Maryland Articles of Organization Form

What is the Maryland Articles of Organization

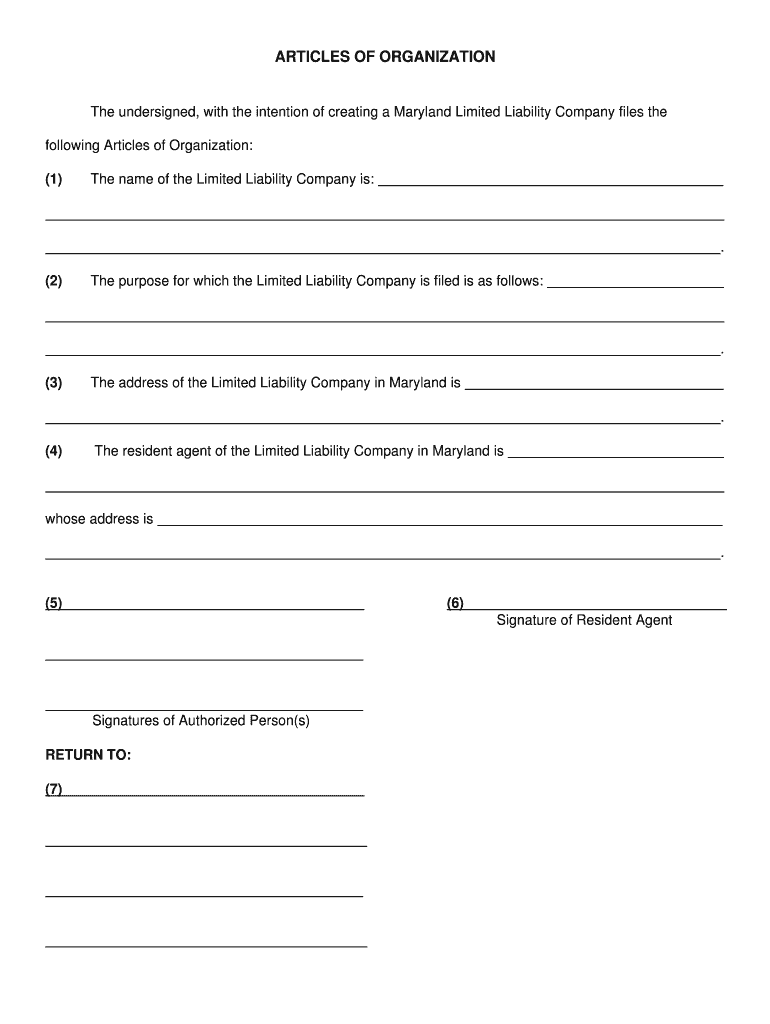

The Maryland Articles of Organization is a legal document required to establish a limited liability company (LLC) in the state of Maryland. This document outlines essential information about the LLC, including its name, principal office address, registered agent, and the purpose of the business. Filing the Articles of Organization is a crucial step in the formation of an LLC, as it officially registers the business with the Maryland State Department of Assessments and Taxation (SDAT).

Steps to Complete the Maryland Articles of Organization

Completing the Maryland Articles of Organization involves several key steps to ensure accuracy and compliance with state regulations:

- Choose a unique name for the LLC that complies with Maryland naming requirements.

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- Provide the principal office address where the business will operate.

- Specify the purpose of the LLC, which can be a general business purpose or a specific activity.

- Complete the Articles of Organization form, ensuring all information is accurate and complete.

- Submit the form to the Maryland State Department of Assessments and Taxation, along with the required filing fee.

Legal Use of the Maryland Articles of Organization

The Maryland Articles of Organization serves as the official record of the formation of an LLC. This document is legally binding and must be filed correctly to ensure the LLC is recognized as a separate legal entity. It provides liability protection for the owners, meaning personal assets are generally protected from business debts and liabilities. Properly filing the Articles of Organization also helps maintain compliance with state laws, avoiding potential penalties or legal issues.

How to Obtain the Maryland Articles of Organization

The Maryland Articles of Organization can be obtained through the Maryland State Department of Assessments and Taxation website. The form is available for download in a PDF format, allowing for easy access. Additionally, businesses can file online through the SDAT's online services portal, which streamlines the submission process. It is important to ensure that the form is filled out completely and accurately to avoid delays in processing.

Key Elements of the Maryland Articles of Organization

Several key elements must be included in the Maryland Articles of Organization to ensure it meets state requirements:

- Name of the LLC: Must be unique and include "Limited Liability Company" or abbreviations like "LLC" or "L.L.C."

- Principal office address: The primary location where the business operates.

- Registered agent: An individual or business entity designated to receive legal documents.

- Purpose: A brief description of the business activities the LLC will engage in.

Form Submission Methods

The Maryland Articles of Organization can be submitted through various methods:

- Online: Filing through the Maryland State Department of Assessments and Taxation's online portal is the fastest option.

- By mail: Completed forms can be mailed to the SDAT office along with the appropriate filing fee.

- In-person: Businesses can also submit the form in person at the SDAT office for immediate processing.

Quick guide on how to complete maryland articles of organization for domestic limited liability company llc

Easily manage Maryland Articles Of Organization on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed materials, as you can access the correct template and securely archive it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Handle Maryland Articles Of Organization on any platform using the airSlate SignNow apps available for Android or iOS, and enhance your document-driven processes today.

The simplest way to modify and eSign Maryland Articles Of Organization effortlessly

- Locate Maryland Articles Of Organization and click on Get Form to begin.

- Make use of the tools we provide to fill in your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specially designed by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose your method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more worries about lost or misplaced files, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and eSign Maryland Articles Of Organization and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you fill out the articles of organization for an LLC in Florida?

Quoting Instructions for Articles of Organization (FL LLC) :FILING ONLINE OR BY MAILThese instructions are for the formation of a Florida Limited Liability Company pursuant to s.605.0201, F.S., and cover the minimum requirements for filing Articles of Organization.Your Articles of Organization may need to include additional items that specifically apply to your situation. The Division of Corporations strongly recommends that legal counsel reviews all documents prior to submission.The Division of Corporations is a ministerial filing agency. We cannot provide any legal, accounting, or tax advice.Limited Liability Company NameThe name must be distinguishable on the records of the Department of State.You should do a preliminary search by name before submitting your document.The name must include:Limited Liability Company, LLC or L.L.C.; ORChartered, Professional Limited Liability Company, P.L.L.C. or PLLC if forming a professional limited liability company.Do not use or assume the name is approved until you receive a filing acknowledgment from the Division of Corporations.Principal Place of Business AddressThe street address of the LLC’s principal office.Mailing AddressThe LLC’s mailing address, if different from the principal address. (P.O. Box is acceptable.)Registered Agent Name and AddressThe individual or legal entity that will accept service of process on behalf of the business entity is the registered agent.A business entity with an active Florida filing or registration may serve as a registered agent.An entity cannot serve as its own registered agent. However, an individual or principal associated with the business may serve as the registered agent.The registered agent must have a physical street address in Florida. (Do not list a P.O. Box address.)Registered Agent’s SignatureThe registered agent must sign the application.The signature confirms the agent is familiar with and accepts the obligations of s.605.0113(3), F.S.If a business entity is designated as the Agent, a principal (individual) of that entity must sign to accept the obligations.If filing online:The registered agent must type their name in the signature block.Pursuant to s.15.16, F.S., electronic signatures have the same legal effect as original signatures.NOTE: Typing someone’s name/signature without their permission constitutes forgery pursuant to s.831.06, F.S.Limited Liability Company PurposeA Professional Limited Liability Company (which is formed under both Chapter 605 and Chapter 621, F.S.) must enter a single specific professional purpose. Example: the practice of law, accounting services, practicing medicine, etc.Non-professional companies are not required to list a purpose, but may do so.Manager/Authorized RepresentativeThe names and street addresses of the authorized representatives or managers are optional.Manager: a person designated to perform the management functions of a manager-managed limited liability company. Use MGR.Authorized Representative: a person who is authorized to execute and file records with the Division of Corporations. Use AR. See 605.0102(8), F.S., for more information.A Manager or Authorized Representative may be an individual or business entity.Do not list members.NOTE: If you are applying for workers’ comp exemption or opening a bank account, Florida’s Division of Workers’ Compensation and your financial institution may require this information to be designated in the Department of State’s records.Effective DateAn LLC’s existence begins on the date the Division of Corporations receives and files your Articles unless your Articles of Organization specify an acceptable alternate “effective” date.LLCs can specify an effective date that is no more than five business days prior to, or 90 days after, the date the document is received by our office.If you are forming your LLC between October 1 and December 31st, but don’t expect to transact business until the next calendar year, avoid filing an annual report form for the upcoming calendar year by listing an effective date of January http://1st.By specifying January 1st as the effective date, your LLC’s existence will not officially begin until January 1st of the following calendar year, even though your entity is already on the Division’s records.The January 1st effective date will allow you to postpone your LLC’s requirement to file an annual report form for one calendar year.SignatureMust be signed by at least one person acting as the authorized representative.If filing online: The authorized representative must type their name in the signature block. Electronic signatures have the same legal effect as original signatures.Correspondence Name and EmailPlease provide a valid email address.If filing online: The filing acknowledgment and certification (if any) will be emailed to this address.All future email communications will be sent to this address.Keep your email address up to date.Certificate of StatusYou may request a certificate of status.This item is not required.A certificate of status certifies the status and existence of the LLC and verifies the LLC has paid all fees due to this office through a certain date.Fee: $5.00 eachCertified CopyYou may request a certified copy of your Articles of Organization.This item is not required.A certified copy will include a filed stamped copy of your Articles of Organization and will verify that the copy is a true and correct copy of the document in our records.Fee: $30.00 eachAnnual Report NoticeEvery LLC is required to file an annual report to maintain an “active” status in our records.If the limited liability company fails to file the report, it will be administratively dissolved.The filing period for annual reports is January 1st to May 1st of the calendar year following the LLC’s date of filing or, if listed, its effective date.The annual report is not a financial statement.The report is used to confirm or update the entity’s information on our records.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

In an LLC format, how are liabilities limited for those who are members? If the manager (one of the members) commits a fraud using the company, do other members have to contribute from their personal assets to pay those being duped?

I'll share my story…and it's all true.Right at the end of my 1st company's life, I discovered my, very trusted, business partner, and ex best friend, was “embezzling.” I use the term embezzling because here's the setup:Me: 100% ownerHe: 100% access to everything - trusted, like with my life, trustedHe was taking money outside of payroll and distributing the withdrawals across multiple lines on the P&L…just enough to not cause attention in individual ledger lines. I, only looking at the P&L level and not at the individual transaction level, didn't see anything out of line to draw the red flag. Plus, I didn't have reason to look for this, cause I trusted him.History: Me - first time business owner. He - 2nd timer, coming off a $10 million company, that went out of business, which had 5 owners.Fraud covers many areas; each despicable. None are good for anyone. I love stories where the fraudulent gets nailed.When I discovered the embezzling (1 month before closing the business), I was instructed to call the police and make a report. I did. AND, embezzling is considered a white collar crime. White collar crimes are put on the bottom of lists for police detectives and county attorneys to handle. The stack tends to be rather large in larger metro areas of more important things like violent crime and cases that have a lot of money backing them. They never signNow the bottom.A police detective did call my partner telling him the company is accusing him of embezzling, and that was the extent of jurisdiction's involvement. No further action was taken by the city police nor the county attorney.I also happen to have a cousin who, at the time, was involved in business fraud cases with the FBI. I had coffee with him. FBI covers cases that are large ($million and more) and cross state lines. My case, no so large and only in my state, but signNow enough to cause big trouble…a major factor in closing the business…another story.My cousin told me this: You can sue him in civil court for damages. It will most likely have a jury because he can simply plead not guilty and have a trial. It would be my attorney's job to convince the jury that I didn't know anything about the embezzling. His attorney would simply say this: jury, it's a small company run by 2 best friends. Do you really think both don't know what the other is doing? Not guilty.I also contacted a civil attorney, independently, and was told the exact same thing.A short while later, I had another chance to talk with another civil attorney, and was told the exact same thing.He got away with it. Me, on the other hand, had to pay for his sins.Back to answering your question. My understanding of the situation is you, as a minority owner, would have to prove you were not involved with the fraudulent activity. This means someone with a summons is asking you what's going on. If you can not prove your innocence, your exposure liability is limited to the amount of “basis” you have in the company. Basis is any initial investment you gave and any profits you took. Basis is different than payroll. Definitely consult an attorney if you feel there could be trouble.Also, most likely, the company would be sued for fraud. If the prosecuting attorney is also going after the owner's personal assets, there is a major situation going on, news worthy situation. Usually, only the company's assets will targeted. If an attorney is attempting to pierce the corporate veil, the owner(s) is a bad dude.If you are a manager, employee, the company protects your personal assets from customer fraud cases against the company. If you are committing fraud, it is proven and you are terminated for it, you can also be sued by your previous employer for damages. In this case, your personal assets are in jeopardy.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the maryland articles of organization for domestic limited liability company llc

How to make an electronic signature for the Maryland Articles Of Organization For Domestic Limited Liability Company Llc online

How to make an eSignature for the Maryland Articles Of Organization For Domestic Limited Liability Company Llc in Google Chrome

How to make an eSignature for putting it on the Maryland Articles Of Organization For Domestic Limited Liability Company Llc in Gmail

How to generate an eSignature for the Maryland Articles Of Organization For Domestic Limited Liability Company Llc straight from your smartphone

How to create an eSignature for the Maryland Articles Of Organization For Domestic Limited Liability Company Llc on iOS

How to generate an eSignature for the Maryland Articles Of Organization For Domestic Limited Liability Company Llc on Android OS

People also ask

-

What are Maryland Articles Of Organization?

Maryland Articles Of Organization are legal documents required to establish a limited liability company (LLC) in Maryland. They outline essential information about your business, such as its name, address, and the names of its members. Filing these documents is a crucial step in forming your LLC and ensuring compliance with Maryland state regulations.

-

How do I file Maryland Articles Of Organization?

To file your Maryland Articles Of Organization, you can complete the form online or submit a paper application to the Maryland State Department of Assessments and Taxation. It’s important to include all required information and pay the necessary filing fee to process your application smoothly. Using airSlate SignNow can streamline this process by allowing you to eSign and send documents securely.

-

What is the cost to file Maryland Articles Of Organization?

The cost to file Maryland Articles Of Organization typically includes a state filing fee, which is currently set at $100 for standard processing. Additional fees may apply for expedited services or certified copies. Utilizing airSlate SignNow can help you keep track of all costs and deadlines associated with your filing.

-

What benefits does airSlate SignNow provide for Maryland Articles Of Organization?

airSlate SignNow simplifies the process of preparing and submitting Maryland Articles Of Organization by allowing you to create, edit, and eSign documents online. This efficient solution saves you time and reduces the risk of errors, ensuring your LLC formation process is seamless. Plus, it offers secure storage for all your important documents.

-

Can airSlate SignNow help with amendments to Maryland Articles Of Organization?

Yes, airSlate SignNow can assist with amendments to your Maryland Articles Of Organization. Whether you need to update your business address, change the name of the LLC, or modify member information, you can easily prepare and eSign the necessary amendments online. This flexibility ensures your business remains compliant with state laws.

-

Does airSlate SignNow integrate with other business tools for Maryland Articles Of Organization?

Absolutely! airSlate SignNow integrates with a variety of business tools, enhancing your ability to manage Maryland Articles Of Organization and other documents effectively. These integrations allow you to sync data with CRM systems, project management tools, and cloud storage solutions, streamlining your workflow.

-

How long does it take to process Maryland Articles Of Organization?

The processing time for Maryland Articles Of Organization typically ranges from a few days to a couple of weeks, depending on the submission method and the workload of the state office. Using airSlate SignNow can expedite the process by ensuring your documents are complete and accurately submitted, helping you get your LLC up and running faster.

Get more for Maryland Articles Of Organization

Find out other Maryland Articles Of Organization

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free