Form 15h Download 2015-2026

Understanding the 15h Tax Form

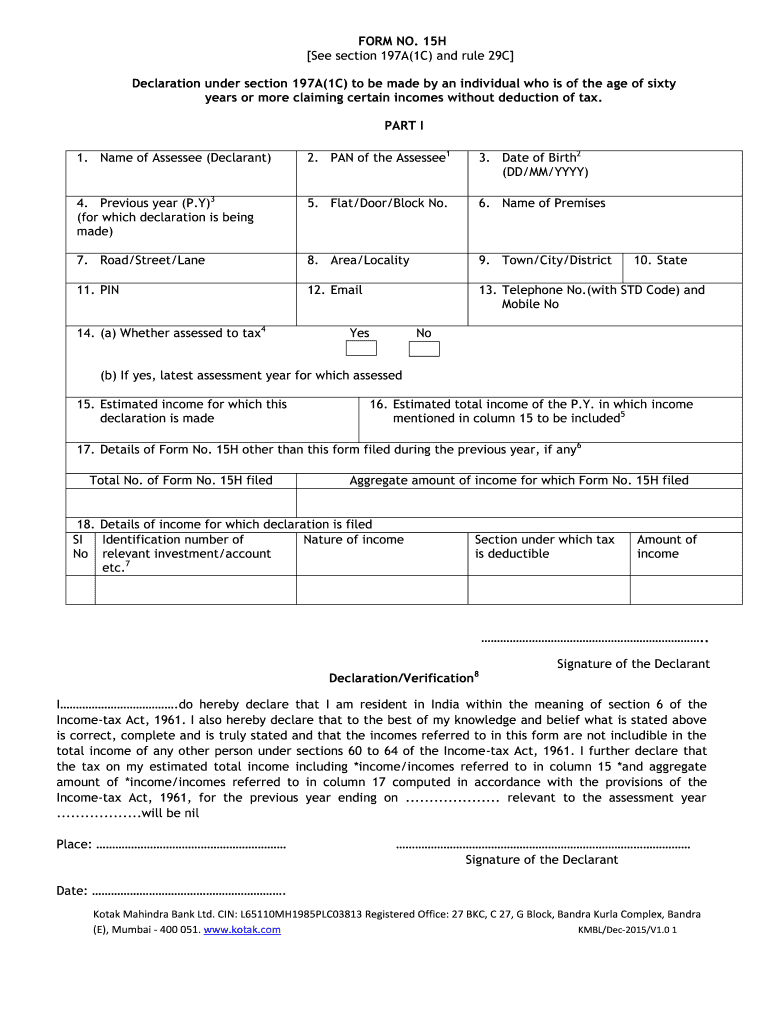

The 15h tax form, also known as the 15h declaration form, is a crucial document for taxpayers in the United States. It is primarily used to claim certain deductions or exemptions related to income tax. This form allows individuals to declare that their income is below a specified threshold, which may exempt them from tax liability. Understanding the purpose and requirements of this form is essential for accurate tax filing and compliance.

Steps to Complete the 15h Tax Form

Completing the 15h tax form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including proof of income and any relevant identification.

- Download the 15h tax form from a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your income sources and amounts, ensuring they are below the taxable threshold.

- Review the form for accuracy and completeness.

- Sign and date the form to validate your declaration.

Legal Use of the 15h Tax Form

The 15h tax form is legally binding when completed correctly. It is important to comply with federal and state regulations regarding tax declarations. The form must be submitted to the appropriate tax authority, and any inaccuracies may lead to penalties. Utilizing a reliable eSignature platform, such as signNow, can enhance the legal validity of your submission by providing a secure and compliant method for signing and submitting documents electronically.

Eligibility Criteria for the 15h Tax Form

To qualify for using the 15h tax form, individuals must meet specific eligibility criteria. Generally, this form is intended for taxpayers whose total income does not exceed a certain limit set by the IRS. Additionally, it is often used by retirees, students, and individuals with low income. Understanding these criteria is essential to ensure that you are eligible to file the form and claim the associated benefits.

Form Submission Methods

The 15h tax form can be submitted through various methods, depending on the preferences of the taxpayer. Common submission methods include:

- Online submission through the IRS website or authorized e-filing services.

- Mailing the completed form to the designated tax authority.

- In-person submission at local tax offices or designated locations.

Choosing the right submission method can help streamline the filing process and ensure timely processing of your tax declaration.

Required Documents for the 15h Tax Form

When filling out the 15h tax form, certain documents are required to support your declaration. These may include:

- Proof of income, such as pay stubs or bank statements.

- Identification documents, including a driver's license or Social Security card.

- Any relevant tax documents from previous years that may support your current filing.

Having these documents ready can facilitate a smoother completion and submission process.

Quick guide on how to complete form 15h download

Execute Form 15h Download seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly replacement for conventional printed and signed papers, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Form 15h Download on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form 15h Download effortlessly

- Locate Form 15h Download and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your device of choice. Modify and eSign Form 15h Download and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 15h download

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the 15h form, and how can airSlate SignNow help with it?

The 15h form is a crucial document for various business transactions. With airSlate SignNow, you can easily create, send, and electronically sign the 15h form, ensuring a streamlined process that saves time and reduces paperwork.

-

Is there a cost associated with using airSlate SignNow for the 15h form?

airSlate SignNow offers competitive pricing plans to accommodate businesses of all sizes. You can start with a free trial to understand how our platform can simplify your 15h form management before committing to a paid plan.

-

What features does airSlate SignNow offer for managing the 15h form?

Our platform provides features like customizable templates, bulk sending options, and secure storage to manage the 15h form effectively. Additionally, you can track the status of your documents in real-time, bringing efficiency to your workflow.

-

How does airSlate SignNow ensure the security of the 15h form?

Security is a top priority at airSlate SignNow. We protect your 15h form with advanced encryption, two-factor authentication, and user permissions to ensure only authorized personnel have access to sensitive documents.

-

Can I integrate airSlate SignNow with other software for my 15h form needs?

Yes, airSlate SignNow supports integrations with various applications such as Google Workspace, Salesforce, and more. This ensures that your 15h form processes can seamlessly connect with the tools your business already uses.

-

What advantages does airSlate SignNow offer for the 15h form compared to traditional methods?

Using airSlate SignNow for your 15h form offers many advantages, including faster turnaround times, reduced paper usage, and enhanced tracking capabilities. This digital approach not only saves time but also minimizes errors associated with manual entry.

-

Is it easy to collaborate on the 15h form with airSlate SignNow?

Absolutely! airSlate SignNow makes collaboration effortless. Multiple users can comment, edit, and sign the 15h form simultaneously, facilitating seamless teamwork and reducing bottlenecks in your workflow.

Get more for Form 15h Download

Find out other Form 15h Download

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free