P45 Form 2008-2026

What is the P45 Form

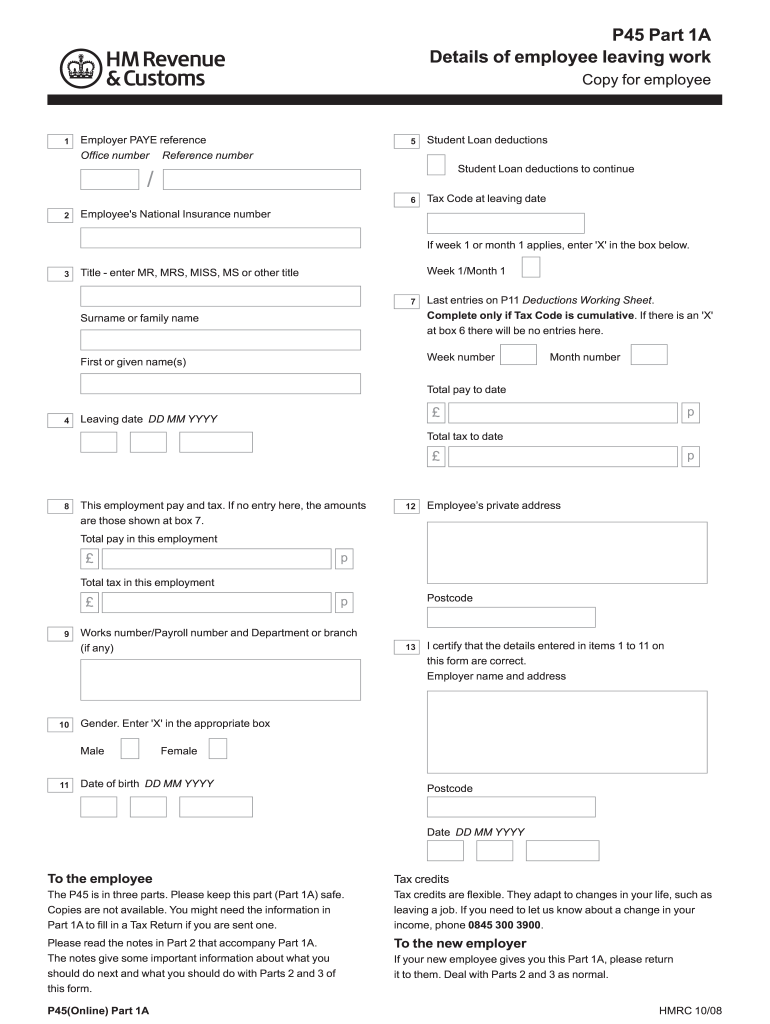

The P45 form is a document used in the United Kingdom to provide information about an employee's tax situation when they leave a job. It outlines the employee's earnings and the taxes that have been deducted up to the point of leaving. Although primarily associated with UK tax regulations, understanding its purpose is essential for anyone dealing with international employment situations or managing employees who may have worked in the UK.

How to use the P45 Form

The P45 form serves as an important record for both employees and employers. For employees, it is crucial for filing tax returns and ensuring that they are not overtaxed in their next job. Employers must provide this form when an employee leaves, ensuring that the new employer has accurate tax information. To use the P45 effectively, employees should keep it safe and present it to their new employer to facilitate a smooth transition in their tax status.

Steps to complete the P45 Form

Completing the P45 form involves several steps. First, the employer must fill out the employee's details, including their name, address, and National Insurance number. Next, they should record the employee's total earnings and the amount of tax deducted during the current tax year. Finally, the employer must sign and date the form before providing it to the employee. It is important to ensure that all information is accurate to prevent any tax issues for the employee in the future.

Legal use of the P45 Form

The P45 form is legally required in the UK when an employee leaves a job. It ensures that the employee's tax information is accurately recorded and transferred to their new employer. Failure to provide a P45 can result in complications for both the employee and employer, including potential tax penalties. Understanding the legal implications of the P45 form is essential for compliance with tax regulations.

Key elements of the P45 Form

Key elements of the P45 form include the employee's personal details, tax code, earnings to date, and tax deducted. Each section of the form serves a specific purpose in providing a comprehensive overview of the employee's tax situation. Ensuring that all elements are accurately filled out is crucial for the form's validity and for the employee's future tax obligations.

Who Issues the Form

The P45 form is issued by the employer when an employee leaves their job. It is the employer's responsibility to complete the form accurately and provide it to the departing employee. This ensures that the employee has the necessary documentation for their tax records and can provide it to their new employer if applicable.

Quick guide on how to complete p45 form

Complete P45 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely save them online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without delays. Manage P45 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign P45 Form effortlessly

- Locate P45 Form and click on Get Form to initiate the process.

- Employ the tools we provide to complete your document.

- Highlight signNow sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign P45 Form to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p45 form

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is a p45 form and why is it important?

A p45 form is an important document that details an employee's tax status when they leave a job. It includes information about their earnings and the tax that has been paid. Understanding the p45 form is essential for both employers and employees to ensure compliance with tax regulations.

-

How can airSlate SignNow help with the p45 form process?

airSlate SignNow streamlines the p45 form signing process, making it easy to send and eSign important documents electronically. With our user-friendly interface, businesses can minimize the hassle and time involved in managing physical paperwork associated with the p45 form.

-

Is there a cost associated with using airSlate SignNow for p45 forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Although there is a cost involved, our service is designed to be cost-effective, especially when managing important documents like the p45 form, which can save you time and resources.

-

What features does airSlate SignNow offer for managing p45 forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for your p45 forms. These tools allow you to efficiently manage the document lifecycle, ensuring that all necessary steps are completed promptly.

-

Can I integrate airSlate SignNow with other applications for handling p45 forms?

Absolutely! airSlate SignNow integrates seamlessly with a range of applications, including popular HR and accounting software. This integration makes it easier to manage the p45 form alongside your other employee management tasks.

-

How does eSigning a p45 form work with airSlate SignNow?

eSigning a p45 form with airSlate SignNow is a straightforward process. Once you upload the document, you can add the required signatures, and send it out for eSigning. The platform ensures that the signed p45 form is securely stored and easily accessible.

-

What are the benefits of using airSlate SignNow for p45 forms?

Using airSlate SignNow for p45 forms offers several benefits, including increased efficiency, reduced turnaround time, and enhanced security for sensitive information. Not only does it automate the signing process, but it also helps in maintaining compliance with tax regulations.

Get more for P45 Form

- Aoc 130 form

- Application for appointment as guardianconservator for minor courts ky form

- Ky garnishment form

- Aocint 7 pdf form

- Petitionmotion for removal of firearm prohibitions kentucky court bb courts ky form

- Aoc 040 form

- Courts log kentucky form

- You can now fill out a customized step by step version of this form and many others

Find out other P45 Form

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself