Invoice Format Without Gst

What is the Invoice Format Without Gst

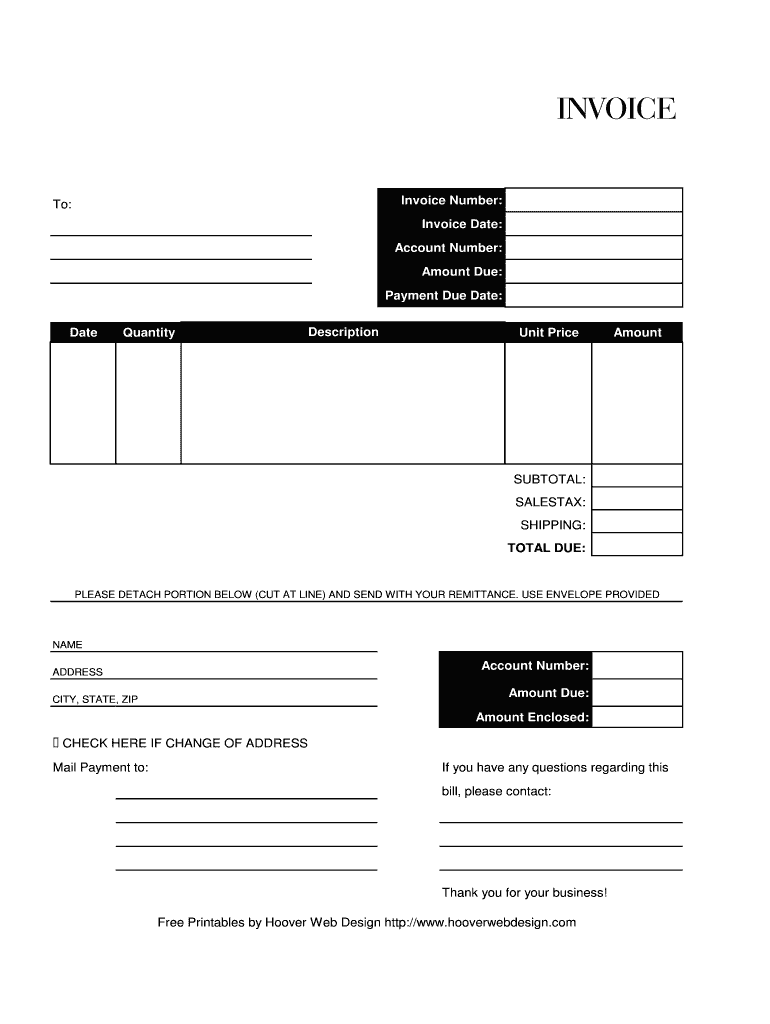

The invoice format without GST is a document used for transactions where Goods and Services Tax (GST) is not applicable. This format is essential for businesses and individuals who provide services or goods that are exempt from GST. The non-GST bill typically includes key information such as the seller's and buyer's details, a description of the goods or services provided, the total amount due, and payment terms. By adhering to this format, businesses can ensure compliance with relevant regulations while maintaining clarity in their financial transactions.

Key Elements of the Invoice Format Without Gst

When creating a non-GST bill, certain key elements must be included to ensure it is complete and legally binding. These elements typically consist of:

- Seller Information: Name, address, and contact details of the seller.

- Buyer Information: Name, address, and contact details of the buyer.

- Invoice Number: A unique identifier for the invoice.

- Date of Issue: The date when the invoice is generated.

- Description of Goods/Services: Detailed information about what is being sold.

- Total Amount Due: The total cost of the goods or services provided.

- Payment Terms: Conditions regarding payment, including due dates and accepted payment methods.

Steps to Complete the Invoice Format Without Gst

Completing a non-GST invoice requires careful attention to detail. Here are the steps to follow:

- Gather all necessary information, including details about the seller and buyer.

- Assign a unique invoice number to the document.

- Clearly state the date of issue to establish a timeline for payment.

- Provide a detailed description of the goods or services rendered.

- Calculate the total amount due, ensuring accuracy in pricing.

- Specify payment terms to inform the buyer of their obligations.

- Review the invoice for completeness and accuracy before sending it to the buyer.

Legal Use of the Invoice Format Without Gst

The legal use of a non-GST bill is crucial for businesses operating in jurisdictions where GST does not apply. To ensure that the invoice is legally binding, it must comply with local laws and regulations. This includes maintaining accurate records of transactions and ensuring that all required information is present. By using a standardized format, businesses can protect themselves against disputes and provide clear documentation for accounting purposes.

Examples of Using the Invoice Format Without Gst

Examples of scenarios where a non-GST invoice may be used include:

- Services provided by freelancers or contractors who are not registered for GST.

- Sales of goods that are exempt from GST due to specific regulations.

- Transactions between non-profit organizations and their clients.

- Sales made by small businesses that fall below the GST registration threshold.

How to Obtain the Invoice Format Without Gst

Obtaining a non-GST invoice format can be done through various means. Many businesses choose to create their own templates using word processing or spreadsheet software. Additionally, numerous online resources offer downloadable templates that can be customized to meet specific needs. It is important to ensure that any template used complies with local regulations and includes all necessary elements for a valid invoice.

Quick guide on how to complete invoice format without gst

Complete Invoice Format Without Gst effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage Invoice Format Without Gst on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

The easiest way to modify and electronically sign Invoice Format Without Gst with ease

- Obtain Invoice Format Without Gst and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Invoice Format Without Gst and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the invoice format without gst

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is the 'without gst invoice format' offered by airSlate SignNow?

The 'without gst invoice format' provided by airSlate SignNow allows businesses to create and send invoices without including GST details. This is particularly beneficial for freelancers or small businesses operating under a threshold limit or in non-GST applicable regions.

-

How can airSlate SignNow help me with invoicing without gst?

airSlate SignNow simplifies the invoicing process by letting you create customized invoices that can exclude GST. You can easily edit templates to suit your needs and manage your documents efficiently, enhancing productivity.

-

Is there a cost associated with using the 'without gst invoice format' feature?

Using the 'without gst invoice format' feature in airSlate SignNow comes at no extra cost, as it is included in our standard pricing plans. We offer affordable solutions that cater to businesses of all sizes, allowing easy access to invoicing tools.

-

Can I integrate airSlate SignNow with my existing accounting software for invoices without gst?

Yes, airSlate SignNow seamlessly integrates with many popular accounting software platforms. This integration allows you to manage your invoicing, including those in 'without gst invoice format,' more efficiently within your existing workflow.

-

What benefits do I gain from using the 'without gst invoice format' feature?

The 'without gst invoice format' feature lets you maintain compliance while providing your clients with the necessary documentation. Additionally, it saves time as you can quickly generate and send invoices without the need for adjusting GST details.

-

Are there templates available for invoices without gst?

Absolutely! airSlate SignNow provides a variety of templates that support invoices without gst. You can customize these templates to fit your branding and specific business needs, making document creation a breeze.

-

Is it easy to send invoices without gst through airSlate SignNow?

Yes, sending invoices without gst through airSlate SignNow is incredibly easy. Once your invoice is prepared, you can send it directly to your clients via email or share a secure link, streamlining the communication process.

Get more for Invoice Format Without Gst

- In the districtsuperior court for the state of alaska form

- Mc 515 alaska court records state of alaska form

- Dv 200 temporary child support order domestic violence 1013 domestic violence forms

- Dr 151 direction to seal affidavit 312 pdf fill in domestic relations forms

- Dr 483 notice of registration of child custody order of another form

- Civ 693 instructions for childs change of name civil forms

- Civ 536 order to debtor and notice of exemption rights 1112 pdf fill in civil forms

- Dd form 2402 ampquotcivil aircraft hold harmless agreementampquot

Find out other Invoice Format Without Gst

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form