Asset Statement Form

What is the Asset Statement Form

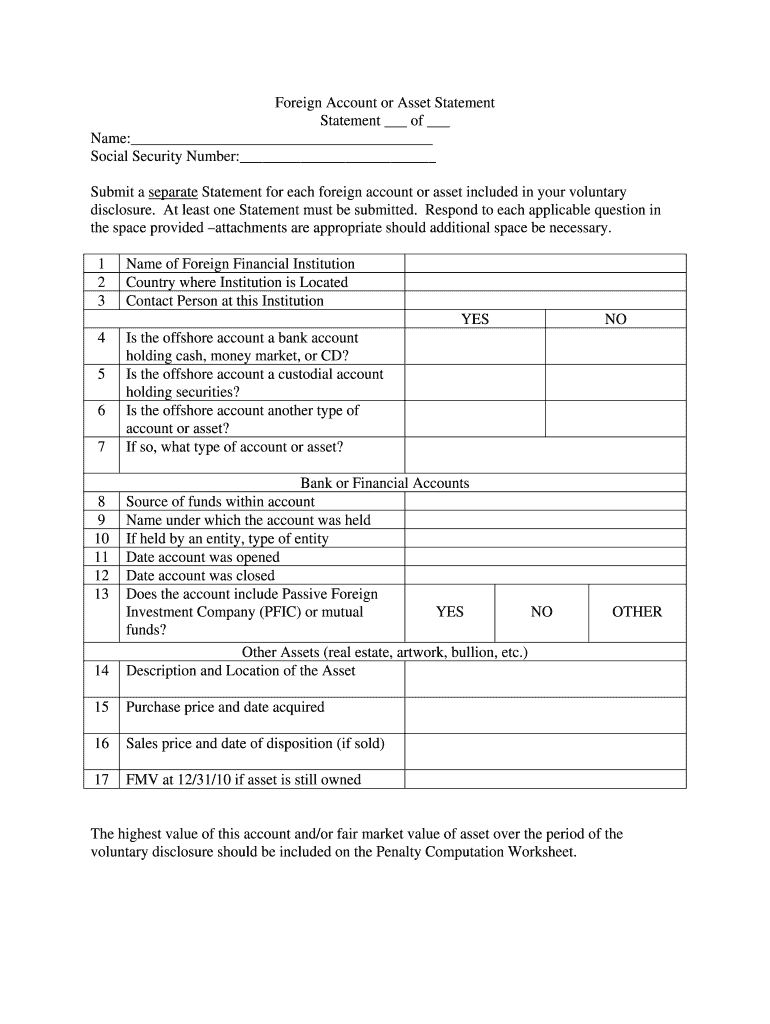

The Asset Statement Form is a crucial document used by individuals and entities to report their specified foreign financial assets to the Internal Revenue Service (IRS). This form, officially known as Form 8938, is part of the Foreign Account Tax Compliance Act (FATCA) requirements. It is designed to help the IRS track foreign assets and ensure compliance with U.S. tax laws. Taxpayers must disclose various types of assets, including bank accounts, securities, and other financial instruments held outside the United States.

Steps to Complete the Asset Statement Form

Completing Form 8938 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your foreign financial assets, including account numbers, asset values, and the institutions where they are held. Next, fill out the form by providing personal information, including your name, address, and taxpayer identification number. Then, list each specified foreign financial asset, detailing the maximum value during the tax year. Finally, review the form for completeness and accuracy before submitting it with your annual tax return.

Penalties for Non-Compliance

Failing to file Form 8938 or inaccurately reporting foreign financial assets can result in significant penalties. The IRS imposes an initial penalty of $10,000 for not filing the form when required. If the failure continues for more than 90 days after the IRS notifies the taxpayer, an additional penalty of $10,000 may be imposed for each 30-day period of non-compliance, up to a maximum of $50,000. Moreover, taxpayers may also face additional penalties related to underreporting income associated with these foreign assets.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 8938. Taxpayers must file this form if they meet certain thresholds regarding the value of their foreign financial assets. For single filers, the threshold is $200,000 at year-end or $300,000 at any point during the year. For married couples filing jointly, the thresholds are $400,000 and $600,000, respectively. It is essential to review the latest IRS instructions to ensure compliance with all reporting requirements and deadlines.

Filing Deadlines / Important Dates

Form 8938 must be filed annually along with your federal income tax return. The standard deadline for filing is April 15, but it may be extended to October 15 if you file for an extension on your tax return. It is important to note that if you are required to file Form 8938, you must do so even if you do not owe any tax or if you are not required to file a tax return. Missing the deadline can lead to penalties and complications with your tax obligations.

Required Documents

To accurately complete Form 8938, taxpayers need to gather specific documents that provide information about their foreign financial assets. These documents typically include bank statements, account statements from foreign financial institutions, and documentation of any securities or investments held abroad. It is crucial to have accurate and complete records to ensure compliance and avoid potential penalties associated with incorrect reporting.

Quick guide on how to complete asset statement form

Complete Asset Statement Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents promptly without delays. Manage Asset Statement Form on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest way to modify and eSign Asset Statement Form without hassle

- Obtain Asset Statement Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending the form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Asset Statement Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the asset statement form

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the form 8938 penalty for late submissions?

The form 8938 penalty for late submissions can be signNow, as failure to report foreign financial assets can lead to penalties ranging from $10,000 to $50,000. It's crucial to file accurately and on time to avoid these penalties. airSlate SignNow can help streamline the eSigning process to ensure timely submission.

-

How does airSlate SignNow help with form 8938 submissions?

airSlate SignNow simplifies the document signing process, enabling users to complete and eSign the form 8938 quickly and securely. By digitizing your workflow, you can ensure that necessary forms are submitted on time, minimizing the risk of encountering a form 8938 penalty. Our platform offers an efficient solution for busy professionals.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. With various tiers available, you can choose one that fits your budget and needs, especially if you are concerned about issues like the form 8938 penalty. Consider our plans to keep your document management efficient and penalty-free.

-

Can I integrate airSlate SignNow with other systems to manage form 8938 filings?

Yes, airSlate SignNow offers integrations with various applications and platforms to enhance your workflow, including those used for managing financial documents like the form 8938. By streamlining processes through integrations, you can better manage your submissions and reduce the chances of incurring a form 8938 penalty.

-

What features make airSlate SignNow ideal for handling tax-related documents?

Notable features of airSlate SignNow, such as secure eSigning, document templates, and real-time collaboration, are essential for handling tax-related documents like form 8938. These features ensure compliance and accuracy, signNowly decreasing the risk of a form 8938 penalty. Our user-friendly interface also helps simplify complex tax filing processes.

-

How does airSlate SignNow ensure the security of my documents related to form 8938?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the form 8938. We employ advanced encryption and secure cloud storage to keep your information safe and confidential. This robustness helps reduce the stress of potential penalties and compliance issues.

-

What should I do if I receive a form 8938 penalty notice?

If you receive a form 8938 penalty notice, it's essential to address the issue promptly. Consult a tax professional to understand the situation and explore options for penalty abatement. Additionally, using airSlate SignNow to manage your document submissions can help prevent future penalties.

Get more for Asset Statement Form

Find out other Asset Statement Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document