Form 5495 Instructions 2008-2026

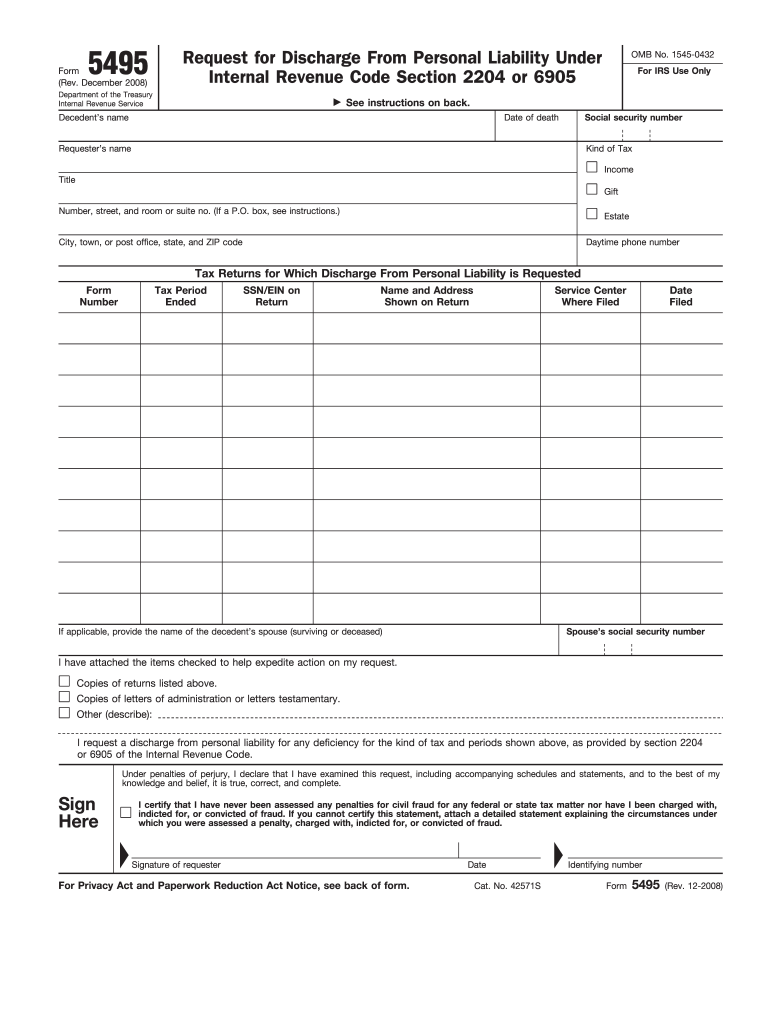

What is the IRS Form 5495?

The IRS Form 5495 is a request form used primarily for the discharge of liability related to educational assistance programs. This form is essential for individuals seeking to apply for a discharge of their federal student loans due to specific circumstances, such as total and permanent disability or death. The form serves as a formal request to the Department of Education, allowing borrowers to provide necessary documentation to support their claim.

Steps to Complete the IRS Form 5495

Completing the IRS Form 5495 involves several key steps to ensure accuracy and compliance. First, gather all relevant information, including personal identification details and documentation supporting the discharge request. Next, fill out the form carefully, ensuring that all sections are completed. Pay special attention to the eligibility criteria and required signatures. Once completed, review the form for any errors before submission.

Legal Use of the IRS Form 5495

The legal use of the IRS Form 5495 is governed by specific regulations that ensure the protection of borrowers' rights. When submitted correctly, the form can lead to the discharge of federal student loan liability under qualifying conditions. It is important to understand that improper use or incomplete submissions may result in delays or denials of the request. Therefore, adhering to the guidelines set forth by the Department of Education is crucial.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 5495 can vary based on individual circumstances and the type of discharge being requested. It is essential to keep track of any specific deadlines related to your situation, as late submissions may jeopardize your eligibility for loan discharge. Regularly checking the Department of Education's website or consulting with a financial advisor can help ensure timely submissions.

Required Documents for IRS Form 5495

When submitting the IRS Form 5495, certain documents are required to support your request. These may include proof of total and permanent disability, medical records, or documentation of death if applicable. It is important to include all necessary paperwork to avoid delays in processing your request. Ensure that all documents are clear and legible, as this will facilitate a smoother review process.

Form Submission Methods

The IRS Form 5495 can be submitted through various methods, including online, by mail, or in person. For online submissions, ensure that you use a secure platform that complies with eSignature laws. If opting to submit by mail, be sure to send it to the correct address provided by the Department of Education. In-person submissions may also be possible at designated offices, providing an opportunity for immediate assistance.

Eligibility Criteria for IRS Form 5495

Eligibility for using the IRS Form 5495 is primarily based on specific circumstances that warrant a discharge of liability. These may include total and permanent disability, death, or other qualifying factors as defined by the Department of Education. It is important to review the eligibility criteria thoroughly to ensure that your situation aligns with the requirements before submitting the form.

Quick guide on how to complete form 5495 instructions

Complete Form 5495 Instructions effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 5495 Instructions on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Form 5495 Instructions with ease

- Locate Form 5495 Instructions and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to submit your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Modify and eSign Form 5495 Instructions and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5495 instructions

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is IRS Form 5495?

IRS Form 5495 is a document used for reporting information related to deceased taxpayers. It provides details required by the IRS to ensure proper management of their tax obligations. Businesses handling such documentation can utilize airSlate SignNow for efficient signing and submission.

-

How can airSlate SignNow help with IRS Form 5495?

AirSlate SignNow allows users to easily eSign and manage IRS Form 5495 digitally. By streamlining the signing process, it saves time, reduces paperwork, and ensures compliance with IRS guidelines. You can send the form securely to relevant parties with just a few clicks.

-

Is there a cost associated with using airSlate SignNow for IRS Form 5495?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including features tailored for managing IRS Form 5495. Each plan provides access to essential tools for document management and electronic signatures, helping you find the right fit for your budget.

-

What features does airSlate SignNow offer for IRS Form 5495?

AirSlate SignNow offers features such as customizable templates, in-person signing, and secure cloud storage for IRS Form 5495. These features enhance the efficiency of managing forms and ensure that sensitive information remains protected throughout the process.

-

Can I integrate airSlate SignNow with other software for handling IRS Form 5495?

Yes, airSlate SignNow supports various integrations with popular business software, making it easy to manage IRS Form 5495 within your existing workflows. Whether using CRM systems, project management tools, or account software, integration ensures a seamless experience.

-

What are the benefits of using airSlate SignNow for IRS Form 5495?

Using airSlate SignNow for IRS Form 5495 provides several benefits, including reduced processing time, enhanced accuracy, and improved compliance with tax regulations. The intuitive interface ensures that users of all levels can efficiently manage their documents without cumbersome paperwork.

-

Is airSlate SignNow secure for handling IRS Form 5495?

Absolutely! AirSlate SignNow employs industry-leading security measures, including encryption and secure access controls, to protect your IRS Form 5495 and other sensitive documents. Your data security is our top priority, ensuring compliance with regulations throughout the signing process.

Get more for Form 5495 Instructions

Find out other Form 5495 Instructions

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed