Zimra Forms

What are Zimra Forms?

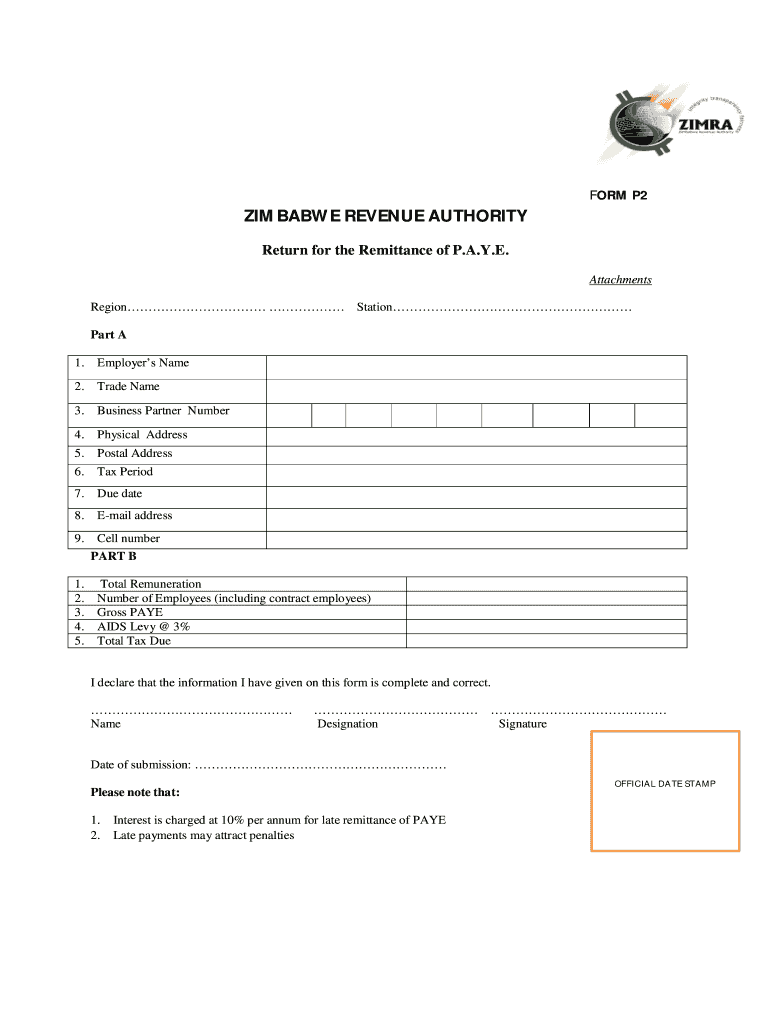

Zimra forms are official documents used for various tax-related purposes in Zimbabwe, primarily administered by the Zimbabwe Revenue Authority (ZIMRA). These forms facilitate the reporting of income, payment of taxes, and compliance with local tax regulations. The rev 2 form zimra pdf specifically pertains to the declaration of income and is essential for individuals and businesses to ensure accurate tax reporting. Understanding the purpose and requirements of these forms is crucial for maintaining compliance with tax obligations.

Steps to Complete the Zimra Forms

Completing the Zimra forms, including the rev 2 form zimra pdf, involves several key steps:

- Gather Required Information: Collect all necessary financial documents, including income statements, previous tax returns, and any relevant financial records.

- Access the Form: Download the rev 2 form zimra pdf from the official ZIMRA website or another authorized source.

- Fill Out the Form: Carefully input your information into the form, ensuring accuracy in all entries to avoid potential penalties.

- Review for Errors: Double-check all information for completeness and correctness before submission.

- Submit the Form: Follow the designated submission methods, whether online, by mail, or in person, as specified by ZIMRA.

Legal Use of the Zimra Forms

The legal use of Zimra forms, including the rev 2 form zimra pdf, is governed by tax laws and regulations in Zimbabwe. These forms must be completed accurately and submitted within specified deadlines to ensure compliance. Failure to use these forms correctly can lead to penalties, including fines or legal action. It is essential to understand the legal implications of submitting these forms, as they serve as official records of income and tax obligations.

Key Elements of the Zimra Forms

Each Zimra form, including the rev 2 form zimra pdf, contains several key elements that must be accurately completed:

- Personal Information: This includes the taxpayer's name, address, and identification details.

- Income Details: Report all sources of income, including salaries, business profits, and any other earnings.

- Deductions: Specify any allowable deductions that can reduce taxable income.

- Tax Calculation: Calculate the total tax due based on reported income and applicable tax rates.

- Signature: The form must be signed by the taxpayer or authorized representative to validate the submission.

Form Submission Methods

Submitting the rev 2 form zimra pdf can be done through various methods, ensuring flexibility for taxpayers:

- Online Submission: Many taxpayers prefer submitting forms electronically through the ZIMRA online portal, which offers a streamlined process.

- Mail: Forms can be printed and mailed to the appropriate ZIMRA office, ensuring they are sent with sufficient time to meet deadlines.

- In-Person: Taxpayers may also choose to submit forms in person at designated ZIMRA offices, allowing for immediate confirmation of receipt.

Required Documents

To complete the rev 2 form zimra pdf, certain documents are typically required:

- Identification: A valid form of ID, such as a national identification card or passport.

- Income Statements: Documentation of all income sources, including pay stubs or business income records.

- Previous Tax Returns: Copies of prior year tax returns may be needed for reference and verification.

- Proof of Deductions: Receipts or documentation supporting any deductions claimed on the form.

Quick guide on how to complete zimra forms

Effortlessly Prepare Zimra Forms on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly and without interruptions. Manage Zimra Forms on any device with the airSlate SignNow apps available for Android or iOS, and enhance any document-related workflow today.

Effortless Ways to Edit and eSign Zimra Forms

- Find Zimra Forms and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Zimra Forms to ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the zimra forms

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is the ZIMRA Rev 2 Form PDF download and why do I need it?

The ZIMRA Rev 2 Form PDF download is a crucial tax document required for compliance with Zimbabwe Revenue Authority regulations. This form helps businesses accurately report their taxes, ensuring they stay within legal guidelines and avoid penalties. Using airSlate SignNow, obtaining this form is convenient and straightforward, allowing for smooth eSigning and submission.

-

How can I access the ZIMRA Rev 2 Form PDF download through airSlate SignNow?

You can easily access the ZIMRA Rev 2 Form PDF download by visiting the airSlate SignNow platform. Simply navigate to the forms section, select the ZIMRA Rev 2 Form, and download it directly. Our user-friendly interface ensures that you can find and download the required form without any hassle.

-

Is there a cost associated with downloading the ZIMRA Rev 2 Form PDF?

The ZIMRA Rev 2 form PDF download is typically available for free through airSlate SignNow. However, you may need to subscribe to a plan for additional features such as document management and eSigning. Overall, it’s a cost-effective solution for all your document needs.

-

What features can I expect when using airSlate SignNow for the ZIMRA Rev 2 Form?

When using airSlate SignNow for the ZIMRA Rev 2 Form PDF download, you'll enjoy features like secure eSigning, document storage, and easy template creation. Our platform allows you to customize the form according to your business needs while ensuring compliance with the latest regulations. These features enhance both efficiency and security in handling your documents.

-

Can I integrate the ZIMRA Rev 2 Form PDF download with other software?

Yes, airSlate SignNow offers seamless integrations with various business applications, allowing you to connect the ZIMRA Rev 2 Form PDF download with your existing systems. Whether it’s your CRM or accounting software, our platform easily fits into your workflow, enhancing productivity. This connectivity means you can manage all your documents in one place.

-

What are the benefits of using airSlate SignNow for the ZIMRA Rev 2 Form?

Using airSlate SignNow for the ZIMRA Rev 2 Form PDF download offers numerous benefits, including increased efficiency, enhanced security, and ease of use. Our platform not only simplifies the signing process but also provides a secure environment for your sensitive information. This means that you can focus more on your business, knowing your tax documents are handled safely.

-

How does airSlate SignNow ensure the security of my ZIMRA Rev 2 Form PDF download?

AirSlate SignNow prioritizes your document security with advanced encryption and compliance with industry standards. When you download the ZIMRA Rev 2 Form PDF, you can rest assured that your data is protected from unauthorized access. We implement robust security measures to keep all your documents safe and secure.

Get more for Zimra Forms

Find out other Zimra Forms

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free