St 11 Form 2010-2026

What is the W-11 Form?

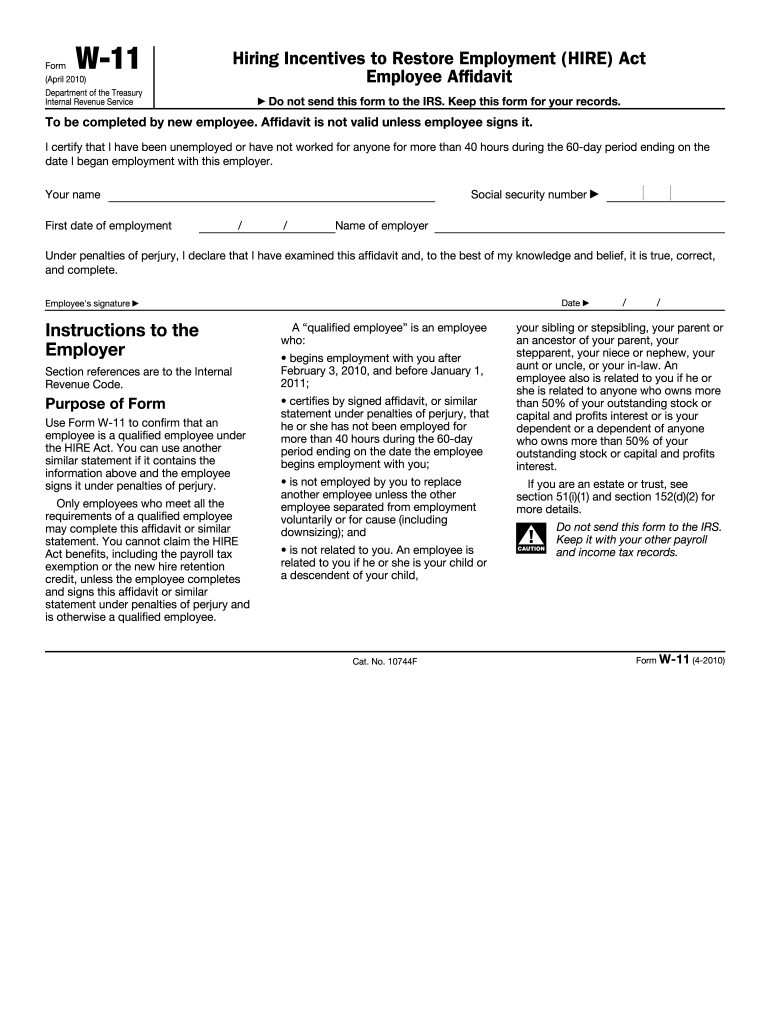

The W-11 form, also known as the IRS W-11, is a tax document used primarily for claiming hiring incentives under the 2010 Incentives Act. This form allows employers to certify that they are eligible to receive certain tax benefits for hiring qualified employees. The W-11 form is essential for businesses looking to take advantage of tax credits that can significantly reduce their tax liabilities. Understanding the purpose and requirements of the W-11 form is crucial for employers aiming to maximize their hiring incentives.

Steps to Complete the W-11 Form

Completing the W-11 form involves several key steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary information about your business and the employee for whom you are claiming the incentive. This includes the employee's name, Social Security number, and details about their employment status. Next, fill out the form by providing the required information accurately. Make sure to review the form for any errors or omissions before submission. Finally, submit the completed W-11 form to the appropriate IRS office or include it with your tax return.

Legal Use of the W-11 Form

The legal use of the W-11 form is governed by IRS regulations. To be considered valid, the form must be completed in accordance with the guidelines set forth by the IRS. This includes ensuring that all information is accurate and that the form is submitted within the specified deadlines. The W-11 form serves as a declaration of eligibility for hiring incentives, and improper use can lead to penalties or disqualification from tax benefits. It is important for employers to understand their responsibilities when using this form to avoid any legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the W-11 form are critical for employers seeking to claim hiring incentives. Generally, the form should be submitted along with the employer's tax return for the year in which the employee was hired. It is advisable to keep track of important dates related to tax filings to ensure compliance. Missing deadlines can result in the loss of potential tax credits, so staying informed about filing requirements is essential for businesses looking to benefit from the incentives offered under the 2010 Incentives Act.

Required Documents

When completing the W-11 form, certain documents may be required to support your claims for hiring incentives. These documents typically include proof of the employee's eligibility, such as their Social Security number and employment verification. Additionally, employers may need to provide documentation that demonstrates their business's eligibility for the tax credits. Having these documents ready can streamline the process of completing and submitting the W-11 form, ensuring that all necessary information is included.

Who Issues the W-11 Form

The W-11 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. Employers can obtain the W-11 form directly from the IRS website or through tax preparation software that includes IRS forms. It is important to use the most current version of the form to ensure compliance with the latest tax regulations and guidelines.

Eligibility Criteria

Eligibility criteria for using the W-11 form are outlined by the IRS and typically include specific requirements related to the employee's status and the employer's business. To qualify for hiring incentives, the employee must meet certain criteria, such as being a member of a targeted group or having been unemployed for a specified period. Employers must also demonstrate that they are eligible to claim the incentives based on their business type and tax status. Understanding these criteria is essential for successfully utilizing the W-11 form for tax benefits.

Quick guide on how to complete st 11 form

Complete St 11 Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to craft, modify, and eSign your documents swiftly without delays. Manage St 11 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign St 11 Form effortlessly

- Find St 11 Form and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal significance as a traditional wet ink signature.

- Verify all information and click on the Done button to preserve your changes.

- Decide how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign St 11 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 11 form

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is airSlate SignNow's pricing for w 11 users?

airSlate SignNow offers flexible pricing plans for w 11 users, catering to businesses of all sizes. You can choose from various subscription tiers that provide essential features at competitive rates, ensuring you find a plan that fits your budget.

-

How does airSlate SignNow improve productivity for w 11 users?

Using airSlate SignNow can signNowly enhance productivity for w 11 users by streamlining the document signing process. With an intuitive interface and automation features, you can send, sign, and manage documents more efficiently, saving valuable time for your team.

-

What key features does airSlate SignNow offer for w 11?

airSlate SignNow provides essential features for w 11 users, including eSignature capabilities, document templates, and real-time tracking. These tools help ensure smooth collaboration and minimize errors, empowering businesses to manage their signing workflows effectively.

-

Can airSlate SignNow integrate with other tools for w 11 users?

Yes, airSlate SignNow offers seamless integration with a range of applications for w 11 users. This allows you to connect with popular tools like Google Drive, Salesforce, and Microsoft Office, enhancing your document management and signing experience.

-

What are the benefits of using airSlate SignNow for w 11?

The benefits of using airSlate SignNow for w 11 users include increased efficiency, cost savings, and improved compliance. With its user-friendly interface and secure platform, businesses can quickly switch to an electronic signing process that meets industry standards.

-

Is airSlate SignNow secure for w 11 document management?

Absolutely! airSlate SignNow prioritizes security, making it a trusted choice for w 11 users. The platform includes robust encryption, secure cloud storage, and compliance with eSignature laws to ensure that your documents and data are protected.

-

What types of documents can I sign using airSlate SignNow with w 11?

airSlate SignNow allows you to electronically sign various document types with w 11, including contracts, agreements, and invoices. This versatility makes it an ideal solution for businesses needing an efficient signing process across multiple document formats.

Get more for St 11 Form

- 447 ncpdf south carolina department of motor vehicles form

- Purchasers statement of tax exemption form

- Sut 1 dmv form

- Vehicle certificate of ownership title application form

- Penndot photo identification card application for change form

- Cg 719s form

- Answer all items type or print in black ink form

- Agency clearance officer us customs and border protection form

Find out other St 11 Form

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free