of Income Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 39 See Rule 54 Of Income Tax effortlessly

- Find Form 39 See Rule 54 Of Income Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight key sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which requires just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all entries and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or a shareable link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Form 39 See Rule 54 Of Income Tax to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 39 see rule 54 of income tax

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 39 and how can airSlate SignNow assist with it?

Form 39 is a specific document often used for various administrative purposes. airSlate SignNow streamlines the process of filling out, sending, and electronically signing Form 39, ensuring compliance and efficiency in document management.

-

What features does airSlate SignNow offer for managing Form 39?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure cloud storage specifically for Form 39. These tools enhance the ease of use while ensuring that your documents are processed swiftly and securely.

-

How much does it cost to use airSlate SignNow for Form 39 processing?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains affordable for businesses of all sizes. Our plans cater to your needs for processing Form 39 efficiently, allowing you to select a subscription that best fits your budget.

-

Is airSlate SignNow secure for signing Form 39 documents?

Yes, airSlate SignNow employs industry-leading security measures to protect your documents, including Form 39. With features like encryption and secure access controls, you can trust that your sensitive information is safe.

-

Can I integrate airSlate SignNow with other software for processing Form 39?

Absolutely! airSlate SignNow offers numerous integrations with popular tools, enabling seamless workflows for processing Form 39 documents. Whether you use CRM software or document management systems, our integrations enhance productivity.

-

What are the benefits of using airSlate SignNow for Form 39?

Using airSlate SignNow for Form 39 offers numerous benefits, including time savings, increased accuracy, and enhanced collaboration. The electronic signing feature eliminates delays, ensuring that your Form 39 is processed quickly and accurately.

-

Is training available for using airSlate SignNow with Form 39?

Yes, airSlate SignNow provides various training resources, including video tutorials and comprehensive user guides tailored for Form 39. These resources help users maximize the platform's features and streamline their document workflows.

Get more for Form 39 See Rule 54 Of Income Tax

Find out other Form 39 See Rule 54 Of Income Tax

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT