CHARITABLE EDUCATIONAL ORGANIZATION TAX YEAR Bernco Form

Understanding the Charitable Educational Organization Tax Year in Bernalillo County

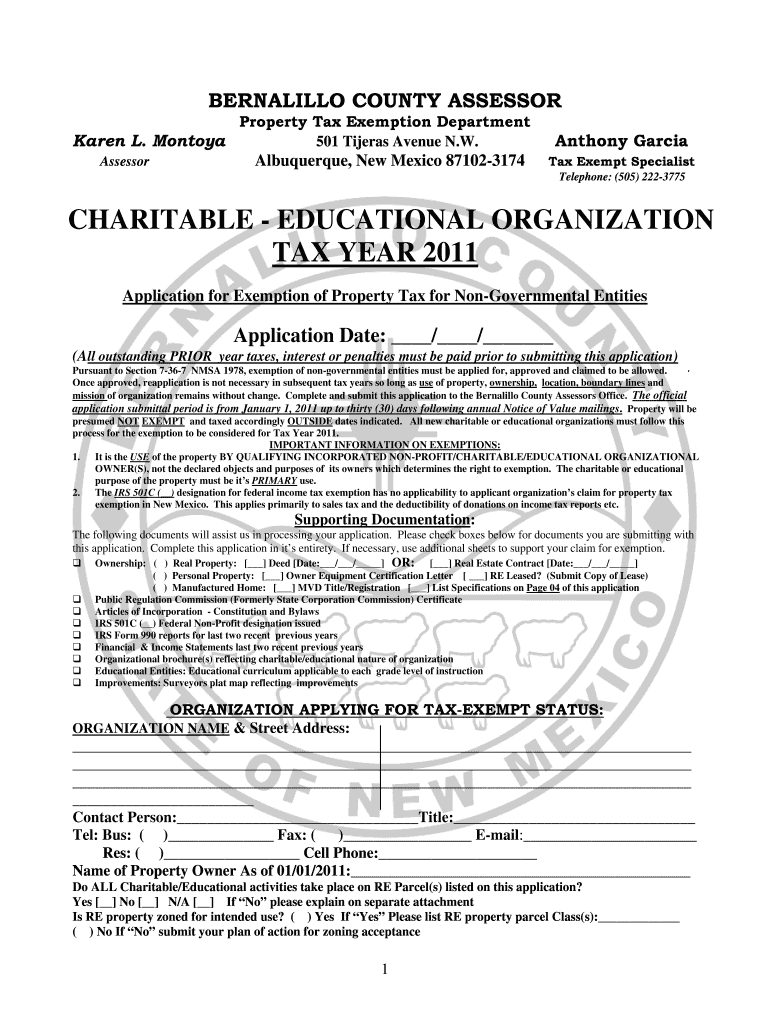

The Charitable Educational Organization Tax Year in Bernalillo County refers to the specific timeframe in which eligible organizations must file their property tax exemptions. This designation allows qualifying educational entities to benefit from tax relief, provided they meet certain criteria established by local regulations. Understanding this tax year is crucial for organizations seeking to maximize their financial resources while complying with state laws.

Steps to Complete the Charitable Educational Organization Tax Year in Bernalillo County

Completing the Charitable Educational Organization Tax Year involves several key steps. First, organizations must determine their eligibility based on the criteria set forth by the Bernalillo County Assessor. Next, they should gather the necessary documentation, including proof of educational status and financial records. Once the required documents are compiled, organizations can fill out the appropriate forms, ensuring all information is accurate and complete. Finally, submissions can be made online, by mail, or in person, depending on the preferred method of the organization.

Required Documents for the Charitable Educational Organization Tax Year

To successfully apply for the Charitable Educational Organization Tax Year exemption, specific documents are required. These typically include:

- Proof of the organization’s educational purpose, such as a charter or bylaws

- Financial statements demonstrating the organization’s non-profit status

- Tax identification number

- Any additional documentation requested by the Bernalillo County Assessor

Having these documents ready can streamline the application process and help ensure compliance with local regulations.

Filing Deadlines and Important Dates

Organizations must be aware of the filing deadlines associated with the Charitable Educational Organization Tax Year. Typically, applications must be submitted by a specific date each year to qualify for the upcoming tax year. Missing these deadlines can result in the loss of potential tax benefits. It is advisable for organizations to mark their calendars and prepare their submissions well in advance to avoid any last-minute issues.

Eligibility Criteria for the Charitable Educational Organization Tax Year

To qualify for the Charitable Educational Organization Tax Year exemption, organizations must meet certain eligibility criteria. These often include:

- Being a recognized non-profit entity focused on educational purposes

- Providing documentation that supports the educational mission

- Operating primarily within Bernalillo County

Understanding these criteria is vital for organizations to ensure they meet all requirements for tax exemption.

Legal Use of the Charitable Educational Organization Tax Year

The legal use of the Charitable Educational Organization Tax Year is governed by state laws and local regulations. Organizations must adhere to these legal frameworks to maintain their tax-exempt status. This includes proper documentation and timely submissions. Failure to comply with these regulations can result in penalties or loss of tax benefits, making it essential for organizations to stay informed about their legal obligations.

Quick guide on how to complete charitable educational organization tax year 2011 bernco

Effortlessly Prepare CHARITABLE EDUCATIONAL ORGANIZATION TAX YEAR Bernco on Any Device

The management of documents online has surged in popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle CHARITABLE EDUCATIONAL ORGANIZATION TAX YEAR Bernco on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Edit and Electronically Sign CHARITABLE EDUCATIONAL ORGANIZATION TAX YEAR Bernco with Ease

- Obtain CHARITABLE EDUCATIONAL ORGANIZATION TAX YEAR Bernco and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Verify all details and click the Done button to save your modifications.

- Select your preferred method to send your form—via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require generating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign CHARITABLE EDUCATIONAL ORGANIZATION TAX YEAR Bernco to ensure excellent communication at every step of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What tax form do I have to fill out for the money I made on Quora?

For 2018, there is only form 1040. Your income is too low to file. Quora will issue you a 1099 Misc only if you made over $600

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I haven't filled the tax forms for 2011, 2012, and 2013 and Glacier Tax Preparation only allows me to do so for 2014. I entered the USA in 2011. How can I file those now?

I don't think you can file taxes for 2011 and 2012 this year.But as you did not have any income in those two years. It is fine even if you dont file taxes.Study how to file taxes, how to determine residency status and which forms you should submit when you are in F1 VisaF1(CPT, OPT), J1, M1 Visa tax returns filing : All information IRS wants you to know - Grad Schools BlogThough I am not expert in tax laws, I figured this from my case and few other friends.

-

I started teaching piano lessons this year, how do I pay quarterly taxes in California? What form should I fill out?

Go to https://www.irs.gov/pub/irs-pdf/... You will file a form 1040ES each quarter. The website will tell you the due dates for each quarterly payment. Get a similar form from your state tax board website if you pay state taxes.Note: If this is your first year filing, ever, then you can get away without sending in estimated payments because you owe the LESSER of what you owe this year or last year. Having been self-employed most of my life, I always filed quarterly estimated taxes, using the amount I had owed the year before, because I had to to avoid fines, and because I didn't want to get to April of the next year and not have the money. As for the amount you should pay to the IRS and your state, you might be able to figure this out using worksheets available on the IRS and state websites. If you chose to deal in cash and not report it, that's your business. Your students are not going to send you a 1099 at the end of the year. But if you teach at an institution which pays you more than a few thousand dollars a year, they WILL file a 1099 stating how much they paid you in miscellaneous income, with the IRS and state.

Create this form in 5 minutes!

How to create an eSignature for the charitable educational organization tax year 2011 bernco

How to generate an eSignature for the Charitable Educational Organization Tax Year 2011 Bernco online

How to create an electronic signature for the Charitable Educational Organization Tax Year 2011 Bernco in Chrome

How to make an eSignature for putting it on the Charitable Educational Organization Tax Year 2011 Bernco in Gmail

How to create an eSignature for the Charitable Educational Organization Tax Year 2011 Bernco right from your smart phone

How to make an electronic signature for the Charitable Educational Organization Tax Year 2011 Bernco on iOS

How to create an eSignature for the Charitable Educational Organization Tax Year 2011 Bernco on Android OS

People also ask

-

What services does the Bernalillo County Assessor provide?

The Bernalillo County Assessor is responsible for assessing property values for taxation purposes. They provide essential services, including property appraisals and tax exemptions. Utilizing airSlate SignNow for document management can streamline communication with the assessor's office.

-

How can airSlate SignNow help me with my Bernalillo County Assessor documents?

airSlate SignNow enables you to easily eSign and send important documents related to your property assessments. This can save you time and ensure that your documents signNow the Bernalillo County Assessor’s office promptly. It also enhances security and reduces the chances of errors in your submissions.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to fit businesses of all sizes, starting with a free trial. Each plan includes features suited for managing documents for the Bernalillo County Assessor's office efficiently. Consider reviewing these plans to determine which fits your specific needs.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with various platforms such as Google Drive and Dropbox, making it easy to manage your documents related to the Bernalillo County Assessor. These integrations can facilitate a seamless workflow for handling property documents. Streamlining your processes has never been easier.

-

What benefits does airSlate SignNow provide for interacting with the Bernalillo County Assessor?

Using airSlate SignNow improves the efficiency of your interactions with the Bernalillo County Assessor by simplifying document management. You can quickly eSign and send required forms, reducing delays in processing your assessments. This ensures that you stay compliant with local regulations.

-

How does airSlate SignNow ensure document security when dealing with the Bernalillo County Assessor?

airSlate SignNow employs advanced encryption and security measures to protect your documents during the signing and submission processes. This is particularly important when dealing with sensitive information required by the Bernalillo County Assessor's office. You can have peace of mind knowing your data is secure.

-

Can I use airSlate SignNow for multiple properties with the Bernalillo County Assessor?

Absolutely! airSlate SignNow can handle multiple documents for different properties seamlessly, making it ideal for property owners working with the Bernalillo County Assessor. You can manage various tasks simultaneously without confusion, enhancing your overall efficiency.

Get more for CHARITABLE EDUCATIONAL ORGANIZATION TAX YEAR Bernco

- Remittance agentamp39s bond illinois secretary of state form

- Notary public application checklist cyberdrive illinois form

- Required document matrix coloradogov colorado form

- Yield to emergency vehicles construction workers and funeral form

- Services for state employees and elected officials illinois form

- Online catalog illinois secretary of state form

- Print reset freedom of information act request form office of the illinois secretary of state date requestor s name company

- Boe 267 a form

Find out other CHARITABLE EDUCATIONAL ORGANIZATION TAX YEAR Bernco

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT