15g Tax Form 2015-2026

What is the 15g Tax Form

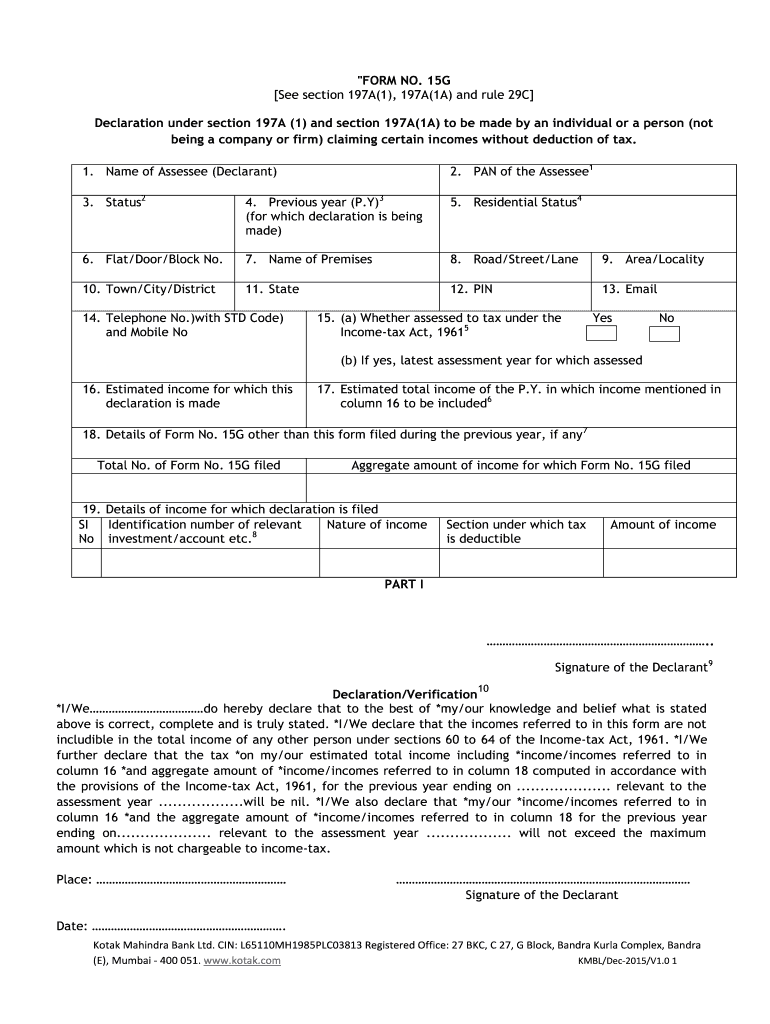

The 15g tax form is a declaration used by individuals in India to ensure that no tax is deducted at source on their income. This form is typically utilized by those whose total income is below the taxable limit. By submitting the form, individuals can claim exemption from tax deductions on interest income from banks or financial institutions. It is essential for taxpayers to understand the purpose of the form and its implications on their tax obligations.

How to use the 15g Tax Form

Using the 15g tax form involves a straightforward process. First, individuals must ensure they meet the eligibility criteria, which generally includes having a total income below the taxable threshold. Next, they should accurately fill out the form with personal details, including name, address, and PAN (Permanent Account Number). After completing the form, it can be submitted to the bank or financial institution where the income is generated. This submission should be done at the beginning of the financial year to ensure that no tax is deducted from interest payments throughout the year.

Steps to complete the 15g Tax Form

Completing the 15g tax form requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the 15g form, which can typically be downloaded from the bank's website or obtained in person.

- Fill in your personal information, including your name, address, and PAN.

- Provide details of the income you wish to declare, such as interest income from savings accounts.

- Sign and date the form to confirm the accuracy of the information provided.

- Submit the completed form to the relevant bank or financial institution.

Legal use of the 15g Tax Form

The legal use of the 15g tax form is governed by tax regulations in India. It is important to note that the form must be filled out truthfully, as providing false information can lead to penalties. The form serves as a legal declaration that the individual’s total income is below the taxable limit, and it must be submitted to the bank to avoid tax deductions. Compliance with the legal requirements ensures that taxpayers can benefit from the exemptions provided under the Income Tax Act.

Eligibility Criteria

To qualify for using the 15g tax form, individuals must meet specific eligibility criteria. Primarily, their total income for the financial year should be below the taxable limit set by the Income Tax Department. Additionally, the form can be submitted by individuals who are residents of India and are not subject to tax deductions on their interest income. It is essential to assess one’s income level and ensure compliance with the criteria to avoid any issues with tax authorities.

Form Submission Methods

There are several methods for submitting the 15g tax form. Individuals can choose to submit the form online through their bank's net banking portal. Many banks provide an option to upload the form digitally, making the process convenient. Alternatively, the form can be submitted in person at the bank branch where the individual holds an account. It is advisable to keep a copy of the submitted form for personal records and future reference.

Quick guide on how to complete 15g tax form

Effortlessly Prepare 15g Tax Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents swiftly without delays. Manage 15g Tax Form on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-based process today.

How to Edit and Electronically Sign 15g Tax Form with Ease

- Locate 15g Tax Form and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, through email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document needs in just a few clicks from any device you choose. Modify and electronically sign 15g Tax Form to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 15g tax form

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is the process for form 15g claiming using airSlate SignNow?

The process for form 15g claiming with airSlate SignNow is straightforward. First, create your form in the platform, ensuring all required fields are included. Once completed, you can easily send it out for electronic signatures, streamlining the entire claiming process.

-

Are there any costs associated with form 15g claiming on airSlate SignNow?

airSlate SignNow offers a cost-effective solution for form 15g claiming, with various pricing plans tailored to your needs. You can choose from a free trial or affordable monthly subscriptions that provide access to advanced features, making it accessible for both individuals and businesses.

-

What features does airSlate SignNow offer for form 15g claiming?

For form 15g claiming, airSlate SignNow provides robust features such as customizable templates, secure document storage, and advanced tracking options. Additionally, you can set reminders for signatories and automate workflows, enhancing efficiency in handling claims.

-

How does airSlate SignNow ensure the security of form 15g claiming?

When it comes to form 15g claiming, airSlate SignNow prioritizes security with industry-standard encryption and compliance with data protection regulations. Your sensitive information is protected throughout the signing process, ensuring that all transactions are secure and confidential.

-

Can I integrate airSlate SignNow with other applications for form 15g claiming?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your form 15g claiming experience. These integrations allow you to connect with tools like CRMs, accounting software, and cloud storage services, streamlining workflow and improving productivity.

-

Is it easy to track the status of form 15g claiming with airSlate SignNow?

Absolutely! airSlate SignNow offers real-time tracking options for form 15g claiming. You can monitor the status of your documents, see who has signed, and receive notifications for any pending actions, making it easy to stay updated throughout the process.

-

What advantages does airSlate SignNow provide for small businesses in form 15g claiming?

For small businesses, airSlate SignNow simplifies form 15g claiming by providing an affordable and efficient eSignature solution. The user-friendly interface and customizable templates save time and reduce the need for paper documentation, allowing businesses to focus on their core operations.

Get more for 15g Tax Form

Find out other 15g Tax Form

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe