APP GP99 NWF Metropolitan Life Insurance Company One Form

What is the APP GP99 NWF Metropolitan Life Insurance Company One

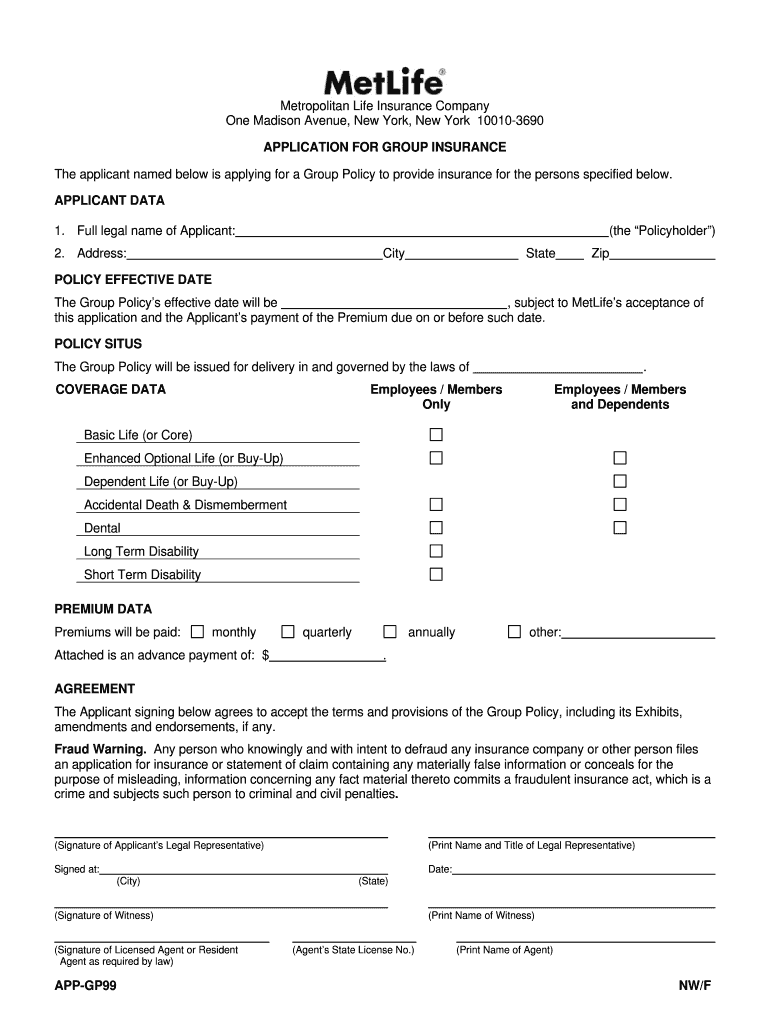

The APP GP99 NWF Metropolitan Life Insurance Company One form is a specific document used within the insurance sector, particularly by Metropolitan Life Insurance Company. This form is essential for individuals seeking to apply for or manage their life insurance policies. It captures critical information that helps the insurance provider assess eligibility, coverage options, and policy details.

How to use the APP GP99 NWF Metropolitan Life Insurance Company One

Using the APP GP99 NWF Metropolitan Life Insurance Company One form involves a straightforward process. First, gather all necessary personal information, including identification details and any previous insurance policy numbers. Next, complete the form by providing accurate and truthful responses. Once filled out, the form can be submitted electronically, ensuring a quick and efficient processing time.

Steps to complete the APP GP99 NWF Metropolitan Life Insurance Company One

Completing the APP GP99 NWF Metropolitan Life Insurance Company One form requires careful attention to detail. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including name, address, and contact details.

- Provide any relevant insurance history or policy numbers.

- Review your entries for accuracy and completeness.

- Sign and date the form to validate your submission.

Legal use of the APP GP99 NWF Metropolitan Life Insurance Company One

The APP GP99 NWF Metropolitan Life Insurance Company One form is legally binding when completed correctly. For the form to hold legal weight, it must comply with relevant regulations governing electronic signatures and document submissions. This includes adherence to the ESIGN Act and UETA, ensuring that the form is recognized as valid in a court of law.

Key elements of the APP GP99 NWF Metropolitan Life Insurance Company One

Several key elements make up the APP GP99 NWF Metropolitan Life Insurance Company One form. These include:

- Personal identification information of the applicant.

- Details regarding the type of insurance being applied for.

- Disclosure of any pre-existing conditions or relevant medical history.

- Signature of the applicant to confirm the information provided is accurate.

Eligibility Criteria

To successfully complete the APP GP99 NWF Metropolitan Life Insurance Company One form, applicants must meet specific eligibility criteria. Generally, this includes being of legal age, possessing a valid identification, and having a clear understanding of the insurance products offered by Metropolitan Life Insurance Company. It is essential to review these criteria before proceeding with the application to avoid delays.

Quick guide on how to complete app gp99 nwf metropolitan life insurance company one

Accomplish APP GP99 NWF Metropolitan Life Insurance Company One effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage APP GP99 NWF Metropolitan Life Insurance Company One on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign APP GP99 NWF Metropolitan Life Insurance Company One with ease

- Obtain APP GP99 NWF Metropolitan Life Insurance Company One and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Modify and electronically sign APP GP99 NWF Metropolitan Life Insurance Company One and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the app gp99 nwf metropolitan life insurance company one

How to create an eSignature for the App Gp99 Nwf Metropolitan Life Insurance Company One in the online mode

How to generate an eSignature for the App Gp99 Nwf Metropolitan Life Insurance Company One in Google Chrome

How to generate an eSignature for putting it on the App Gp99 Nwf Metropolitan Life Insurance Company One in Gmail

How to create an electronic signature for the App Gp99 Nwf Metropolitan Life Insurance Company One straight from your mobile device

How to create an eSignature for the App Gp99 Nwf Metropolitan Life Insurance Company One on iOS

How to create an electronic signature for the App Gp99 Nwf Metropolitan Life Insurance Company One on Android OS

People also ask

-

What is the APP GP99 NWF Metropolitan Life Insurance Company One?

The APP GP99 NWF Metropolitan Life Insurance Company One is a specialized insurance plan offered by Metropolitan Life Insurance Company. It provides comprehensive coverage tailored to meet the unique needs of policyholders, ensuring they have the right protection and support.

-

How does the APP GP99 NWF Metropolitan Life Insurance Company One benefit policyholders?

Policyholders of the APP GP99 NWF Metropolitan Life Insurance Company One gain access to a range of benefits, including flexible coverage options and competitive premiums. This ensures that individuals and families can find an insurance solution that fits their specific needs while maximizing their financial security.

-

What features are included with the APP GP99 NWF Metropolitan Life Insurance Company One?

The APP GP99 NWF Metropolitan Life Insurance Company One includes features such as customizable coverage levels, additional riders for enhanced protection, and a straightforward claims process. These features are designed to provide peace of mind and make managing your insurance easier.

-

Is the APP GP99 NWF Metropolitan Life Insurance Company One affordable?

Yes, the APP GP99 NWF Metropolitan Life Insurance Company One is designed to be a cost-effective insurance solution. By offering various pricing tiers and flexible payment options, it allows policyholders to select a plan that fits their budget without sacrificing essential coverage.

-

Can I integrate the APP GP99 NWF Metropolitan Life Insurance Company One with other services?

Absolutely! The APP GP99 NWF Metropolitan Life Insurance Company One can be easily integrated with a variety of financial and management tools, enhancing your overall experience. This integration facilitates seamless tracking of your insurance needs alongside other financial products.

-

How do I apply for the APP GP99 NWF Metropolitan Life Insurance Company One?

Applying for the APP GP99 NWF Metropolitan Life Insurance Company One is straightforward. You can start by visiting the Metropolitan Life Insurance Company website, where you’ll find an easy-to-use application form that guides you through the process.

-

What support is available for customers of the APP GP99 NWF Metropolitan Life Insurance Company One?

Customers of the APP GP99 NWF Metropolitan Life Insurance Company One receive comprehensive support from dedicated service representatives. Whether you have questions about your policy or need assistance with claims, help is just a phone call or email away.

Get more for APP GP99 NWF Metropolitan Life Insurance Company One

Find out other APP GP99 NWF Metropolitan Life Insurance Company One

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast